- Regardless of sizeable good points since November, the day by day chart revealed a bearish worth construction

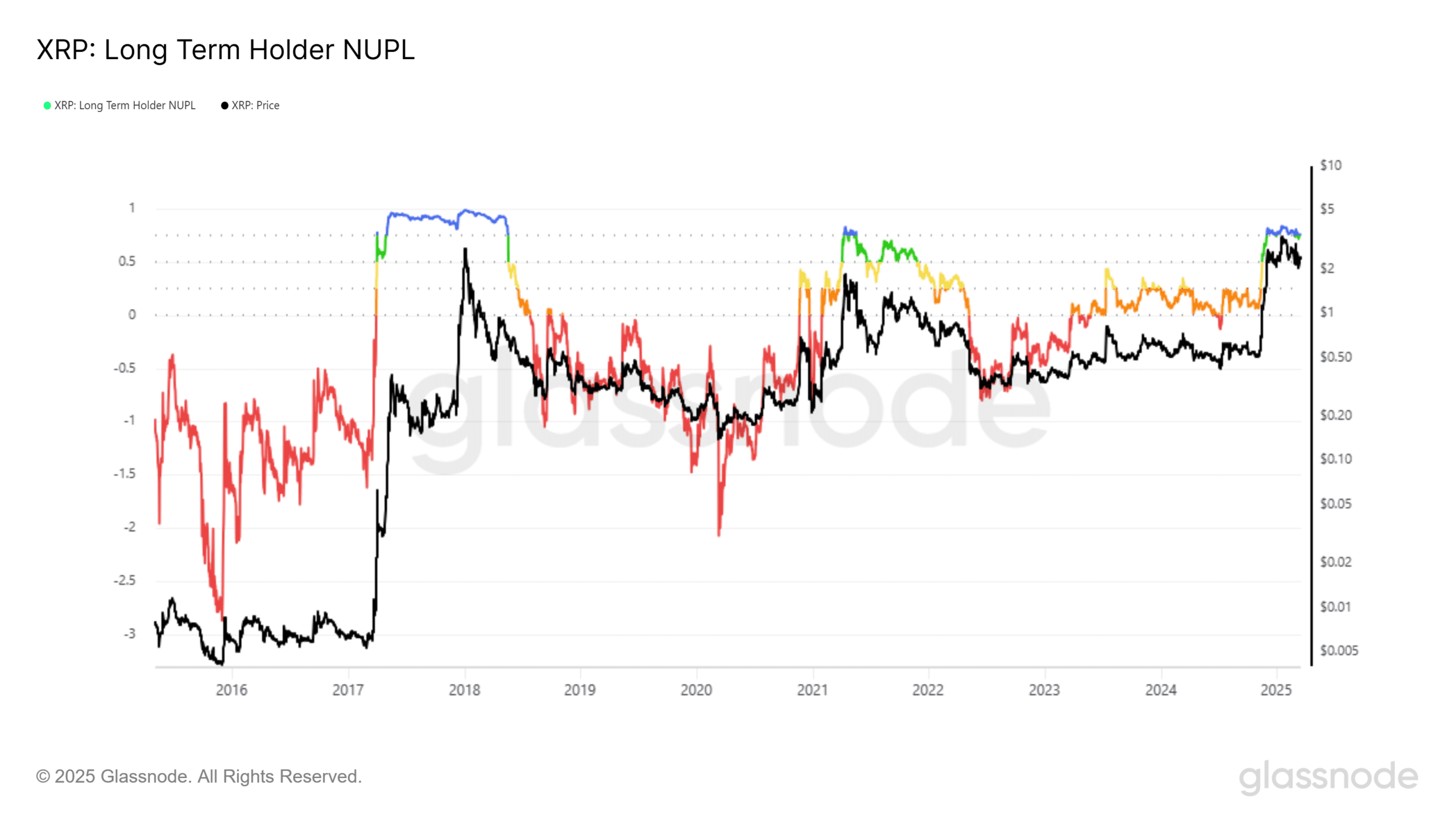

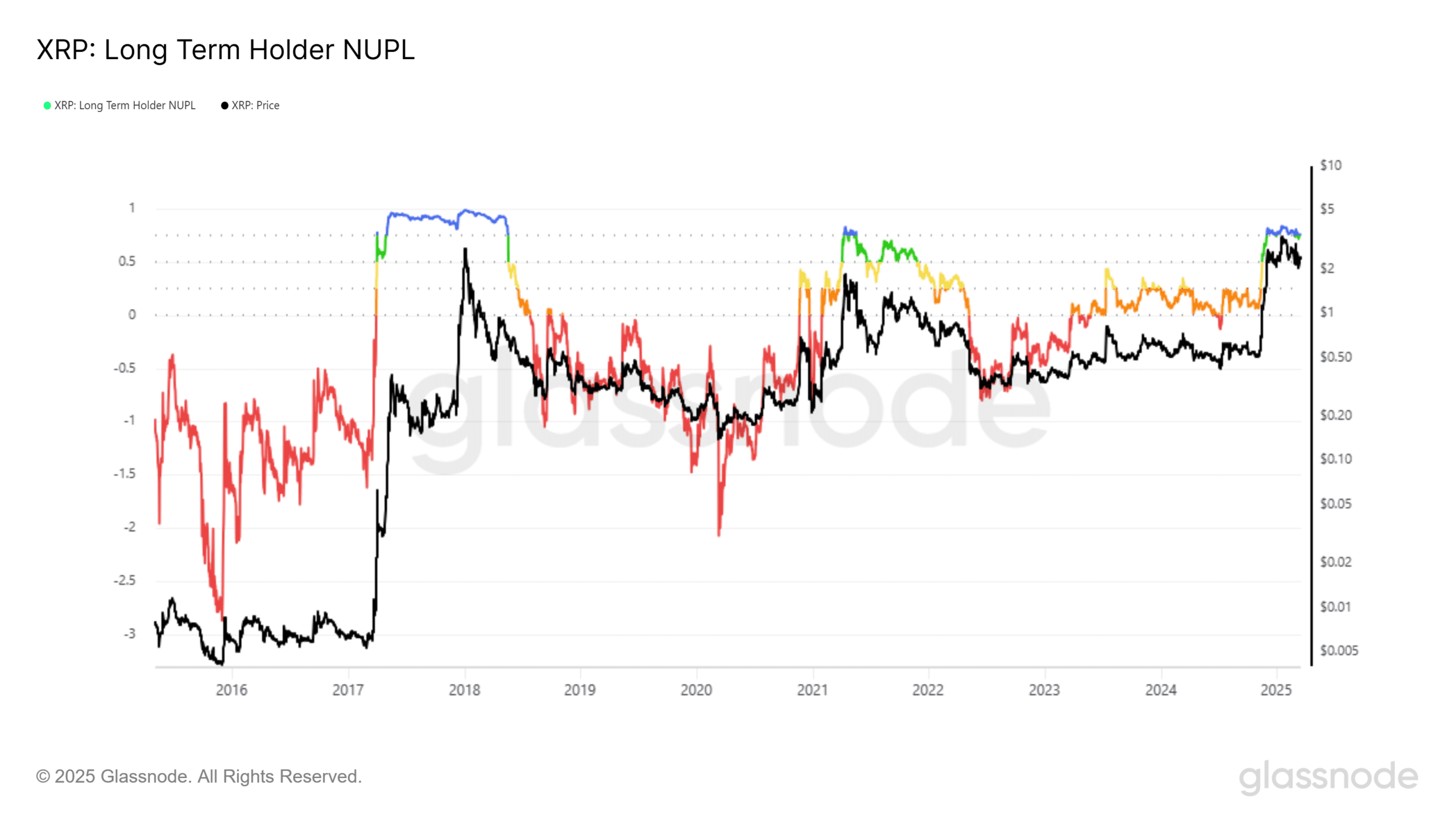

- Lengthy-term holder unrealized revenue/loss metric revealed similarities to the 2021 cycle high

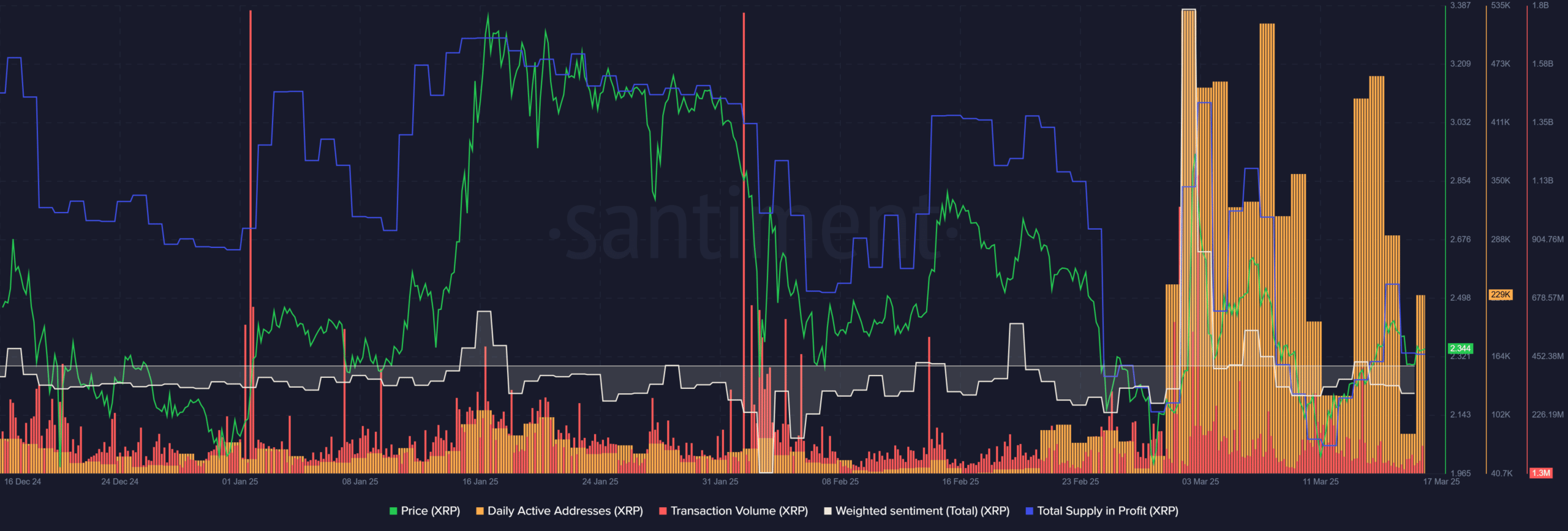

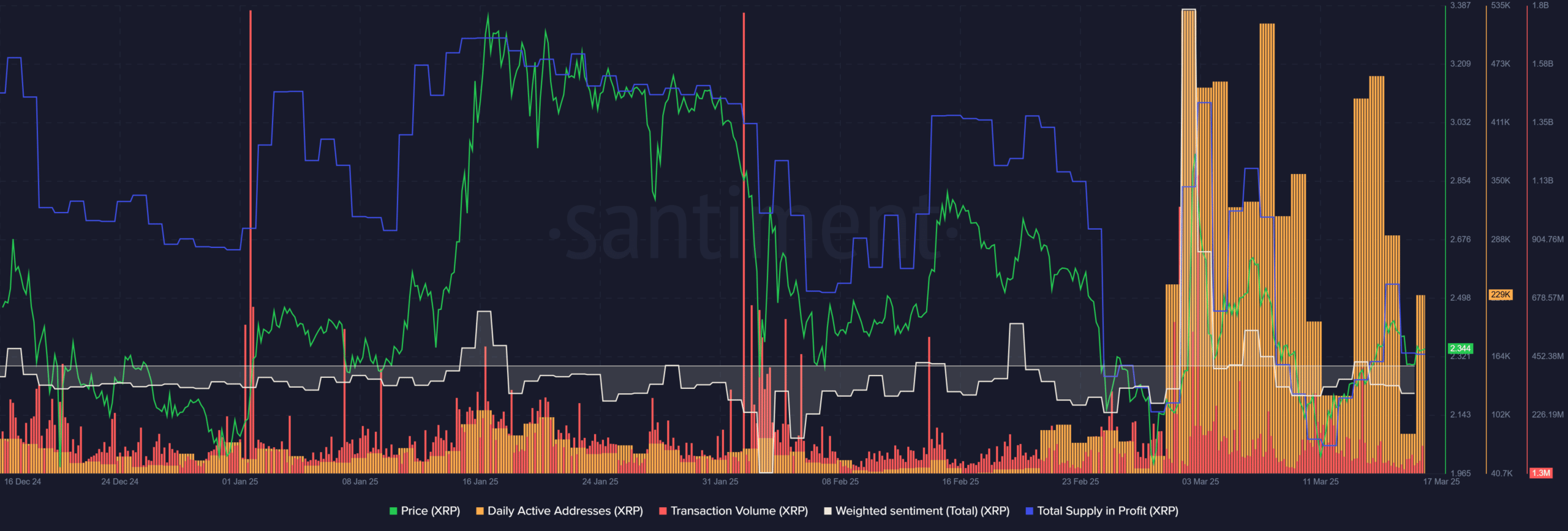

The on-chain indicators behind the robust XRP good points prior to now six months have been blended thus far. The availability in revenue was excessive, as anticipated, however the sentiment behind the token was detrimental.

In truth, the web unrealized revenue/loss revealed similarities to April 2021 and this might be eerie for the bulls.

The altcoin’s 1-day worth motion confirmed a bearish construction on the day by day chart. This shift, highlighted in pink, occurred per week in the past when XRP slipped beneath the $2.19-level. Since dropping to $1.9, the altcoin has rebounded to check the $2.45-level as resistance.

This degree occurred to be the 50% retracement degree of the transfer from $2.99 to $1.9. The rejection at $2.45 over the weekend highlighted the bearish strain on the coin. Subsequently, regardless that XRP has been up 370% for the reason that U.S. Presidential Elections, sellers have had the higher hand.

Excessive community exercise boosts XRP investor morale

Supply: Santiment

Knowledge from Santiment underlined some positivity for buyers. The whole provide in revenue has been falling alongside the worth since January. Nevertheless, it was nonetheless considerably greater than ranges it had been at in October and November 2024.

The weighted sentiment, which tracks social media engagement associated to XRP, was detrimental. It has been detrimental over the previous three months, with just a few spikes of constructive engagement.

The day by day energetic addresses shot skywards in March. Though the numbers have receded considerably, it was a lot greater than latest months. The transaction quantity developments remained much like the previous three months.

Supply: Glassnode

Whereas Santiment’s metrics confirmed hike in on-chain exercise and potential demand, the long-term holder web unrealized profit-loss (LTH NUPL) highlighted euphoria/greed out there. Over the previous few months, the metric has been hovering simply above the 0.75-level.

Right here, the NUPL measures the distinction between unrealized income and unrealized losses amongst holders whose tokens are a minimum of 155 days outdated. Optimistic values indicate that buyers are, on common, worthwhile. A price of 0.75 meant that 75% of the market capitalization was in revenue.

In the summertime of 2021, the metric rose above 0.75 and marked the cycle high for XRP. In 2017, the metric surged past 0.9 and stayed there for weeks. Nevertheless, again then, it was additionally a a lot youthful asset.

XRP might need made its cycle high already. Traders needs to be trying to money out their holdings partially in case the market begins to show and sustains a downtrend for the subsequent two years.