- Shiba Inu loved a bearish construction on the every day timeframe

- Lack of shopping for stress and the build-up of liquidation ranges meant memecoin may keep inside the vary this week

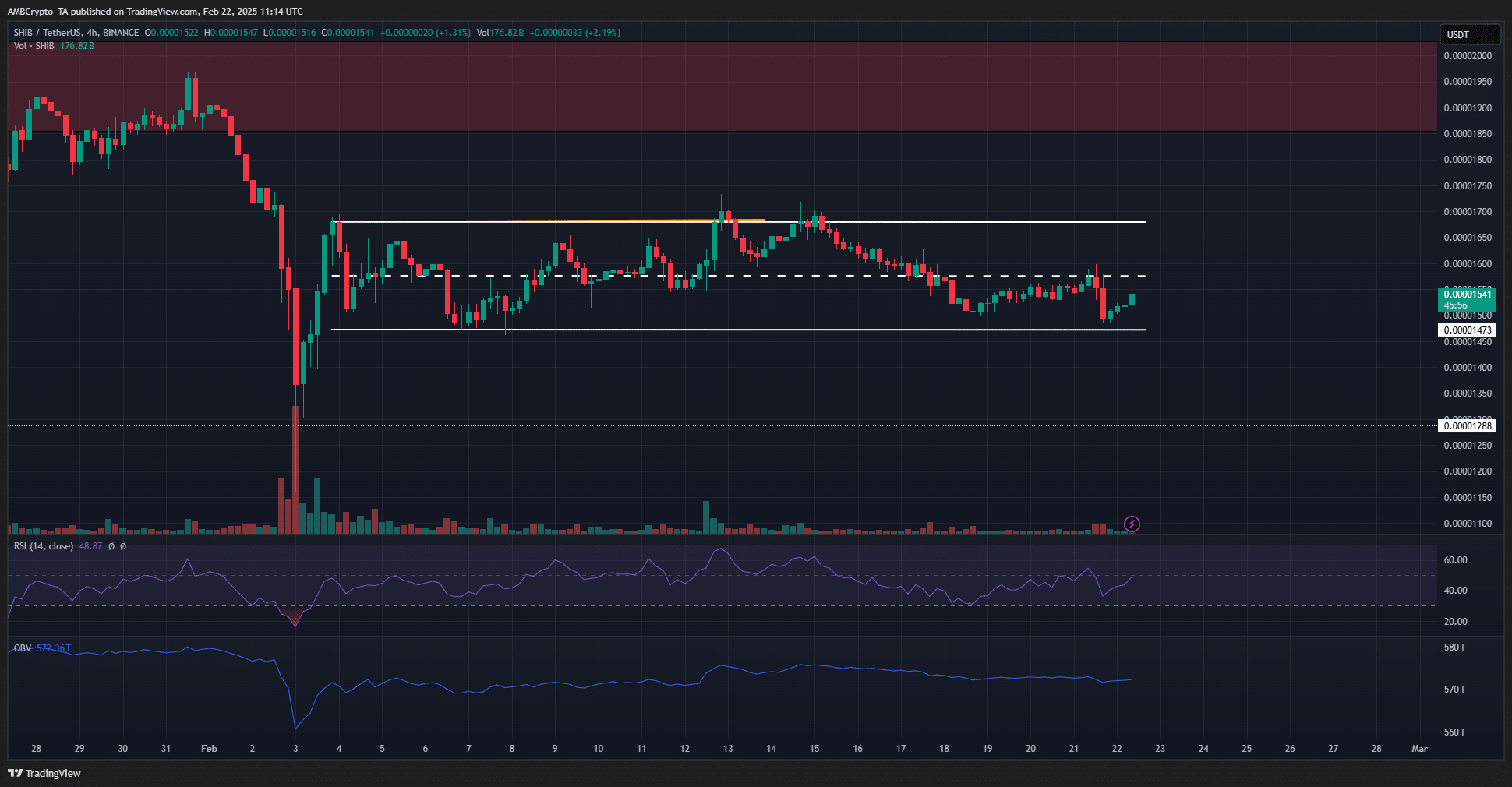

Shiba Inu [SHIB] appeared to make a bullish construction break on the 4-hour chart ten days in the past. Nonetheless, this break has faltered since, and the worth has retested its native lows twice. As a substitute, a decrease timeframe vary formation has materialized, mirroring Bitcoin’s [BTC] lack of path on the charts.

Shiba Inu set to consolidate inside vary

The 1-day chart revealed that the swing construction was firmly bearish. A value transfer past the current decrease excessive at $0.0000196 can be wanted to shift the construction. As issues stand, there gave the impression to be no proof that such a transfer would quickly seem.

An area assist zone was established at $0.0000147 too. Additional south, the $0.0000128-level has been a major assist degree from September 2024.

At press time, the every day RSI remained bearish with a studying of 40. The OBV climbed increased after its early February losses, signaling some shopping for stress. And but, this was not sufficient to power the memecoin to register new highs.

