- Updates from SOL Methods and Galaxy bolstered a bullish long-term outlook

- Nonetheless, SOL’s short-term has remained uneven amid muted retail curiosity

Institutional curiosity in Solana [SOL] has remained excessive, regardless of the token’s muted worth motion. On 07 March, Canadian-based SOL Methods, a pioneer in company treasury by way of SOL, scooped up an additional 24k tokens price $3.3M.

The agency now holds 250.7k SOL and has expanded to a complete service provision within the ecosystem, together with validator and staking providers. Based on the agency, the newest bid would increase its validator operations.

“This continued accumulation aligns with the Firm’s technique of increasing its SOL holdings to assist its validator operations and long-term funding method within the Solana ecosystem.”

Based on Antanas Guoga, Chairman of SOL Methods, the agency would purchase extra SOL throughout the “market meltdown.”

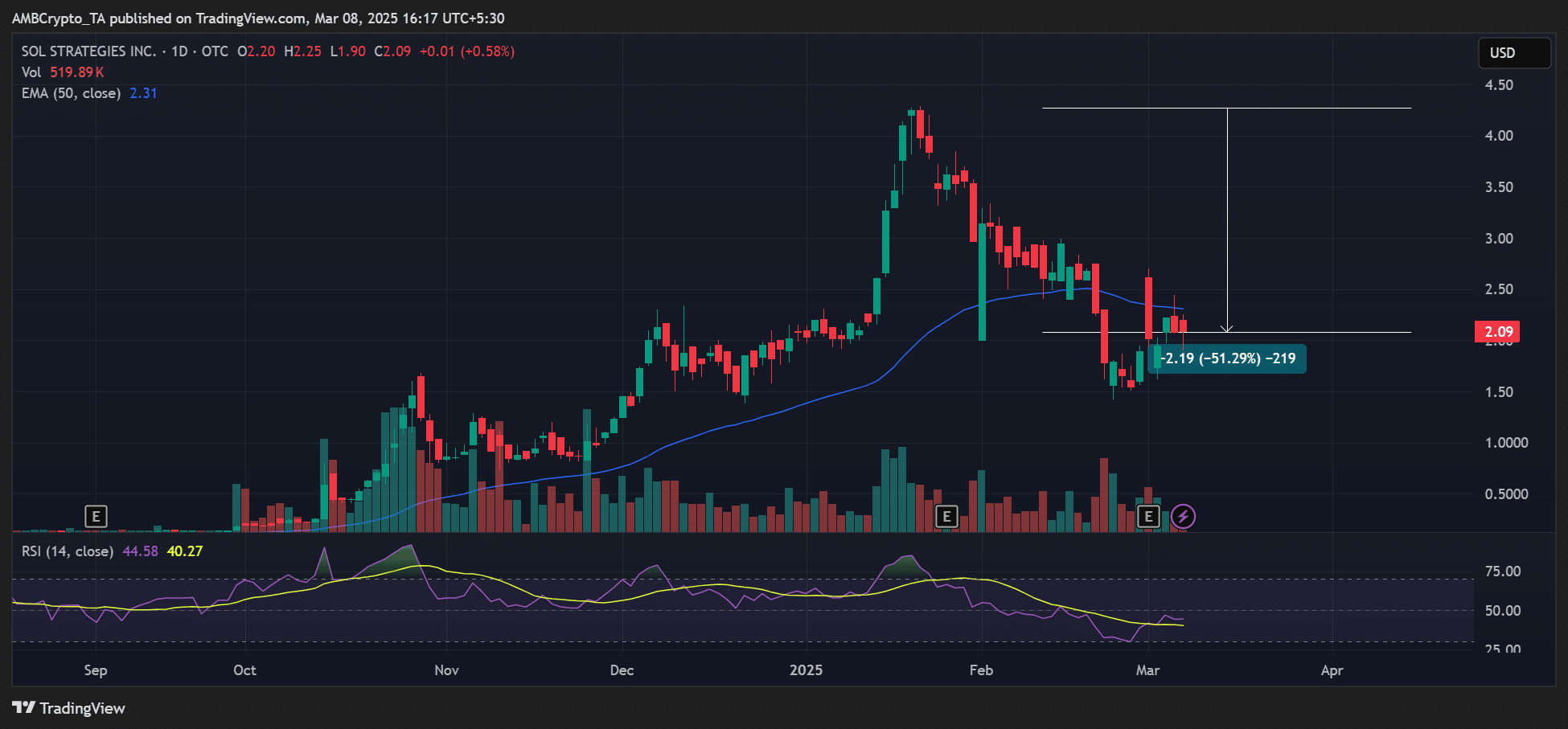

These days, the agency’s inventory (CYFRF) has been weighed down by SOL losses, dropping by 51% from $4.2 to $2. And but, it’s nonetheless recording post-U.S election positive aspects of 156% proper now.

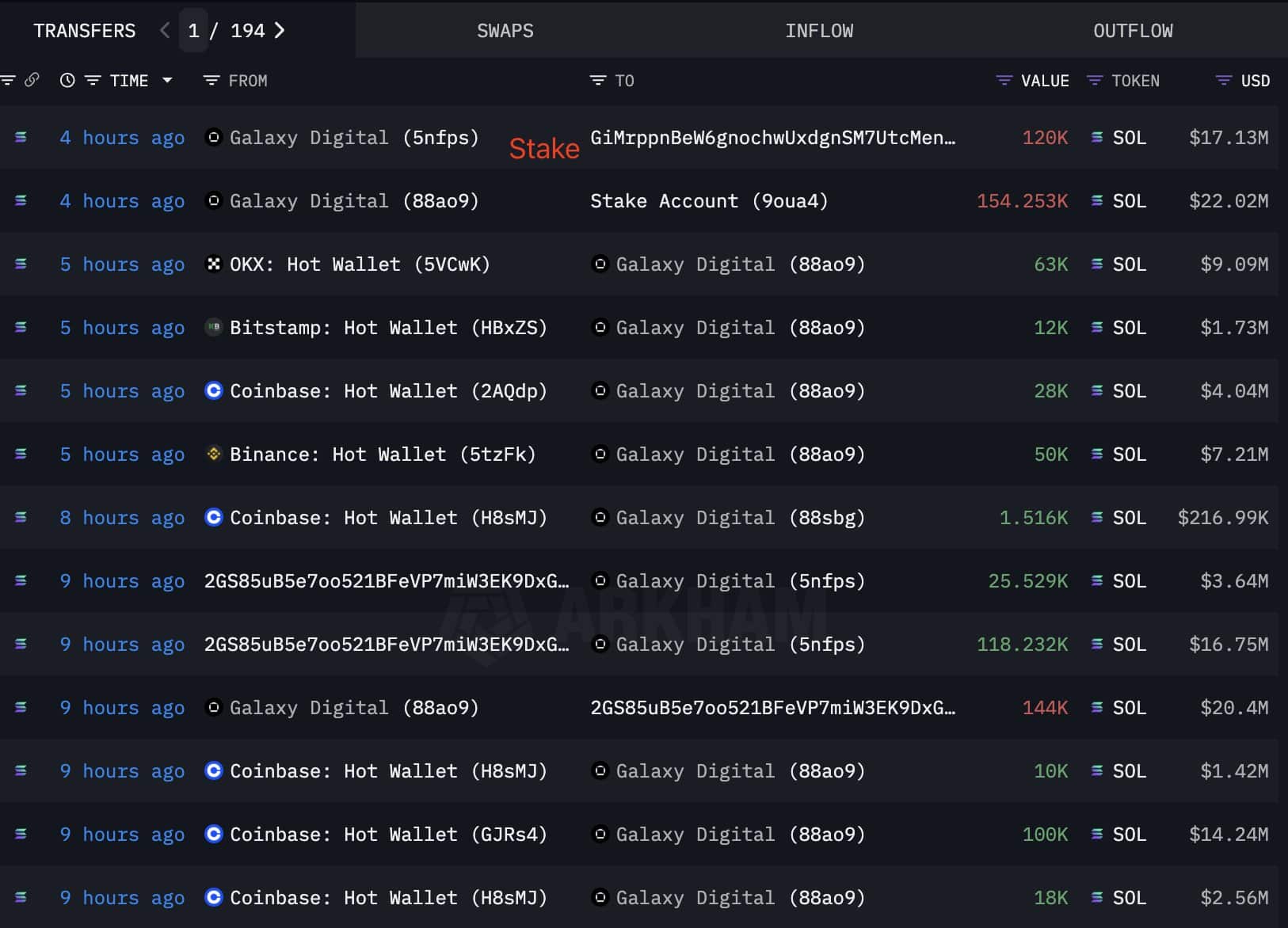

Galaxy stake $39M SOL

In different information, Galaxy Digital withdrew 282.5k SOL, price $40.5M, from centralized exchanges and staked $39.15M (274,253 tokens), as per a report by LookOnChain.

Normally, a hike in staking is a bullish sign and an indication of long-term confidence within the ecosystem. Merely put, massive gamers are nonetheless constructive about SOL’s outlook proper now, regardless of the short-term whipsawing.

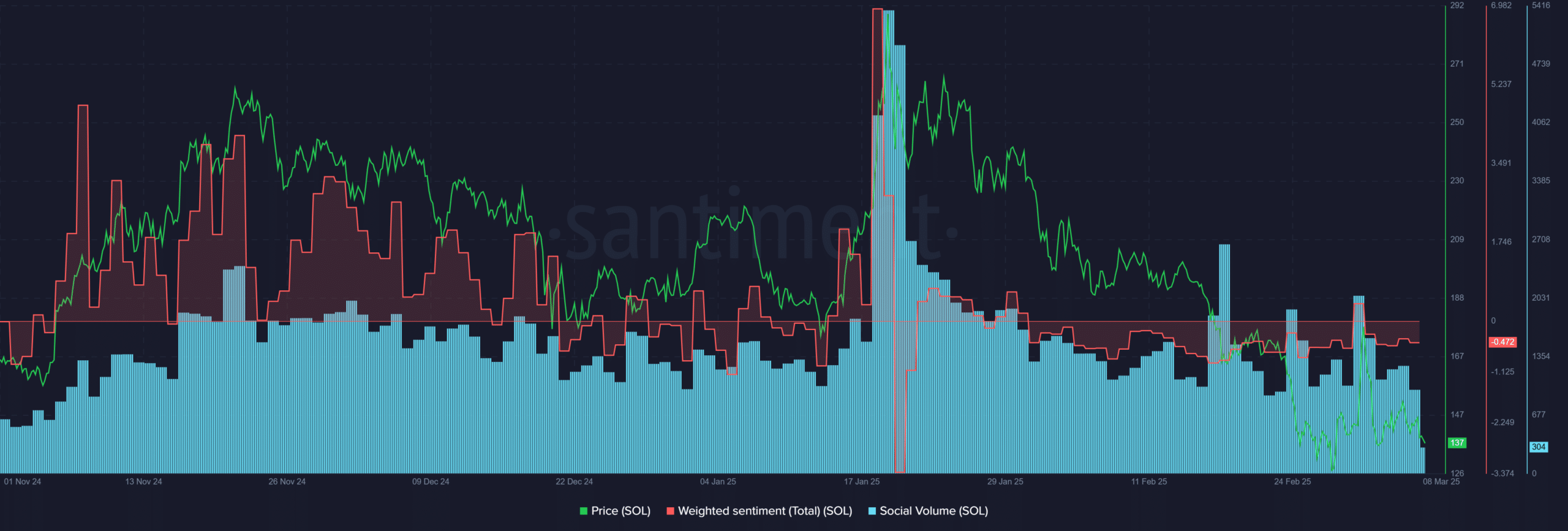

That being mentioned, retail buyers’ curiosity within the token has dropped considerably for the reason that TRUMP memecoin debuted in mid-January. This was revealed by the low social quantity, alongside overly weak sentiment after the LIBRA memecoin’s implosion.

Now, the sentiment briefly turned constructive after the announcement of CME Futures on 1 March. Nonetheless, it didn’t maintain the momentum for lengthy. Until the metrics flip constructive, SOL’s restoration would stay elusive within the brief time period.

