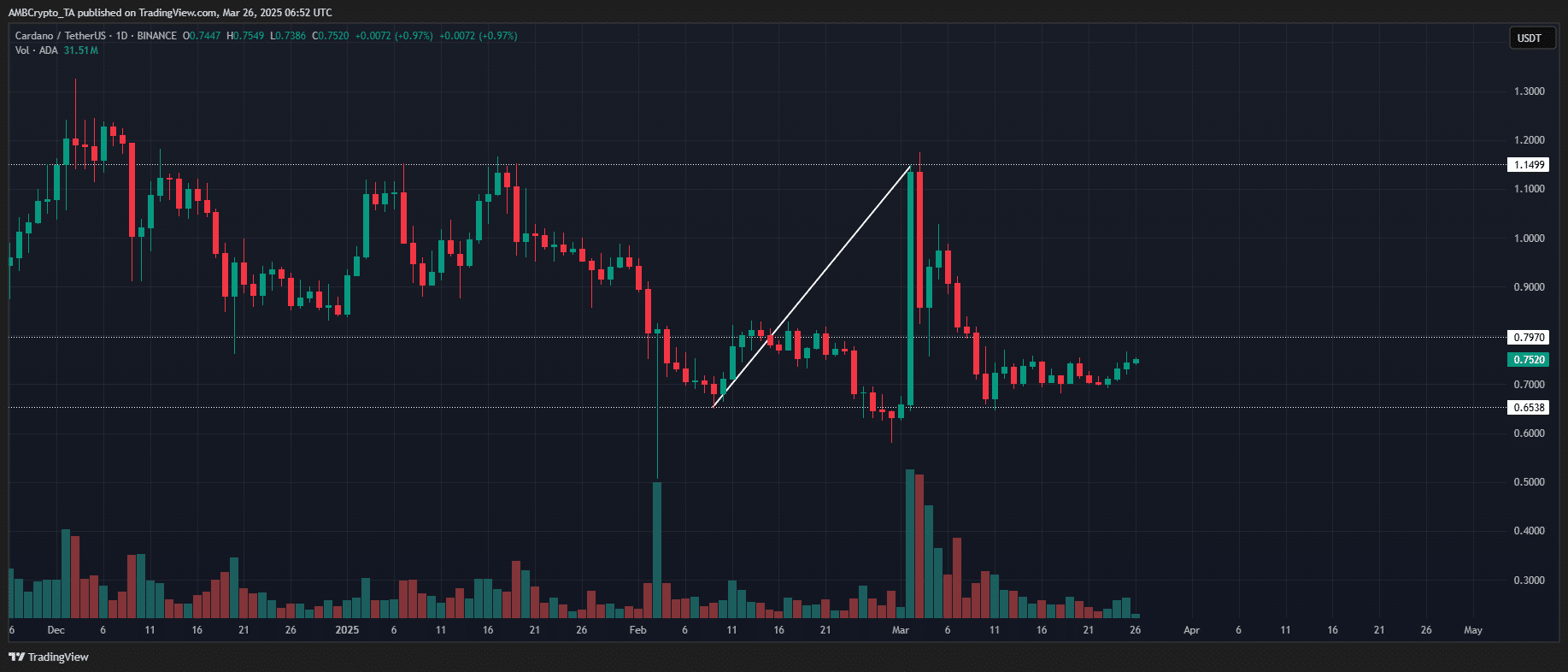

- ADA’s worth motion mirrored the February cycle, the place a $0.52 pullback triggered a breakout to $1.14.

- Is an analogous repeat possible with bullish metrics, or does this sign a bull lure within the making?

Cardano [ADA] is exhibiting tight consolidation on the every day chart, a typical precursor to heightened volatility. Its present worth motion aligns with the mid-February construction, with ADA buying and selling at $0.75, a press time, and encountering resistance at $0.79.

The market construction stays bullish, supported by power throughout each spot and futures markets. Given the current momentum, the chance of a retest of the $0.56 help zone seems low.

Furthermore, on the twenty fifth of March, ADA registered 1.06 billion in buying and selling quantity at $0.74, intently mirroring the mid-to-late February accumulation section, which preceded a breakout to $1.14.

If the present sample persists, ADA could also be positioned for one more robust upward transfer. Its latest BingX itemizing strengthens this outlook by probably enhancing liquidity and market depth throughout a 10-million-user buying and selling platform.

Moreover, capital rotation from Bitcoin to Cardano is noticeable, because the ADA/BTC pair reveals a bullish shift. Bitcoin’s regular upward pattern is fostering risk-on sentiment, encouraging capital inflows into altcoins.

Contemplating these components, a retest of the $0.80 resistance degree seems extremely possible for Cardano. Nonetheless, a confirmed breakout stays unsure. Elevated bull lure dangers at key resistance ranges may result in distribution-driven reversals.

Pink flags level to a attainable ADA bull lure

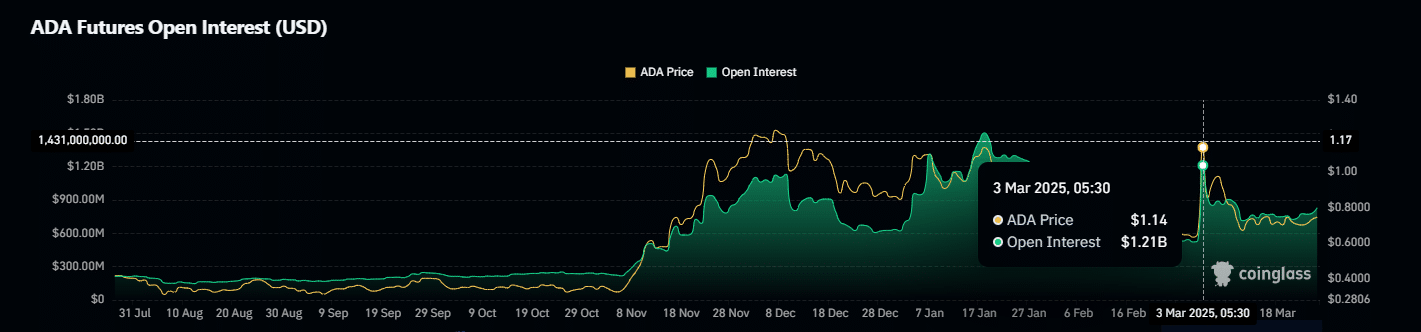

An evaluation of Cardano’s derivatives market reveals a notable uptick in threat urge for food amongst merchants. Open Curiosity (OI) has surged 4.24% to $834 million, reflecting elevated leveraged publicity.

In the meantime, the Funding Charges have turned positive for the second consecutive session, the primary such prevalence this month, indicating long-side dominance.

In a bullish liquidity cycle, whale accumulation has intensified, with giant Cardano entities absorbing 240 million ADA over the previous week, reinforcing community inflows.

This capital injection parallels the late February growth section, when OI soared to $1.25 billion, fueling ADA’s breakout.

Nonetheless, in contrast to the earlier cycle, pattern validation stays unsure as macro-driven volatility persists, elevating the danger of a market-wide deleveraging occasion.

To keep away from a bull lure, ADA wants a decisive breakout above key resistance clusters. If it fails to reclaim the $0.80–$0.85 vary, overleveraged lengthy positions may face liquidation. This may increasingly result in a distribution section and set off cascading sell-offs.

With the present market construction, a retracement towards the $0.65 demand zone is a sensible risk. Nonetheless, bulls should flip resistance right into a confirmed help degree to stop this end result.