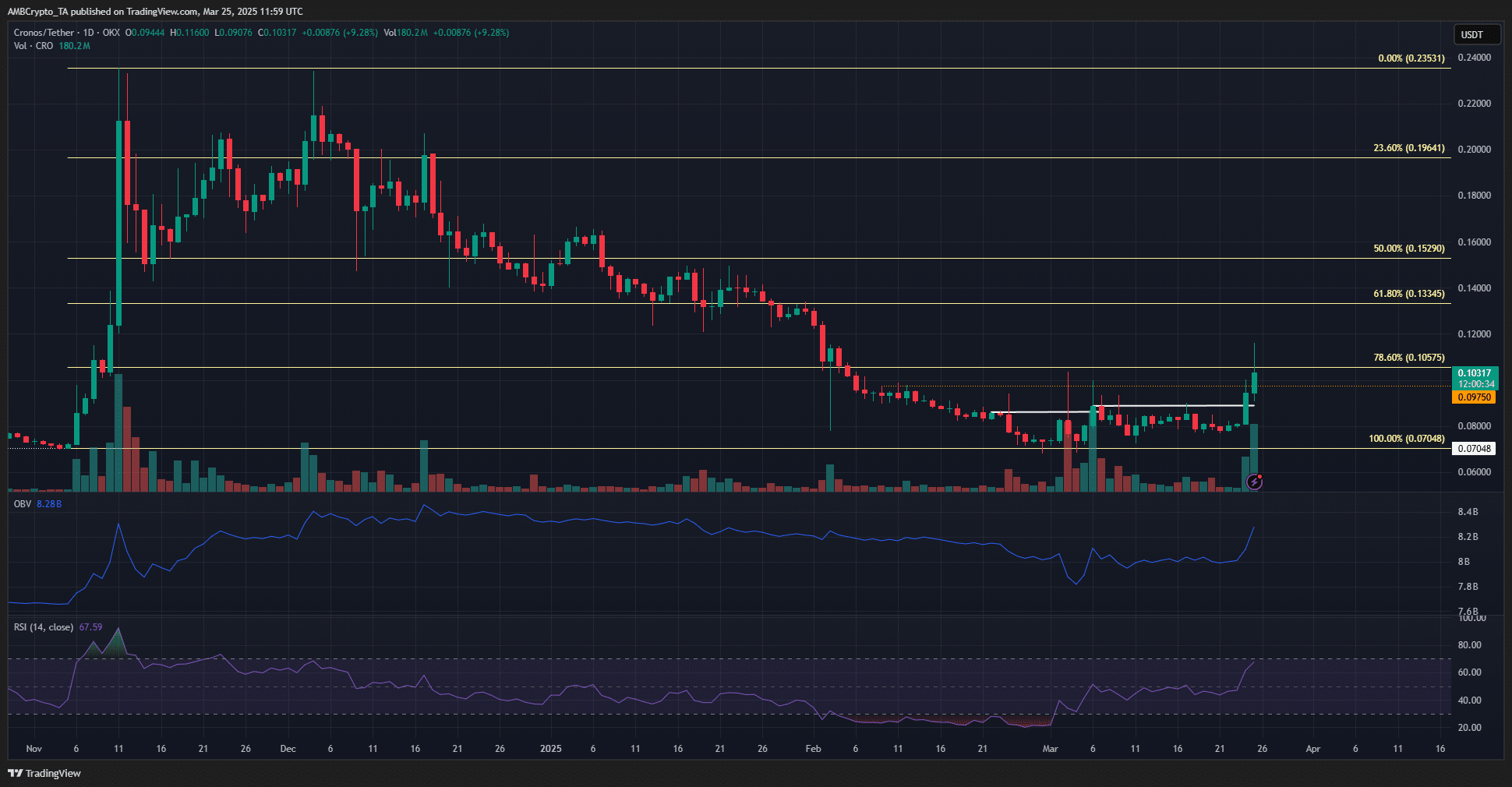

- Cronos has a bullish market construction on the each day chart and was attempting to flip $0.1 to help.

- The sturdy shopping for stress alongside the worth breakout meant additional beneficial properties had been probably within the coming weeks.

Cronos [CRO], previously often known as Crypto.com Coin, noticed sturdy beneficial properties prior to now 36 hours. It was up by 27.7% at press time, however there have been indicators of a pullback. This minor value dip was anticipated to be roughly 5% in magnitude.

The 1-day value motion for Cronos was strongly bullish. With rising shopping for stress, it appeared probably that the CRO bulls might provoke a restoration.

Cronos: Second bullish market construction break

In white, the 2 each day timeframe market construction breaks had been marked. Furthermore, the worth was above the native resistance stage at $0.0975 and tried to scale the $0.105 resistance.

The OBV noticed a robust uptick because the buying and selling quantity prior to now couple of days was excessive. The breakout past the native resistance on the again of excessive quantity was an encouraging sight for the bulls.

The 1-day RSI additionally surged previous impartial 50 to indicate sturdy bullish momentum.

If the present demand will be sustained, Cronos has likelihood of initiating a rally increased. But, if it sinks under $0.1 and $0.0975 within the coming days, the current value surge would develop into a fake-out.

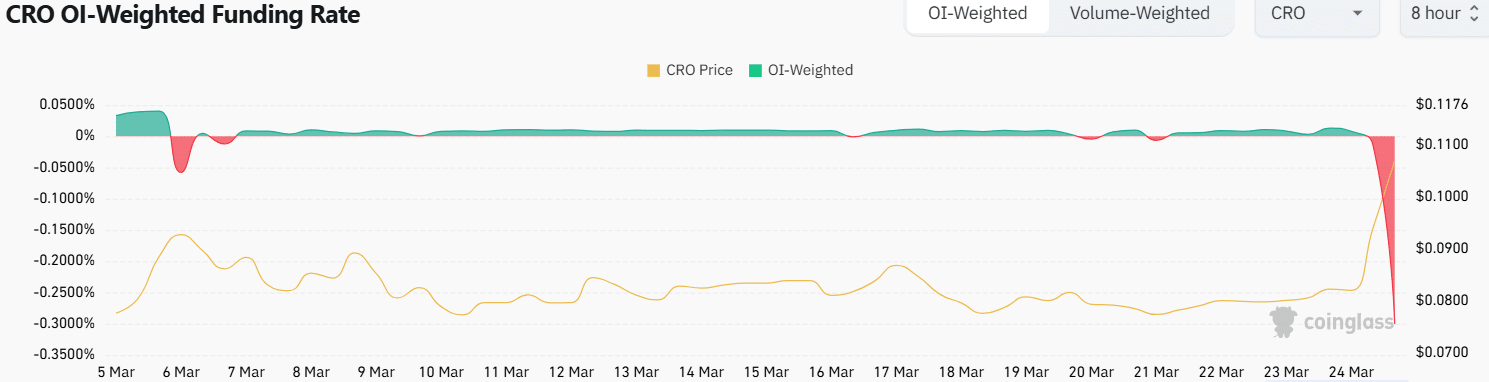

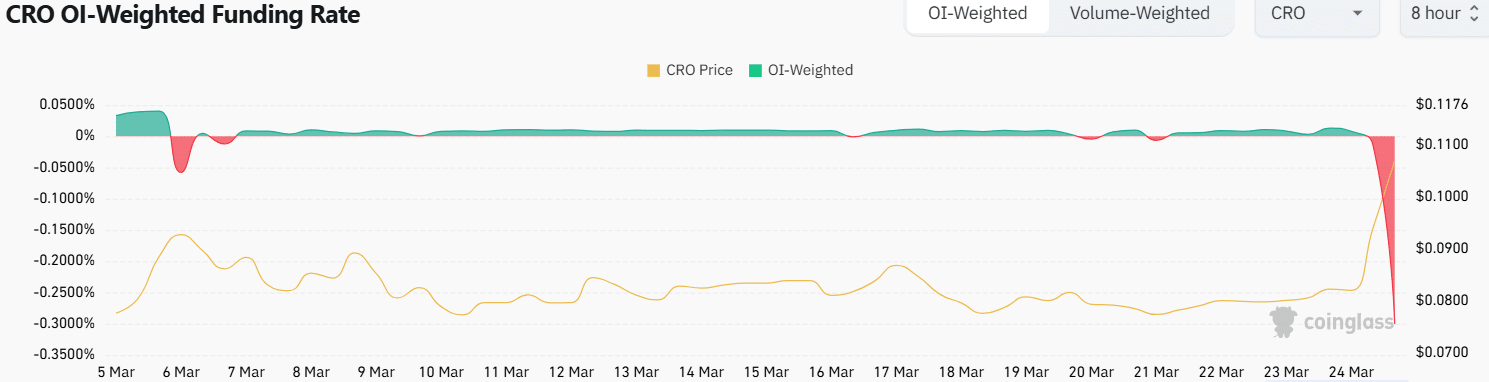

Supply: Coinglass

The Funding Fee was steeply destructive, standing at -0.3% at press time. It final fell to destructive territory on the sixth of March, falling to -0.05%. It occurred to mark the native value high at $0.093.

