- Aave has a bullish weekly construction, however extra losses are anticipated within the coming days.

- A drop beneath the psychological $200 stage may take costs to $141.

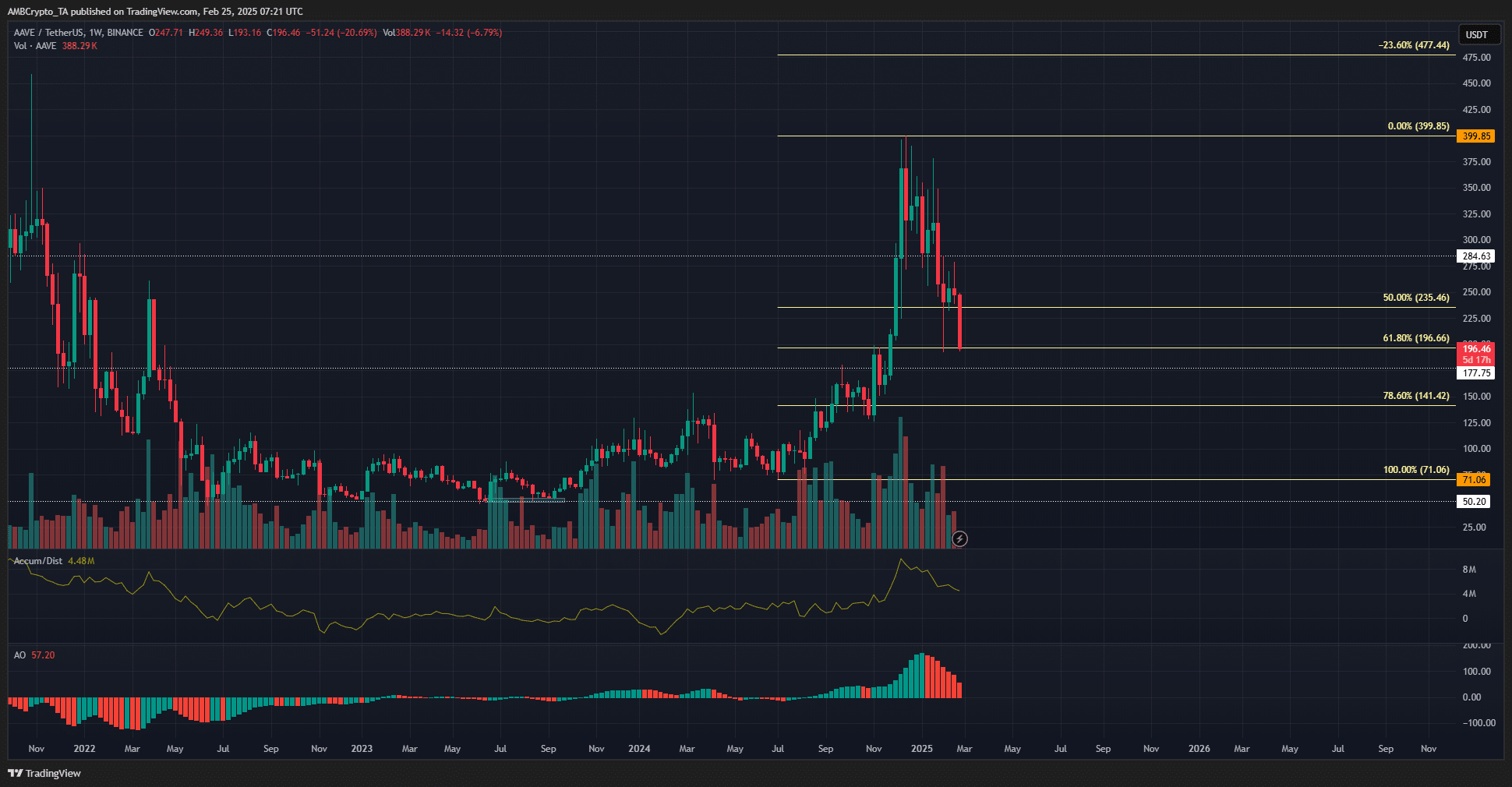

Aave [AAVE] had outperformed widespread DeFi tokens, gaining 465% from July to December earlier than starting to retrace. This retracement section has pulled costs decrease because the market-wide sentiment worsened.

Bulls seeking to accumulate extra AAVE can control the $141 and $177 ranges and anticipate a spread formation.

Within the close to time period, elevated volatility is predicted. A worth transfer to $216 as a liquidity hunt may materialize within the coming hours.

Is Aave on the verge of dropping the $200 assist stage

Over the previous two months, Aave has aggressively retraced the good points it made in This fall 2024. It has ceded the $284 and $235 assist ranges and is on the verge of falling beneath the $196 stage as effectively.

To the south, the $177 and $141 ranges are the following vital assist ranges the place the bulls would possibly make a stand. The swing construction on the weekly chart is bullish, however the present retracement may fall as deep as $125-$141.

The A/D indicator reveals that the promoting stress has not undone the shopping for quantity in current months. The Superior Oscillator famous the change in momentum round mid-January.

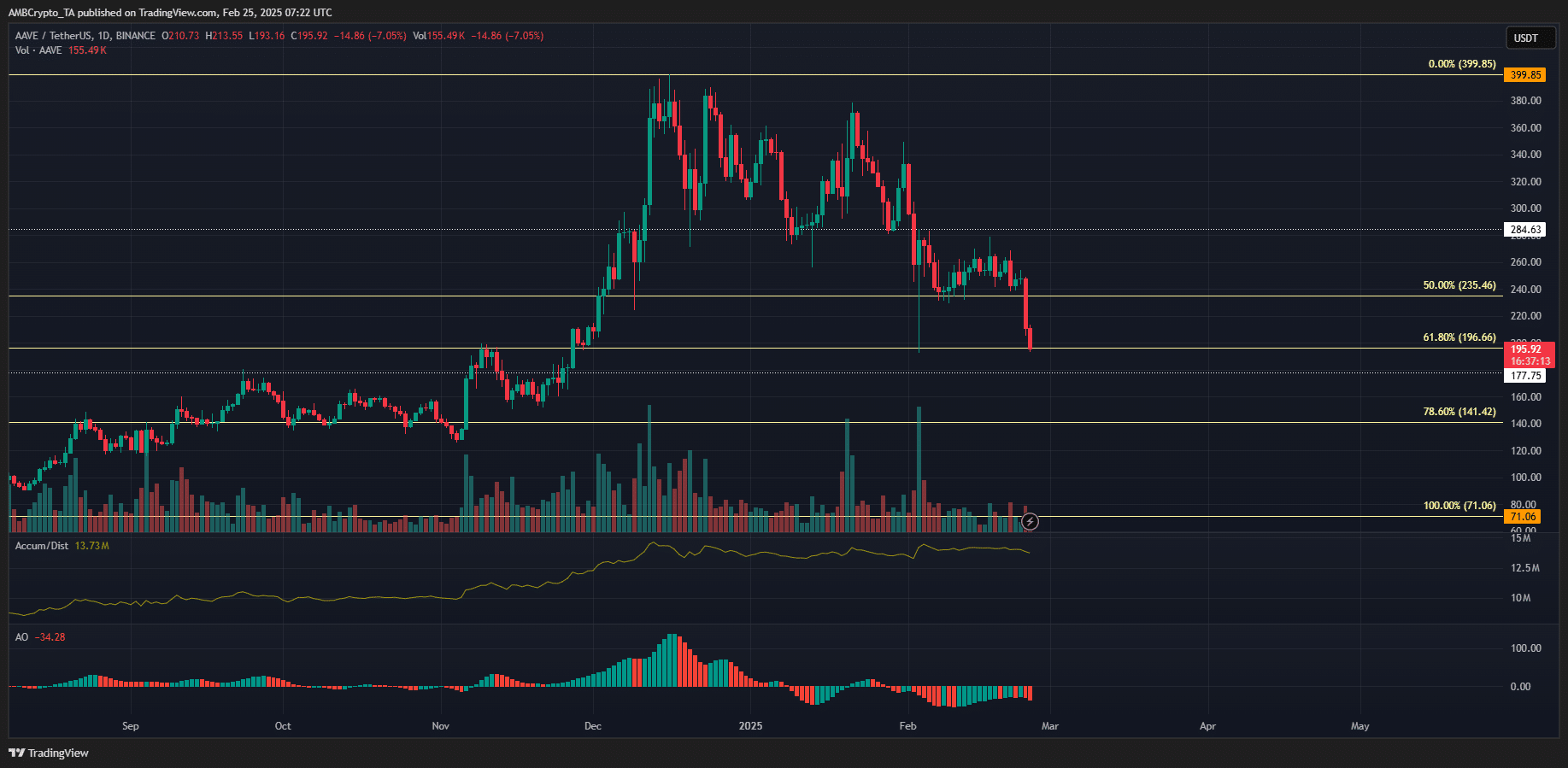

The each day chart gave extra actionable data for merchants. The construction was firmly bearish, however the buying and selling quantity in current days has been muted.

In consequence, the A/D indicator continued to drift close to the excessive from January.

Alternatively, the Superior Oscillator mirrored clear bearish momentum. The $196, $171, and $155 ranges have been the assist ranges {that a} reversal would possibly happen.

Aave consumers can anticipate a spread formation earlier than seeking to bid, as it might be an indication of consolidation after the pullback.

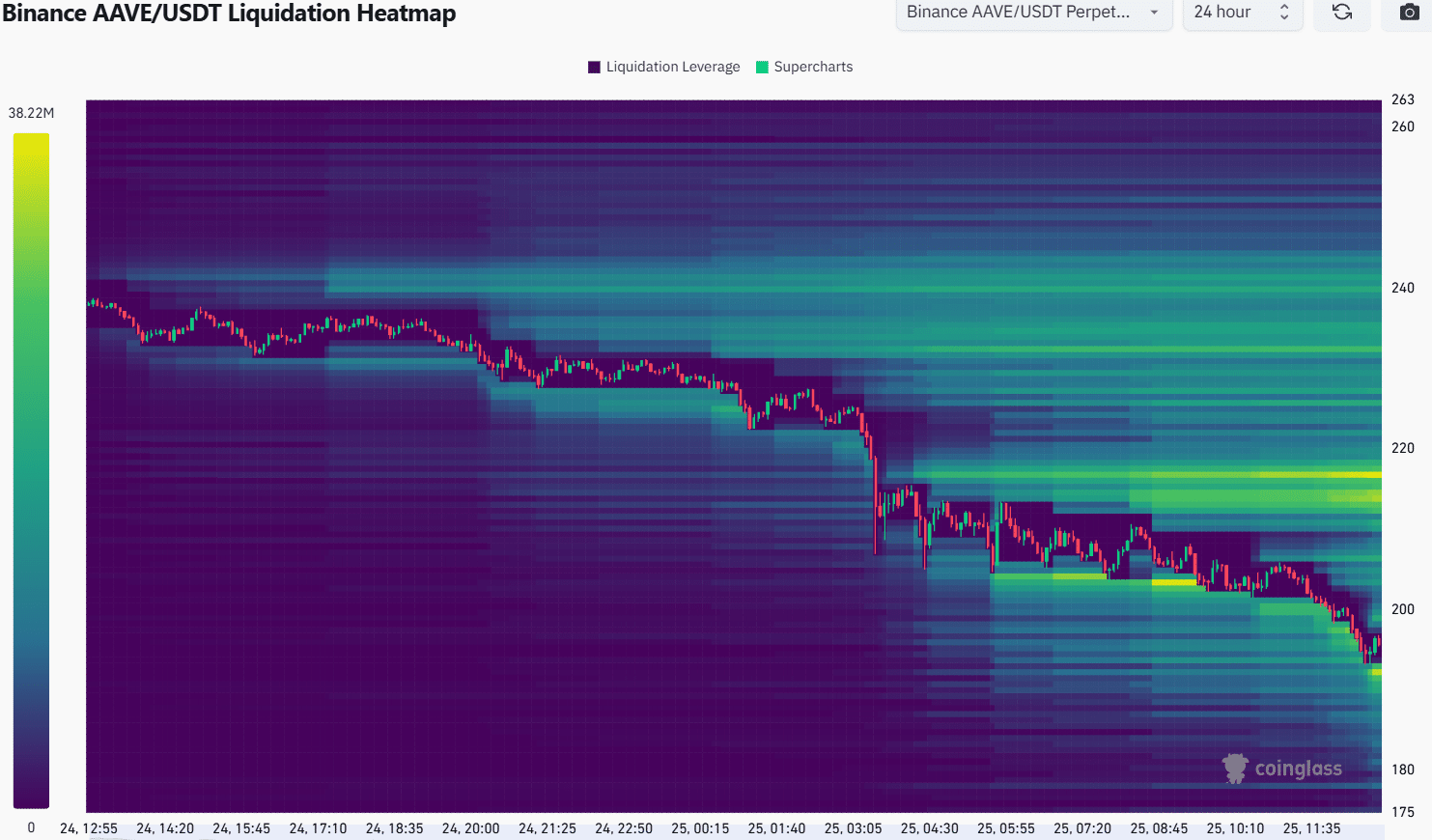

Supply: Coinglass

Within the brief time period, the $192 and $216 ranges are fascinating. They noticed a cluster of liquidation ranges construct up over the previous 24 hours.

The two-day and 3-day AAVE liquidation heatmaps additionally spotlight this stage because the closest liquidity cluster to the north, with the following sizable one at $270.

Volatility was on the rise, at press time, and costs are typically drawn to liquidity. Therefore, merchants ought to watch out for a 12% AAVE worth bounce to $216 to brush the liquidity earlier than the downward transfer resumes.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion