- Solana confronted a vital resistance at $240, with key help at $196, figuring out its subsequent transfer.

- Market sentiment remained adverse, although social quantity and technical indicators present potential reversal indicators.

Solana [SOL] is at a crucial juncture, with merchants watching intently because the cryptocurrency’s value faces a vital check. At $202.94 at press time, displaying a 1.58% decline, the cryptocurrency is experiencing fluctuations that would both push it increased or ship it decrease.

As the value exams crucial ranges, merchants are debating whether or not SOL will break resistance and goal $350 or drop towards $150.

This text delves into the technical indicators, social quantity, and sentiment to find out Solana’s subsequent potential course.

Will Solana break by a key resistance?

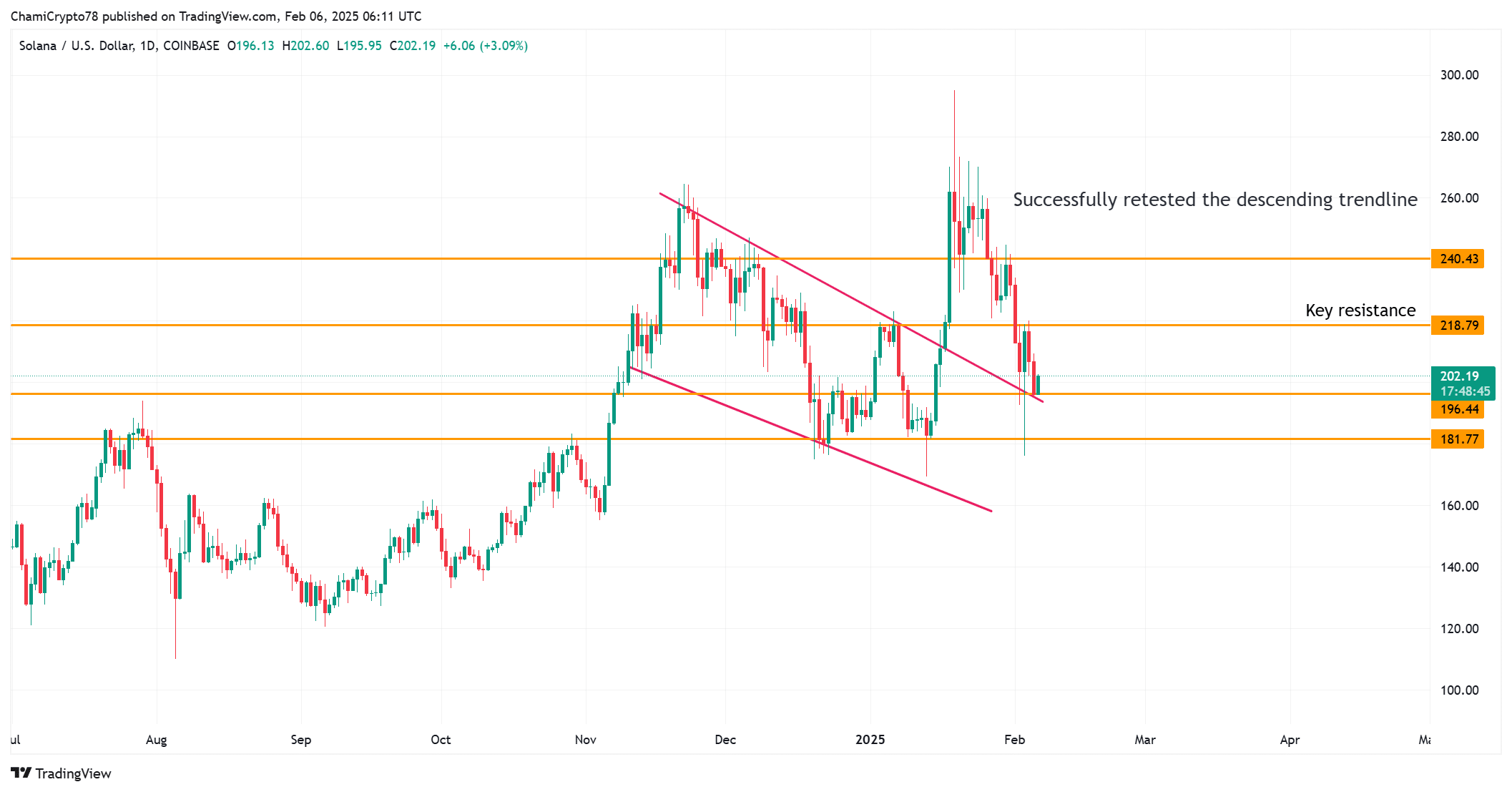

On the time of writing, Solana’s value was shifting inside a well-defined channel, with help round $196.44 and resistance at $240.43.

Just lately, the value retested the descending trendline, however the subsequent transfer is determined by whether or not it may well break by the resistance. If the value surpasses $240.43, it may set off a bullish transfer in the direction of the $350 mark.

Nevertheless, if SOL fails to take care of its momentum, it may fall again to decrease ranges, probably close to $150. Due to this fact, merchants ought to deal with these key ranges within the coming days to gauge the course of Solana’s value motion.

Is the market curious about SOL?

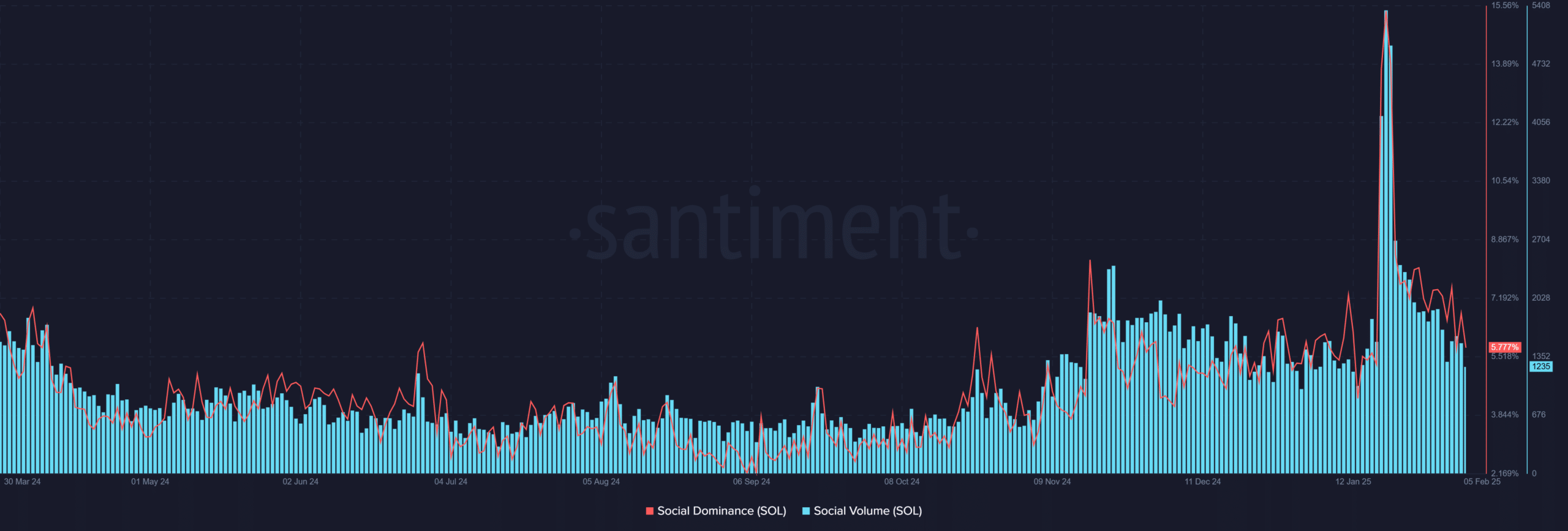

SOL’s Social Quantity reached 1,235 mentions, displaying a average enhance in curiosity. Nevertheless, its Social Dominance stays at 5.78%, indicating that SOL shouldn’t be but dominating discussions within the broader crypto house.

Regardless of this, the rise in social mentions suggests rising consideration and sentiment round Solana.

If Social Quantity continues to extend, it may sign stronger help for the value motion, whether or not bullish or bearish.

Due to this fact, merchants ought to monitor social exercise, because it may present the required momentum for a value shift.

What do the RSI and MACD present?

The RSI for SOL stood at 42.41, approaching oversold situations however not but signaling an imminent reversal. Moreover, the MACD is displaying a adverse worth of -3.61, suggesting bearish momentum within the brief time period.

Nevertheless, the MACD line is starting to method a impartial place, which may point out a possible reversal.

Due to this fact, merchants must be cautious, as Solana may expertise a short-term pullback earlier than any important transfer.

What’s the market feeling about SOL?

SOL’s complete Weighted Sentiment was -0.54, indicating a barely adverse market sentiment. This aligns with the bearish indicators and suggests that there’s extra draw back strain than bullish momentum.

Nevertheless, market sentiment can shift shortly, particularly if Solana breaks by key resistance ranges.

Due to this fact, if SOL can flip across the sentiment with a powerful value transfer, it may sign a possible rally.

Conclusion: Will Solana rise or fall?

SOL’s value motion presents a combined outlook. Whereas a breakout above the $240 resistance may result in a rally in the direction of $350, the technical indicators recommend a attainable decline in the direction of $150.

Learn Solana’s [SOL] Price Prediction 2025–2026

Merchants ought to intently monitor key help and resistance ranges, as these will seemingly decide SOL’s subsequent transfer.

Due to this fact, the following few days might be essential in deciding whether or not Solana will rise or fall.