- Lower than 24 hours after triggering a $4 million loss in Hyperliquid’s HLP Vault, the identical whale dealer reappeared

- If whales can manipulate liquidation engines, smaller merchants might really feel at an obstacle.

The whale dealer accountable for Hyperliquid’s $4 million vault loss yesterday is again in motion, executing one other spherical of high-leverage trades throughout a number of platforms.

This time, the dealer deposited $4.08 million USDC into GMX. He initially shorted Ethereum [ETH], however shortly closed the place and switched to an extended, securing a $177,000 revenue.

After closing the worthwhile GMX commerce, the whale moved $2.3 million USDC into Hyperliquid [HYPE], opening a 25x lengthy place on ETH and a 40x brief place on BTC.

The return of the identical whale in such a short while body raises crucial questions – Is that this simply sensible buying and selling, or one other try to take advantage of liquidation mechanics?

On-chain information unveils a high-risk playbook

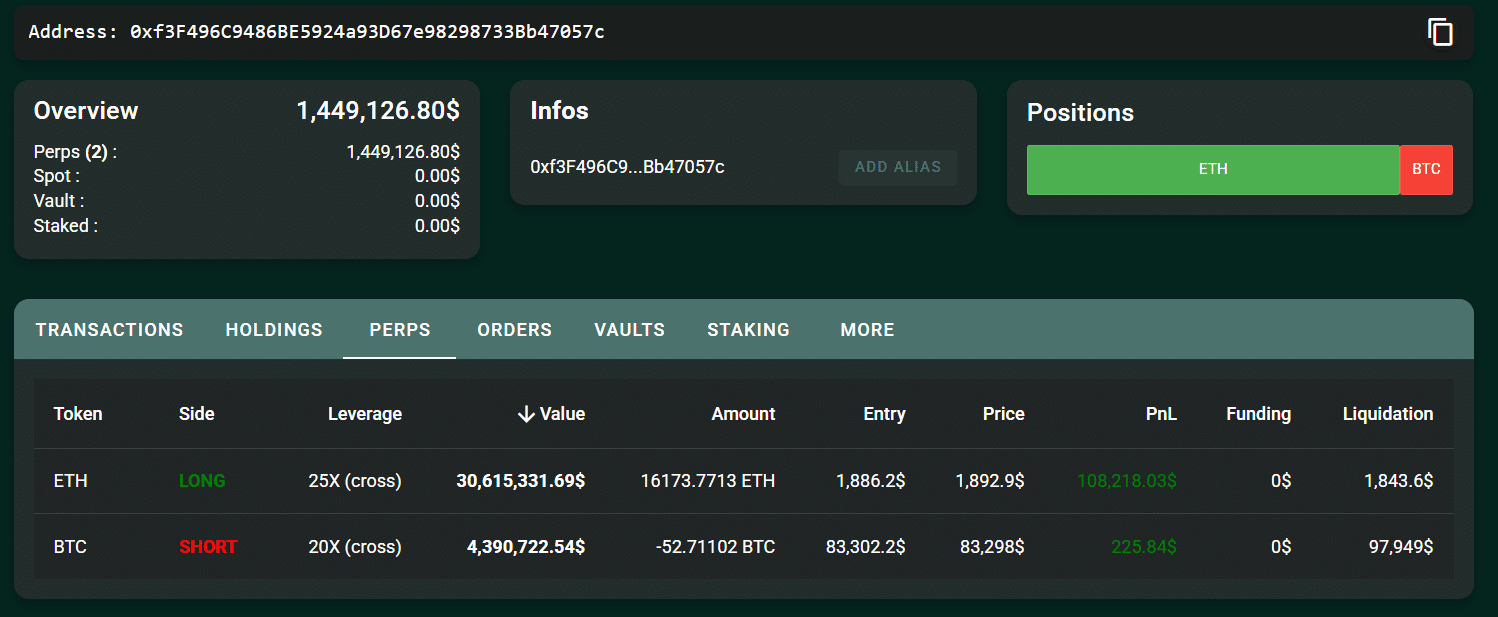

On-chain information from Lookonchain revealed the newest positions of a crypto whale.

The dealer just lately made strategic strikes on GMX and Hyperliquid, leveraging giant sums to capitalize on worth fluctuations.

On GMX, the whale initially shorted ETH/USD with $4.08 million USDC. Later, they flipped to an extended place, securing income of $177,000.

Furthermore, on Hyperliquid, the whale opened an extended ETH place with 25x leverage.

The place measurement is $30.54 million, with an entry worth of $1,886.20. Their liquidation worth is ready at $1,804, and the press time revenue and loss stood at $35,436.05.

For Bitcoin [BTC], the whale took a brief place with 40x leverage with place measurement being $19.09 million, with an entry worth of $83,156.45. Their liquidation worth is $88,844, and their press time revenue and loss was $13,880.49.

The dealer’s aggressive use of leverage alerts a high-risk, high-reward strategy. Hundreds of thousands in USDC are actively transferring between GMX and Hyperliquid.

Seemingly, this can be a signal of a liquidity-optimized technique, permitting them to deploy capital shortly and revenue from small worth actions.

Déjà vu? Identical techniques, greater positions

The similarities between as we speak’s trades and yesterday’s liquidation occasion can’t be ignored.

Only a day in the past, this similar whale withdrew margin from Hyperliquid earlier than liquidation, forcing the HLP Vault to soak up losses. The timing of those withdrawals allowed the dealer to shift threat onto the trade whereas exiting with minimal injury.

Now, the dealer has returned with even bigger positions. This time, benefiting from exact entry and exit factors.

The fast transitions from brief to lengthy on GMX and Hyperliquid recommend an consciousness of liquidation engine habits, presumably making the most of inefficiencies in automated threat administration techniques.

Market analysts at the moment are debating whether or not this can be a repeatable sample.

Hyperliquid’s response to yesterday’s liquidation occasion included decreased leverage limits – BTC trades had been capped at 40x and ETH at 25x. Nevertheless, these modifications didn’t forestall as we speak’s whale trades, which nonetheless reached the brand new most allowable leverage.

CEX vs. DEX leverage – Who handles it higher?

Bybit CEO Ben Zhou weighed in on the Hyperliquid whale liquidation, highlighting a crucial challenge in liquidation mechanics.

“To me, this in the end results in the dialogue on Leverage, DEX vs CEX capabilities to supply low or excessive leverage.”

Zhou identified that this challenge isn’t unique to Hyperliquid. In actual fact, each CEX and DEX exchanges face the identical problem when dealing with liquidations at scale. Whereas reducing the leverage could also be an efficient answer, Zhou mentioned this could possibly be unhealthy for enterprise.

“CEX or DEX on this case faces the identical problem, our liquidation engine additionally takes over the entire place when whales get liquidated. I see that HP has already lowered their general leverage; that’s one option to do it and possibly the best one, nevertheless, this can harm enterprise as customers would need greater leverage.”

On-chain analysts joined the dialogue, agreeing that lowering leverage is a straightforward short-term repair whereas highlighting the larger image drawback.

“The true query is whether or not a DEX can ever help excessive leverage sustainably with out implementing CEX-style surveillance and threat controls. Open Curiosity limits, market surveillance, and liquidation mechanism innovation might assist, however every of those strikes Hyperliquid (or any DEX) nearer to the centralized threat administration playbook.”

Hyperliquid’s confidence shaken?

The affect of the whale liquidations is already being felt throughout Hyperliquid’s ecosystem.

Dune Analytics information revealed that Hyperliquid noticed internet outflows of $166 million on 12 March, the identical day the whale’s place was liquidated.

With merchants and trade leaders now debating the way forward for DEX leverage, Hyperliquid faces a crucial determination.

As Ben Zhou put it,

“Could be fascinating to see the way it develops, possibly new innovation on liquidation mechanism?”