- ADA value prediction appears to be like bullish after retracing all of the features it made following the strategic reserve announcement.

- The obstacles overhead had been vital, and the sentiment throughout the market meant consumers had been reluctant to enter.

Cardano [ADA] noticed a 17.8% value acquire previously 36 hours.

Hypothesis that Gemini might list Cardano on their change, mixed with the U.S. crypto strategic reserve information from earlier this month, may have modified investor sentiment previously two days.

Whereas the co-founder of Gemini didn’t assume Cardano was an acceptable asset for the strategic reserve, he didn’t downplay the itemizing risk both.

Mixed with a retest of the 3-month sturdy assist, may ADA be set for a bullish reversal?

Cardano’s fast features might be halted at…

Cardano’s bounce previously 48 hours was seemingly as a result of its retest of the 3-month vary lows at $0.68. Nevertheless, the volatility following the strategic reserve announcement meant the consumers had been at an obstacle.

The value was unable to defend the $0.8 degree. It had been a bearish order block, however acted as a bullish breaker block for a quick time. The descent beneath $0.8 has put the bulls on the again foot and preventing uphill.

The Superior Oscillator confirmed momentum has shifted bearishly.

The construction on the each day chart was bearish, however the vary sure nature in latest months meant it was higher to concentrate to the vary ranges than the construction.

The 75% vary degree at $0.8 coincided with the bearish order block from February, marking it because the closest and strongest resistance zone.

The CMF was at -0.01, exhibiting no vital capital flows into or out of the market.

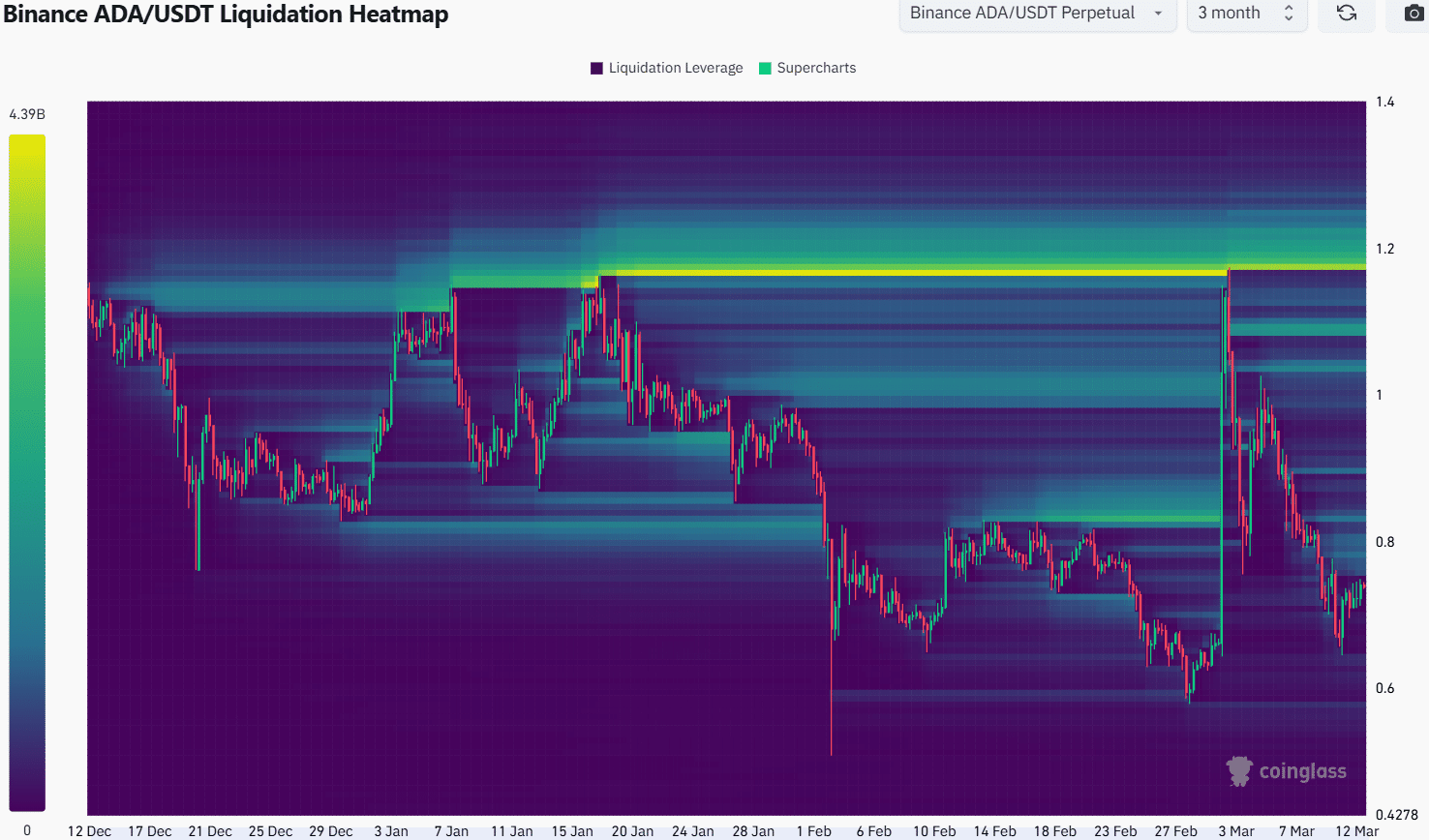

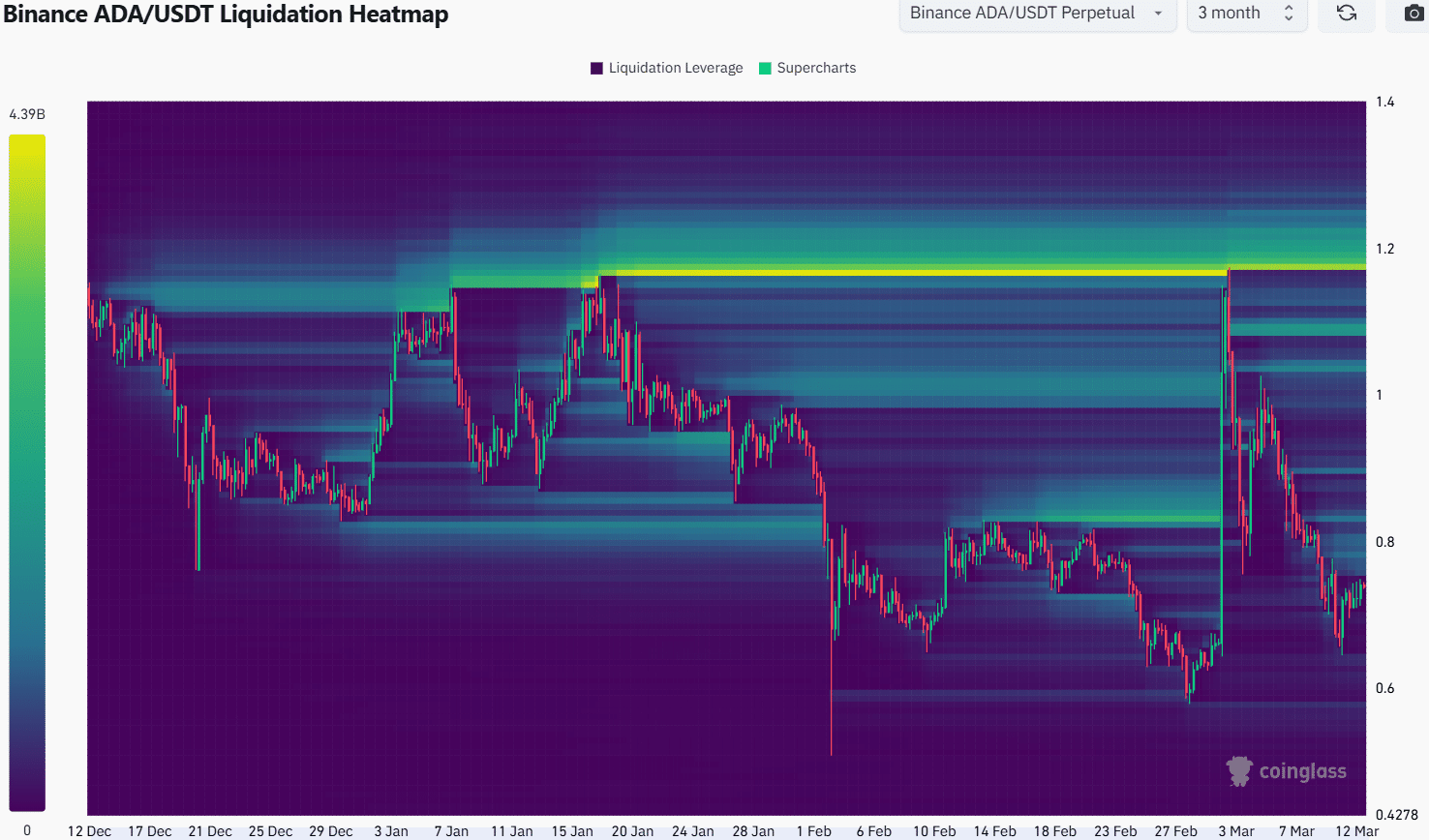

Supply: Coinglass

ADA value prediction

The three-month liquidation heatmap confirmed that the key liquidity cluster to be careful for was at $1.17. The $0.634, $0.8, and $0.83 ranges had been additionally decrease timeframe liquidity pockets to look at.

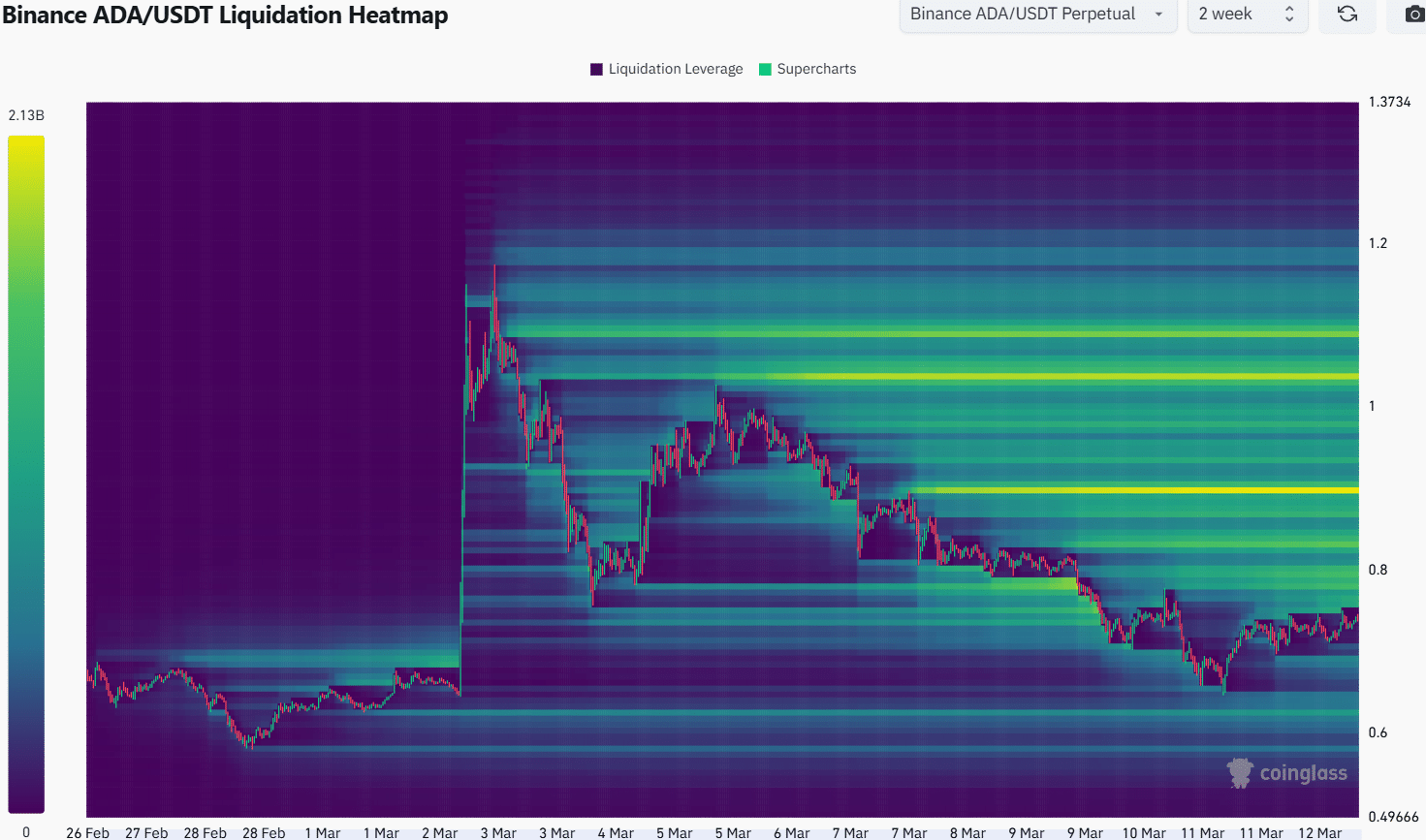

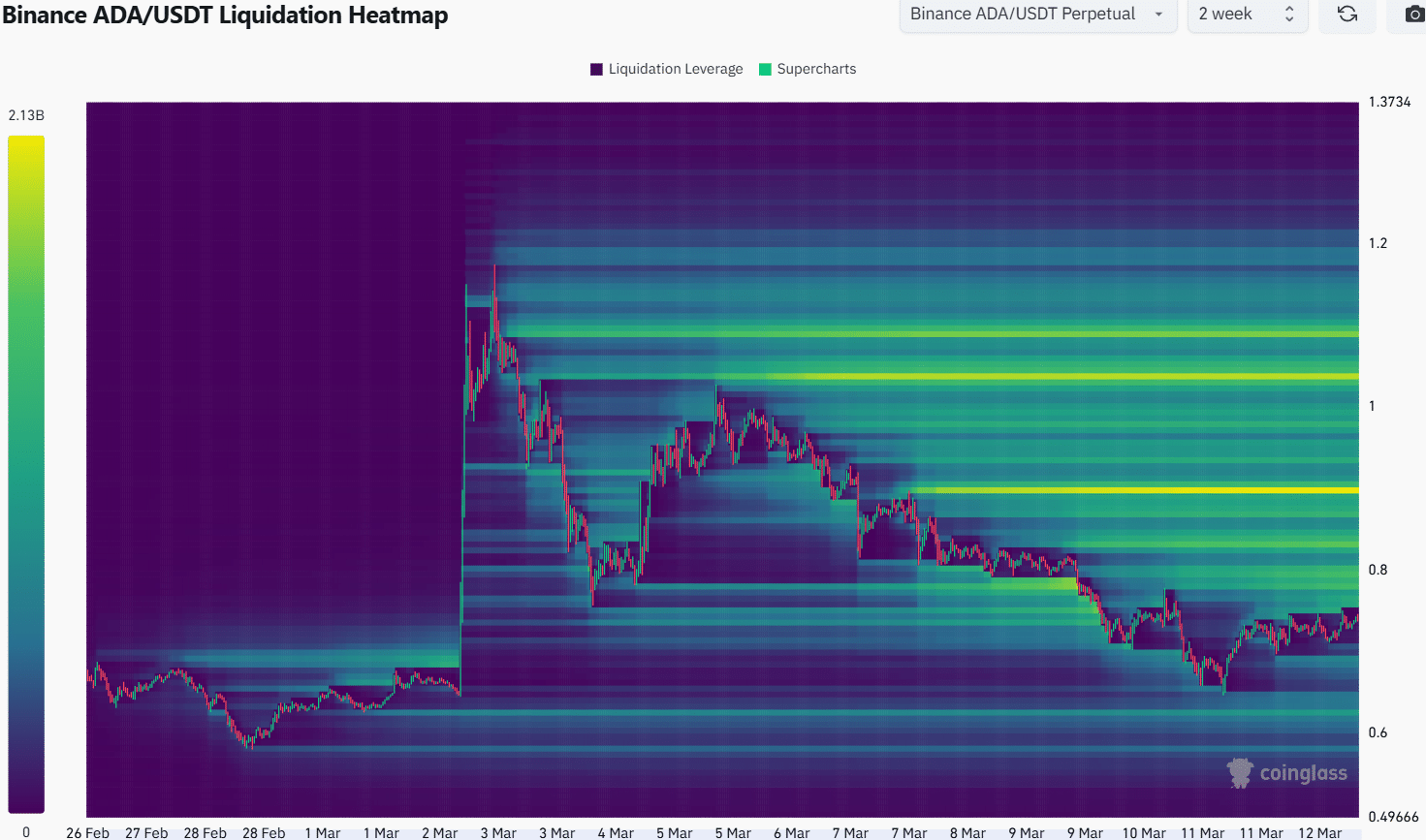

Supply: Coinglass

The two-week heatmap confirmed that this was certainly the case. The way in which north was stuffed with liquidation ranges, that means ADA costs will likely be attracted northward, doubtlessly as excessive as $1.

Nevertheless, this upward pull was contrasted by a scarcity of shopping for stress within the spot market and a market-wide bearish bias.

Particularly, the $0.9 was a promising bearish reversal zone. It lined up effectively with the mid-range degree at $0.907.

Due to this fact, merchants can anticipate Cardano’s response from $0.8 to grasp if they need to attempt to seize a bounce towards $0.9. Equally, a transfer past $0.9 may see $1.03 and $1.09 revisited.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion