- At press time, ONDO’s worth gave the impression to be consolidating, with a 6.26% decline elevating short-term uncertainty

- Massive transactions have been declining, and liquidation dangers may improve volatility

Ondo [ONDO] Finance has taken the decentralized finance (DeFi) house by storm, surpassing $1 billion in whole worth locked (TVL) in simply 30 days. This exceptional 57% surge has firmly established Ondo on the forefront of the tokenized U.S. Treasuries market, which now exceeds a complete market worth of $4 billion.

Because of this, the challenge is now shortly turning into a serious participant on this quickly rising sector.

What does ONDO’s worth motion point out?

Analyzing the altcoin’s latest worth motion revealed some fascinating patterns. The token has been buying and selling inside a symmetrical triangle formation after its sharp hike, with its worth nearing the decrease boundary of the sample.

At press time, ONDO was buying and selling at $0.96, down 6.26% within the final 24 hours. This hinted at some degree of short-term uncertainty. Though the general development has been constructive, the prevailing downtrend in worth raises some questions concerning the token’s short-term stability.

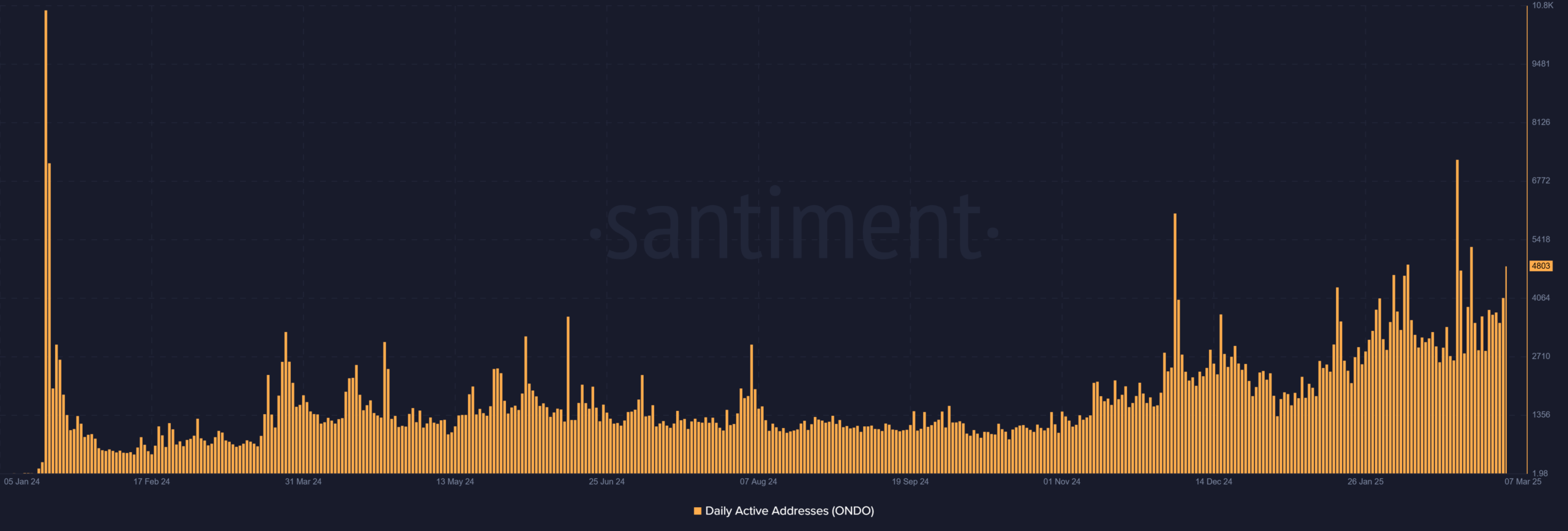

How have every day lively addresses developed?

ONDO recorded 4,803 every day lively addresses, highlighting a average uptick in consumer exercise. This hike in every day engagement is a constructive indicator, particularly contemplating the rising adoption of tokenized treasuries.

Moreover, this development in every day lively addresses signified that extra buyers have been interacting with the platform and taking part within the increasing DeFi ecosystem. Nonetheless, it stays to be seen whether or not this development will proceed, given the volatility throughout the market.

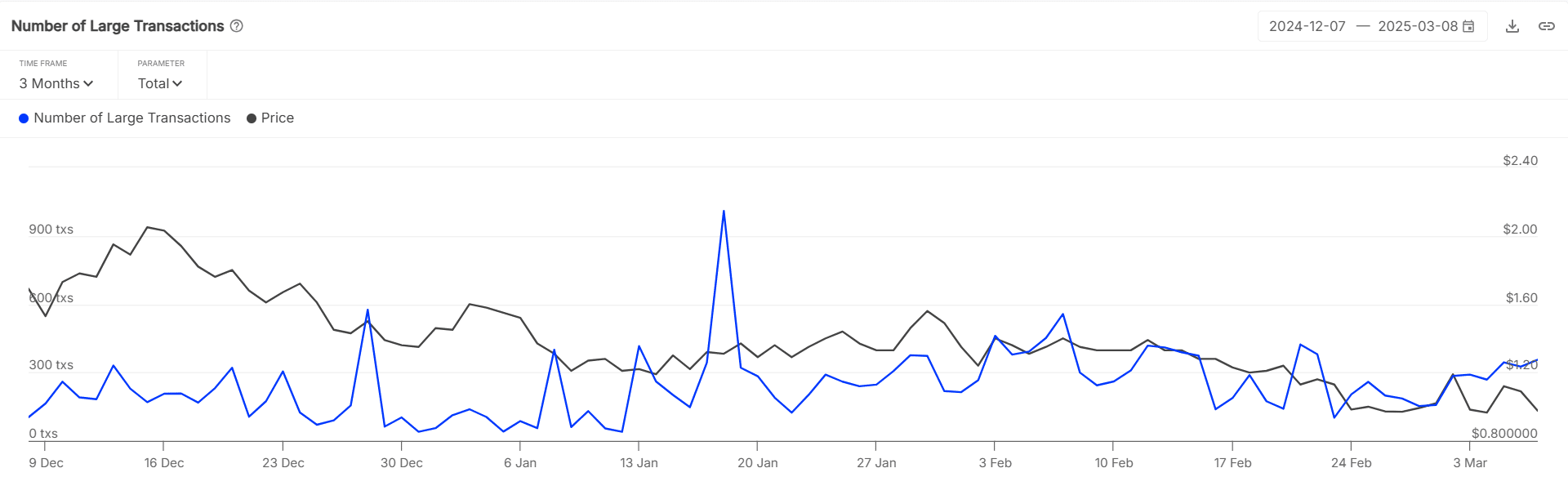

What do giant transactions inform us?

Massive transactions have been on the decline, with a 1.09% drop in giant transaction exercise. This meant that a number of the main gamers could also be retreating from Ondo, probably attributable to its newest worth correction.

Moreover, it might be an indication that institutional buyers are taking a extra cautious method, ready for clearer alerts earlier than committing extra capital.

The autumn in giant transactions highlighted the necessity to monitor sentiment throughout the broader market.

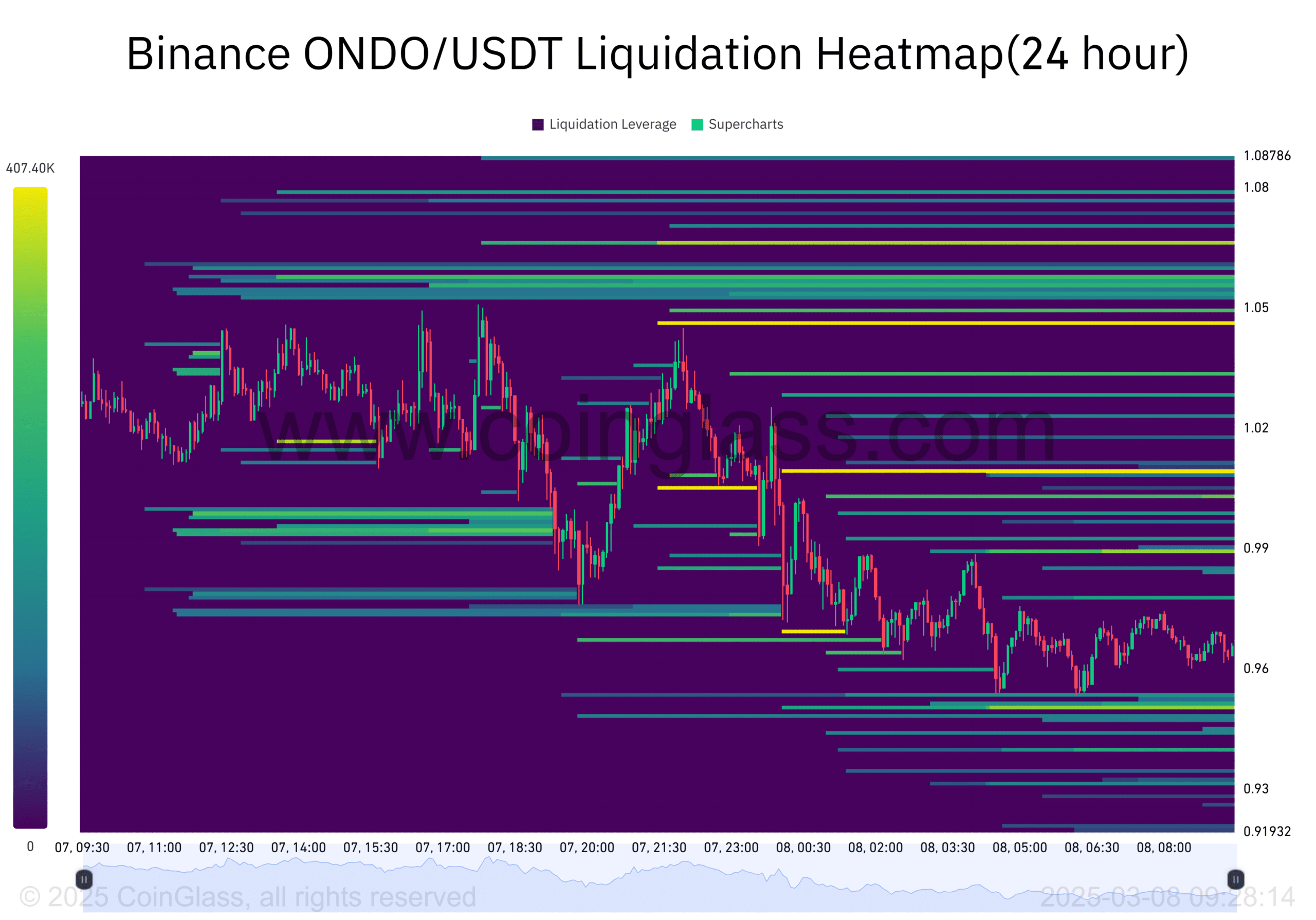

What does the liquidation heatmap reveal about market sentiment?

The liquidation heatmap for Ondo additionally added to the cautious outlook. Important liquidations gave the impression to be occurring within the 0.96–1.00 worth vary – An indication that many merchants are uncovered to threat close to these ranges.

As the value continues to method this vary, we may see a hike in liquidation exercise, which can contribute to additional volatility. Due to this fact, watching the liquidation ranges can be important. Particularly because it may sign potential for sharp worth fluctuations if a wave of liquidations takes place.

Regardless of Ondo’s exceptional development in TVL and hike in consumer exercise, a number of components hinted at potential volatility within the quick time period.

Whereas its place within the tokenized treasuries market stays sturdy, the latest worth decline, lowering giant transactions, and liquidation dangers recommend that it could face challenges forward.

Due to this fact, whereas Ondo has undoubtedly established itself as a dominant participant within the DeFi house, sustaining this development within the face of those dangers stays unsure.