- Sonic noticed a 46% quantity drop on the day as costs retraced from $0.99.

- The retest of $0.8 and $0.73 as help ought to probably be adopted by one other worth transfer increased.

Sonic [S] (prev. FTM) has proven bullish energy over the previous two weeks. It has reversed its early February losses and was pushing towards $1.

At press time, the $0.8 stage was being retested as help. It was probably that the bulls would defend this stage. The momentum and the quantity signaled it was a purchaser’s market.

Sonic is about to proceed the uptrend

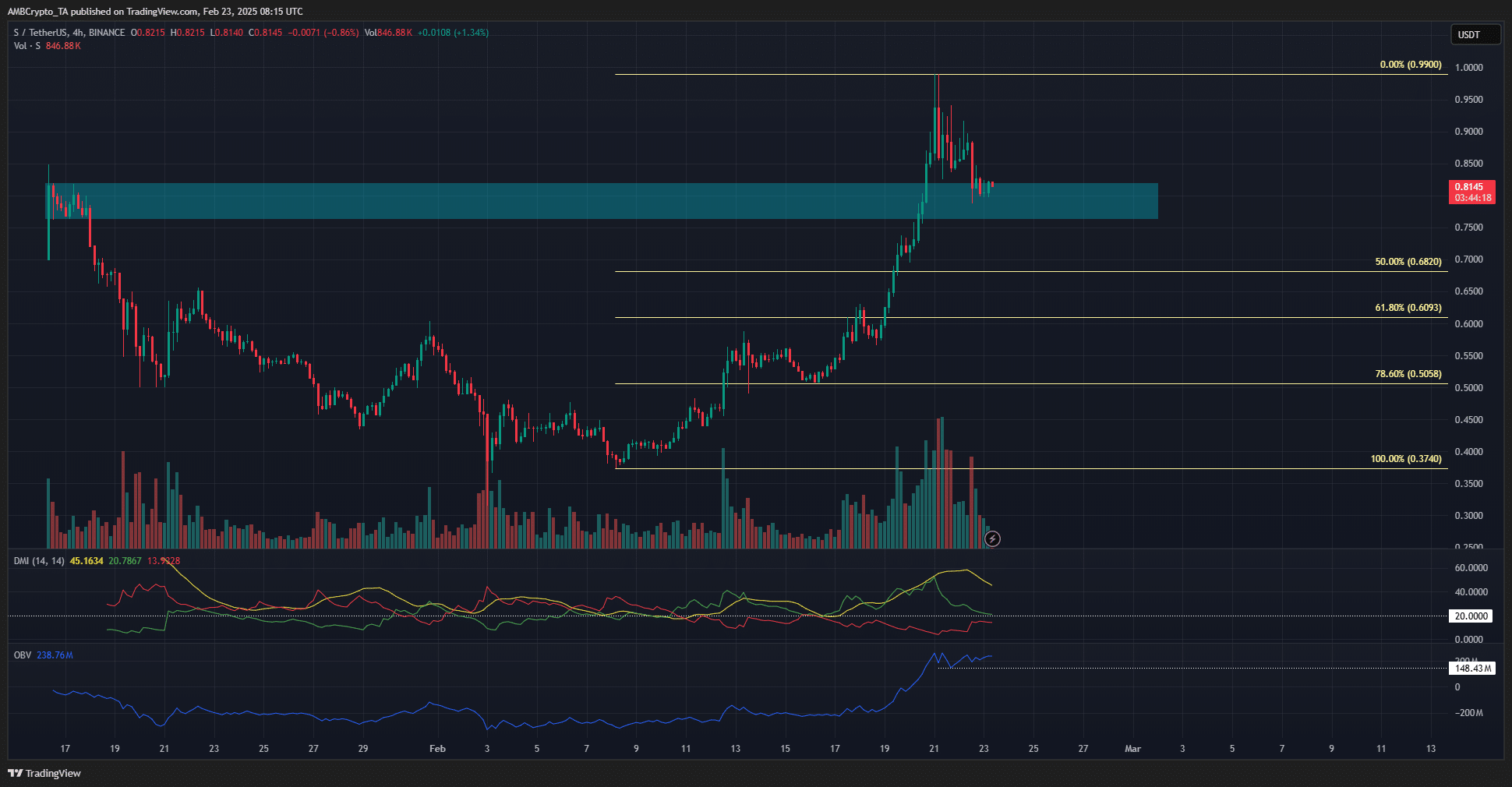

The 4-hour chart of S confirmed that the uptrend was going robust. The worth has shaped a collection of upper highs and better lows since breaking above the $0.6 resistance stage.

This resistance had been the decrease excessive that noticed the worth plummet to the $0.315 low throughout the early February sell-off.

The upward worth transfer over the previous three weeks has been borne by robust shopping for stress. The quantity bars confirmed distinctive shopping for quantity, particularly over the previous week.

This got here alongside an S breakout past the $0.8 resistance.

The DMI of Sonic agreed with the discovering from the worth motion. The +DI and ADX strains had been each above 20, exhibiting a big uptrend in progress.

The OBV made robust features as the quantity soared in current days, and was effectively above the native low marked in white.

A transfer beneath $0.75 wouldn’t flip the bullish market construction, nevertheless it might weaken the momentum. This might open the trail for a deeper retracement towards $0.609 or $0.505.

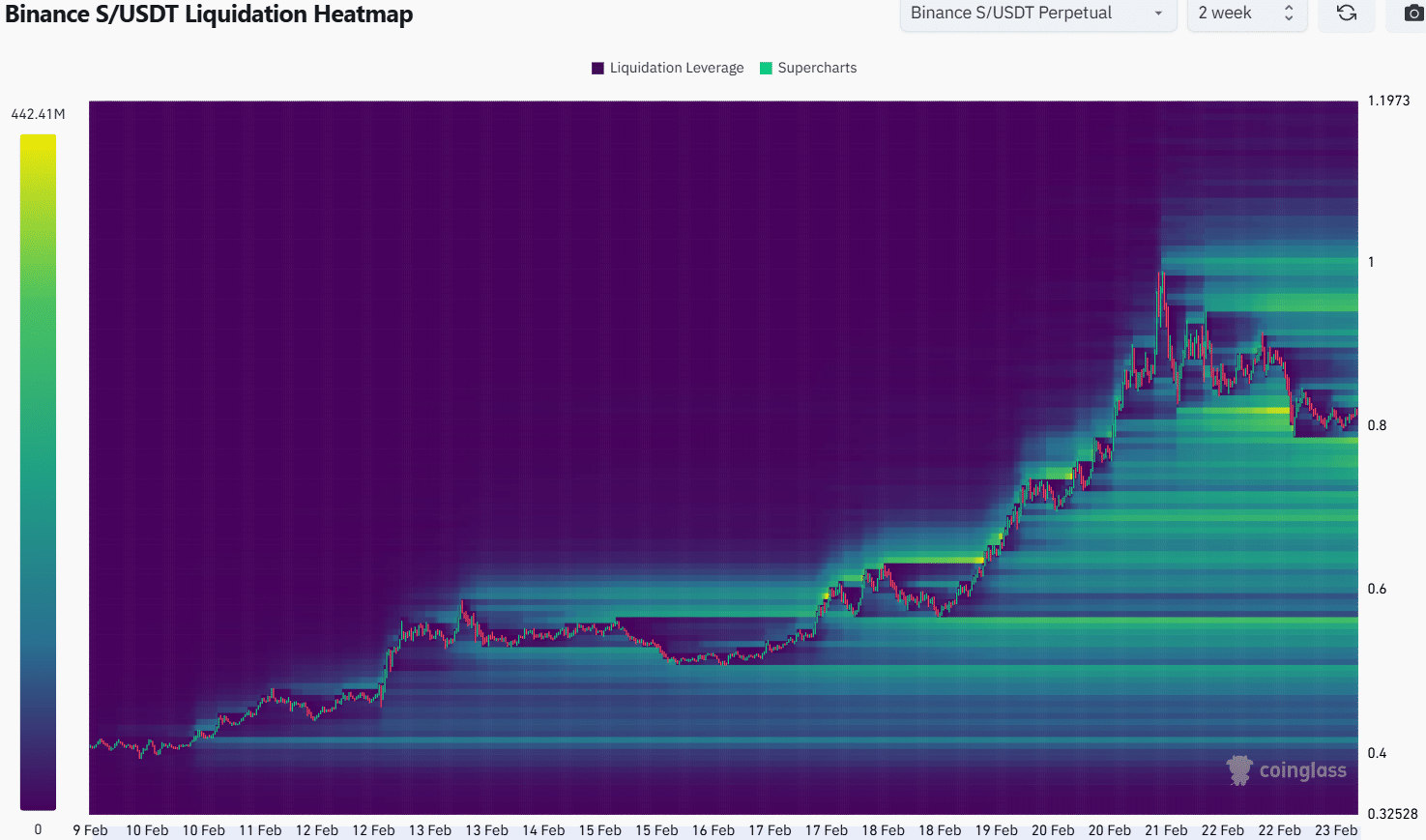

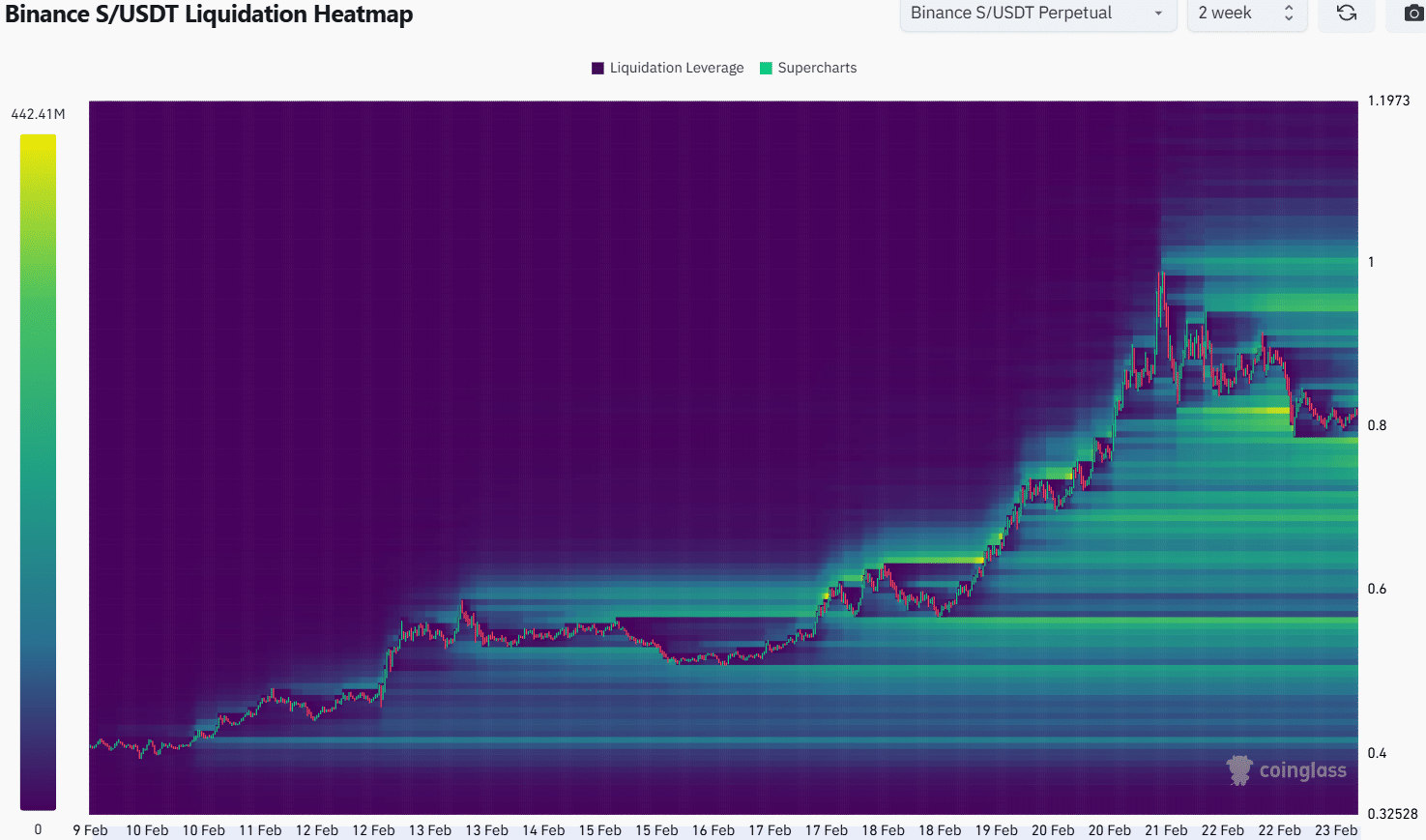

Supply: Coinglass

The liquidation heatmap confirmed sizeable liquidity beneath $0.8 and round $$0.95-$1. These are the worth targets over the approaching days. A transfer to $0.739 would sweep the liquidity to the south.

The compelled lengthy liquidations may very well be rapidly reversed, because the bulls retain management of the market within the close to time period.

Therefore, S merchants must be cautious of a worth drop beneath $0.8, however it will not be a sign to go quick. The $0.71-$073 is anticipated to function a decrease timeframe demand zone.

Above $1, the $1.4 stage is anticipated to be the subsequent notable resistance stage.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion