- Bitcoin surpasses Amazon in market cap, hitting $2.045 trillion and a $104K value stage.

- Amazon urged to undertake Bitcoin treasury technique amid BTC’s rising institutional affect.

Bitcoin [BTC] has damaged by the $100K threshold as soon as once more, reaching a exceptional $104K after weeks of downward stress.

In keeping with the newest information from CoinMarketCap, BTC was buying and selling at $103,234.98 at press time, posting a 3.67% each day acquire and a formidable 33.63% surge over the previous month.

However maybe probably the most putting improvement is Bitcoin’s newest milestone, and that’s, it has formally overtaken Amazon in market capitalization.

Bitcoin surpasses Amazon

As of the ninth of Could, Bitcoin’s valuation soared to $2.045 trillion, narrowly edging previous Amazon’s $2.039 trillion cap.

Whereas Amazon inventory continues to climb, trading at $192.08 with a 1.79% acquire, Bitcoin’s ascent alerts greater than only a value rally.

With this transfer, it has additionally surpassed the market caps of silver, Google’s guardian firm Alphabet, and Meta, positioning itself because the world’s fifth-largest asset by market capitalization, in keeping with CompanyMarketCap.

Remarking on the identical, Sina G., co-founder and COO of twenty first Capital, noted,

“Bitcoin simply surpassed Amazon to change into the fifth largest asset on the earth.

– No CEO

– No headquarters

– No advertising and marketing crew

Simply code, conviction, and world demand. Subsequent cease: NVIDIA.”

As soon as thought-about a fringe funding, Bitcoin now stands shoulder to shoulder with conventional monetary powerhouses, signaling its evolution right into a mainstream retailer of worth.

Bitcoin’s progress thus far

That being mentioned, this isn’t the primary time Bitcoin has challenged Huge Tech’s dominance.

Again in April 2025, it briefly overtook each Amazon and Google with a $1.86 trillion valuation, reaching $94,000 per coin amid easing U.S.–China commerce tensions and a tech-led market rally.

Nevertheless, the newest surge past $100,000 seems way more resilient, with Bitcoin surpassing its earlier peak and firmly asserting itself among the many world’s most dear property, particularly after briefly hitting $109,000 throughout President Trump’s re-inauguration in January 2025.

Evidently, Bitcoin’s explosive rally hasn’t simply shaken up dealer sentiment; it’s sparked broader conversations amongst company giants.

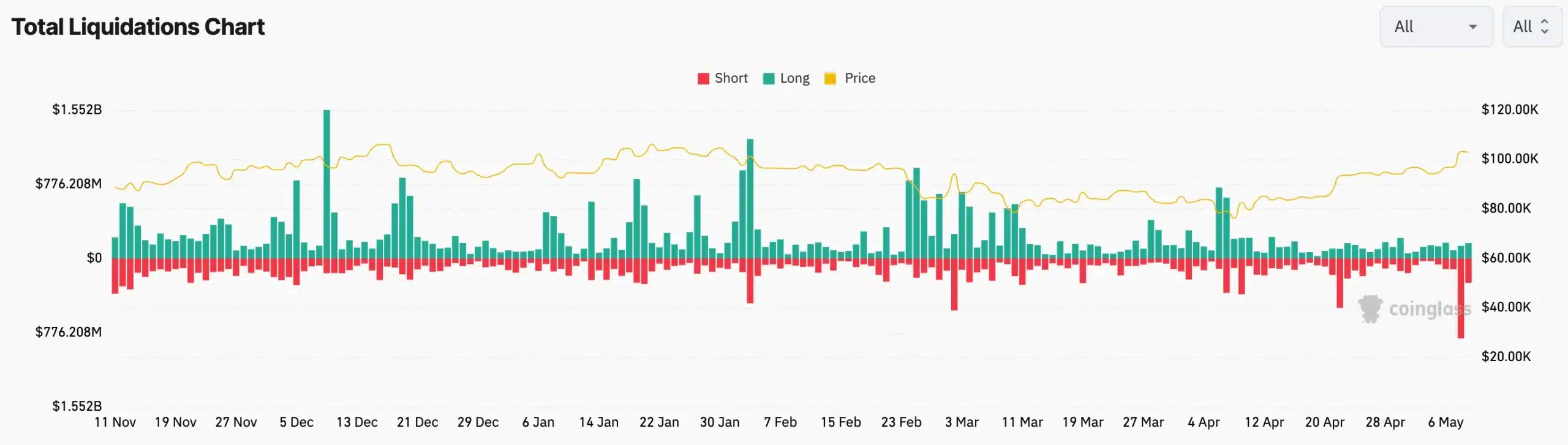

In actual fact, with practically $1 billion in liquidations and over 190,000 merchants caught off guard, the market is experiencing its most vital quick squeeze since 2021, as per CoinGlass’ latest analysis.

Amazon considers including Bitcoin

Subsequently, as BTC continues to claim itself as a dominant monetary asset, even conventional gamers are beginning to take discover.

Notably, again in December 2024, Amazon faced stress from the Nationwide Heart for Public Coverage Analysis to contemplate adopting a Bitcoin treasury technique.

The proposal urges the tech big to allocate a part of its $88 billion in reserves to BTC, underscoring how the cryptocurrency’s ascent is starting to affect boardroom choices and long-term company finance methods.