- SOL declined by 35.5% over the previous months.

- Solana’s every day Energetic Addresses and on-chain exercise declined, signaling downward strain.

Since hitting an area excessive of $195 three weeks in the past, Solana [SOL] has skilled sturdy bearish strain. Over this era, Solana has declined to hit a three-month low.

With such a robust downtrend, the query is what’s inflicting Solana to say no? Evaluation means that Solana is struggling basically with low on-chain exercise.

Solana’s On-chain exercise decline

Solana’s chain exercise has been on a gradual decline over the previous months. As such, the community’s variety of every day lively addresses has declined to hit a three-month low of three.5 million.

When lively customers decline, it displays a robust decline in market curiosity and decrease adoption. Typically, decrease lively customers result in lowered on-chain exercise, which might end in worth depreciation.

Traditionally, a decrease variety of customers usually correlates with worth decline as demand drops.

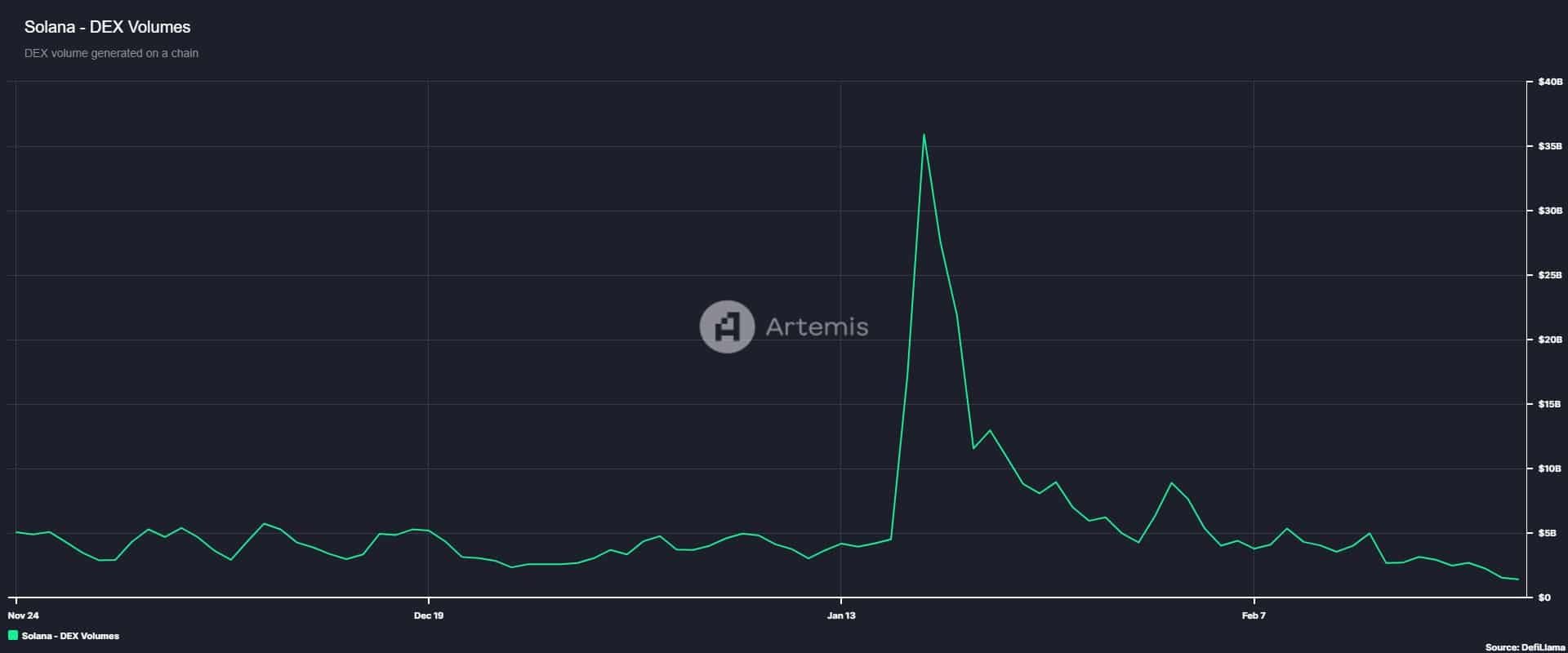

This lowered on-chain exercise on Solana is additional evidenced by the declining Decentralized Change (DEX) buying and selling quantity. In line with Artemis data, this has dropped to hit a four-month low of $1.5 billion.

