- Cardano’s newest purchase sign hinted at potential for a short-term rally, however uncertainty stays

- Regardless of hike in market exercise, the funding price and MVRV ratio highlighted warning

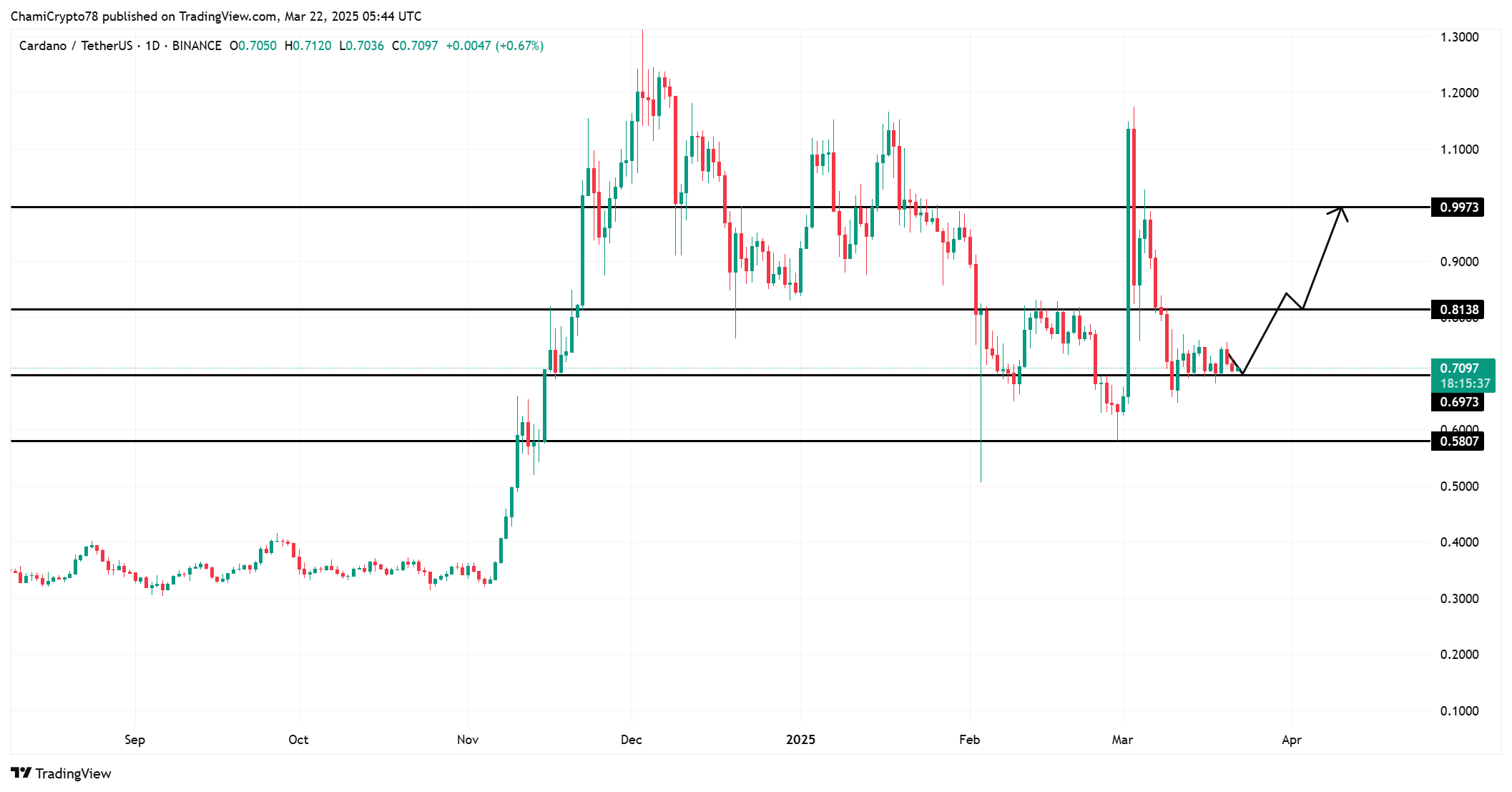

The TD Sequential indicator is within the information in the present day after it not too long ago generated a purchase sign for Cardano [ADA], with the altcoin buying and selling at $0.7100, down 0.98%, at press time. This technical sign has sparked curiosity amongst merchants, hinting on the potential for a value rebound.

Because the market watches intently, the query stays – May this be the beginning of a short-term rally, or will it transform simply one other fleeting spike?

Analyzing Cardano’s current value motion, we will see clear consolidation after a interval of volatility. In truth, the value registered an try to interrupt above the $0.8138-level, with assist forming across the $0.6973-level.

If ADA can maintain above this key assist stage, it might goal to check the following resistance round $0.8138. To place it merely, the TD Sequential purchase sign offered a glimmer of hope for merchants in search of a value rebound.

Binance funding charges evaluation – Is sentiment bullish or bearish?

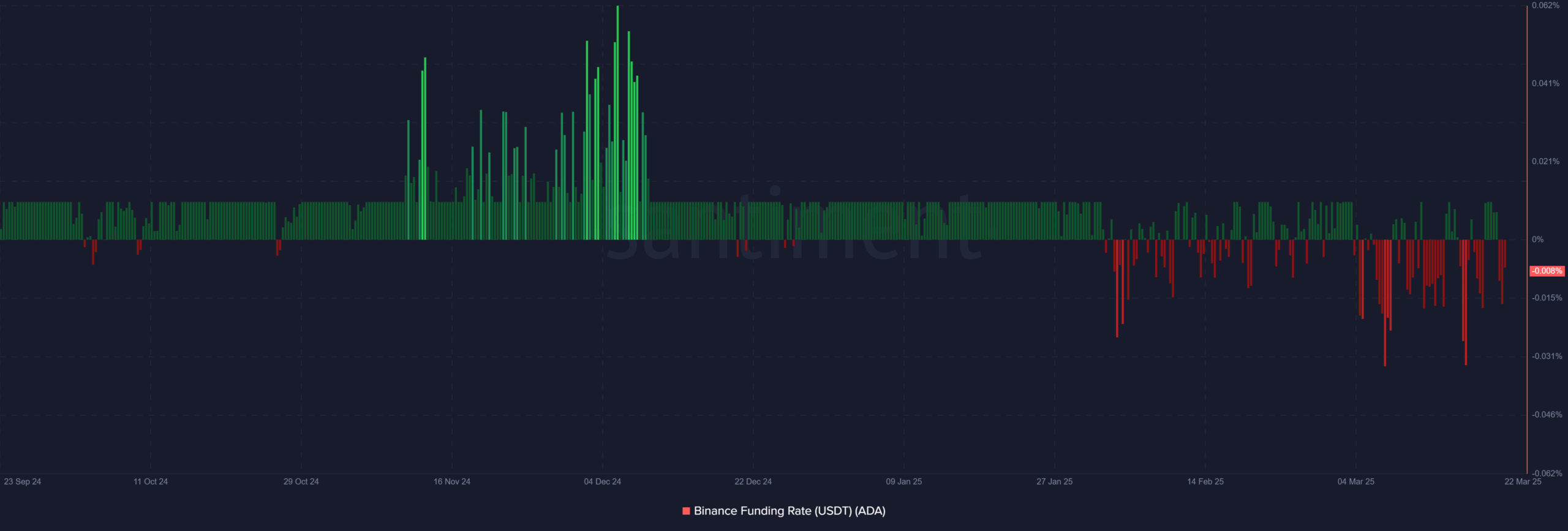

On the time of writing, the Binance funding price for Cardano had a worth of -0.0084%. This destructive price advised that extra merchants are holding quick positions – An indication of bearish sentiment available in the market.

Nevertheless, the speed’s delicate fluctuations alluded that the market stays comparatively balanced, with no excessive sentiment driving the value in both course.

Moreover, this destructive funding price might result in downward stress if quick positions proceed to dominate.

Each day energetic addresses and transaction quantity evaluation

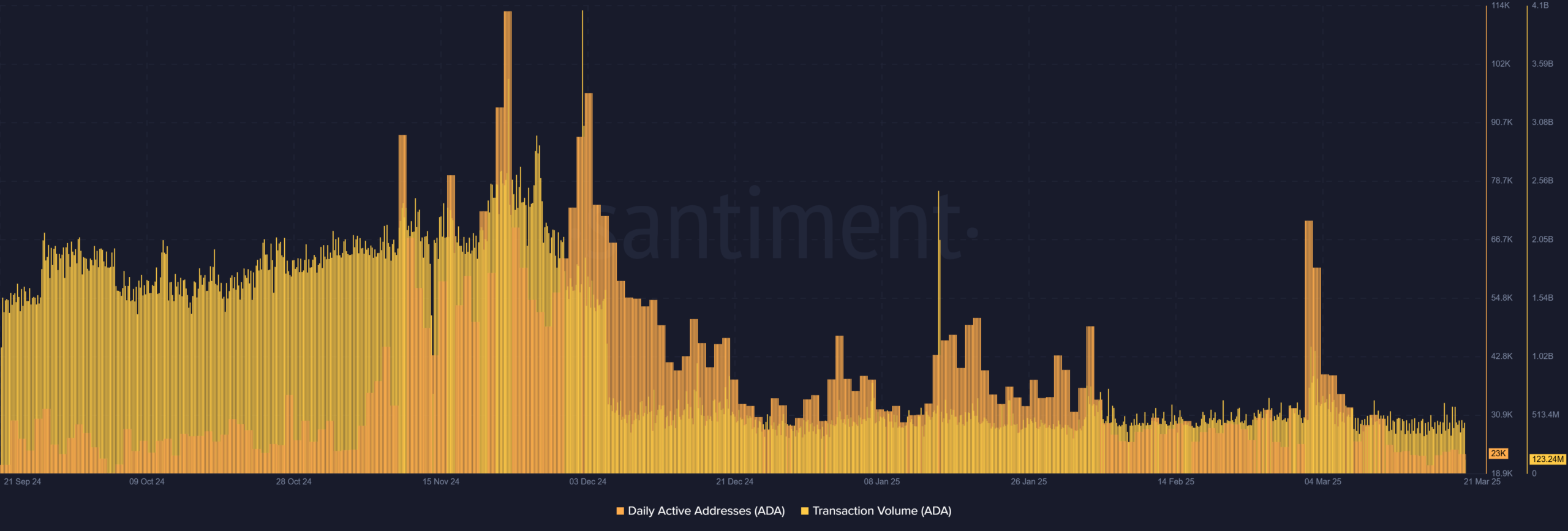

Cardano’s each day energetic addresses noticed a noticeable uptick not too long ago, climbing to 23,009 addresses. Moreover, transaction quantity surged to 123.24 million ADA, signaling rising curiosity within the asset.

This hike in exercise might point out that extra traders are collaborating available in the market, probably supporting a short-term value surge.

Nevertheless, regardless of the expansion in addresses and transactions, the market has been iffy. This could possibly be an indication that the continued development is probably not sustainable for the long run.

ADA MVRV ratio – Overvalued or undervalued?

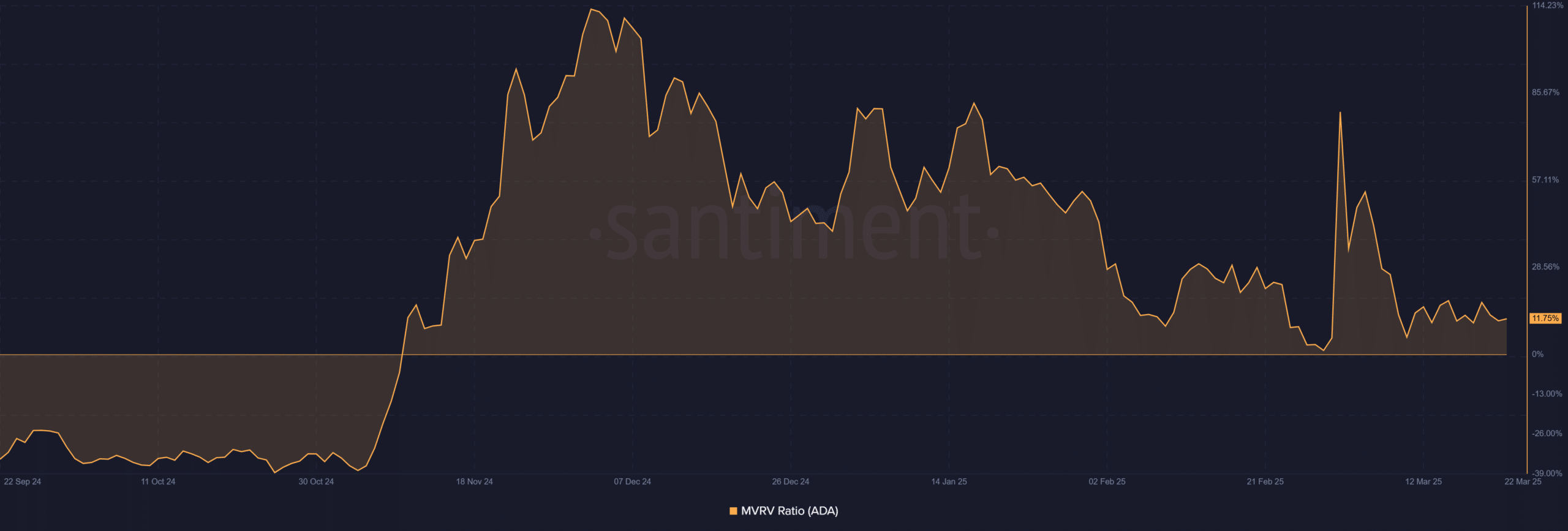

Cardano’s MVRV ratio stood at 11.75% – An indication that the asset was considerably overvalued within the quick time period. This ratio measures the distinction between Cardano’s market worth and its realized worth, indicating potential profit-taking stress.

Whereas the MVRV ratio hinted that ADA might face some resistance at larger value ranges, it additionally pointed to a possible long-term bullish development.

To place it merely, regardless of short-term overvaluation, Cardano should see progress potential sooner or later.

Will Cardano’s rebound maintain or fade away?

The most recent purchase sign and hike in market exercise for Cardano hinted at a possible short-term rally. Nevertheless, the destructive funding price and excessive MVRV ratio pointed to warning amongst merchants.

Based mostly on prevailing market situations, Cardano may even see a short lived value bounce. Nevertheless, the rally won’t be sustainable in the long term. Subsequently, Cardano’s value may even see some upward motion, however it’s unlikely to set off an enduring bull run presently.