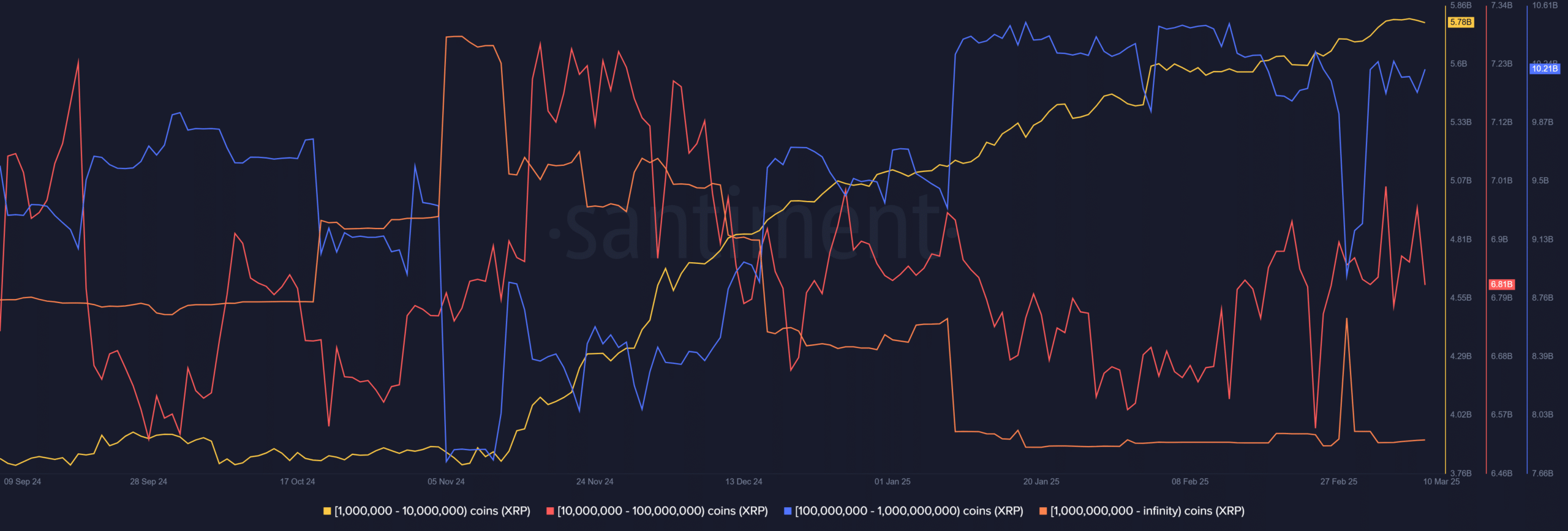

- XRP has relied on whale help twice post-election, making it a vital metric to observe.

- Is the $2 help stage hanging by a thread?

Ripple [XRP] plunged to $2.10 amid the current market downturn, recording an 8.06% single-day drop – one of many steepest amongst high-cap property.

Following the election, XRP twice closed under $2, inside the $1.95–$1.98 vary, which triggered important rallies of 71% and 53%, respectively.

These rebounds weren’t coincidental—they have been pushed by whale wallets injecting billions into the XRP Ledger. Every dip coincided with a surge in institutional inflows.

Now, as Ripple revisits this essential help zone, the query arises: is one other breakout imminent?

Key risk to its $2 help

In a current evaluation, a market strategist warned {that a} breach of XRP’s $2 help might set off its “finish sport,” signaling a deeper breakdown.

This prompted AMBCrypto to dive deeper into the doable components at play.

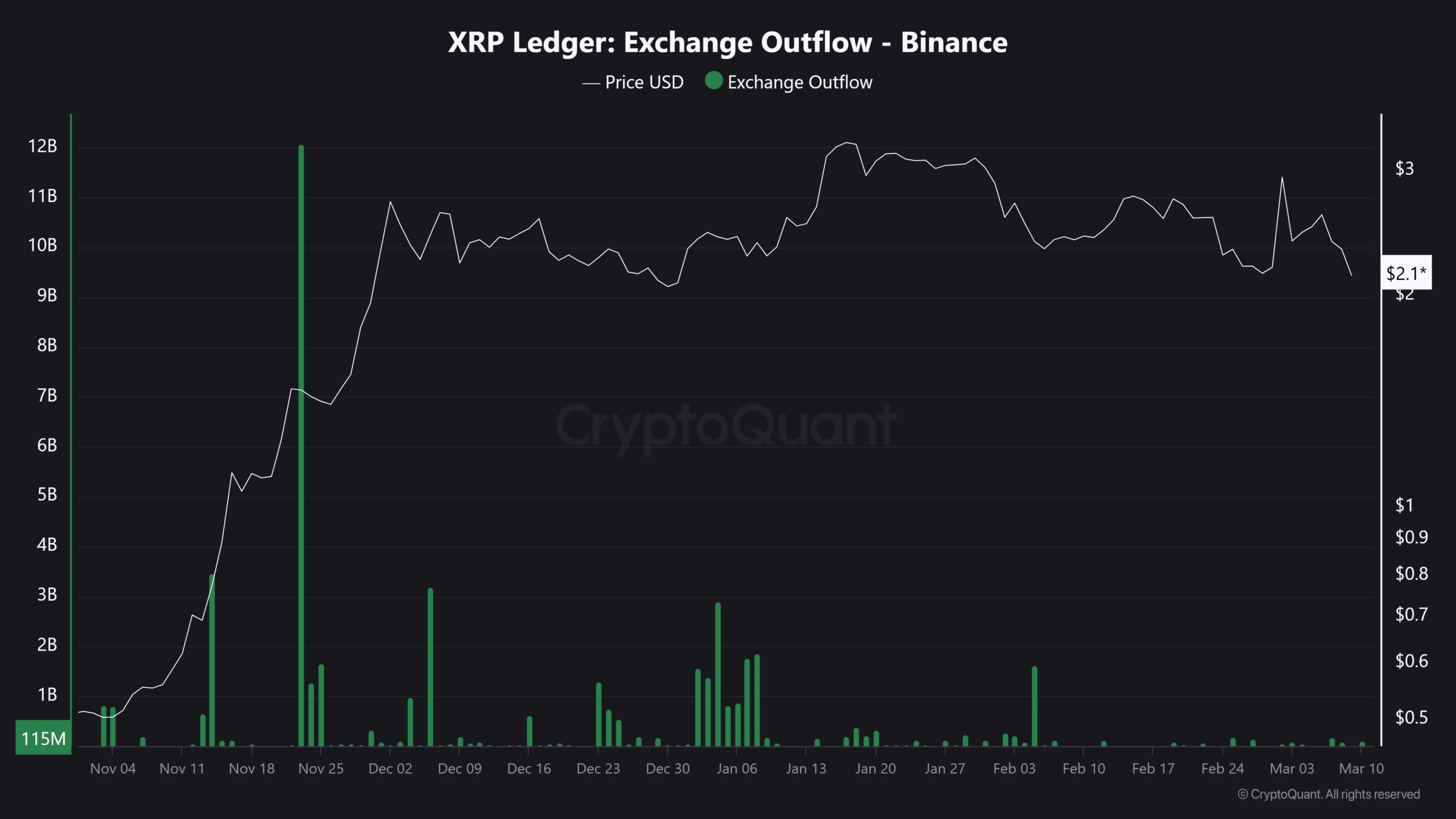

Retail-driven FOMO, a key liquidity driver, has been absent because the election rally. Binance outflows, which beforehand surged to 12 billion XRP, have now dropped to 115 million.

Including to the priority, throughout XRP’s two earlier dips under $2, outflows dropped to simply 10 million XRP, indicating that small retail traders have been reluctant to purchase the dip.

On the identical time, futures merchants are pulling again as properly. XRP’s Open Curiosity (OI) has fallen by 6.38% to $3.17 billion—a pointy decline from the $7.80 billion OI peak throughout its mid-January rally.

With shrinking liquidity and waning FOMO, the potential for reclaiming $3 appears more and more slim, heightening fears that Ripple’s $2 help stage stays unstable.

Is XRP dropping its grip available on the market?

Lower than two weeks after discuss of XRP’s ‘potential’ inclusion within the Strategic Reserve sparked backlash, the market’s response was decisive.

Inside a day, Ripple plunged 18.79%, struggling a far steeper decline than Bitcoin’s 8.10% drop.

Regardless of being 2024’s top-performing high-cap asset by YTD development, a repeat rally in 2025 stays unsure.

The important thing now lies with main holders, whose accumulation has defended the $2 stage to date.

With rising volatility, retail demand is diminishing, and futures liquidity is drying up. There isn’t any institutional help for an XRP reserve.

The $2 help stage now faces rising strain. Main holders stay the final line of protection for sustaining this essential help zone.