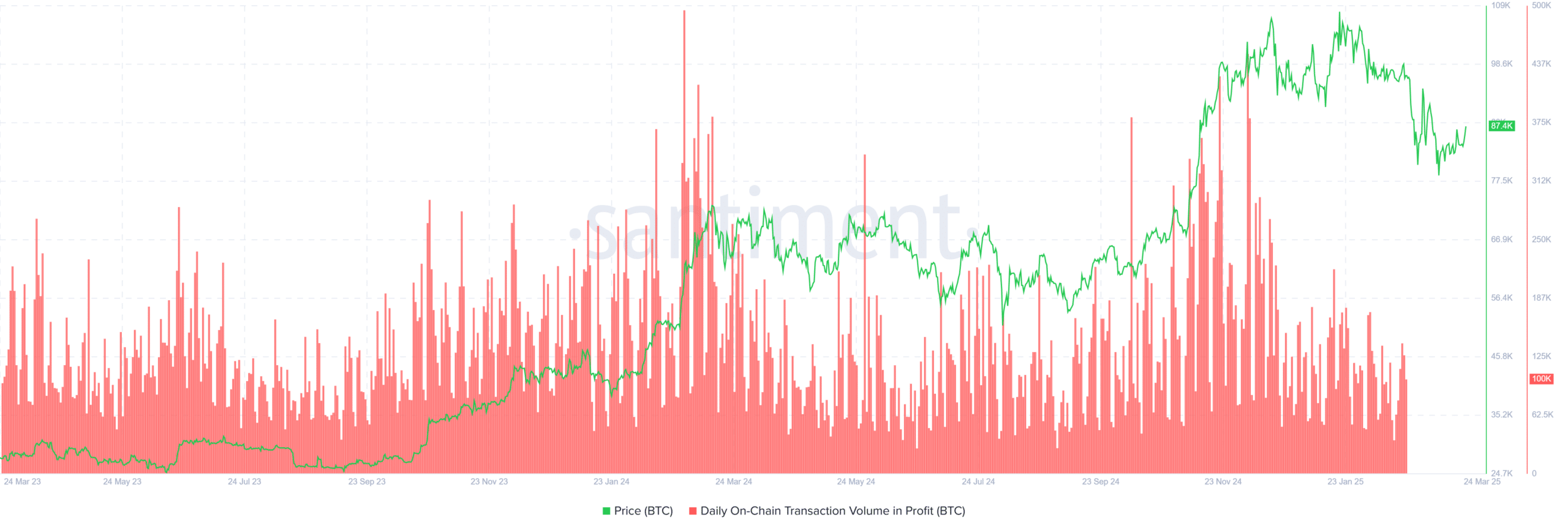

- BTC’s day by day on-chain transaction quantity in revenue highlights investor habits throughout value actions.

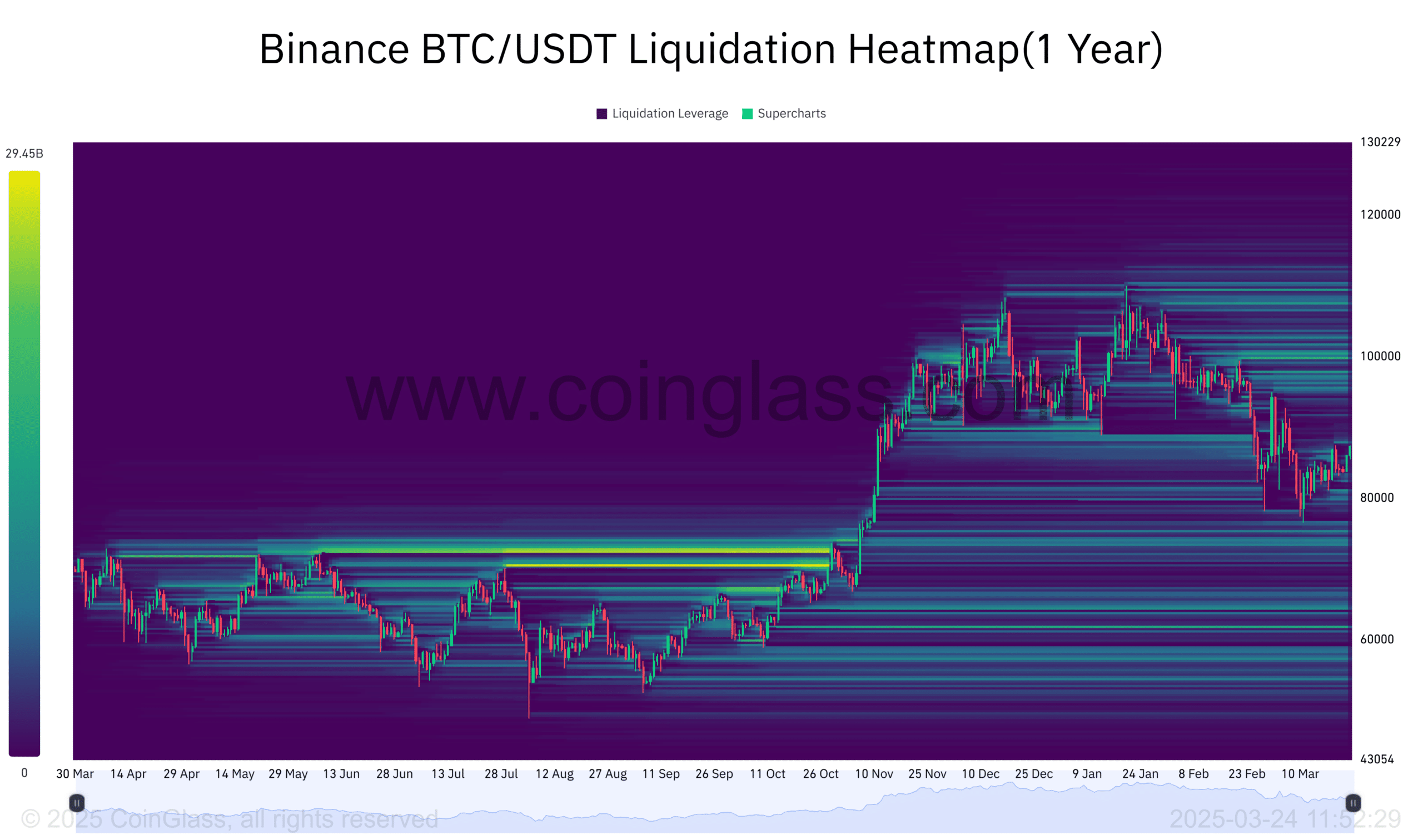

- BTC liquidation heatmap on Binance gives insights into leveraged positions and market stability.

Bitcoin’s [BTC] provide in loss (%) provides essential insights into market sentiment and value habits.

In early 2022, the provision in loss peaked at 21.9% as Bitcoin dropped under $20K, reflecting sturdy promoting stress throughout a bearish section.

As the worth fluctuated between $20K and $30K all through 2022 and 2023, the provision in loss stabilized between 10–15%, indicating lowered however persistent promoting stress.

By mid-2024, as Bitcoin surged towards $70K, the provision in loss declined steadily, falling under 5% by early 2025 as the worth reached $94K.

This downward pattern instructed lowering promoting stress, as fewer holders remained at a loss. The correlation between a shrinking provide in loss and rising costs pointed to rising investor confidence.

As extra market members held onto their property in anticipation of additional good points, the chance of panic promoting diminished, reinforcing a bullish outlook for 2025.

BTC’s day by day on-chain transaction quantity in revenue

Additional, Bitcoin’s day by day on-chain transaction quantity in revenue highlights investor habits throughout value actions.

In early 2024, with BTC buying and selling round $60K, profit-taking remained low, indicating cautious market sentiment.

As Bitcoin climbed to $87K by late 2024, transaction quantity in revenue spiked, reflecting elevated revenue realization as traders capitalized on the rally.

Nevertheless, by early 2025, as Bitcoin corrected to $77K, transaction quantity in revenue declined. This instructed that fewer holders had been actively promoting, aligning with the lowering provide in loss.

Thus, traders in revenue opted for selective profit-taking moderately than mass liquidation, contributing to cost stability.

This pattern bolstered the broader market sentiment that confidence in BTC’s long-term worth remained sturdy regardless of short-term corrections.

Market stability or instability?

The BTC liquidation heatmap on Binance gives insights into leveraged positions and market stability.

Excessive liquidation zones round $60K–$70K in mid-2024 indicated extreme leverage, resulting in compelled liquidations throughout value volatility.

As Bitcoin rallied to $87K by late 2024, liquidation ranges decreased, suggesting extra balanced leverage utilization amongst merchants.

By early 2025, with Bitcoin consolidating round $77K, liquidation exercise remained low. This aligned with the declining provide in loss, as fewer underwater positions lowered compelled liquidations.

Decrease liquidation dangers contributed to a extra steady market, permitting Bitcoin’s value motion to be pushed by natural demand moderately than extreme leverage.

This atmosphere positioned Bitcoin for potential continued progress in 2025, with lowered draw back threat from compelled promoting.

Subsequently, as BTC adoption grows and institutional curiosity strengthens, market members might even see continued value appreciation, pushed by long-term confidence moderately than short-term hypothesis.