- ADA’s merchants have been over-leveraged at $0.634 on the decrease aspect and at $0.708 on the higher aspect.

- On-chain metrics revealed that exchanges have witnessed an outflow of over $8 million value of ADA tokens.

Cardano [ADA] is garnering consideration from crypto lovers resulting from its vital value drop previously 24 hours.

With a 13% decline, ADA has reached an important stage the place dealer and investor participation has surged, resulting in a notable improve in buying and selling quantity.

ADA’s present value momentum

At press time, ADA was buying and selling close to $0.665. It has seen a 90% surge in buying and selling quantity over the previous 24 hours. Nonetheless, this spike in buying and selling quantity doesn’t essentially point out a value rally.

Such will increase usually happen when an asset breaks out or breaks down from a value sample. Important volatility prompts merchants and traders to both liquidate their open positions or offload holdings for revenue reserving.

Cardano value motion and upcoming stage

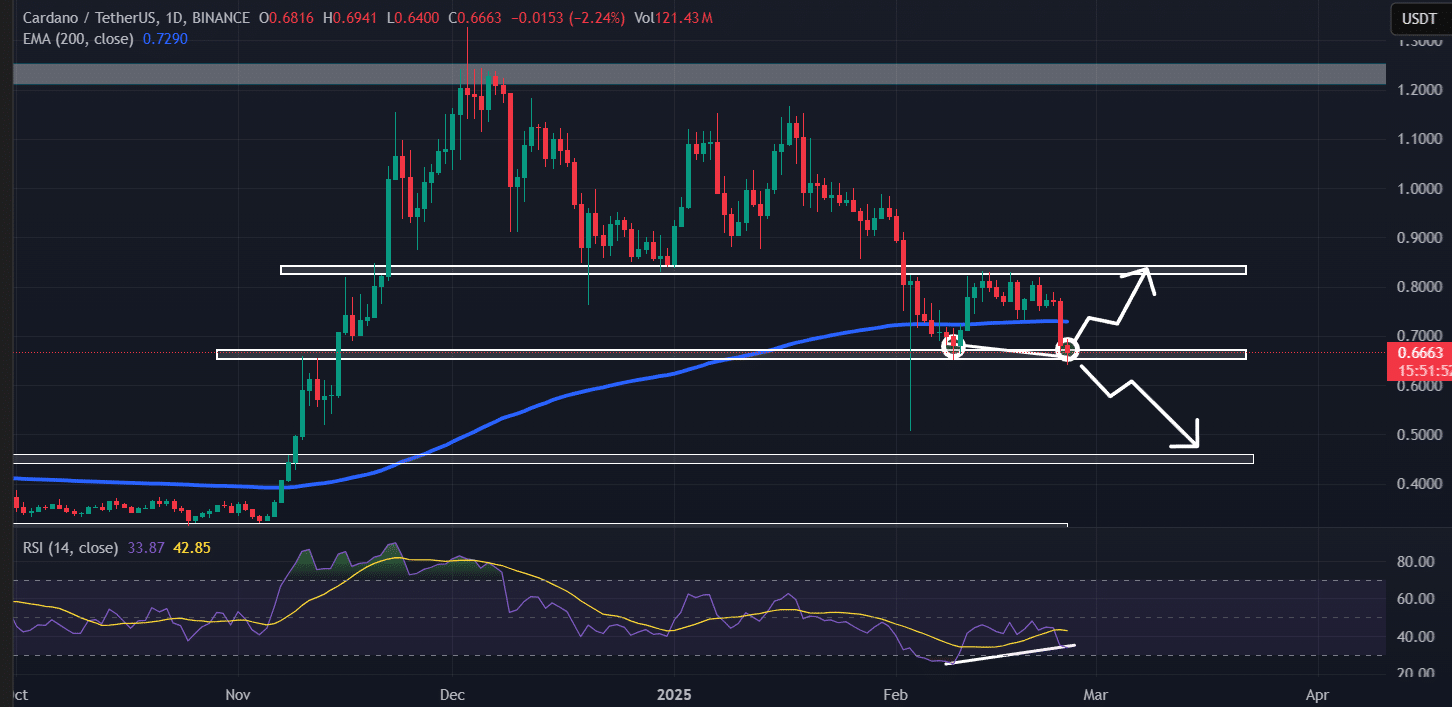

In keeping with AMBCrypto’s technical evaluation, ADA seems to be forming a bullish double-bottom sample on the every day timeframe. Nonetheless, the current value drop has pushed the asset to an important help stage of $0.65.

This stage has a robust historical past of value reversals, additional reinforcing this bullish outlook.

Moreover, ADA’s technical indicators have flashed a bullish divergence, signaling vital upside potential.

Primarily based on historic value momentum, if ADA holds above the $0.65 stage, there’s a robust chance it may soar by 25% to succeed in $0.85 sooner or later.

Then again, if ADA breaches the $0.65 stage, it may drop by 30% to succeed in $0.45.

$8 million value of ADA outflow

Regardless of the continual value drop, long-term holders seem like accumulating ADA tokens and following value motion, because the on-chain analytics agency Coinglass reported.

Information from Spot Inflows/Outflows reveals that exchanges have witnessed an outflow of over $8 million value of ADA tokens previously 24 hours.

Nonetheless, in a market situation the place costs proceed to say no, alternate outflows point out potential accumulation, which may create shopping for stress and drive additional upside momentum.

ADA merchants’ $17 million guess on the quick aspect

In the meantime, intraday merchants seem like following the present market sentiment, betting on the quick aspect, as reported by the on-chain analytics agency Coinglass.

On the time of writing, quick positions dominate, whereas lengthy merchants appear to be exhausted.

Information exhibits that the foremost liquidation ranges are at $0.634 on the decrease aspect and $0.708 on the higher aspect, with merchants being over-leveraged at these ranges.

If market sentiment stays unchanged and the value falls to $0.634, almost $3.08 million value of lengthy positions can be liquidated.

Conversely, if sentiment shifts and the value soars to $0.708, roughly $17.30 million value of quick positions can be liquidated.

This on-chain metric signifies that quick merchants nonetheless imagine ADA’s value received’t recuperate quickly. This perception could be the rationale for the formation of $17.30 million value of quick positions.