- TON has declined by 19.97% over the previous month.

- Toncoin’s on-chain exercise dipped, with income and market cap hitting a yearly low.

Over the previous two months, Toncoin [TON] has skilled important struggles on its worth charts and in fundamentals. In truth, TON is presently experiencing appreciable challenges essentially.

Inasmuch, AMBCrypto’s evaluation reveals that Toncoin’s on-chain actions have seen a sustained decline over the previous 12 months.

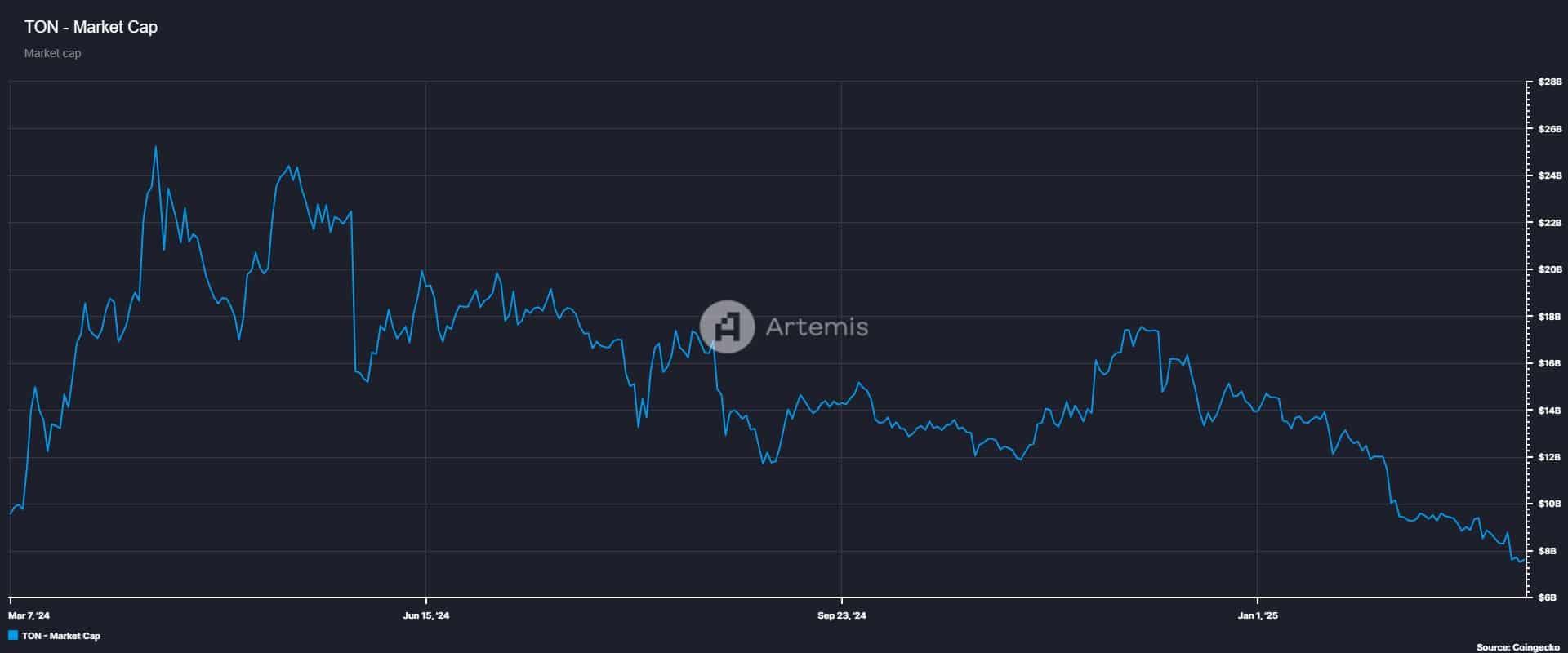

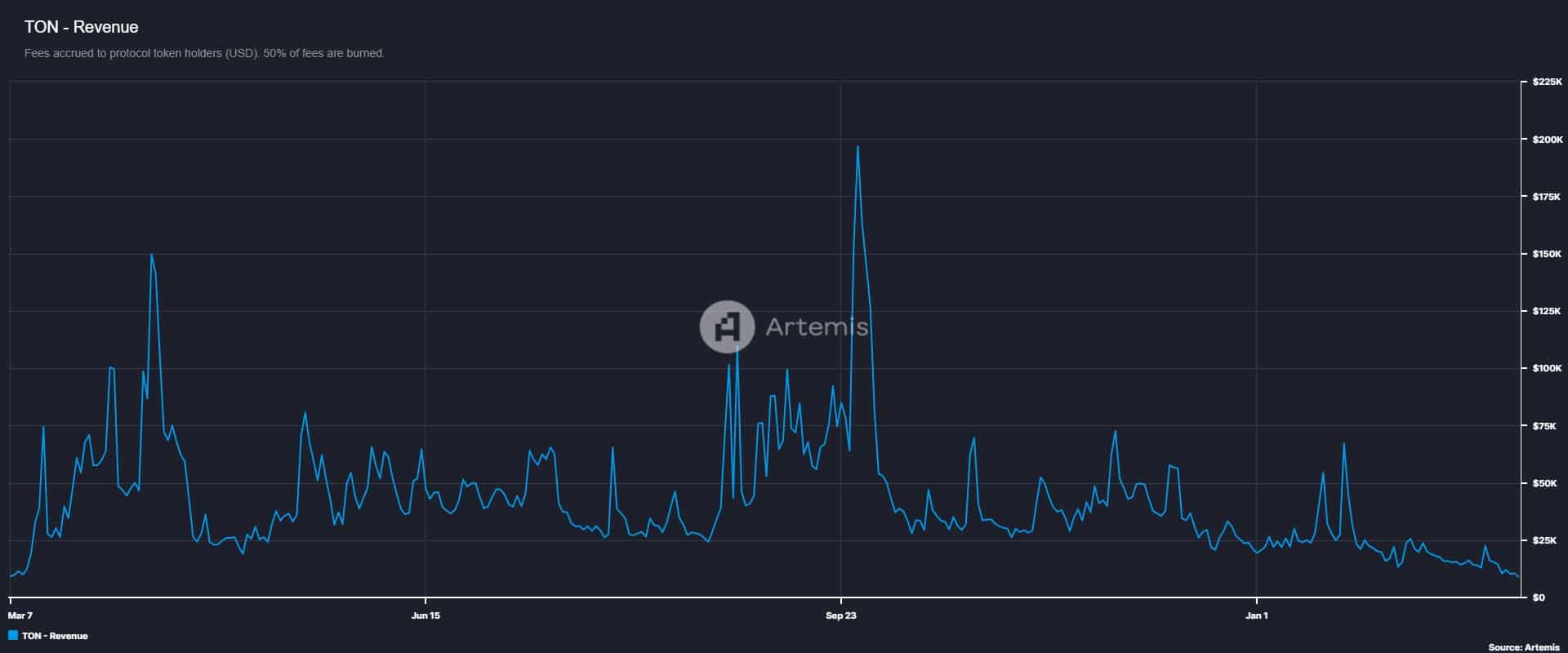

Supply: Artemis

For starters, Toncoin’s income has fallen to a yearly low of $9.1k, indicating a major decline within the blockchain’s financial exercise. This downturn suggests decreased transactions, DeFi exercise, and buying and selling, pointing to a pointy drop in demand.

The decline in financial exercise is additional highlighted by a latest lower in market capitalization.

Toncoin’s market cap has hit a yearly low of $7.5 billion. The simultaneous drop in income and market cap displays decrease community utilization and decreased demand for block area.

The discount in demand for block area leads to larger inflation, because it implies much less deflationary stress. Traditionally, larger inflation precedes decrease costs.

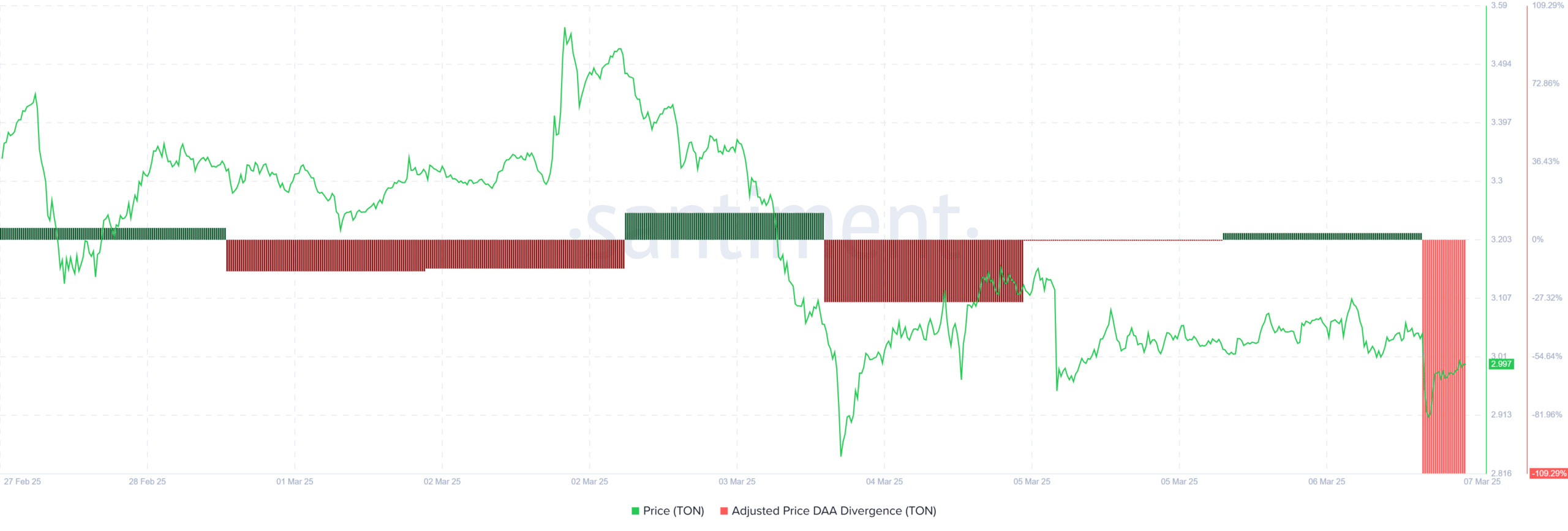

Equally, we will see this decreased on-chain exercise as Adjusted Worth DAA Divergence has turned damaging.

With the value DAA at a damaging zone, it confirms low community engagement, implying that Ton’s worth might decline additional to satisfy the precise community demand.

What subsequent for Toncoin

Undoubtedly, the declining demand and community utilization replicate robust bearish sentiments, with traders promoting as costs decline.

AMBCrypto noticed rising promoting stress as Toncoin RSI has dropped to hit oversold territory, at press time. With the RSI at this stage, it means that sellers are dominating the market with no patrons out there available in the market.

This vendor’s dominance is additional evidenced by CMF which has declined to hit a damaging worth.

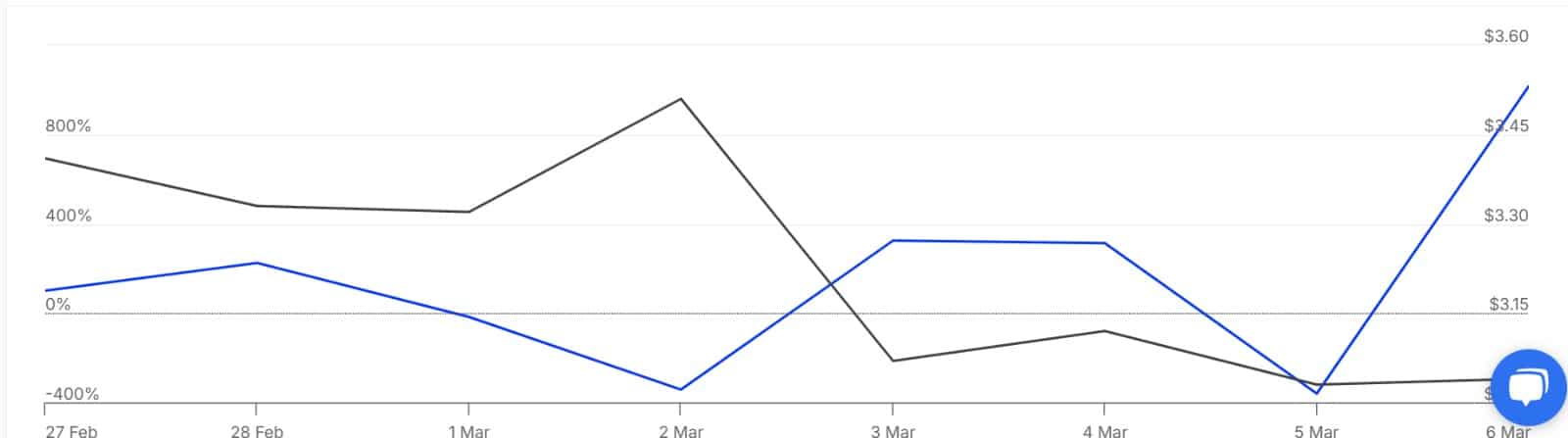

This selling stress is especially evident amongst whales. Toncoin’s Giant Holders Netflow to Trade Netflow Ratio has jumped considerably from -359.99 to 1016%.

This sharp improve signifies that many massive holders are transferring TON to exchanges for promoting, intensifying the promoting stress. Such exercise from whales displays low market confidence, reinforcing bearish sentiment.

At present, Toncoin faces robust bearish traits, resulting in decreased community utilization and on-chain exercise. Decrease demand, mixed with robust promoting stress, might lead to additional losses for TON’s worth.

If bearish sentiment persists, TON would possibly drop to $2.83. Nevertheless, with the RSI in oversold territory, a shopping for alternative emerges for traders seeking to purchase the dip.

If accumulation begins and patrons return, a development reversal might push Toncoin to reclaim $3.5.