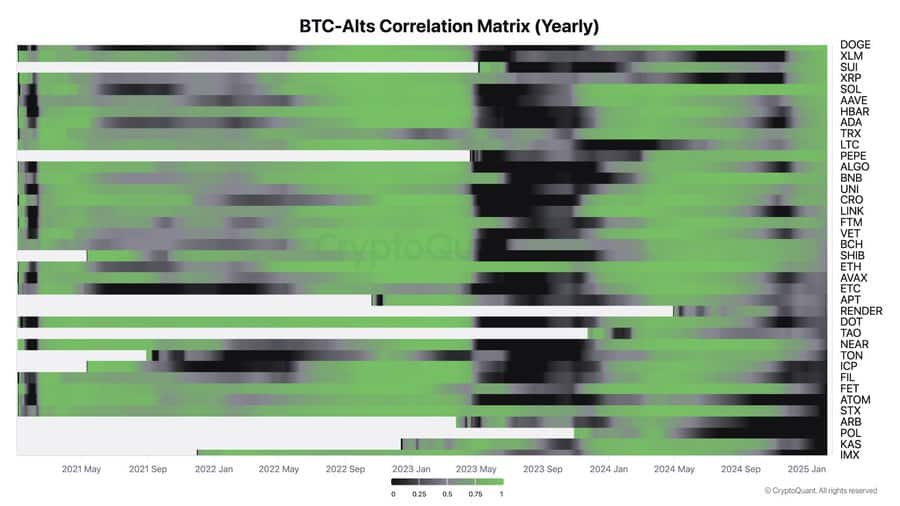

The BTC-Alts Correlation Matrix offers insights into the connection between Bitcoin and numerous altcoins over time.

As could be seen on the chart, sure altcoins like Ethereum, Binance Coin [BNB], and Avalanche [AVAX] have continued to take care of a excessive correlation with Bitcoin, reflecting their tendency to reflect BTC’s worth actions.

Nevertheless, a definite development of decoupling has emerged, notably amongst altcoins like Dogecoin [DOGE], Shiba Inu [SHIB], and Pepe [PEPE], in addition to the likes of the Sui Community.

These cash have displayed considerably decrease correlations. Their performances have been pushed by unbiased elements similar to distinctive use instances, social sentiment, or ecosystem-specific developments.

Resilient altcoins and memecoin mania

In 2025, altcoins related to institutional adoption demonstrated some notable resilience. Tasks like XRP decoupled from broader altcoin traits, pushed by rising partnerships with monetary establishments. This institutional backing has bolstered investor confidence, resulting in vital positive factors on the charts.

Concurrently, the market witnessed a resurgence of memecoins. Regardless of missing inherent utility, these tokens outperformed conventional infrastructure cash, propelled by community-driven enthusiasm and speculative fervor. The launch of President Donald Trump’s memecoin, as an illustration, spurred the creation of over 700 imitators, highlighting the potent affect of social sentiment on this phase.

Psychologically, memecoin investments are sometimes pushed by herd mentality, a standard trait in speculative markets. Traders usually flock to those cash primarily based on prevailing traits slightly than elementary evaluation, resulting in fast worth surges.

What does this imply for traders?

The decoupling from Bitcoin’s correlation signifies that traders have to adapt their methods. With Bitcoin not dictating altcoin actions, different market drivers have gotten extra essential. Establishment-backed altcoins tied to finance and enterprise sectors present sturdy potential, providing stability amid market shifts. In the meantime, memecoins thrive on sentiment however stay high-risk, high-reward bets.

With conventional indicators shedding relevance, a focused strategy is vital. Traders ought to prioritize tasks with real-world use instances and rising adoption. Infrastructure tokens might proceed to lag, making them much less engaging. Diversification and a concentrate on data-driven selections are important because the market evolves, requiring traders to navigate with precision on this new, decoupled panorama.