Such a decline suggests lowered belief within the community, as buyers want Centralized Change (CEX) over safety issues.

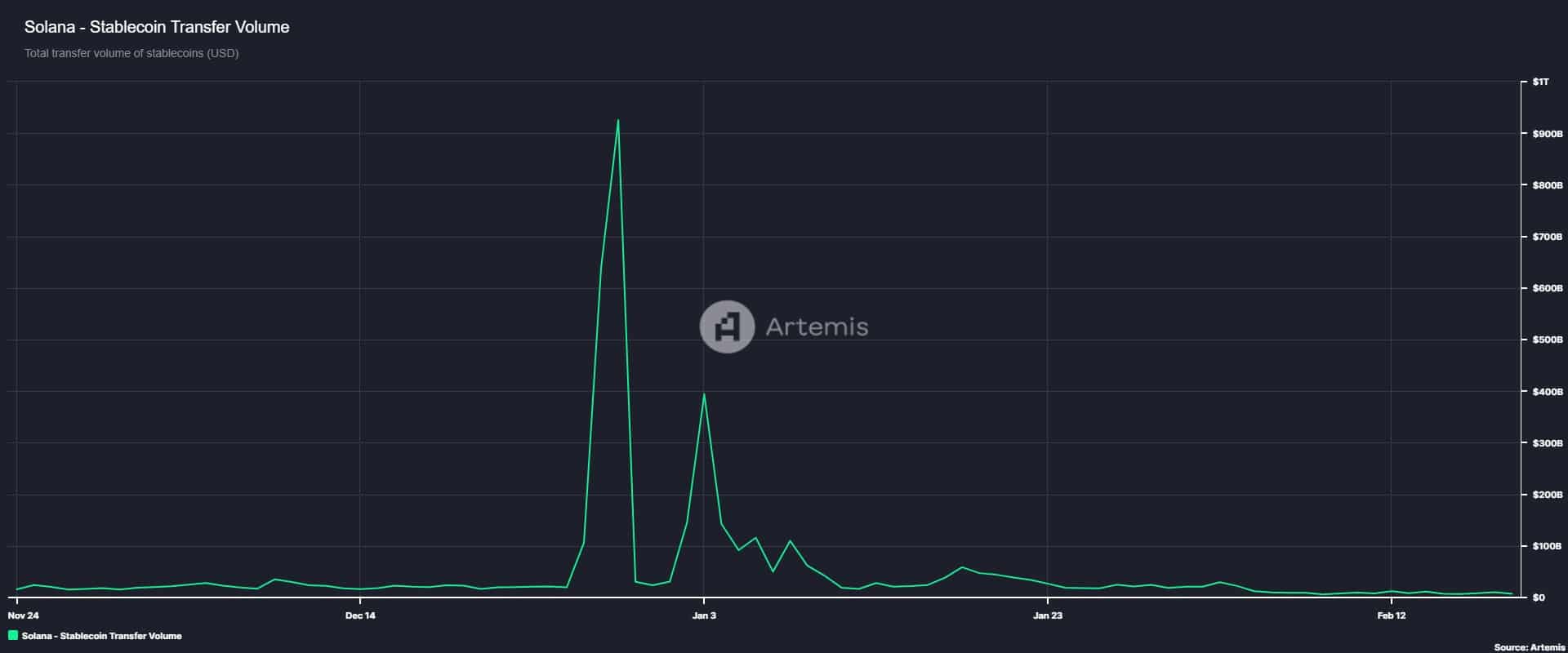

Moreover, Solana’s stablecoin switch quantity has declined to $7.1 billion. This marks a sustained decline from $394 billion a month in the past.

Such a big drop means that buyers, particularly giant ones, are contemplating different chains like Ethereum’s [ETH].

This additionally displays a risk-off sentiment amongst SOL buyers.

Impression on SOL?

As anticipated, lowered on-chain exercise has negatively affected Sol’s worth actions. This has impacted SOL’s demand facet. Often, low demand results in much less shopping for strain, leaving the market to sellers and leading to downward worth strain.

On the time of writing, Solana was buying and selling at a three-month low of $158. This marked a 7.09% decline on every day charts. Solana has additionally dropped by 35.52% over the previous month.

With sturdy downward strain and low demand, SOL might decline additional.

If the present pattern persists, SOL dangers dipping to $154. Nevertheless, if patrons take this chance to purchase the dip, SOL might recuperate to $175.