With brief sellers crowding the derivatives market, the current surge may mark the native high once more. Nevertheless, a neighborhood high doesn’t subtract from the bullish market construction on the each day chart.

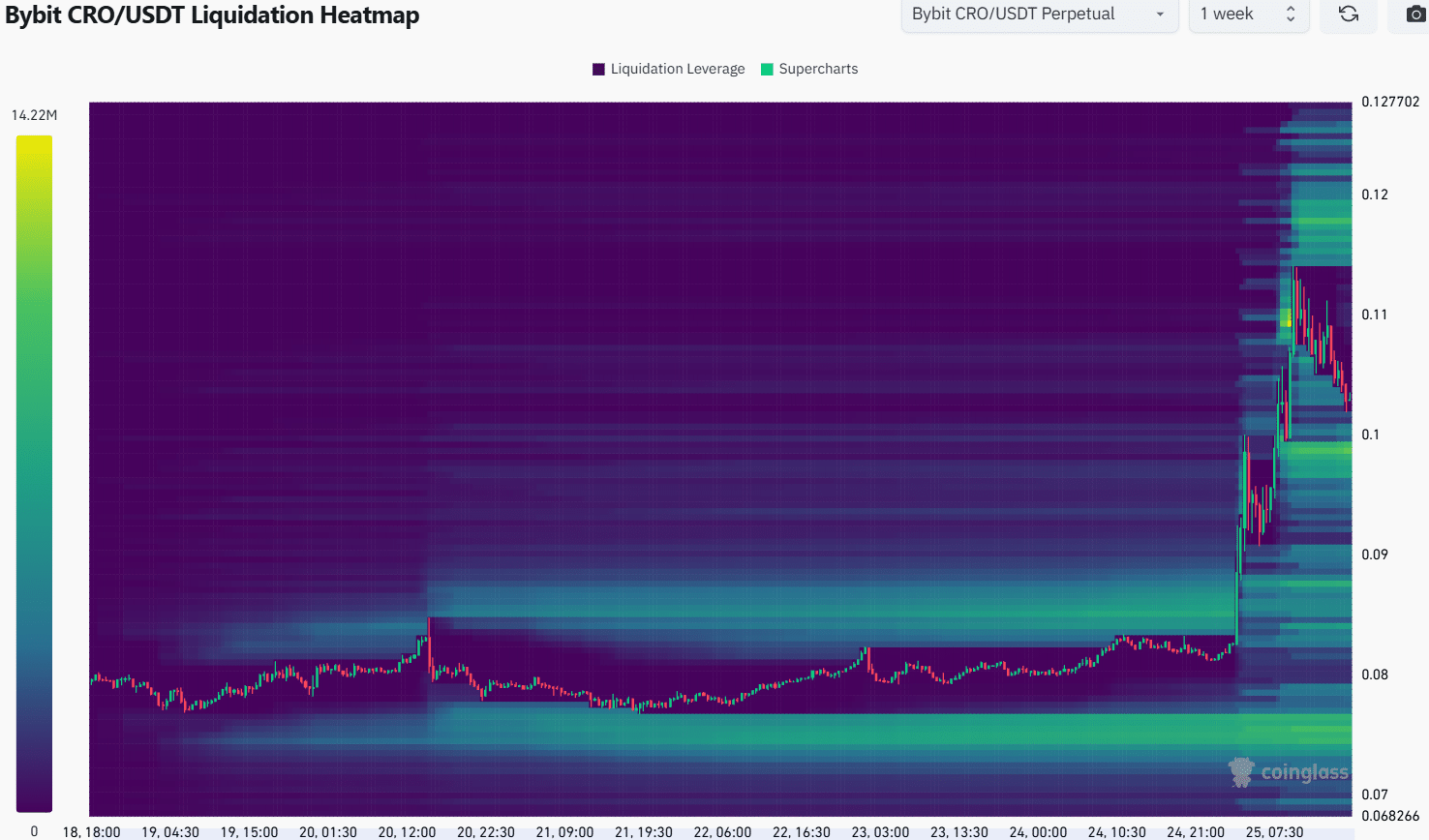

Supply: Coinglass

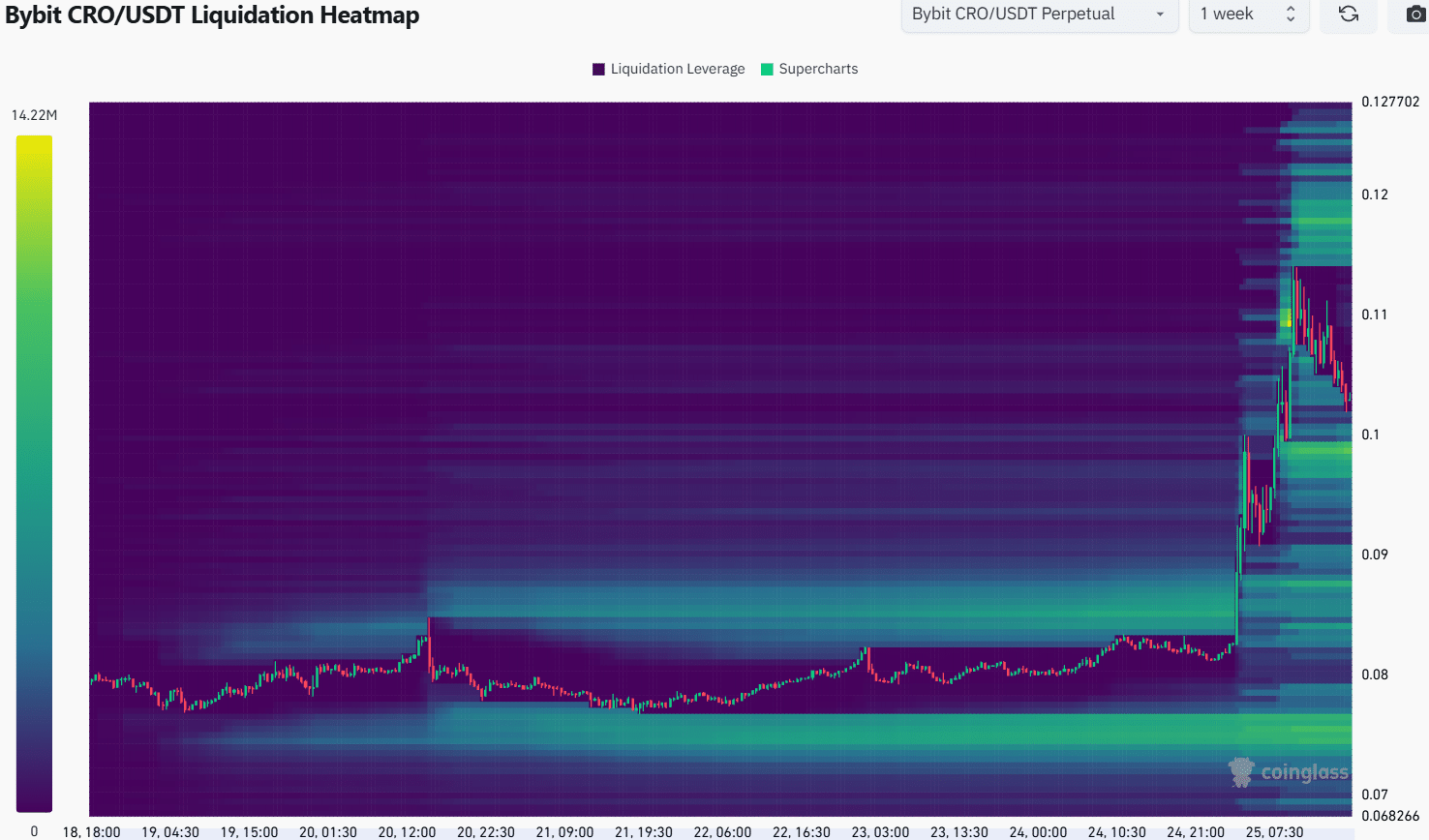

The 1-week liquidation heatmap famous two magnetic zones of curiosity at $0.098 and $0.118.

The destructive Funding Fee mixed with overbought situations within the decrease timeframes meant {that a} CRO value dip to $0.098 was potential.

Therefore, swing merchants can look to purchase the token upon a retest of the close by demand zone, concentrating on the $0.118-$0.12 liquidity cluster.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion