- Low social media engagement and falling on-chain exercise are pressing considerations for DOGE

- October’s lows could be the subsequent value targets for DOGE

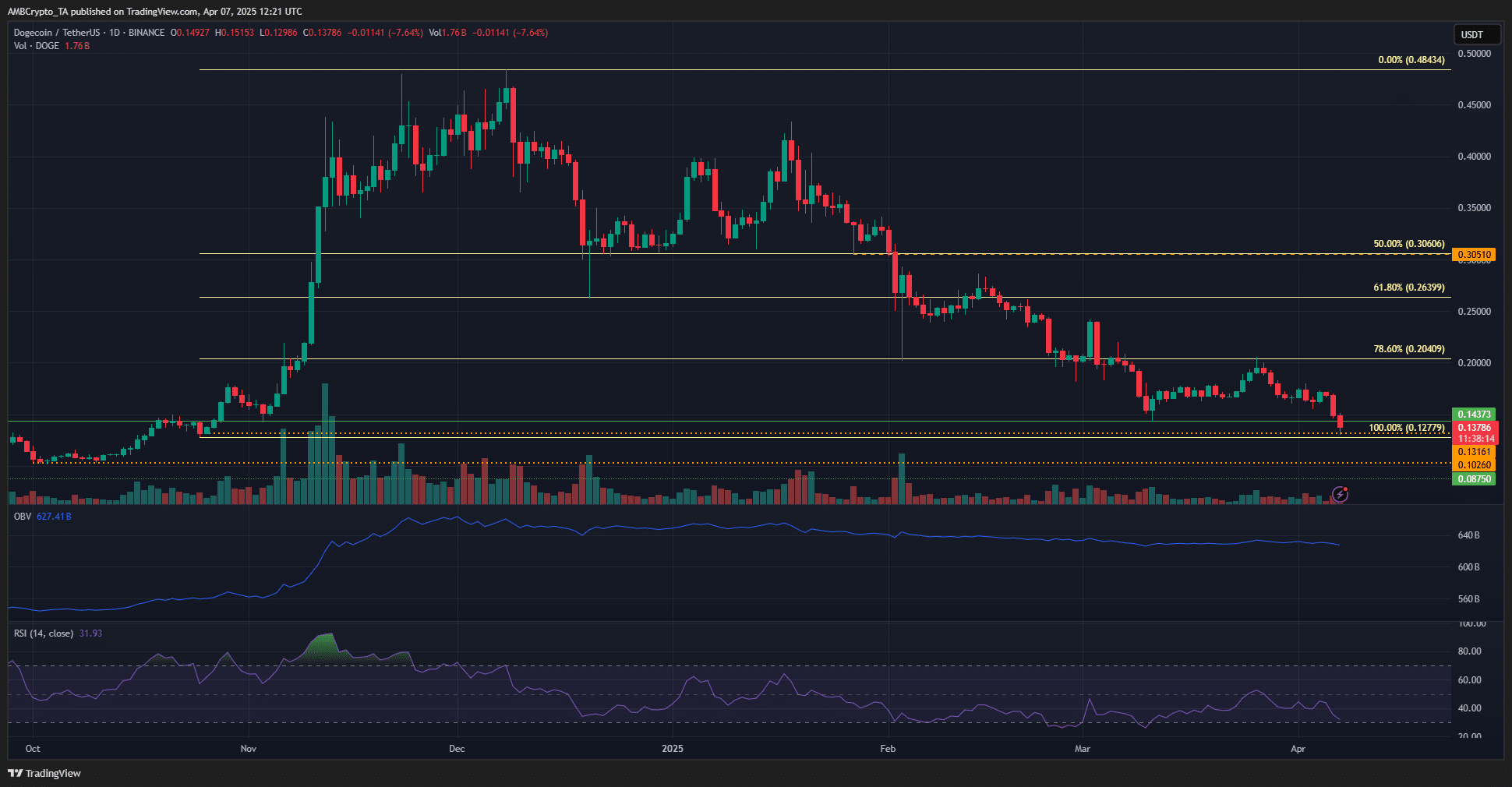

Dogecoin [DOGE] has fallen by 20% from Saturday’s excessive at $0.171. Within the final 24 hours, there have been $37.15 million value of liquidations throughout all exchanges for DOGE alone. Of those, $31.87 million or 85.78% had been long positions.

Dogecoin noticed a 22.6% value slide in 24 hours, and Bitcoin [BTC] shed 10.68% of its worth after panic unfold throughout world markets within the wake of the commerce conflict developments. Extra losses is perhaps possible and therefore, buyers must be affected person.

Social media engagement dries up as bearish pattern drives costs decrease

Supply: Santiment

Day by day lively addresses noticed a significant uptick in November. Since then, it has fallen in direction of ranges that it has maintained since January. One other surge in exercise got here in mid-March, but it surely was fast to taper off too.

The social dominance pattern has additionally been falling. March was not essentially the most bearish month for DOGE, regardless of the heavy value losses. Equally, the social quantity additionally set new lows in April. This meant that until the worth pattern modifications route, consideration and capital flows will proceed to leak out of the market.

There was a surge in social dominance on 12 March when the each day lively addresses leaped larger. This, after a 20% value bounce from the native lows in a day, highlighting the significance of bullishness to the Dogecoin market.

Supply: Coinglass

The funding charge crept into destructive figures after per week of valiant efforts from the bulls.

This underlined the favorable situations for sellers. Though it should be famous that the worth has tended to bounce larger within the short-term every time the FR has leaned destructive.

The 1-day Dogecoin chart underlined regular promoting strain since December, with the OBV slowly however steadily falling decrease. The RSI was under impartial 50 since mid-January – Indicative of a bearish pattern in progress.

The $0.131 and $0.102 assist ranges from October 2024 are actually the subsequent value targets. The previous has been examined in latest hours, and will yield a bounce to $0.154-$0.164. Regardless of a possible 15% bounce, nevertheless, the pattern can be firmly bearish within the close to time period.