- U.S. crypto customers missed out on as much as $5 billion in airdrops between 2020 and 2024 on account of SEC-driven geofencing

- Lawmakers are urging the SEC to make clear its place on airdrops

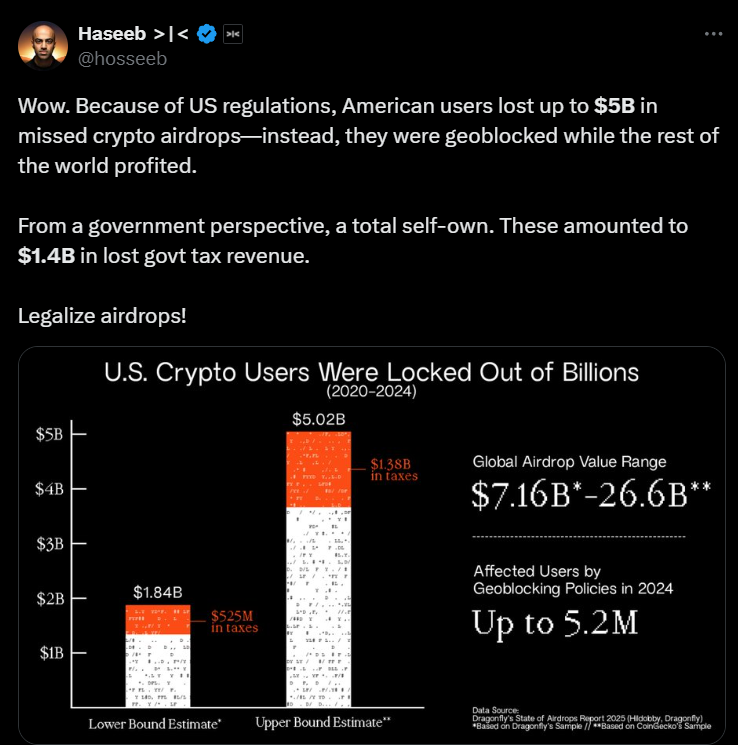

Over the previous 4 years, tens of millions of U.S. crypto holders have discovered themselves unable to take part in main airdrops, lacking out on an estimated $5 billion in potential earnings.

A current study from enterprise capital agency Dragonfly revealed that geoblocking insurance policies, applied by crypto initiatives to keep away from U.S regulatory scrutiny, have been chargeable for these losses. These restrictions stem from ongoing authorized uncertainty relating to whether or not airdropped tokens qualify as securities or not.

With the SEC additionally ramping up enforcement actions towards crypto corporations, many initiatives have taken a cautious strategy by blocking U.S customers outright. In truth, Dragonfly’s report estimated that between 1.84 million and 5.2 million energetic U.S customers have been affected by these restrictions in 2024 alone.

Nonetheless, the monetary affect of those restrictions prolonged past simply particular person buyers.

$1.4 billion in misplaced tax income

The report additionally discovered that by stopping U.S customers from claiming airdrops, the federal government forfeited an estimated $1.4 billion in tax income between 2020 and 2024.

The misplaced tax income stems from two major sources – Private revenue tax on airdropped tokens and company taxes that will have been generated by crypto initiatives working within the U.S, as a substitute of shifting offshore.

Haseeb Qureshi, Managing Accomplice at Dragonfly, assessed,

“Airdrops have been as soon as essentially the most democratic technique to distribute tokens. As we speak, they’ve grow to be a recreation of avoiding the SEC’s wrath.”

One placing instance is Tether, which reported $6.2 billion in income in 2024 however paid no U.S company taxes on account of its offshore incorporation.

Dragonfly’s “State of Airdrops Report 2025”, claimed,

“Tether, which reported $6.2 billion in income in 2024 however is integrated offshore, may have contributed roughly $1.3 billion in federal company tax and $316 million in state taxes if it had been absolutely topic to U.S. taxation.”

Regulatory uncertainty has led to an exodus of blockchain startups from the US.

Startups search friendlier shores

In 2024 alone, the SEC initiated 33 enforcement actions towards crypto corporations, with 73% involving fraud allegations and 58% tied to unregistered securities choices. These actions have created a chilling impact on crypto innovation, with many initiatives preferring to keep away from the U.S market altogether.

Jessica Furr, Counsel at Dragonfly, emphasized the unintended penalties of this strategy.

“The SEC’s enforcement-driven regulatory stance has compelled crypto initiatives to exclude U.S. customers from airdrops, depriving them of billions in potential features. Clearer pointers are wanted to stop additional financial loss.”

Furr’s remarks echo broader trade frustrations over the dearth of clear authorized frameworks for crypto belongings – A problem that has pushed many blockchain builders to relocate abroad.

The regulatory challenges surrounding airdrops have caught the eye of lawmakers too.

Congress to the SEC – “Make clear or justify”

In September 2024, Patrick McHenry and Tom Emmer despatched a letter to SEC Chair Gary Gensler, demanding readability on whether or not airdrops must be categorised as securities. The letter raised key questions concerning the SEC’s inconsistent strategy, significantly compared to conventional reward packages like airline miles and bank card factors.

“Given the SEC’s unwillingness to ascertain a regulatory framework in the US, builders have been compelled to dam Individuals from claiming possession of a digital asset in an airdrop”.”

Geofencing—the observe of blocking customers from particular jurisdictions—has grow to be the default risk-avoidance technique for crypto initiatives working beneath regulatory uncertainty. In keeping with a report by Variant, geofencing is usually poorly applied and leads to pointless exclusion of customers from legally compliant markets.

Jake Chervinsky, a authorized professional in crypto regulation, believes that geofencing is a stop-gap measure reasonably than a long-term resolution,

“Many corporations geofence out of concern reasonably than necessity, resulting in misplaced alternatives for each customers and the federal government.”

The Variant report additionally instructed {that a} extra structured compliance framework would enable crypto initiatives to serve U.S customers whereas adhering to regulatory necessities.

What crypto leaders mentioned to regulators

A16z Crypto, a serious enterprise capital agency, printed a coverage advice for the SEC. The agency urged the company to difficulty formal steerage on airdrops. It additionally known as for clear exemptions for token distributions. These exemptions would apply to distributions that don’t function fundraising mechanisms.

Scott Walker and Invoice Hinman have proposed reforms to make clear airdrop laws too.

They instructed creating eligibility standards so airdrops will not be categorised as securities. Aligning airdrop guidelines with client reward packages would supply consistency and scale back regulatory confusion.

Additionally they really useful protected harbor provisions to guard blockchain initiatives distributing tokens to their communities.

Will the SEC adapt or maintain the road?

Lawmakers, trade leaders, and buyers are rising stress for regulatory adjustments.

As an example – Alexander Grieve, VP of Authorities Affairs at Paradigm, shared that the agency met with Hester Peirce and SEC officers to debate airdrop laws.

The SEC may introduce clearer pointers to handle ongoing uncertainties. Clearer guidelines would enable U.S buyers to take part in airdrops with out authorized dangers.

This may profit each people and the broader financial system.

For now, crypto initiatives stay cautious about together with U.S customers in airdrops. Therefore, American buyers proceed to overlook out on alternatives obtainable to worldwide individuals.