- FET could also be set to stay in its downtrend and fall in direction of $0.42 subsequent

- Lack of shopping for strain meant no restoration was in sight at press time

Artificial Superintelligence Alliance [FET] has joined the record of altcoins which have fallen under their 2024 lows. Actually, the sentiment throughout the market has been rising more and more bearish. A whole bunch of hundreds of thousands of {dollars} value of liquidations have been seen within the crypto market every day over the previous two weeks.

The promoting strain that drove Bitcoin [BTC] under the $92k vary low has not but absolutely abated. And, traders should stay cautious. With Synthetic Superintelligence Alliance token plunging in direction of new lows every week, and no restoration in sight, traders would possibly wish to stay sidelined.

The place will FET mark an area backside on the charts?

The each day timeframe revealed a robust bearish pattern in progress. The Directional Motion Index’s ADX (yellow) and -DI (purple) had been each above 20, highlighting the downward pattern. The Choppiness Index’s studying was 39.92. This meant that the market was much less uneven and had a robust directional pattern, bearish on this case.

The OBV backed up this discovering by trending downwards since mid-December. This downtrend appeared to be characterised by persistent promoting quantity behind FET. Therefore, it was not a consolidation part that noticed accumulation from holders. In keeping with the OBV, consumers had been scant and scattered.

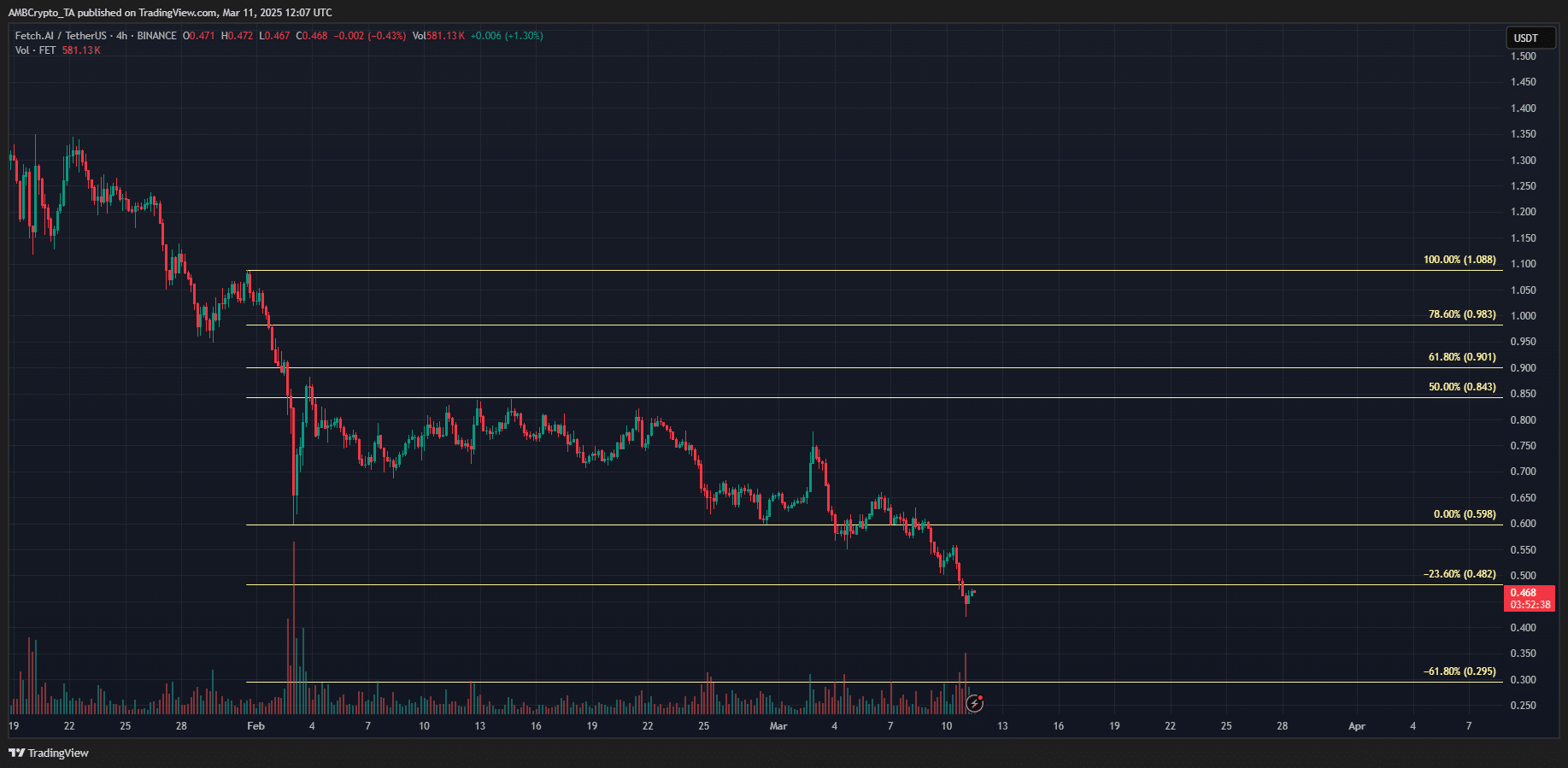

The 4-hour chart illuminated the decrease timeframe state of affairs. It confirmed that the $0.6 assist from February was examined a number of instances. And, it will definitely gave manner within the first week of March. The Fibonacci extension ranges confirmed that the 23.6% stage at $0.482 posed little opposition to the worth.

Therefore, it could be probably that FET would retest the $0.48-$0.52 area as resistance earlier than falling decrease. The 61.8% extension stage at $0.295 could be the following goal. The $0.35-$0.37 stage may additionally act as assist on the best way down.

Merchants can anticipate a bounce to $0.5-$0.52, adopted by a drop to $0.37 or $0.42. If the downtrend continues, extra losses and a transfer to $0.295 could be believable.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion