- Ethereum dropped over 55% in 14 months amid sustained sell-side stress.

- The $1,800 help stage holds regardless of bearish sentiment and value volatility.

Ethereum’s [ETH] descent from a $4,000 peak in February 2024 to simply underneath $1,800 in April 2025 tells a narrative far deeper than a easy value crash.

There are indicators the worst could also be behind us

After 14 months of steady promoting stress, Ethereum’s market seems to be nearing a turning level.

Latest CryptoQuant analysis highlights a big bullish divergence rising beneath the floor. Though Ethereum’s value has dropped to multi-month lows, a number of metrics point out that sellers are shedding momentum.

One key issue is Ethereum’s Web Taker Quantity (NTV). Traditionally deeply detrimental, NTV peaked at -$360 million, reflecting intense and extended promote stress. Nevertheless, this stress is now easing.

Just lately, NTV has begun forming greater lows regardless of Ethereum’s declining value, signaling a traditional bullish sample usually seen at main market inflection factors.

This divergence means that sellers are shedding management, hinting at a possible shift in market energy dynamics and the potential for a pattern reversal.

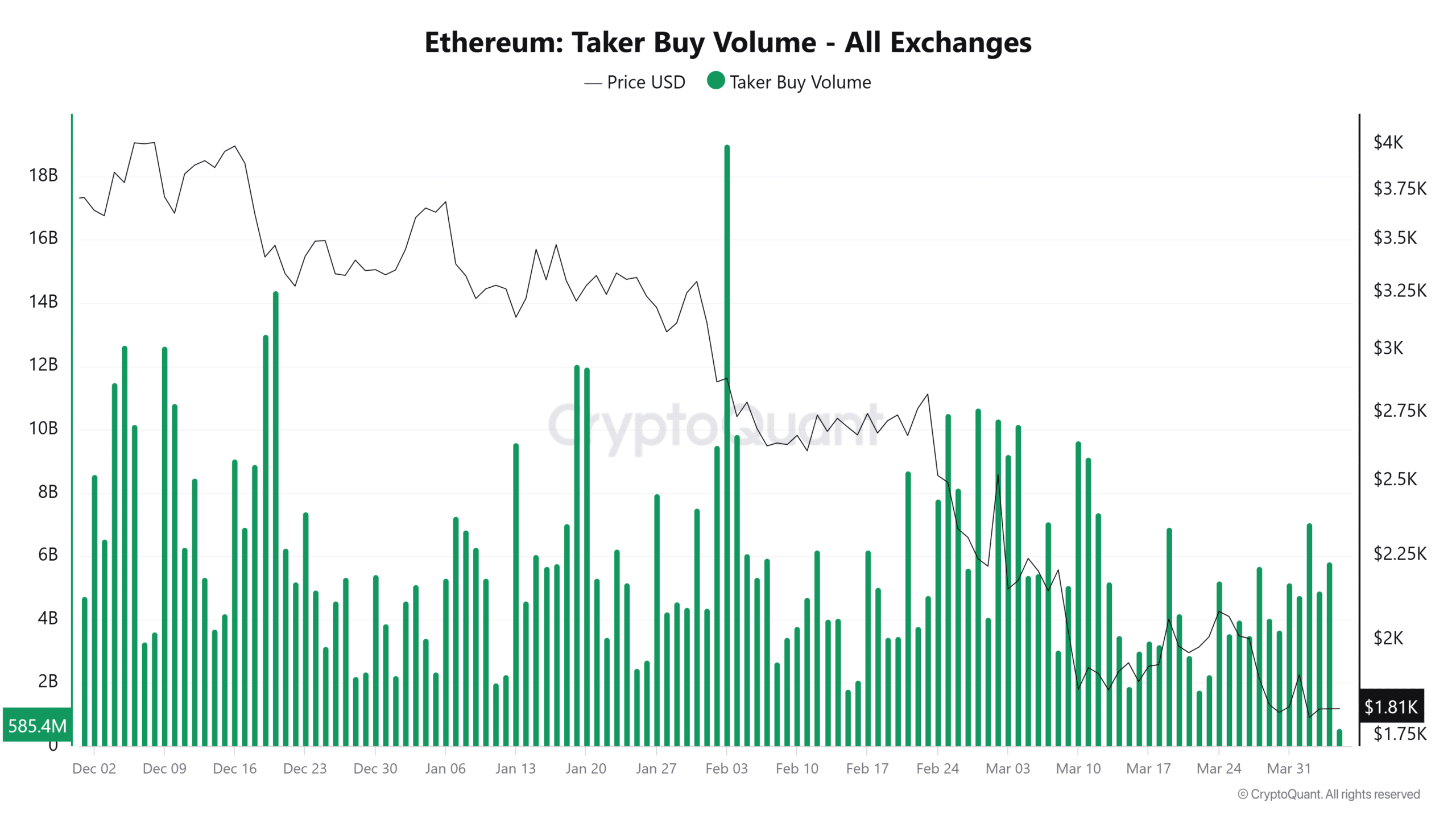

Quantity breakdowns solely add to this evolving narrative

Between December 2024 and April 2025, Ethereum’s Taker Purchase Quantity noticed erratic but important surges.

For instance, on the third of February, the Taker Purchase Quantity hit $19 billion as ETH hovered round $2,882.93.

Although value didn’t rally, the spike displays patrons trying to soak up sell-side stress. By the first of April, that quantity had dropped to $4.75 billion, with ETH priced at $1,905.17.

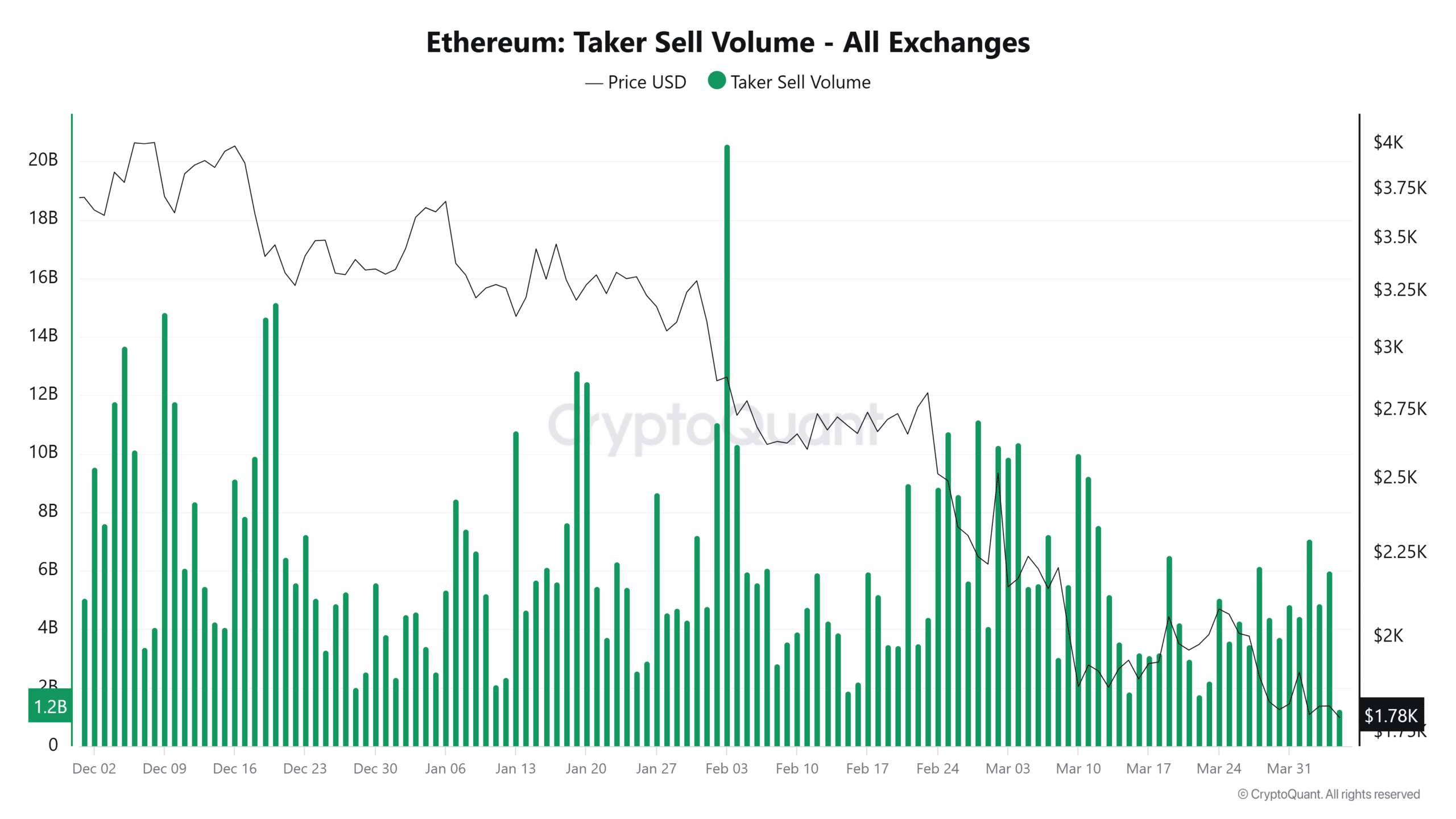

In the meantime, the Taker Promote Quantity has additionally been tapering.

Promote volumes for Ethereum reached $601.6 million on the finish of December and surged to $17.6 billion in early February. Nevertheless, by the first of April, that they had considerably cooled to roughly $4 billion, indicating a decline in panic-driven sell-offs.

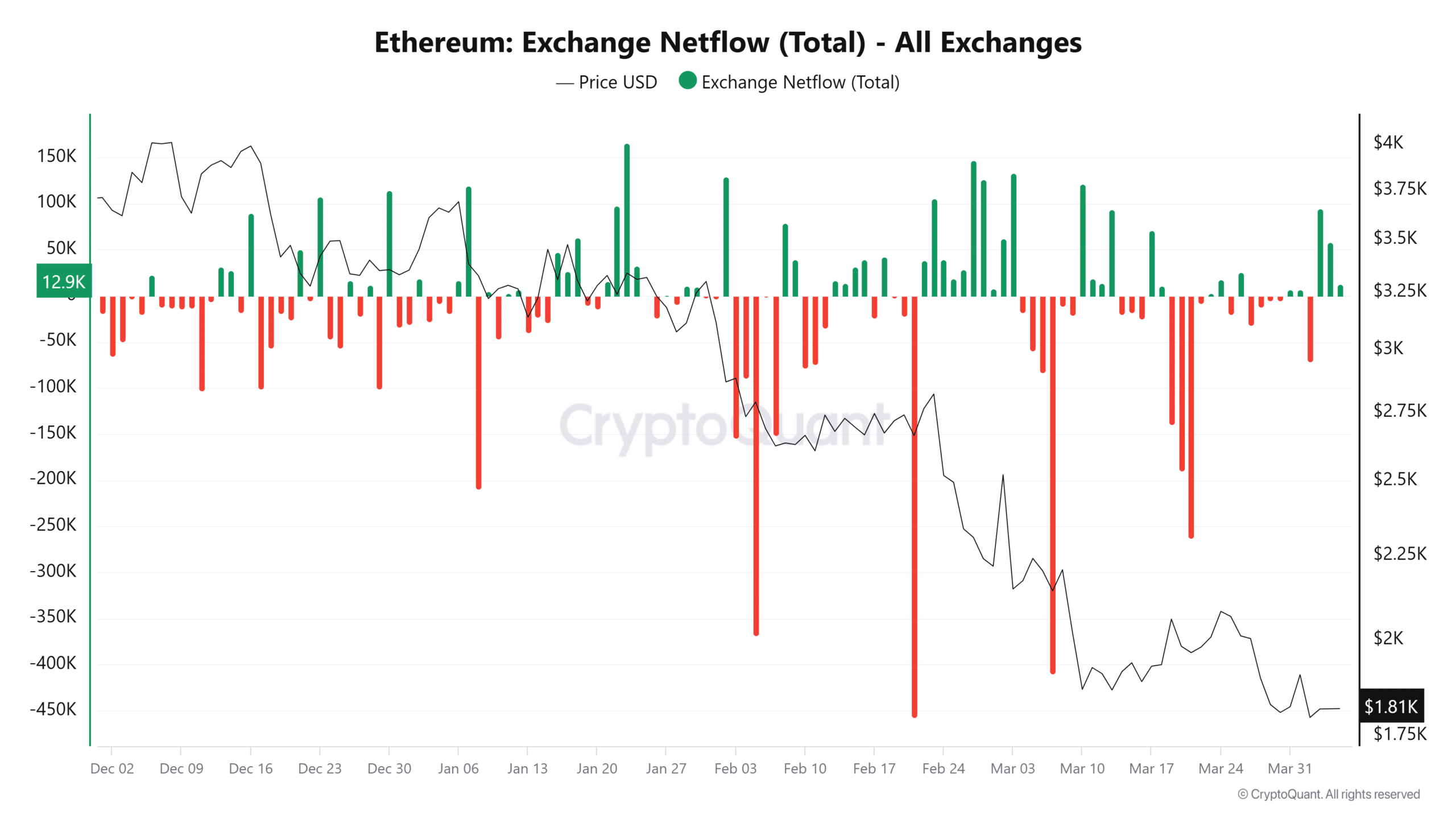

Moreover, Ethereum’s trade netflows present further insights into shifting market dynamics.

From December to March, whereas ETH tumbled 45%—from $3,278 to $1,810—withdrawals from exchanges elevated.

As an illustration, the twenty first of February noticed a internet outflow of 257,700 ETH, with the worth sitting at $2,661.

Having mentioned that, there was one notable exception.

On the tenth of March, 120,900 ETH flowed into exchanges as the worth dropped to $1,866—doubtless representing short-term merchants liquidating.

Nonetheless, the broader pattern leans towards strategic accumulation

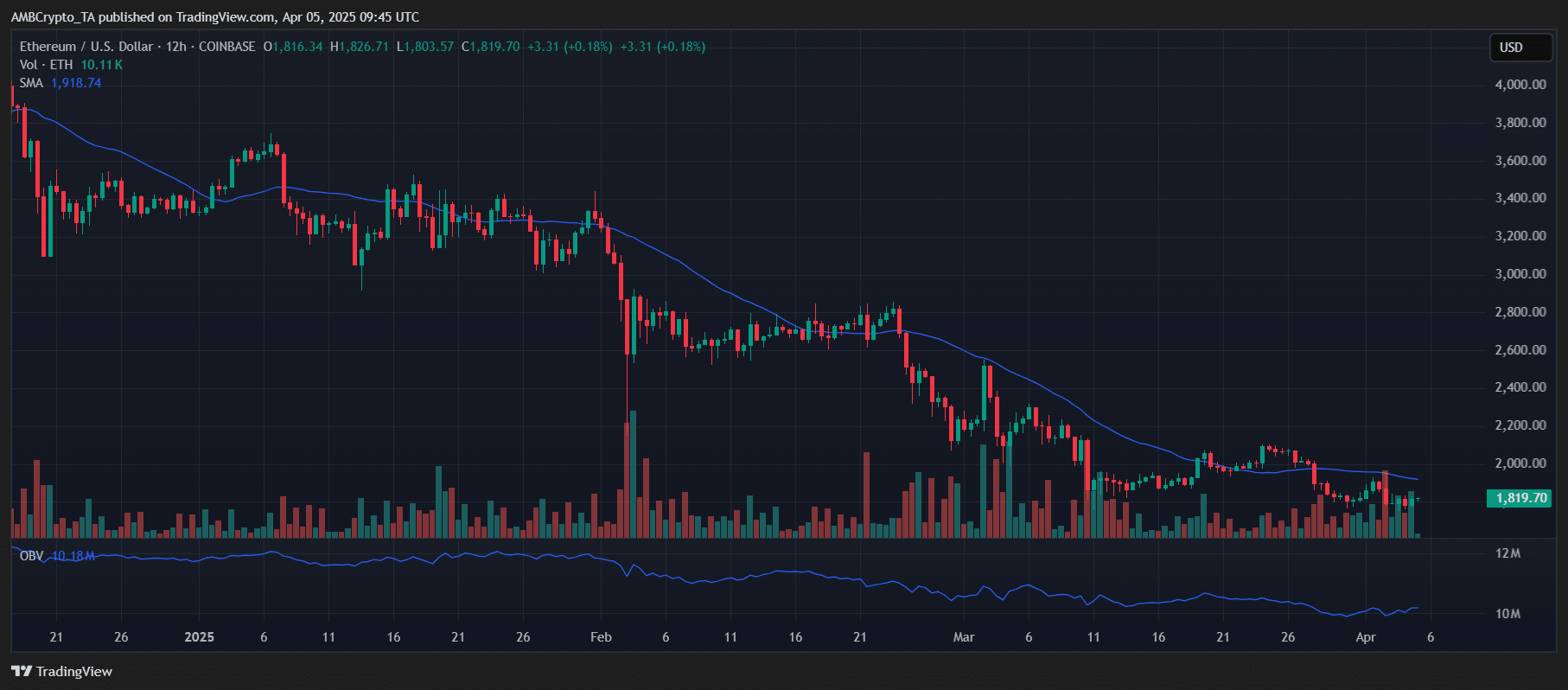

From a technical standpoint, Ethereum stays entrenched in a downtrend.

Worth motion continues to hug the underside of its Easy Transferring Common (SMA), which has acted as dynamic resistance since January 2025.

A number of failed rallies—most notably to $2,700 in February and $2,000 in March present persistent overhead stress.

Nevertheless, there’s a twist.

Ethereum has persistently held the $1,800 help zone throughout a number of exams in March and April. Every rebound from this stage, mixed with lowering quantity throughout value dips, signifies that sellers could also be shedding momentum quite than growing their efforts.

Key elements such because the flattening OBV, trade outflows, and cooling Taker Promote Quantity recommend that $1,800 could be creating right into a essential accumulation zone.

If Ethereum reclaims the $2,000–$2,200 vary, it may sign a pattern reversal. For now, $1,800 stays the central battleground, balancing between bearish continuation and bullish buildup.