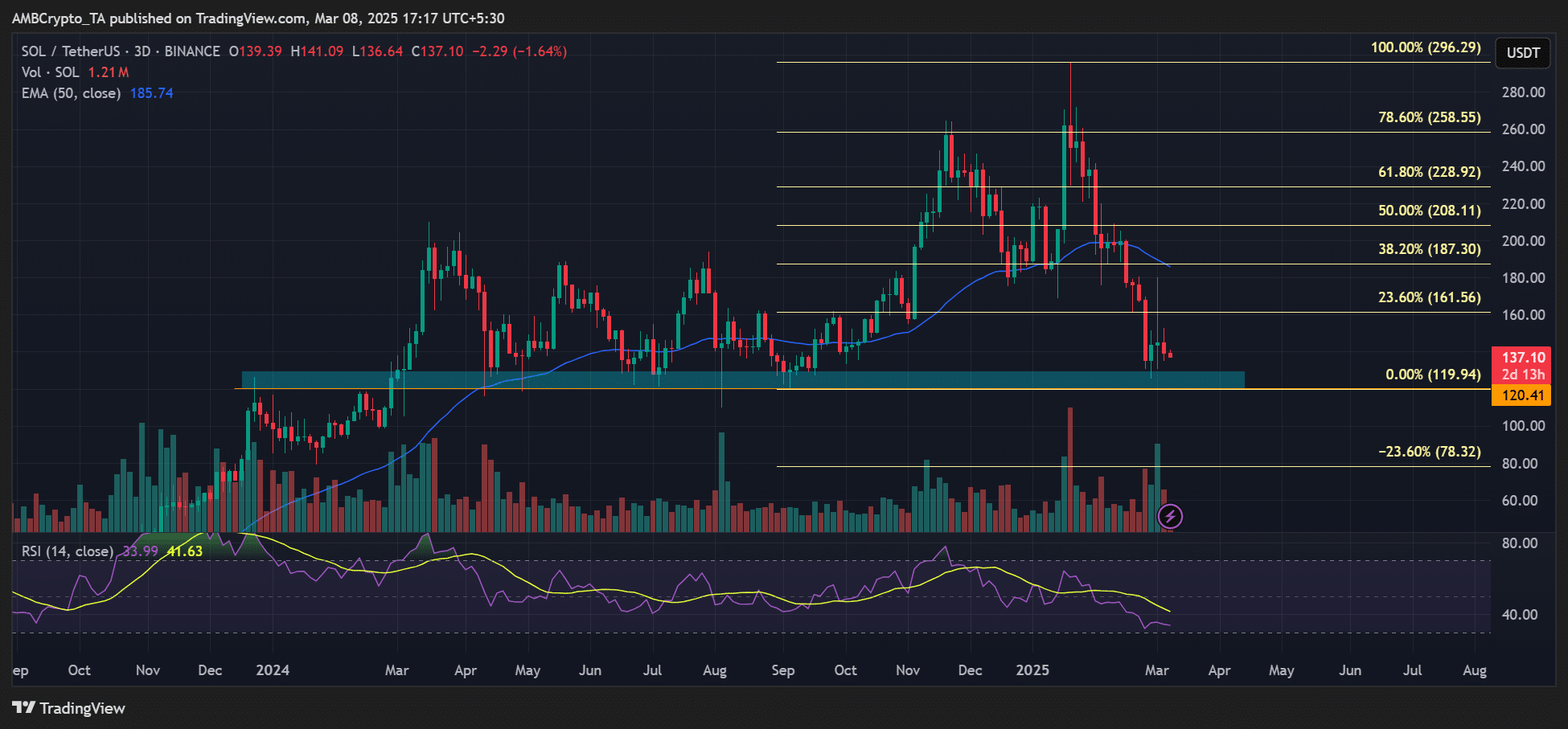

On the prediction website Polymarket, extra bettors expect the altcoin to drop to $130 by the top of March. Curiously, Choices merchants on Deribit are eyeing $200 for end-March Choices expiry, however they’re solely pricing a ten% likelihood of SOL hitting the goal.

In the meantime, the $120 worth zone has remained a key assist since early 2024. Bulls may try and defend it if draw back threat extends to the extent.