- Pepe has a bearish construction and outlook on the upper timeframes.

- One other 5% transfer larger is anticipated, however demand was too weak to point any additional beneficial properties.

Pepe [PEPE] noticed outflows from exchanges and a few proof of accumulation in current weeks. On the identical time, holders have been at a loss, and constant promoting strain has compelled this 12 months’s downtrend.

This long-term bearishness has not but ended.

Within the quick time period, there was some hope for small beneficial properties. A transfer to the two-week vary highs was anticipated, however a breakout was not. Listed here are the degrees merchants have to be careful for.

Pepe rebounds from mid-range help

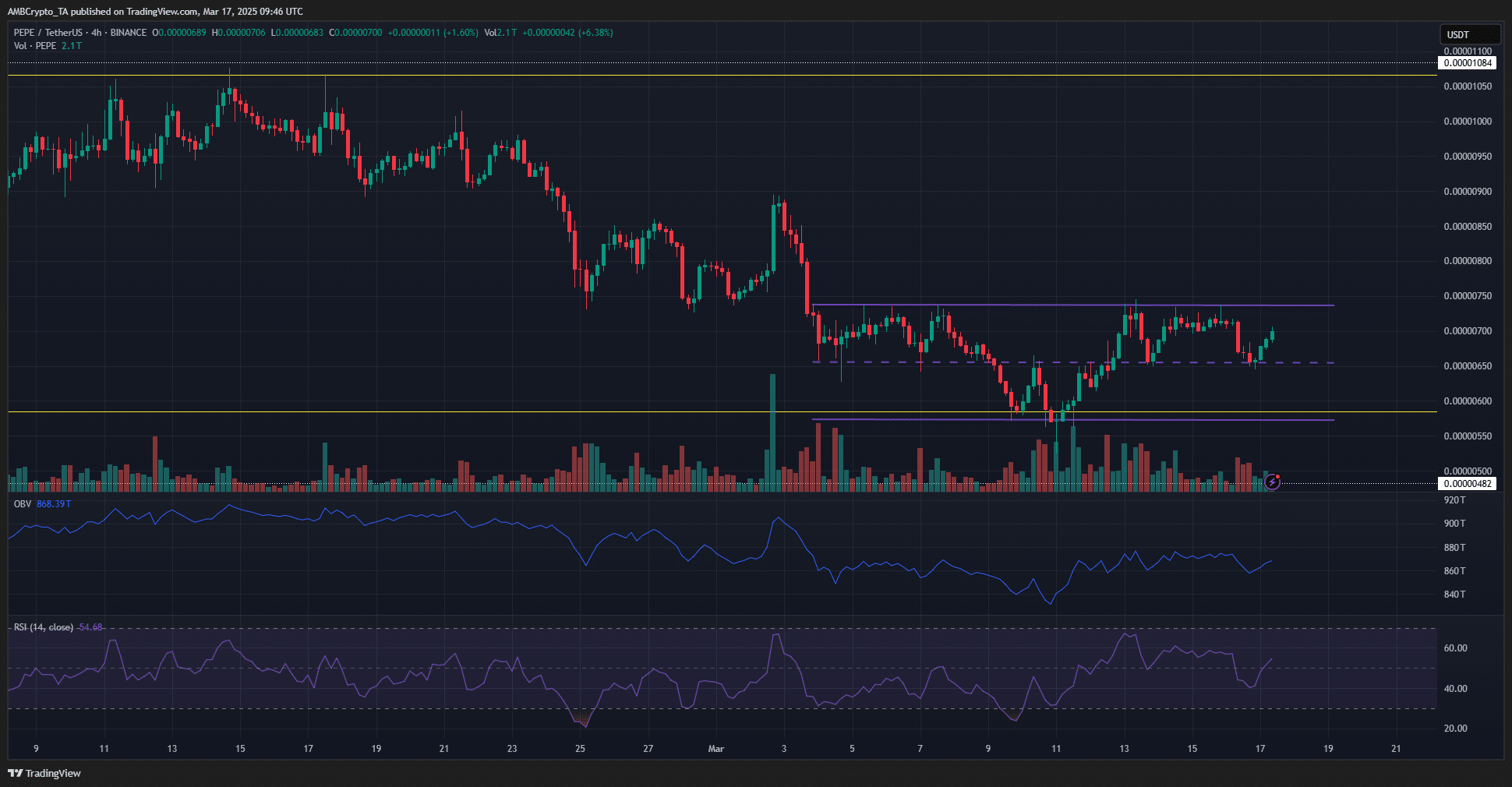

The upper timeframes have been firmly bearish, however the decrease timeframes confirmed consolidation for the memecoin. PEPE has traded between the $0.00000572 and $0.0000736 ranges for 2 weeks now.

The vary formation (purple) had validity as a result of not solely have been the extremes revered, but additionally the mid-range stage at $0.00000655.

The repeated exams of this stage as help and Pepe’s robust response elevated the vary’s credibility.

At press time, the RSI was climbing again above impartial 50 after a dip over the weekend. This confirmed short-term bullish momentum that would take PEPE to the vary highs.

A breakout was not on the playing cards, however merchants ought to nonetheless handle threat in case one happens.

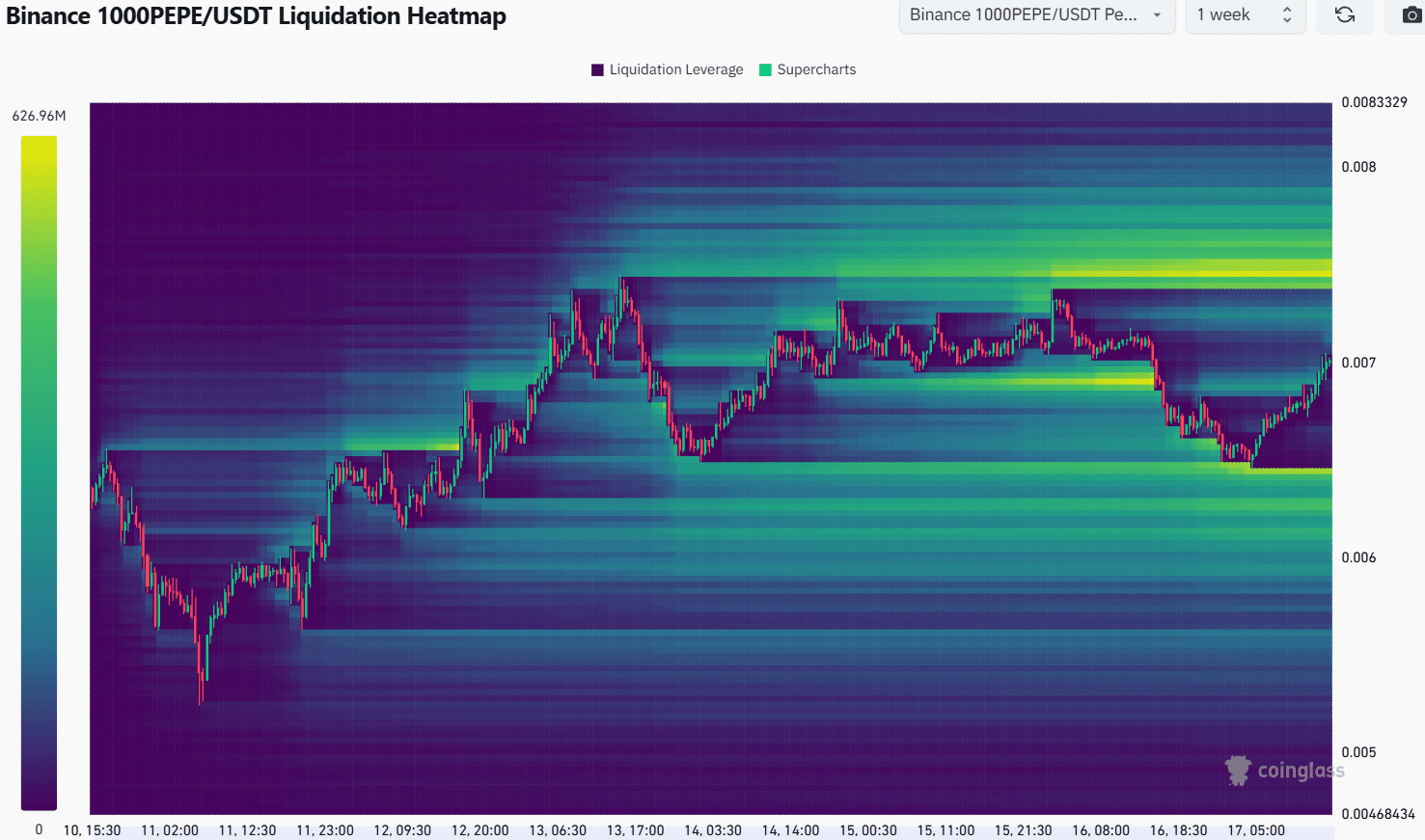

Supply: Coinglass

The 1-month liquidation heatmap confirmed a cluster of liquidity at $0.0000075, simply above the vary highs.

This backed up the concept Pepe costs would soar one other 5% within the coming hours or days to comb the liquidity pocket. Additional larger, the $0.000009 was the subsequent magnetic zone to observe.

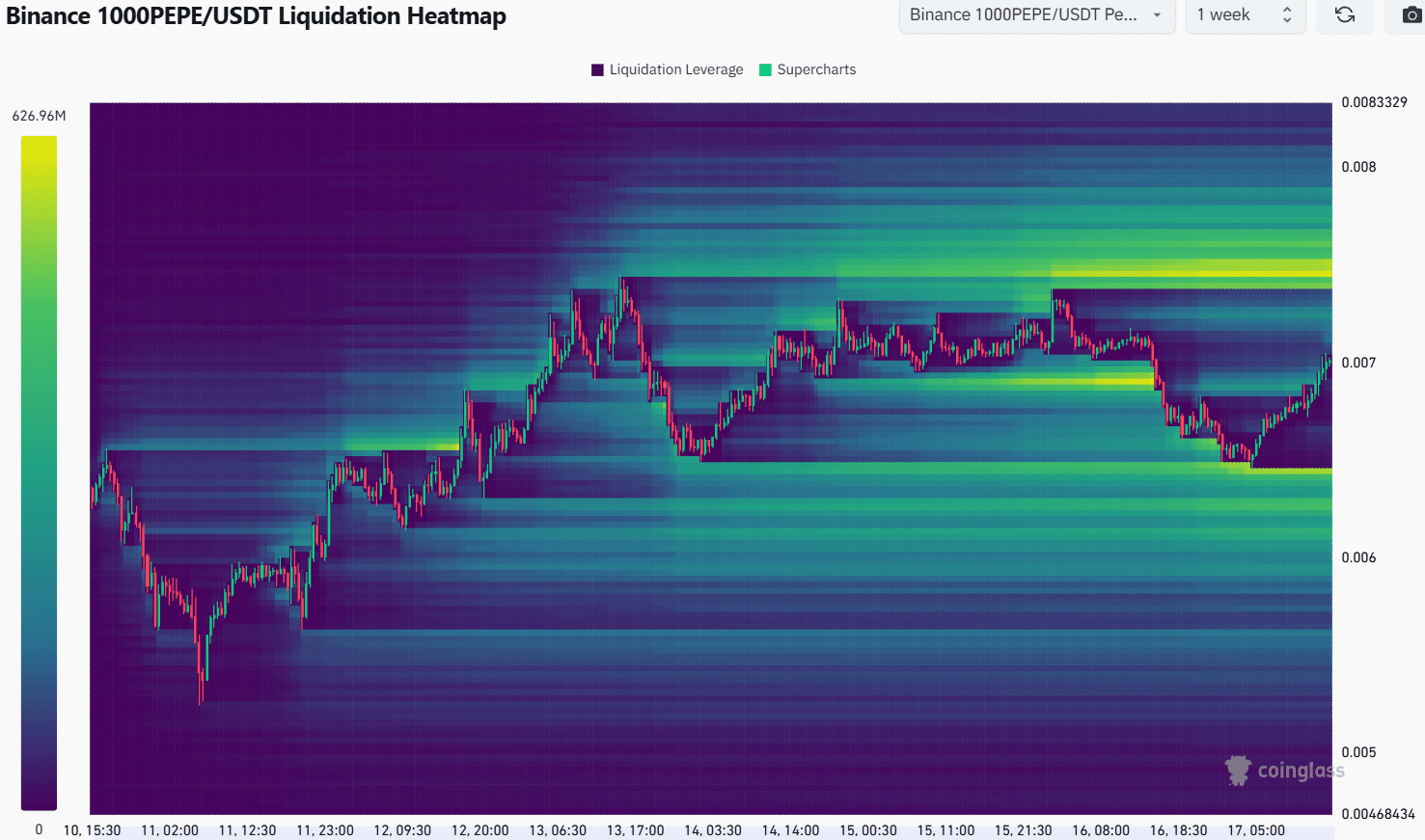

Supply: Coinglass

Because the quantity indicator doesn’t present a breakout was probably, we are able to follow the concept the vary formation would persist. The 1-week heatmap confirmed a liquidity pocket at $0.00000745-$0.0000075.

The native low round $0.00000645 was a short-term bearish goal. This stage was just under the mid-range stage, that means {that a} retest of the mid-range area may provide swing merchants a shopping for alternative.

Bitcoin [BTC] volatility may damage the Pepe vary formation and trigger deviations above the vary in the course of the New York session for conventional markets.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion