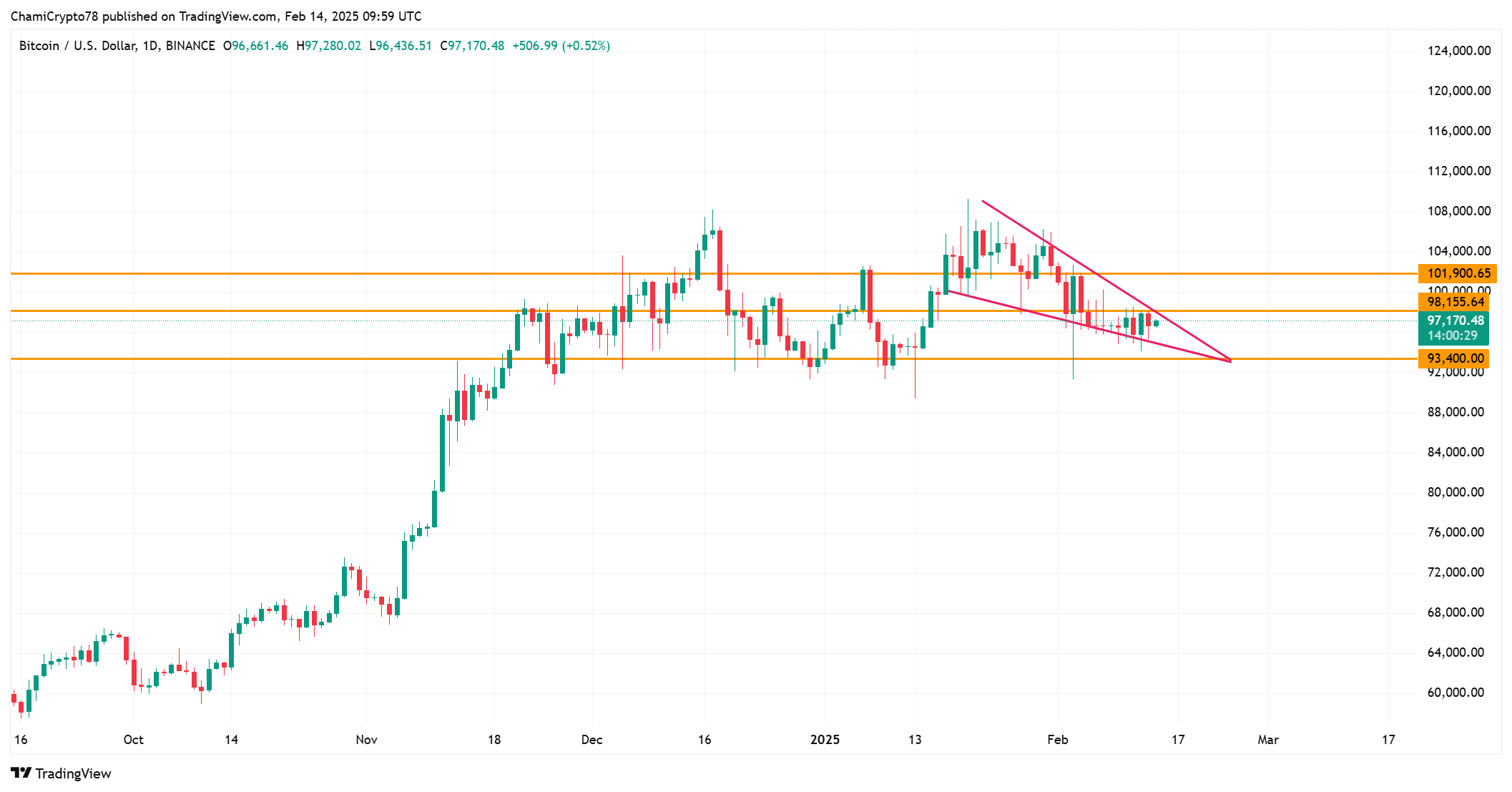

- Bitcoin appeared to be consolidating under $101,900, forming a symmetrical triangle for potential breakout or reversal

- NVT Golden Cross and Taker Purchase/Promote Ratio hinted at overbought situations and reasonable shopping for strain

Bitcoin [BTC], on the time of writing, appeared to be testing essential help ranges, with merchants now intently looking ahead to indicators of a possible breakout or pullback. Valued at $97,183, the world’s largest cryptocurrency hiked by slightly below 1% within the final 24 hours.

On the charts, the $93,400-level has been marked by the 111-day transferring common. This stage has traditionally served as a key help, and its conduct may decide Bitcoin’s subsequent transfer. Will Bitcoin maintain regular at this threshold, or is it poised for an additional surge?

Supply: X

What’s subsequent for Bitcoin’s worth?

Proper now, Bitcoin is consolidating under the $101,900 resistance zone. Regardless of a number of makes an attempt to interrupt this stage, Bitcoin has been unable to maintain a worth above it in latest weeks. Consequently, Bitcoin has been forming a symmetrical triangle – A sample that usually alludes to important worth motion.

Ought to Bitcoin break above $101,900, it may shortly surge in direction of larger resistance ranges, probably beginning one other rally.

Nonetheless, failure to interrupt this resistance may result in a worth pullback, testing the $93,400 and $97,170 help zones. Due to this fact, merchants might want to monitor these ranges intently for any indication of a breakout or a reversal.

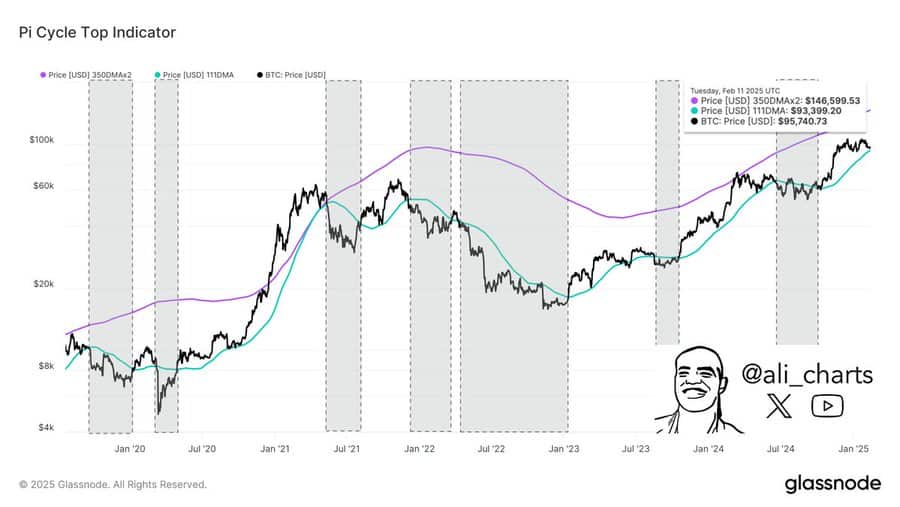

NVT Golden Cross – Ought to merchants be cautious?

Bitcoin’s NVT Golden Cross indicator climbed by 28.21% during the last 24 hours, as per CryptoQuant analytics. Such a change implies that Bitcoin could also be coming into overbought territory. Particularly for the reason that NVT’s values had exceeded 2.2 too.

Traditionally, such ranges have usually signaled native tops, which may very well be adopted by worth corrections.

Nonetheless, Bitcoin may proceed its bullish momentum if demand stays robust. So, this indicator alone will not be sufficient to foretell a direct reversal. Due to this fact, whereas warning is important, Bitcoin may additionally proceed its hike, relying on the energy of the market.

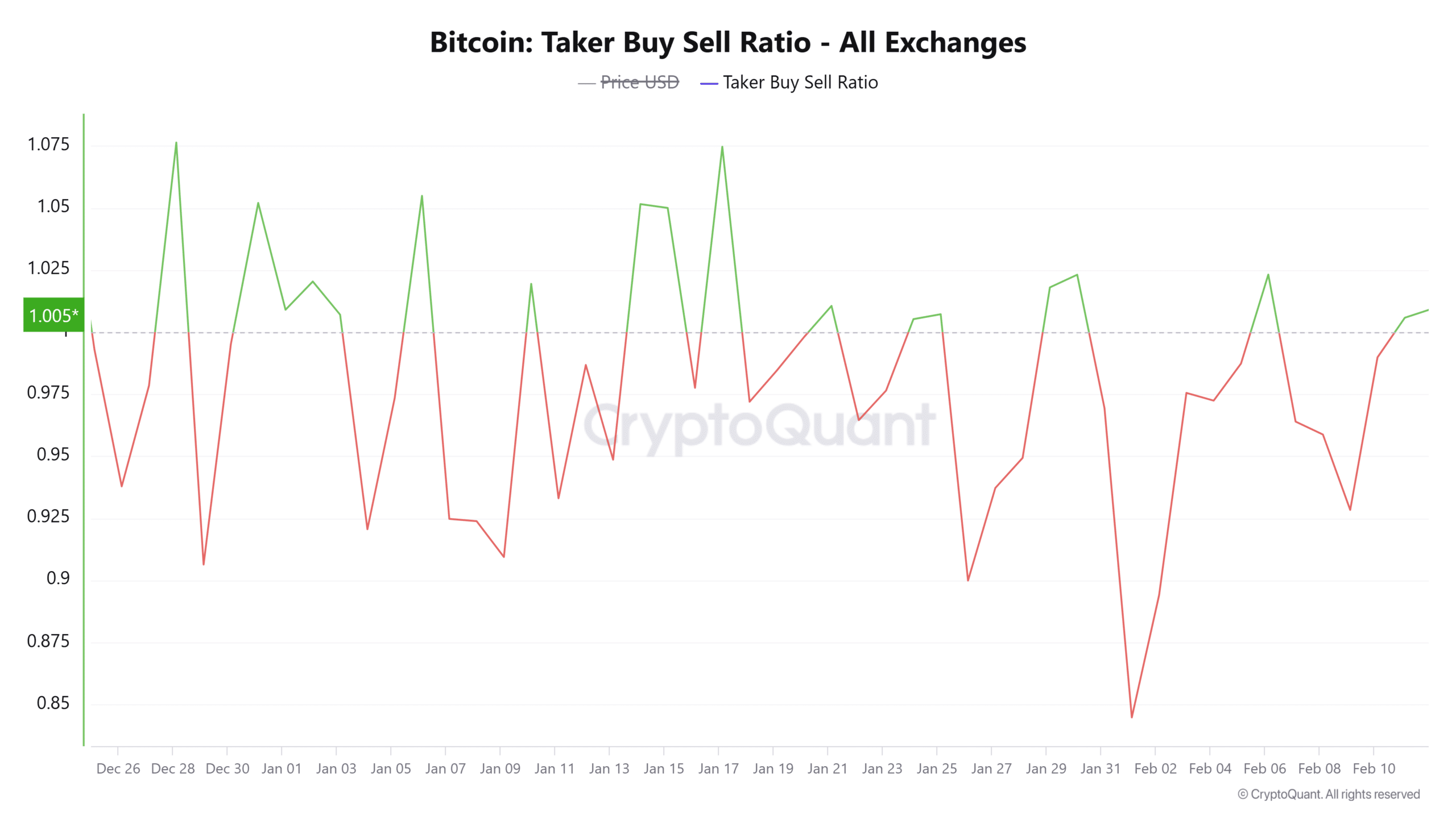

Taker purchase/promote ratio – Is shopping for strain constructing?

The Taker Purchase/Promote Ratio rose by 0.95% within the final 24 hours too, hinting at a slight uptick in shopping for strain. Though the ratio was under 1, it recommended that there’s extra shopping for than promoting exercise.

If this development continues, Bitcoin may even see upward momentum on the charts. Nonetheless, if the promote strain intensifies, Bitcoin may face a reversal, testing its key help zones as soon as once more. Due to this fact, market sentiment will play a vital function in figuring out Bitcoin’s subsequent transfer.

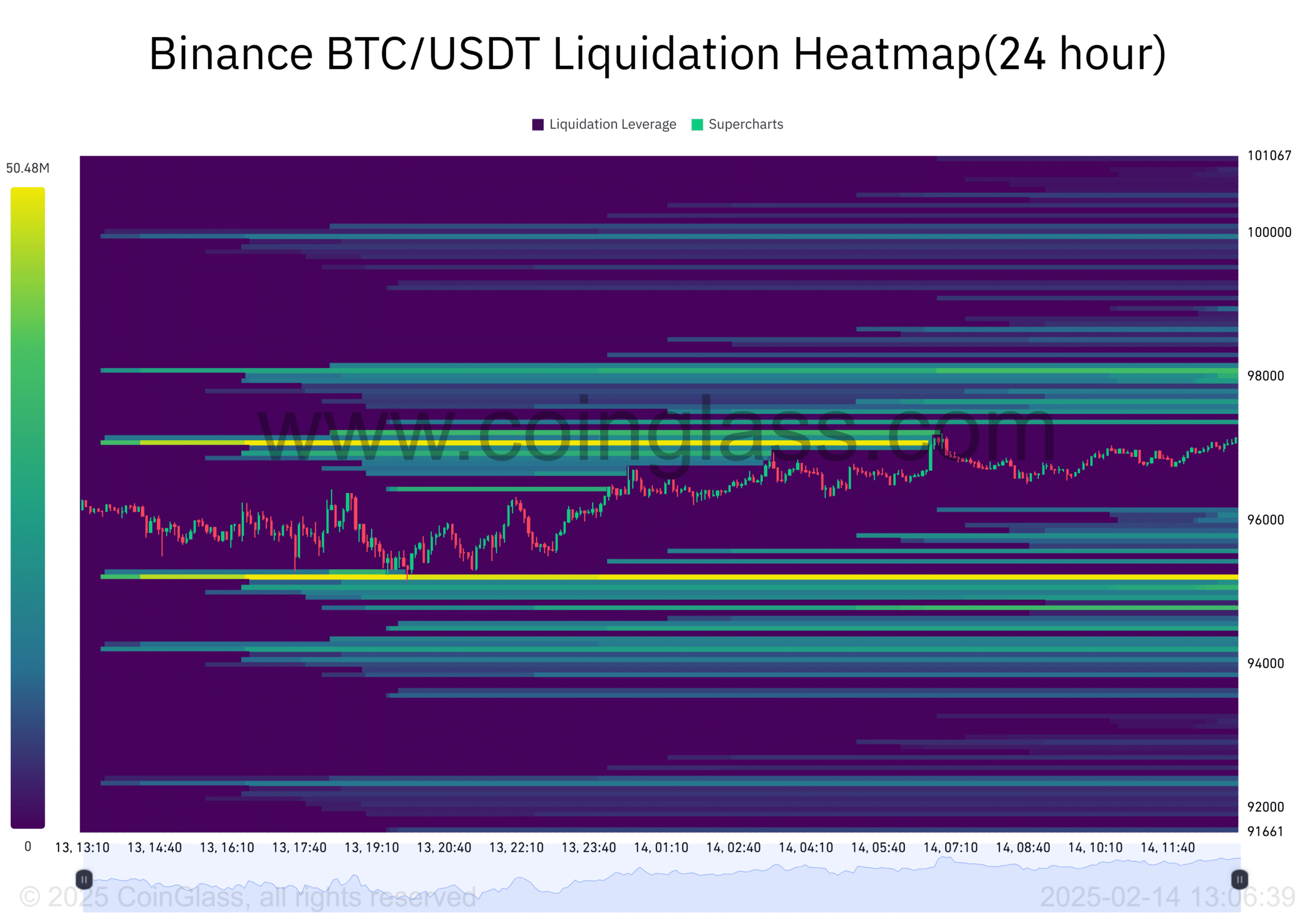

What do liquidations reveal?

Bitcoin’s liquidation heatmap revealed important focus of liquidations across the $93,400 help stage and the $97,170 resistance. If Bitcoin falls additional, liquidations may speed up, sparking a possible rebound.

Then again, a push above the $97,170 resistance might set off lengthy liquidations, growing upward worth strain.

At press time, Bitcoin remained near the essential stage close to $97,170, with a number of indicators hinting at attainable volatility. The NVT Golden Cross appeared to warn of overbought situations too, with the Taker Purchase/Promote Ratio underlining reasonable shopping for strain.

Given the liquidation heatmap and present market situations, Bitcoin is extra more likely to take a look at its help, earlier than transferring decisively. Due to this fact, Bitcoin’s subsequent transfer might be a take a look at of its key help ranges, with potential for a rebound or a breakout quickly after.