- BERA recorded important web outflows on-chain, however spot and spinoff merchants have been accumulating.

- OKX merchants stay resistant, with promoting quantity persevering with to outweigh shopping for strain.

Berachain [BERA] has emerged as one of many high gainers, rising 14% prior to now 24 hours and pushing its weekly achieve above 30%, in distinction to different tokens struggling to file good points.

Evaluation means that the asset nonetheless has a transparent path to additional good points as shopping for strain from spot and spinoff merchants begins to extend.

Spot merchants search to reverse losses

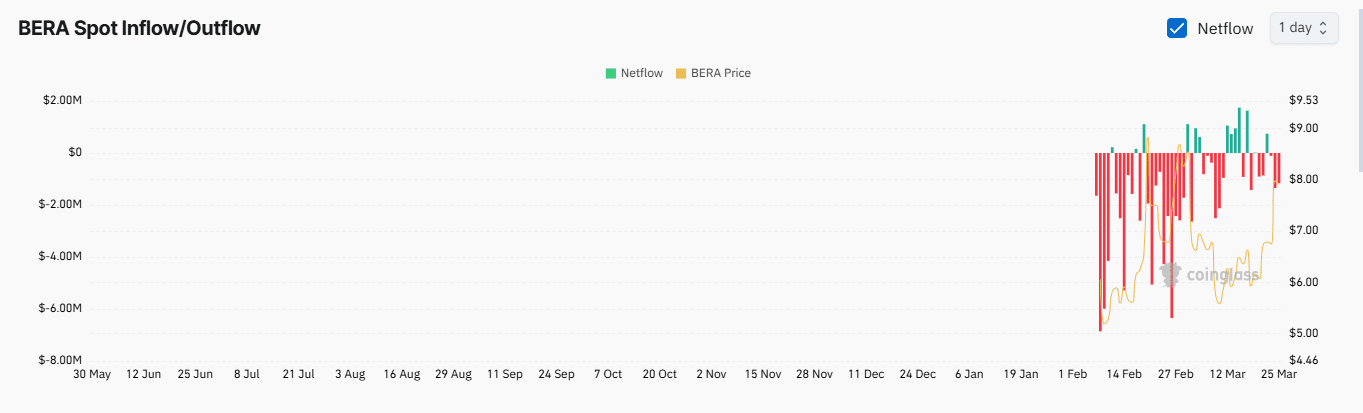

Previously week, Berachain has seen a large liquidity outflow, as indicated by Artemis, with $19.4 million faraway from the chain, which is usually a bearish sign.

Nonetheless, the latest surge in BERA’s value contradicts this pattern.

On the time of writing, spot merchants have begun stepping in, buying $2.8 million price of BERA prior to now three days, as proven by alternate netflow information.

If shopping for exercise extends into the week, it could point out elevated dealer optimism, probably driving BERA to additional good points.

Derivatives merchants might gas BERA’s rally

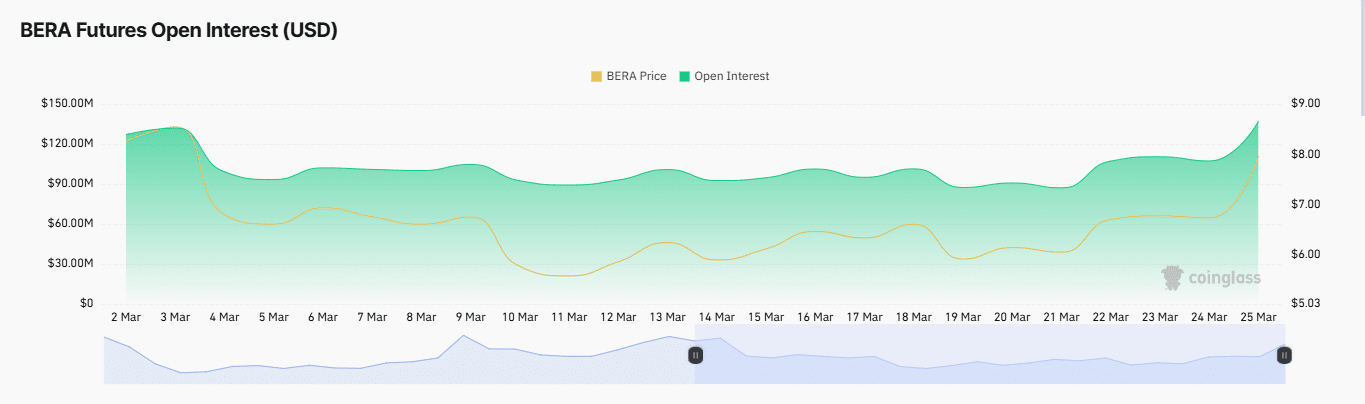

By-product merchants might act as a catalyst for a possible BERA rally. At present, key indicators counsel a shift in momentum.

Previously 24 hours, BERA’s Open Curiosity has surged 202.2% to $136.79 million, signaling a notable enhance in unsettled spinoff contracts.

These contracts might favor both bulls or bears, however rising quantity and brief liquidations verify a bullish pattern.

BERA’s buying and selling quantity has additionally climbed over 262% to $595 million prior to now 24 hours, reflecting heightened market exercise that has positively impacted its value.

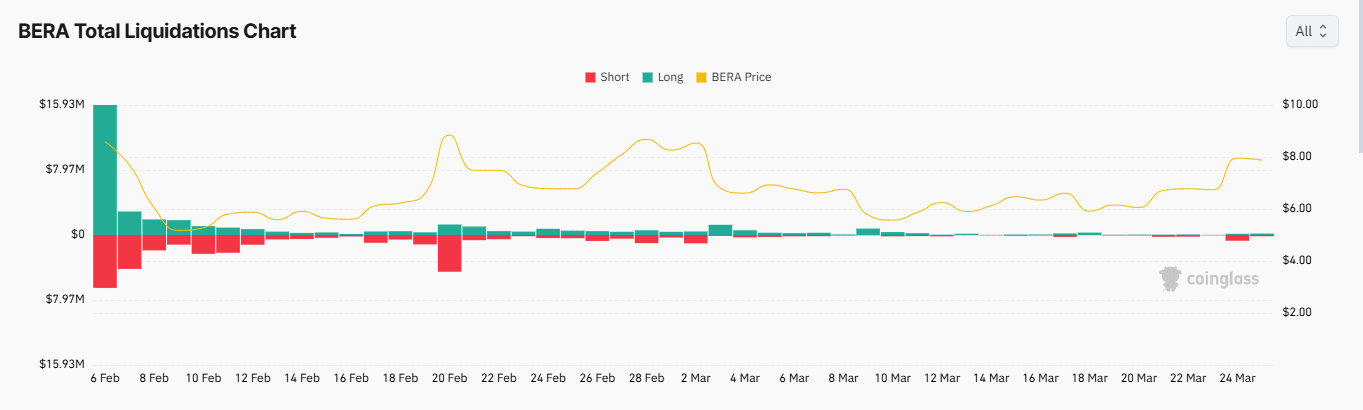

In the meantime, brief liquidations have elevated, with merchants betting towards BERA shedding $769,000 because the market moved towards them.

When brief liquidations outpace lengthy liquidations, it indicators robust bullish sentiment, forcing merchants to exit their positions at stop-loss ranges.

Regardless of the general bullish outlook, AMBCrypto discovered that not all market segments align with BERA’s potential for additional good points.

OKX merchants resist shopping for, proceed promoting BERA

Promoting strain from spinoff merchants on OKX has intensified over the previous day.

In line with Coinglass information, the long-to-short ratio, a metric that signifies shopping for vs. promoting exercise, presently stands at 0.76 on OKX.

A ratio beneath 1 suggests promoting strain dominates, and the additional it’s from 1, the stronger the bearish momentum.

With OKX merchants closely bearish, sustained promoting might hinder BERA’s probabilities of an instantaneous rally.