- Bitcoin’s spot demand drops sharply, making it weak to additional draw back, with bearish sentiment rising

- The futures market confirmed growing quick positions, reinforcing the bearish outlook for Bitcoin amidst world uncertainties

Bitcoin [BTC] is dealing with renewed promoting strain as demand within the spot market shrinks at its quickest fee since July 2024.

On-chain data reveals a big contraction in obvious demand, decreasing buy-side liquidity and making the asset extra weak to downward worth actions.

In the meantime, within the futures market, merchants are more and more opening quick positions, reinforcing a bearish outlook. With each spot demand waning and bearish sentiment dominating the derivatives market, Bitcoin’s worth has struggled to seek out help.

Spot demand plummets

Bitcoin’s spot demand performs an important function in sustaining worth stability by guaranteeing constant buy-side strain.

When spot demand declines, fewer consumers are prepared to amass Bitcoin, growing the chance of downward worth actions.

The chart reveals a pointy decline in obvious demand beginning in early 2025, reaching its lowest level in almost a yr. This drop resembles the sample noticed in July 2024, when an analogous lower in spot demand aligned with a worth correction.

All through late 2024, constructive demand predominantly drove Bitcoin’s rally. Nevertheless, the latest adverse demand displays a decline in market confidence. If this pattern persists, Bitcoin might expertise further downward strain within the coming weeks.

Bearish bets intensify Bitcoin’s downtrend

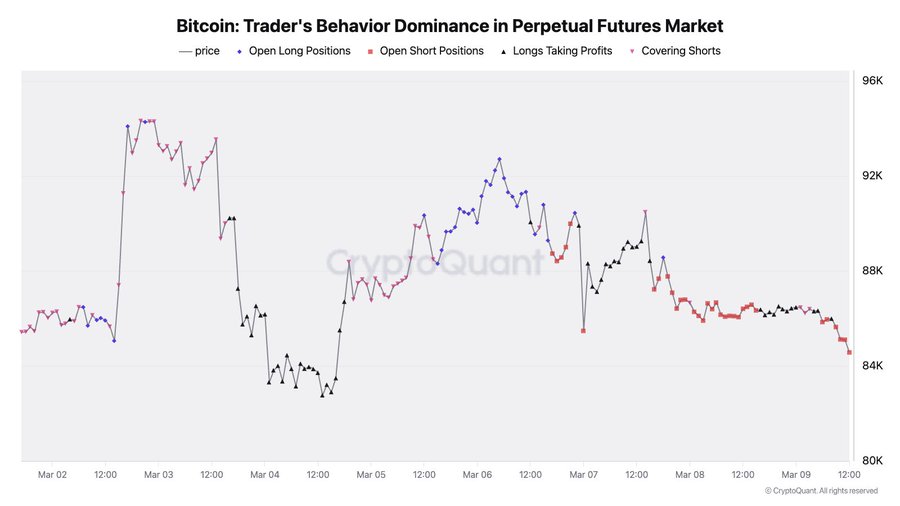

The perpetual futures market performs an important function in Bitcoin’s worth motion, as merchants use leverage to invest on worth actions.

When lengthy positions dominate, it suggests bullish sentiment, whereas a rise in brief positions indicators rising bearish strain.

The info reveals that from the third of March onward, there was a noticeable improve in open quick positions, which aligns with Bitcoin’s worth drop from roughly $96K to under $84K.

This sample displays merchants’ anticipation of additional worth declines, strengthening bearish sentiment. Moreover, the choice of long-position merchants to take earnings signifies that bullish merchants are closing their positions relatively than reinforcing them.

If quick merchants don’t start overlaying their positions, Bitcoin’s worth might proceed to expertise downward strain quickly.

Broader market sentiment

Over the previous week, Bitcoin’s worth has dropped by roughly 10.98%, settling at $82,211 on the time of writing.

This decline aligns with growing world financial uncertainties. Notably, President Donald Trump has acknowledged the opportunity of a recession, describing the financial system as present process a big transition.

Moreover, escalating commerce tensions and issues about China’s deflationary pressures have fostered a risk-averse sentiment, inflicting declines in each conventional and cryptocurrency markets.

These elements counsel that Bitcoin’s latest worth drop could also be a part of a broader market pattern pushed by macroeconomic influences relatively than an remoted incident.

If these financial uncertainties persist, Bitcoin might face ongoing bearish strain within the weeks forward. Nevertheless, constructive developments resembling favorable regulatory adjustments or better institutional adoption might restore market confidence and doubtlessly reverse the downward pattern.