- BERA’s current rise has been pushed by elevated transaction exercise on its blockchain.

- Merchants have responded positively, inserting lengthy bets on BERA.

Berachain [BERA] at present ranks among the many high gainers out there over the previous 24 hours, with an 11% rise.

This surge has been influenced by rising buying and selling exercise, with its quantity reaching $500 million throughout this part.

Progress in on-chain exercise influences BERA

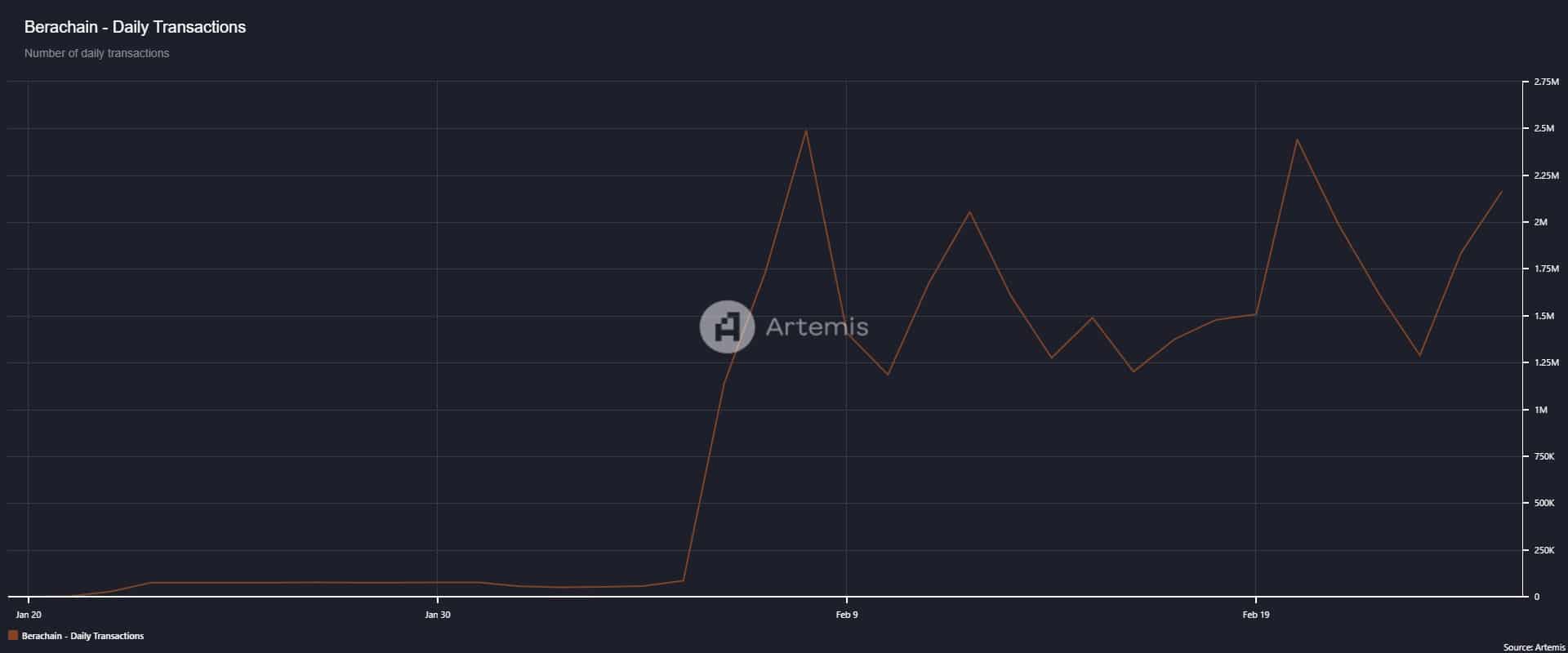

There was a notable surge in exercise on BERA Chain, which may very well be linked to its current rally.

Artemis data signifies that each day transactions have climbed considerably.

The variety of each day transactions, which data shopping for and promoting exercise on the chain, spiked from a low of 1.3 million on the twenty third February to a press time studying of two.2 million.

Throughout this era, the variety of each day lively addresses on BERA reached a brand new excessive of 29,600, its highest because the twenty first of February, when it traded above 46,000.

This improve in lively addresses suggests a renewed confidence within the asset and the potential of additional shopping for exercise within the coming weeks.

When transaction and buying and selling exercise surge alongside value and quantity, it sometimes alerts sturdy market momentum.

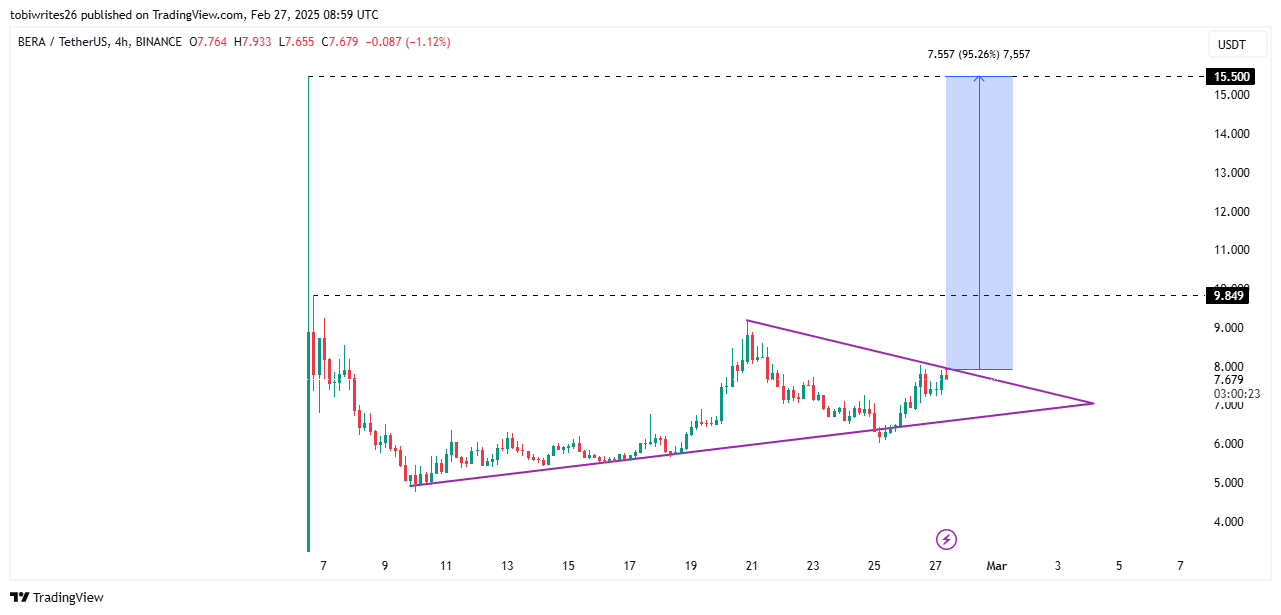

A 95% rally may maintain

A zoom into the 4-hour timeframe confirmed that BERA was buying and selling inside a bullish symmetrical triangle sample, which is usually a precursor to a market rally.

As of this writing, BERA was buying and selling on the resistance degree of this sample.

A profitable breakout may set off a rally, with two key targets: a short-term transfer to $9.80 and a long-term surge to $15.50, representing a 95.26% value improve.

If the breakout try fails, BERA may consolidate additional inside the symmetrical triangle, with market members accumulating the asset at a decrease price forward of the rally.

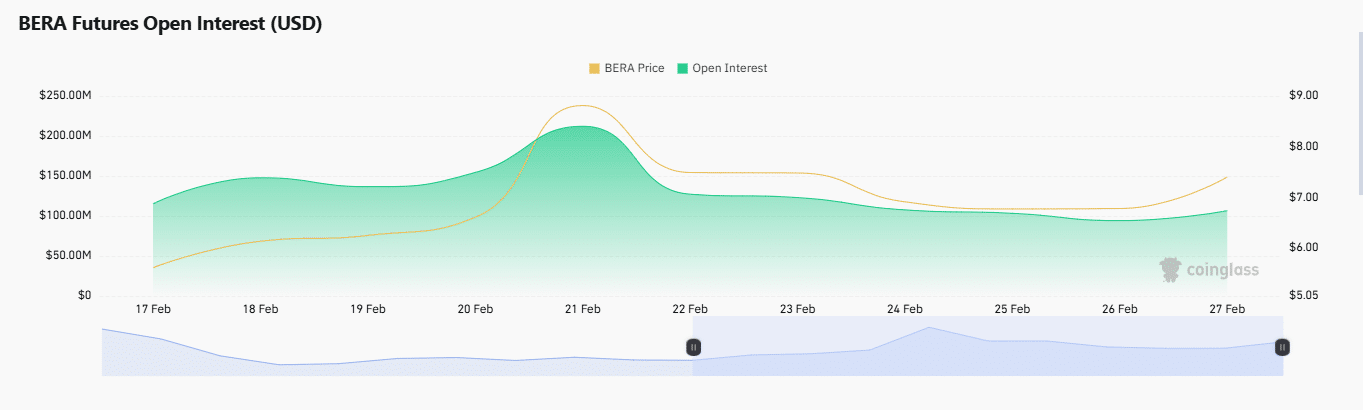

Hypothesis surges in BERA

There was an increase in hypothesis amongst derivatives merchants. On the time of writing, each Open Curiosity and the Lengthy-to-Brief ratio replicate this development.

Open Curiosity is rising, with extra liquidity coming into the market. Previously 24 hours, it has elevated by 14.17%, from $94.26 million to $116.95 million—a further $22.69 million.

Additionally, the Lengthy-to-Brief ratio, which measures shopping for versus promoting quantity within the derivatives market, confirms this bullish sentiment because it stays above 1, indicating stronger shopping for exercise.

Continued shopping for stress within the derivatives market may assist BERA break by means of the resistance degree is at present limiting its rally.