- Ethereum ETFs logged $10M, bringing whole outflows up to now two days to $100M

- Is the declining CME ETH yield behind the continued outflows?

The U.S. Ethereum [ETH] ETFs logged one other $35.89M each day outflow on 6 March, marking the second day of bleed-out. The renewed risk-off sentiment adopted a short pause on Tuesday, after 8-day consecutive outflows.

General, ETH ETF buyers have withdrawn over $400M from the product within the final two weeks.

This starkly differed from the steady inflows seen in early February. Particularly because the market rout deepened amid the continuing Trump tariff wars.

ETH CME yield drops

In February, ETH ETFs noticed comparatively larger inflows than BTC ETFs – A pattern Coinbase analysts linked to irresistible excessive yield from CME ETH foundation commerce.

For the unfamiliar, the commerce entails establishments shopping for spot ETH ETF and opening a corresponding quick on CME Futures to pocket the value distinction (yield).

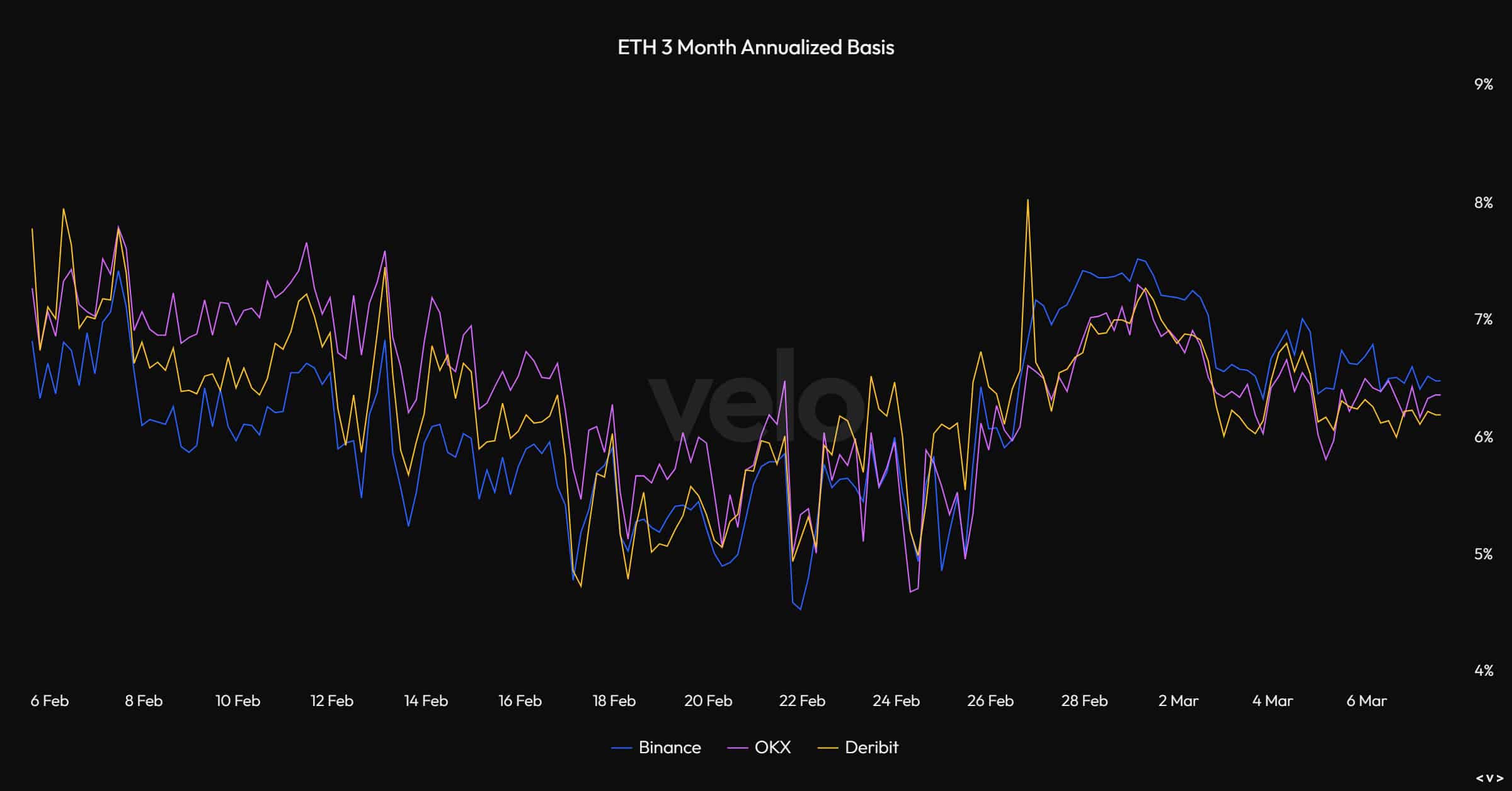

Based on Velo, the ETH yield surged to eight% in direction of the top of February and was marked by sturdy ETH ETF flows.

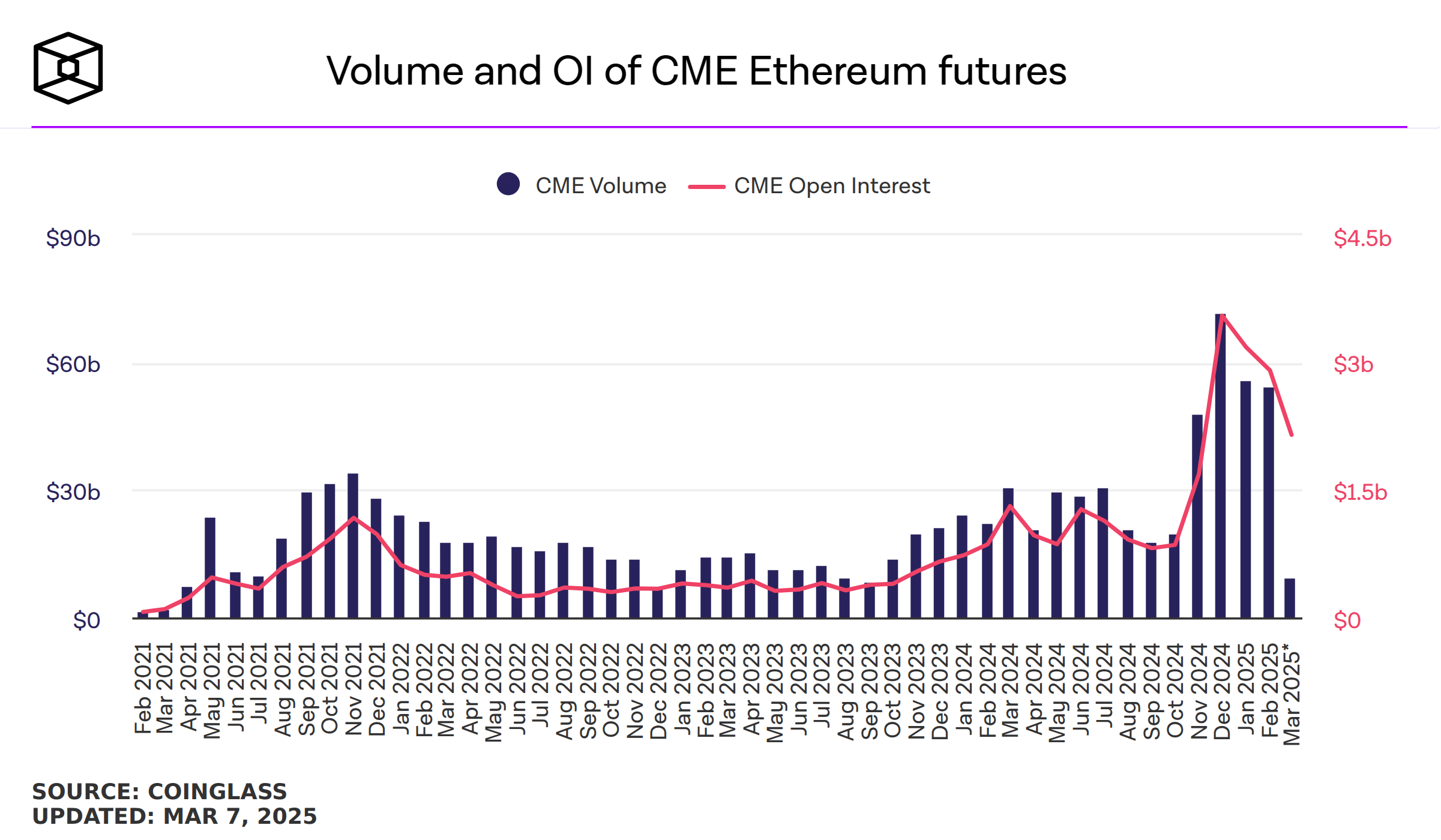

In March, nonetheless, the yield dropped to six%. This might dent urge for food for carry commerce and ETH ETFs. In actual fact, the concept was strengthened by the CME Futures Open Curiosity (OI) charge too.

The OI has been steadily declining in 2025, slipping from $3.18 billion in January to $2.15 billion in March, suggesting slight unwinding or carry-trade gamers closing positions.

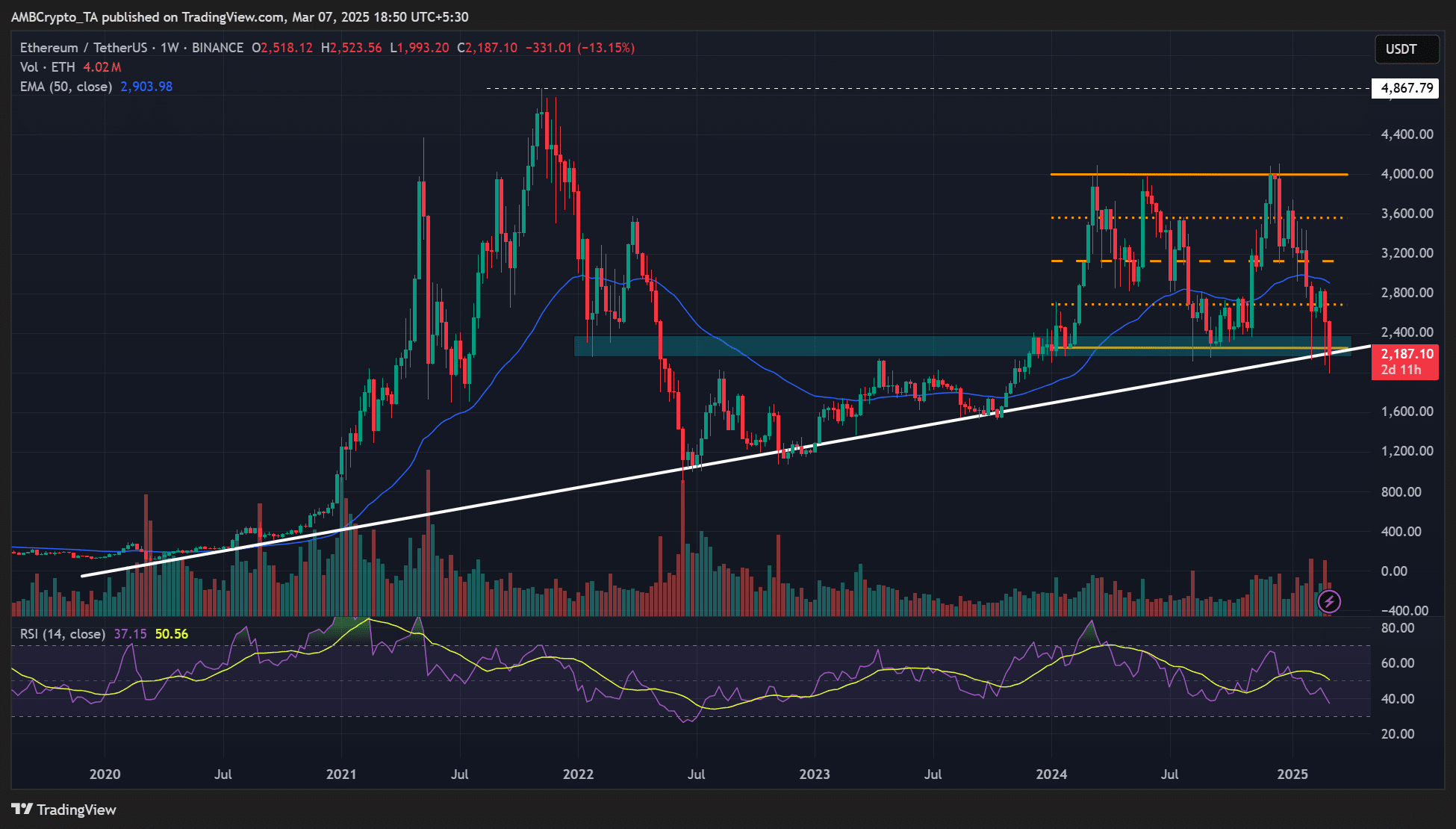

Nonetheless, the broader weak market sentiment hasn’t made issues higher for the king altcoin. As such, the altcoin’s draw back danger may stay at giant.

From a technical perspective, ETH appeared to be at a pivotal intersection of range-low and long-term trendline help above $2000. A breach beneath the extent may alter the upper timeframe market construction and merchants’ curiosity within the altcoin.