- Spot merchants took a impartial place available in the market, with whale accumulation climbing on the charts too

- Litecoin’s value may reclaim a key consolidation degree and see a significant transfer to the upside

Litecoin [LTC] traders have had a difficult previous few weeks. In truth, they’ve accrued losses of 12.75% over the previous week and 36.61% on the month-to-month charts. Nonetheless, the tides seem like altering, with the market’s whales taking up proper now. As anticipated, the entry of whales had a constructive impression on the cryptocurrency, with the identical up by nearly 2% in 24 hours.

Can it climb any greater? Nicely, in accordance with AMBCrypto’s evaluation, LTC may reclaim a key degree. This is able to doubtlessly mark the beginning of a significant rally, with the altcoin reversing its current losses too.

Spot merchants cross the baton to whales

Based on IntoTheBlock, spot merchants have stopped actively shopping for and promoting the asset, with 0 LTC traded within the final 24 hours.

When such a situation happens, it’s a signal of exhaustion amongst patrons and sellers. What this implies is that there isn’t a accumulation or distribution of LTC on exchanges. Inflows and outflows stability out too – Indicative of a impartial positon.

Whereas spot merchants have adopted a impartial place, whales have recorded excessive buying and selling volumes, with this cohort sitting on $8.24 billion value of LTC at press time. These transaction volumes include whale patrons and sellers.

The Bull Bear Indicator is a metric that measures whether or not massive patrons or sellers are dominating buying and selling quantity. As per the identical, the market could also be at stability now, with 28 bulls and bears.

Every time there’s stability available in the market and the worth rises, it signifies that patrons are in management. They accomplish that by buying extra LTC whereas sellers offload their holdings. That is additionally an indication of whales accumulating the altcoin at a cheaper price, whereas rising their very own place sizes.

By-product merchants have additionally performed a notable function in Litecoin’s current value motion. In truth, most of those merchants are bullish, as indicated by the constructive funding charge of 0.0063%.

A constructive funding charge means the market favors lengthy contract holders (patrons) who pay a periodic premium charge.

Alongside the rising funding charge is the rising taker buy-sell ratio, which measures whether or not by-product buying and selling quantity is dominated by patrons or sellers. On the time of writing, the ratio stood at 1:1. All whereas the Open Curiosity grew by 8.66% to hit $10.80 million on the charts.

Therefore, it’s additionally value analyzing the potential value impression IF a significant bull run does start.

Reclaiming the consolidation path

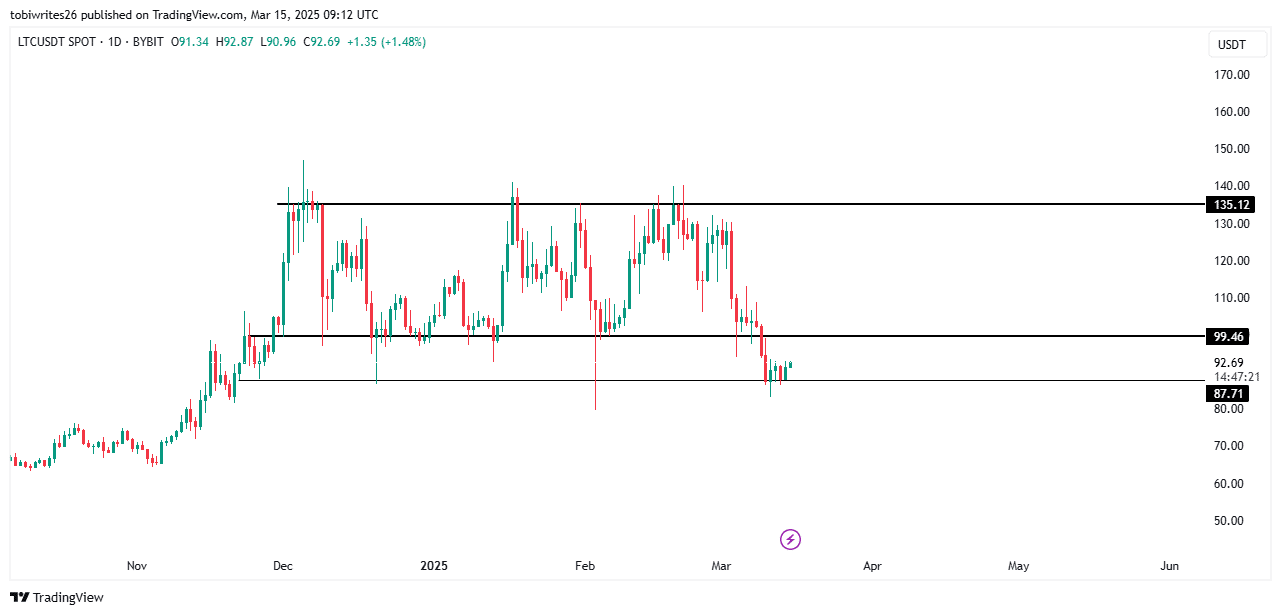

Litecoin’s recent gains correlated with the worth bouncing off a help degree at $87.71, doubtlessly reflecting sturdy shopping for strain that aided its two-day consecutive uptrend.

If the bullish development continues, LTC may reclaim the help degree of the consolidation channel it beforehand breached at $99.46. This is able to point out that the drop beneath this degree was merely a cease hunt, and the worth can proceed rallying north.

If the altcoin hits this new help degree at $99.46, the worth may surge to the height of the channel at $135. If momentum stays sturdy at this degree, Litecoin would possibly proceed its upward trajectory.