- The amount indicators for the day by day timeframe confirmed that the promoting strain was not overwhelming.

- Cardano was not assured to bounce from the lows, and merchants should watch out for BTC’s worth strikes as properly.

Cardano [ADA] confronted rejection on the $0.75-$0.76 space within the hours previous press time. Bitcoin [BTC] noticed a 2.38% decline in seven hours, dragging ADA down by 4.68%. An earlier report famous that the worth’s response on the $0.8 resistance zone could be telling.

The bulls have been rebuffed earlier than testing that resistance as BTC witnessed weekend volatility, rocking the altcoin market as properly. But, the upper timeframe bias remained in place.

So long as the vary formation was in play, ADA traders had a shopping for alternative with a transparent, close-by invalidation.

Time for Cardano bulls to bid on the dip

The market sentiment was shot — the fear and greed index stood at 30, indicating concern. It has denoted fearful sentiment all through March.

Latest on-line exercise and worth motion counsel ADA might wrestle to take care of help on the $0.6 degree. Nevertheless, for swing merchants, the risk-to-reward ratio nonetheless seems favorable.

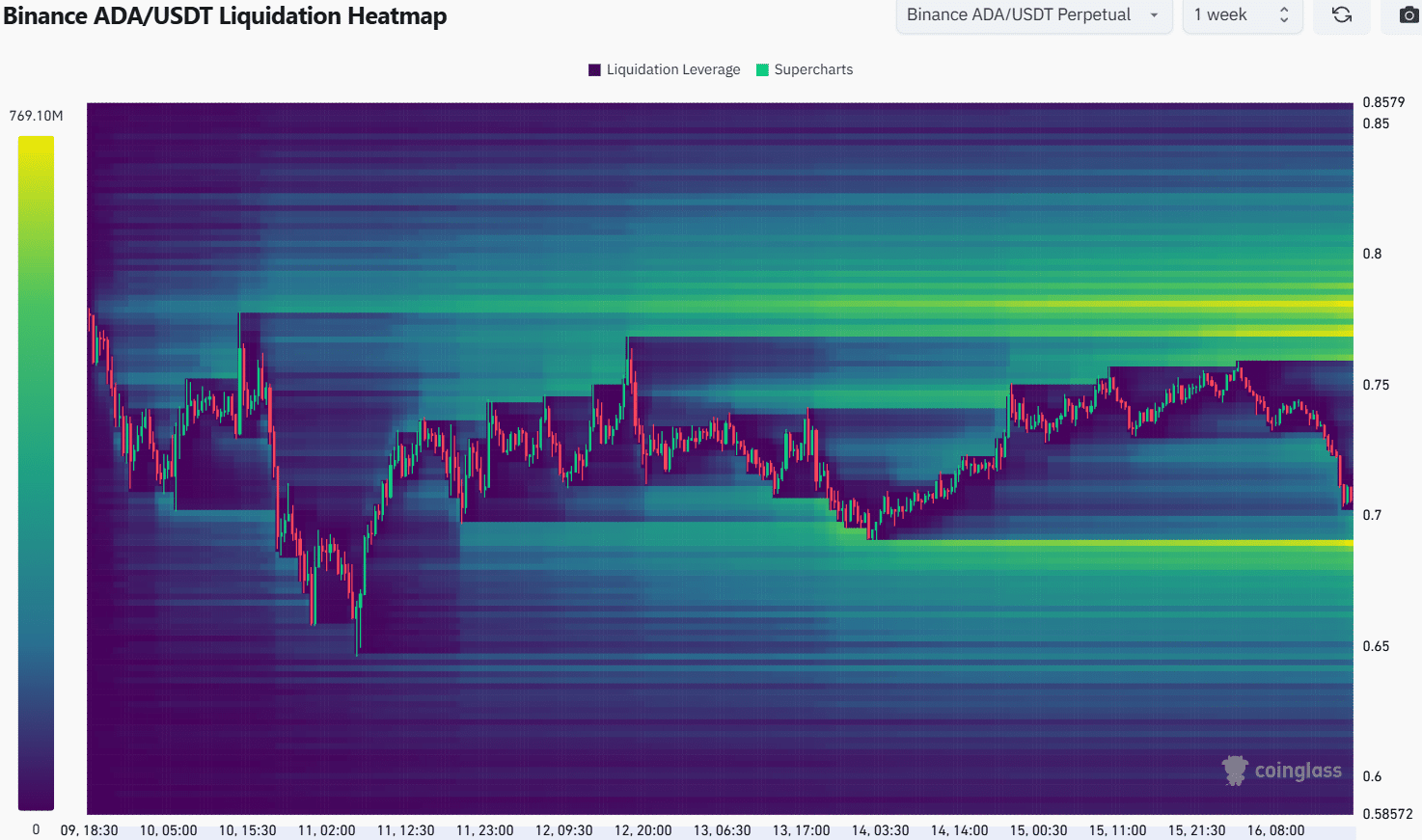

The vary low, highlighted at $0.682, positions ADA’s current dip to $0.58 as an space the place liquidity has possible gathered. This might doubtlessly pull costs decrease.

Regardless of this, final week’s low at $0.647 affords a possibility for lengthy entries, with stop-losses really helpful at 3%-5% under this degree. This chance arises from the confluence of help on the vary low and the shortage of serious bearish strain in technical indicators.

On the time of writing, the A/D line retraced the good points from early March however didn’t crash under native lows. Equally, the CMF was inside impartial territory, and capital outflows have been vital in accordance with the indicator.

The Superior Oscillator additionally confirmed weak bearish momentum. All these elements marked the $0.65-$0.68 area as a probable candidate for a worth bounce.

The 1-week liquidation heatmap confirmed that the lows at $0.68-$0.69 was a liquidity pocket close to the worth. It was more likely to pull costs decrease earlier than a worth bounce.

Nevertheless, it was not a assure that Cardano would bounce from right here — it could be closely depending on BTC tendencies within the subsequent 24–48 hours.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion