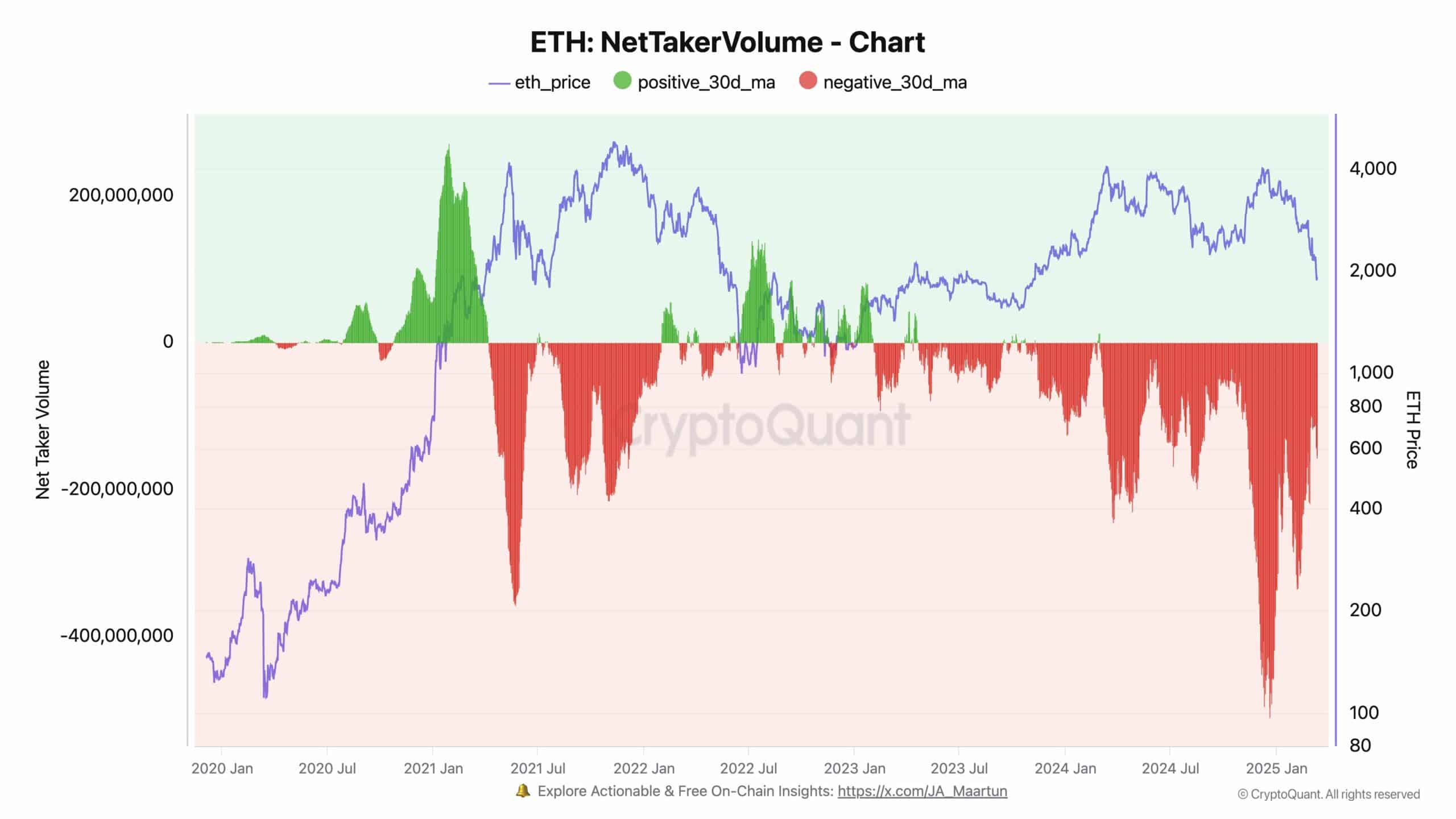

- Ethereum’s internet taker quantity remained deep within the crimson, signaling sustained promote stress over the previous few months.

- Regardless of the promoting stress, the whole variety of ETH holders continued to extend, suggesting sturdy accumulation.

Ethereum [ETH] has witnessed a protracted interval of lively promoting stress, with internet taker quantity indicating sustained adverse momentum over the previous few months.

This development suggests aggressive sell-side dominance, usually related to declining market confidence or broader risk-off sentiment.

Regardless of this, the variety of ETH holders continues to climb, elevating questions on whether or not long-term traders are accumulating amid the sell-off or if a worth reversal is on the horizon.

Ethereum’s persistent promote stress

Knowledge from CryptoQuant highlighted an prolonged section of aggressive promoting, with internet taker quantity displaying deep crimson values.

Which means that promote orders have dominated purchase orders, reflecting a bearish grip on Ethereum’s market construction.

Traditionally, such extended adverse taker quantity precedes main corrections or capitulation occasions, which may result in additional draw back if the development persists.

Supply: X

Taking a look at previous cycles, ETH has skilled comparable phases of intense promoting stress, adopted by a reversal when shopping for momentum re-emerges.

Nevertheless, the present development seems extra prolonged, suggesting that investor sentiment stays cautious regardless of broader crypto market developments.

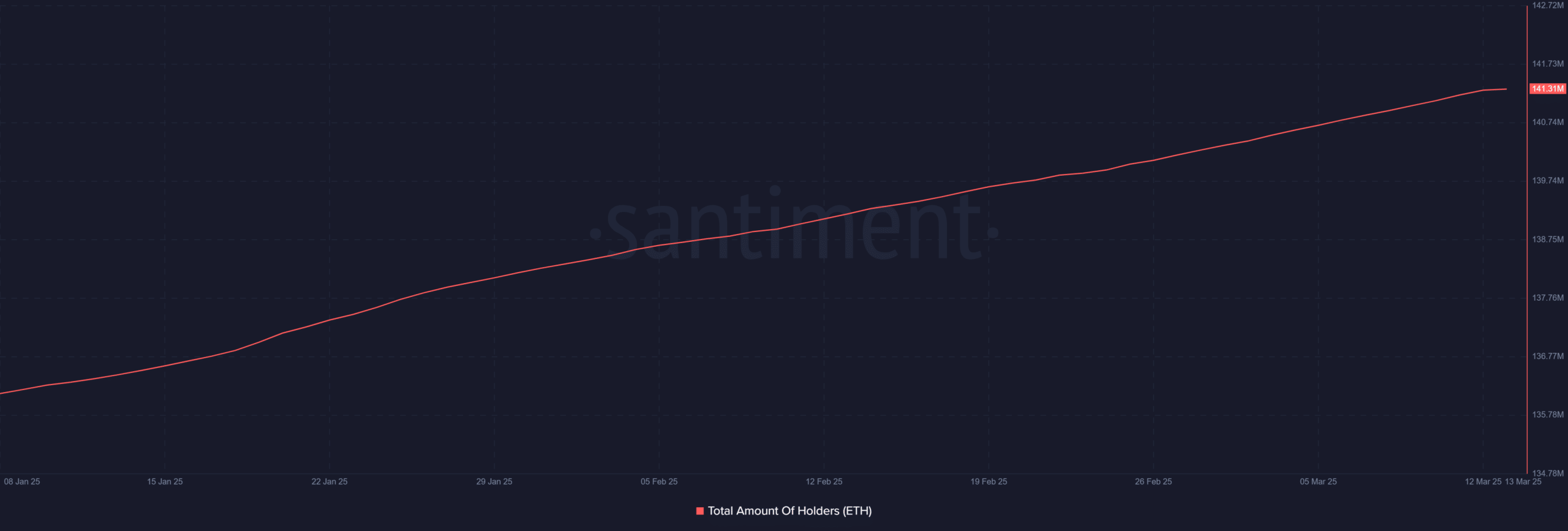

ETH holders proceed to develop

Whereas Ethereum’s worth struggles, the variety of holders has been steadily growing.

On-chain information from Santiment confirmed that whole ETH holders had reached roughly 141.31 million, marking constant development regardless of the worth stoop.

This implies that whereas short-term merchants have been exiting their positions, long-term traders proceed to see worth in accumulating ETH at present ranges.

One doable rationalization for this divergence is that institutional and whale traders are step by step buying Ethereum whereas retail merchants capitulate.

This accumulation sample may set the stage for a possible restoration if promote stress subsides and broader market situations enhance.

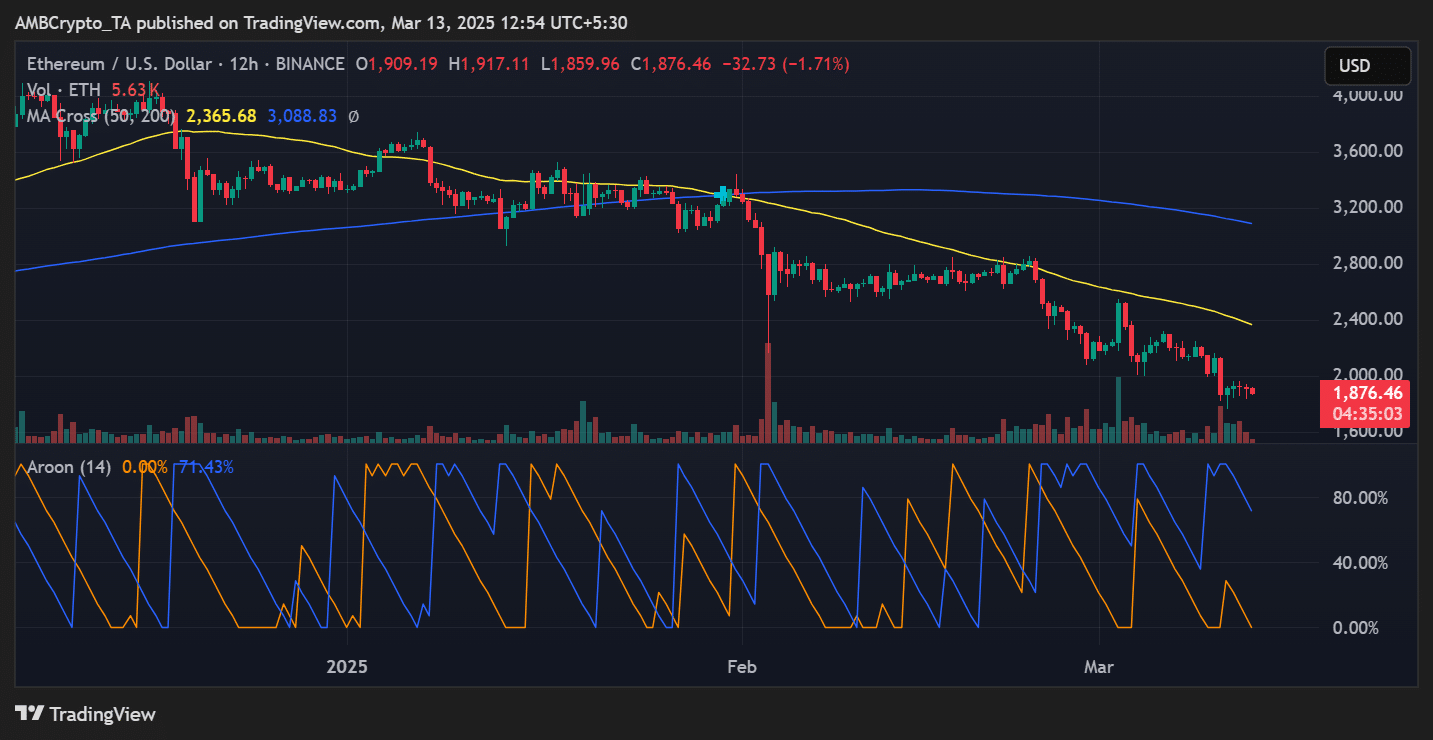

Value outlook: Will ETH discover help?

Ethereum was buying and selling at $1,876 at press time, having suffered a gradual decline over the previous few weeks. Key help ranges to observe included $1,850, which has traditionally served as a vital demand zone.

If promoting stress intensifies, Ethereum may check the $1,750 area, a degree that beforehand acted as a powerful accumulation zone.

Conversely, if ETH manages to stabilize and reclaim the $2,000 mark, it may set off a shift in sentiment.

The Aroon indicator, which measures development power, at present indicators weak spot, suggesting that ETH remains to be in a downtrend.

Nevertheless, a breakout above the 50-day transferring common [2,365] would point out renewed bullish momentum.

Conclusion

Ethereum’s market stays below promoting stress, as evidenced by sustained adverse internet taker quantity.

Nevertheless, the regular improve in ETH holders indicators that some traders view the present worth vary as an accumulation alternative.

Whereas draw back dangers persist, a shift in sentiment or easing promote stress may place ETH for a restoration.

Merchants ought to watch key help and resistance ranges carefully, as Ethereum’s subsequent transfer will seemingly dictate broader market sentiment.