The vary formation was evident on the 4-hour timeframe. What seemed to be a construction break (orange) on the H4 turned out to mark the native highs at $0.000017. The mid-range degree at $0.0000157 appeared to emerge as a key short-term resistance too.

Additionally, the RSI was bearish on the 4-hour chart. The truth is, it has remained beneath 50 over the previous week. A transfer above 50, alongside a flip of the mid-range resistance to assist, may permit merchants to go lengthy – Concentrating on the $0.0000168 native resistance.

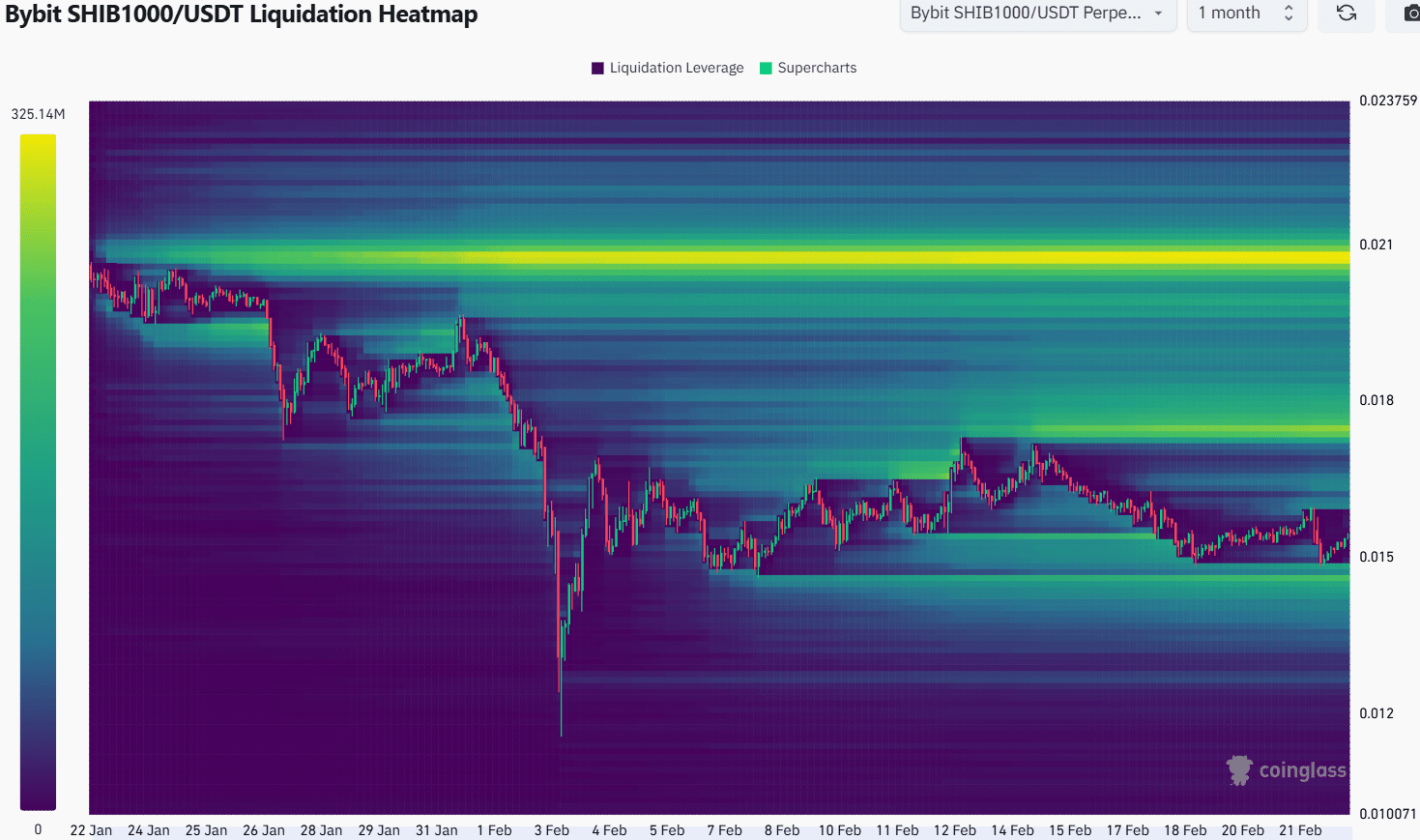

Supply: Coinglass

The liquidation heatmap of the previous month underlined the vary formation. It revealed two liquidity clusters round $0.0000145 and $0.0000176, ranges simply past the vary extremes marked on the 4-hour chart.

The build-up of liquidation ranges round these costs implied that the worth is more likely to gravitate in the direction of one, then the opposite, over the approaching days. Therefore, a retest of $0.0000145 can be a shopping for alternative, and the $0.0000175-level a take-profit goal.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion