- XRP’s lively addresses have declined steadily, suggesting decreased engagement and potential value volatility forward.

- A key help degree is beneath strain, and if damaged, it might face additional downsides regardless of broader market situations.

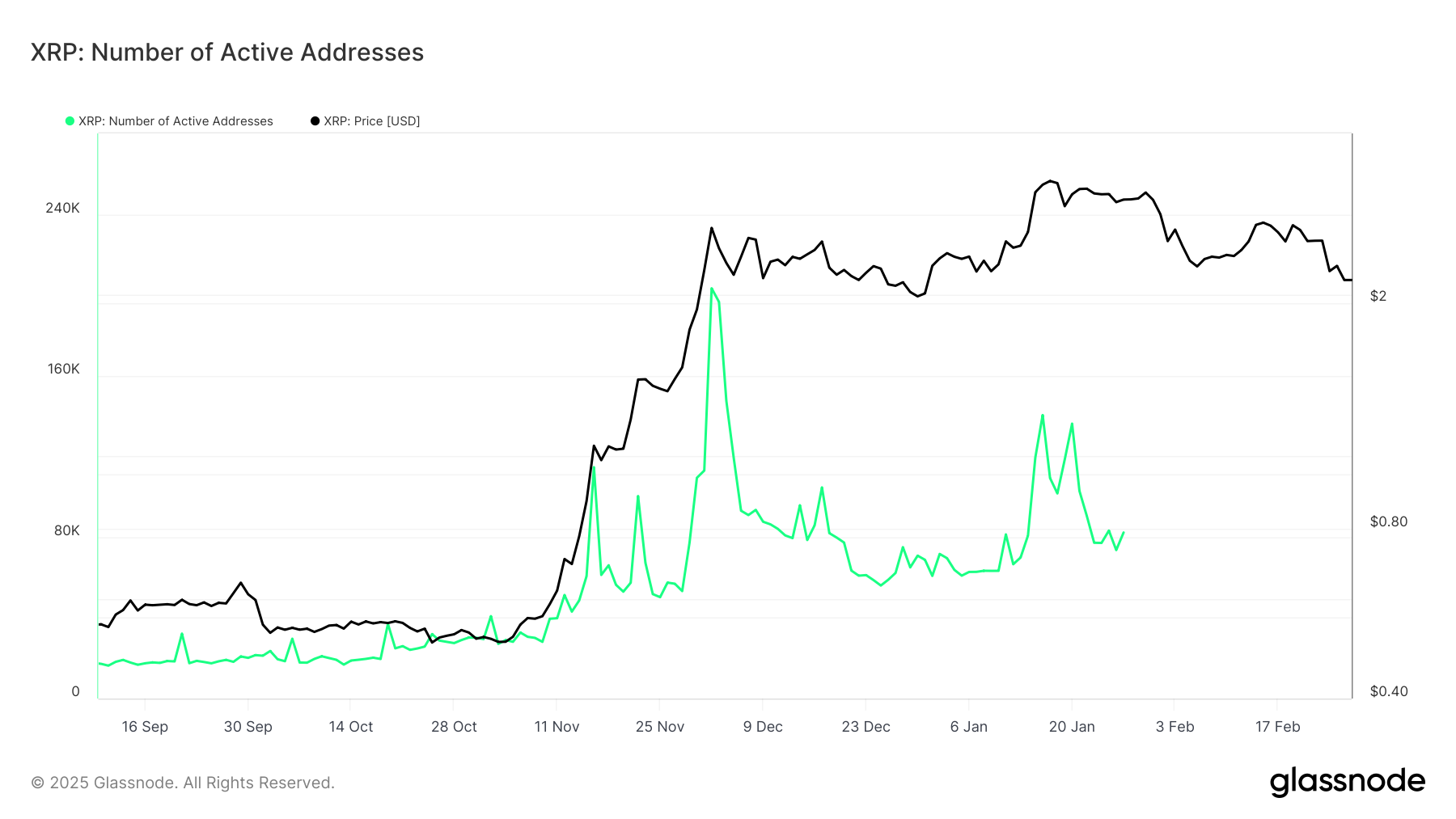

The variety of lively Ripple[XRP] addresses has considerably declined over the previous three months, elevating issues about decreased community exercise and its potential influence on value traits.

This drop in engagement has coincided with a broader value correction, resulting in hypothesis concerning the future trajectory.

XRP lively addresses and market sentiment

Glassnode data exhibits that XRP’s lively addresses peaked in early December 2024 earlier than starting a gentle decline. Evaluation confirmed that the quantity spiked to over 203,000.

The most recent information reveals a major drop in lively wallets, which usually signifies decrease transaction volumes and decreased market participation. As of this writing, the quantity was round 82,000, signaling over a 50% drop.

Traditionally, sustained declines in lively addresses have correlated with value stagnation or downward actions, as fewer transactions counsel waning investor curiosity.

Value development and technical indicators

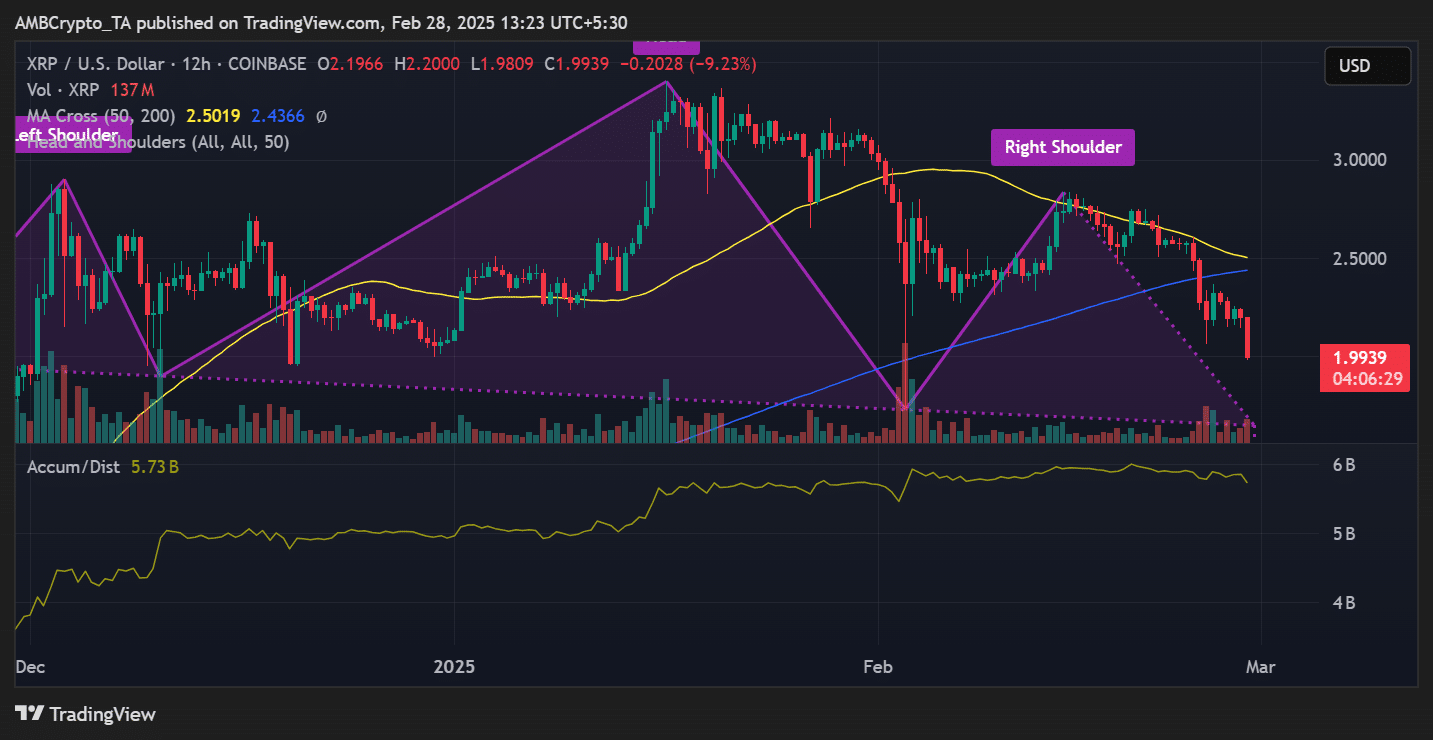

XRP has adopted a bearish development, reflecting the drop in community exercise. The 12-hour chart exhibits a well-defined head and shoulders sample, a basic bearish reversal indicator. This formation means that XRP might proceed its downtrend if key help ranges fail to carry.

On the time of writing, XRP was buying and selling at $1.9939, reflecting a 9.23% decline within the final 24 hours.

The 50-day Shifting Common (MA) was $2.5019, considerably above the present value, signaling persistent promoting strain.

In the meantime, the Accumulation/Distribution (A/D) indicator confirmed a downward development, reinforcing the view that enormous holders are exiting their positions moderately than accumulating.

What this implies for XRP’s future

With declining community participation and bearish value motion, XRP wants a resurgence in lively wallets to ascertain a restoration development. If lively addresses proceed to drop, XRP might face additional downward strain, probably testing the $1.80-$1.85 vary as the following help zone.

Nevertheless, a pointy enhance in lively addresses might sign renewed investor confidence, probably stabilizing costs and organising a reversal. For a bullish situation, XRP should reclaim $2.20-$2.25 as a key resistance zone.

Conclusion

The present downtrend in lively addresses and costs signifies warning for XRP traders. Monitoring on-chain exercise might be essential in assessing whether or not the asset is poised for additional declines or if a turnaround is on the horizon.

Till then, XRP stays in a weak place, closely depending on a resurgence in community exercise to regain upward momentum.