- SIMD 228 proposal didn’t go, however SIMD 123 handed

- Solana insiders hailed the historic voting turnout for the proposal

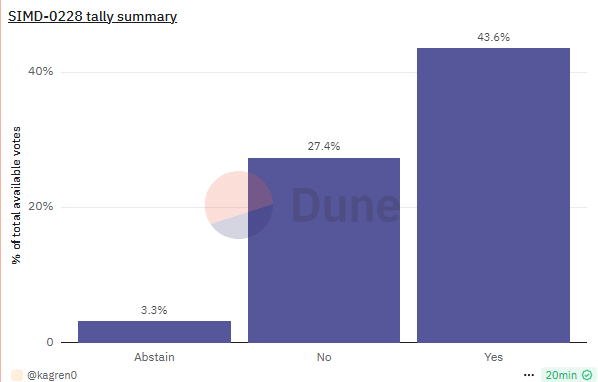

Solana’s [SOL] most controversial inflation proposal, SIMD 228, didn’t go after garnering simply 43.6% YES votes, about 23% beneath the required threshold of 66.67%.

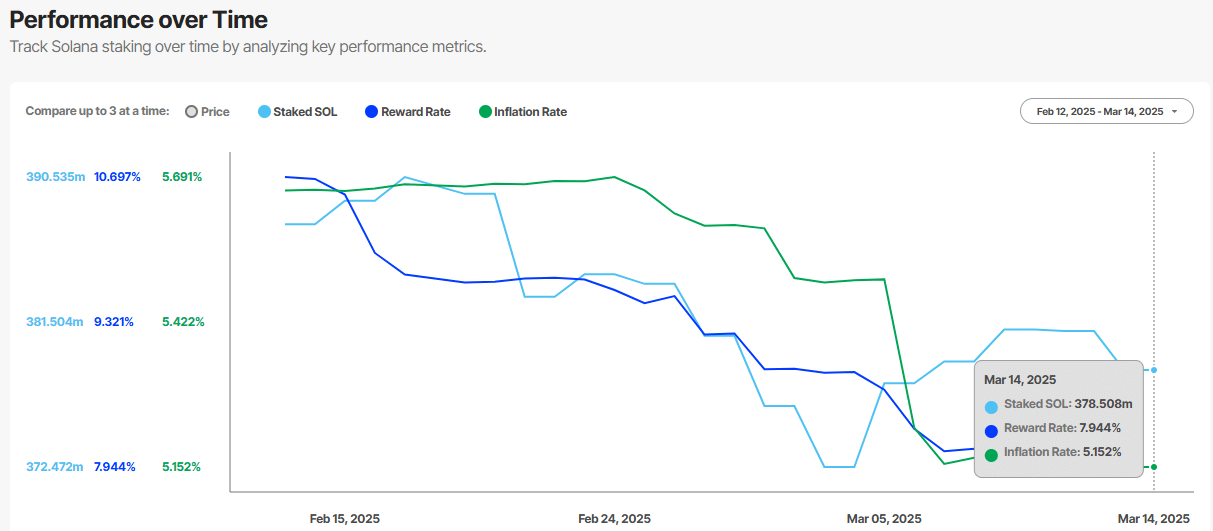

In response to Dune Analytics’ data, the ultimate vote tally confirmed that 27.4% of stakeholders voted towards the proposal to chop Solana’s inflation by 80%.

Supply: Dune

Combined views on Solana’s vote

Regardless of the result, Solana insiders hailed the governance voting course of. Notably, 74% of staked SOL voted on the proposal, alongside 910 validators.

This episode had the best participation ever in a blockchain ecosystem, famous Tushar Jain, Co-founder of Multicoin Capital. Right here, it’s value noting that he’s the crypto VC behind the SIMD 228 proposal.

Jain added,

“This was a significant scaling stress take a look at—a social, moderately than technical, stress take a look at—and the community handed regardless of a large stratification of diverging opinions and pursuits.”

Within the run-up to the voting, the proposal attracted sturdy opposition and supporters in equal measure. Supporters argued that pointless, mounted inflation weighs SOL’s worth, whereas opposers appeared uncomfortable with the potential lower on staking rewards.

Surprisingly, one other SIMD 123 proposal for validator reward distribution, voted alongside SIMD 228, handed.

Even so, the divergent views remained even after the SIMD 228 vote. In response to Solana co-founder Anatoly Yakavenko, opposition to SIMD 228 was performing past their ‘self-interest.’

“Simd 228 didn’t go, however 123 handed. Despite the fact that each proposals had been for decreasing validator income. Opposition to 228 isn’t simply performing in their very own self-interest.”

The SIMD 228 would have launched a compulsory income lower, not like the pliability of the SIMD 123. For his half, Helius Labs’ founder Mert Mumtaz, one of many SIMD 228 opposers and Solana validator operator, stated,

“The one makes stakers extra and the opposite makes stakers much less”

At the moment, Solana’s inflation stands at about 5%, whereas stakers take pleasure in annualized 8% rewards, in response to Staking Rewards data.

In response to simulation estimates, the SIMD 228 proposal would have slashed staker returns to 1.34% – An 80% discount.

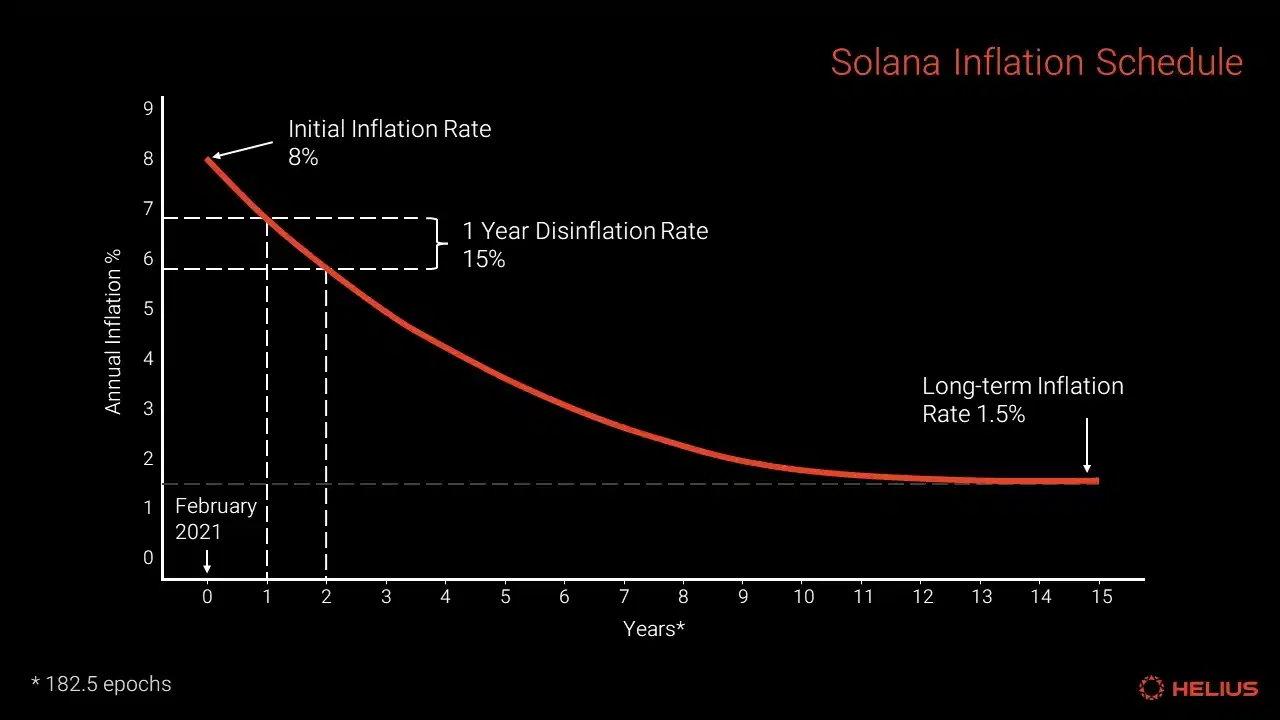

Now, Solana’s mounted inflation schedule, with an annual 15% deflationary fee till it hits a long-term 1.5% fee, will proceed to be in place.

In the meantime, SOL’s value was unmoved by the vote final result at press time. It was valued at $125, and above the essential $120-support zone.