Bitcoin (BTC) has confronted heightened volatility in latest weeks, initially pushed by Donald Trump’s proposed trade tariffs and later exacerbated by the most recent Shopper Value Index (CPI) information. The inflation report despatched BTC plummeting to as little as $94,000 earlier than it managed to get better some losses. Nonetheless, based on crypto analyst Ali Martinez, Bitcoin should defend a crucial worth stage to keep away from a big correction.

Analyst Identifies Important Bitcoin Value Stage

In an X post shared earlier at this time, Martinez introduced consideration to the Pi Cycle High Indicator. For the uninitiated, the Pi Cycle High Indicator is a Bitcoin market software that goals to determine market cycle peaks.

Associated Studying

The indicator tracks the 111-day transferring common (MA) and a a number of – usually 2x – of the 350-day transferring common. When the 111-day MA crosses above the 2x 350-day MA, it traditionally indicators a market high.

Based on Martinez, Bitcoin tends to expertise steep worth corrections when it drops under the 111-day MA. Presently, this transferring common stands at roughly $93,400. If BTC falls under this stage, it may set off a serious draw back transfer.

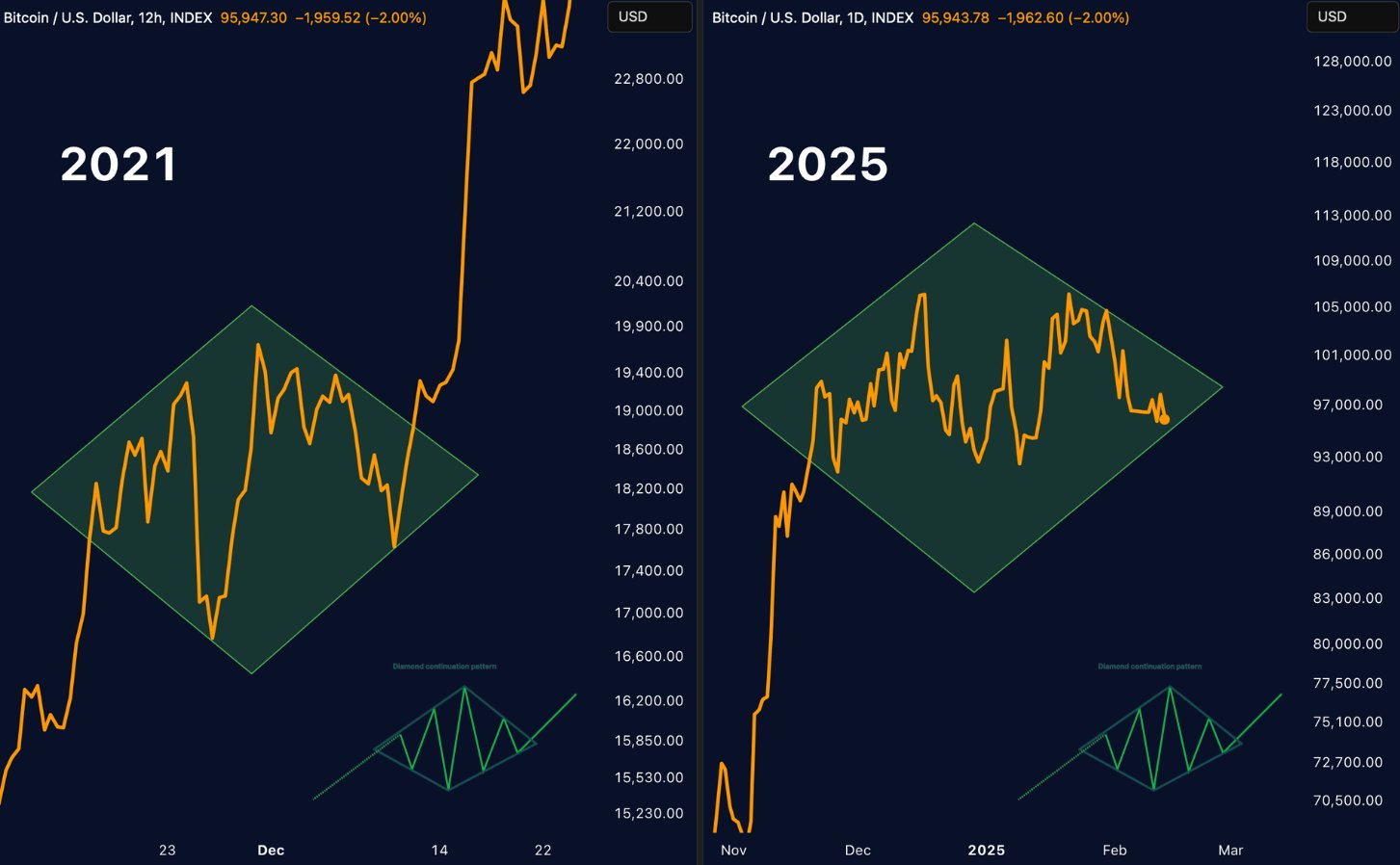

Fellow crypto analyst Merlijn The Dealer shared their ideas on the present BTC worth motion. The analyst shared the next chart which reveals the similarity between BTC worth motion in 2021 and 2025.

Based on the chart, BTC is presently within the midst of finishing a bullish diamond sample. A profitable completion of this sample adopted by a bullish breakout might propel BTC to new all-time highs (ATH) past $120,000.

The place Is BTC Headed Subsequent?

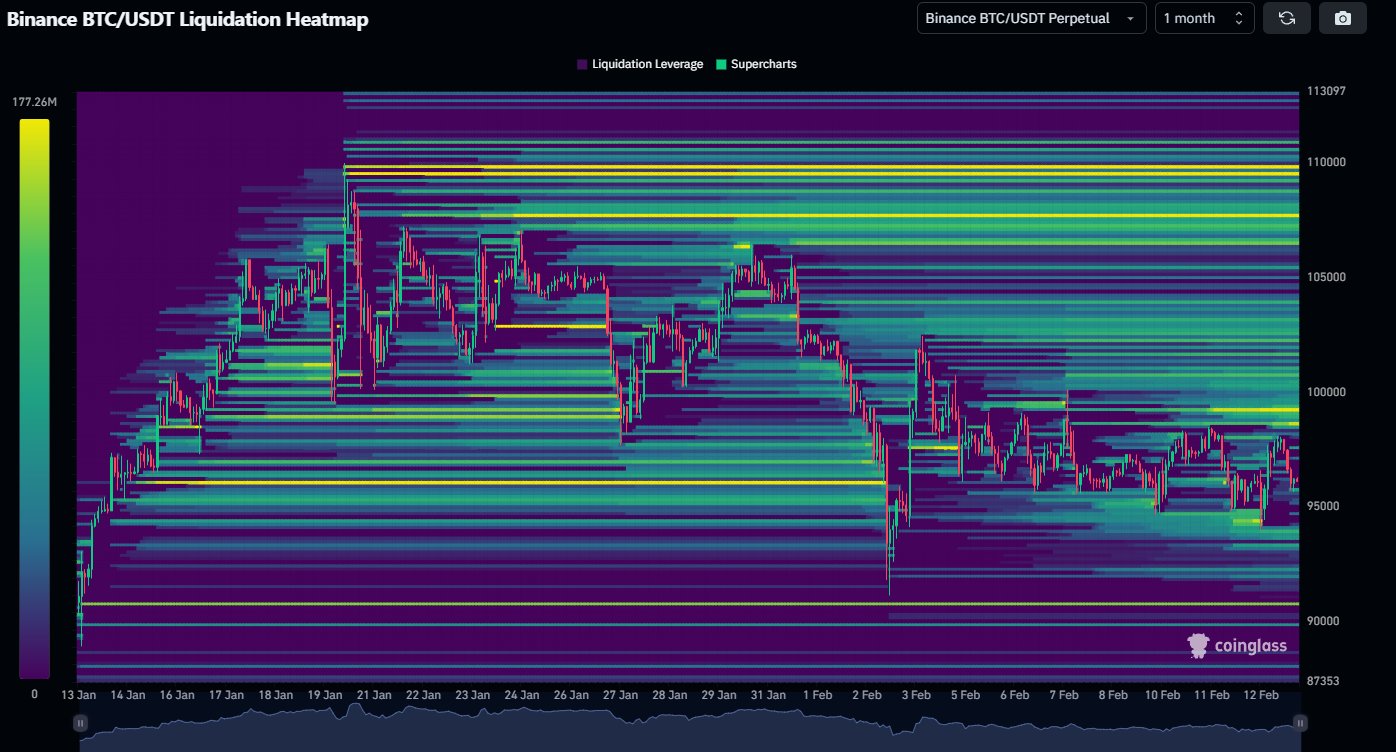

Crypto investor Daan Crypto Trades additionally analyzed Bitcoin’s newest worth motion, significantly in response to the CPI information. The report confirmed that inflation stays sizzling within the US, decreasing the chance of additional rate of interest cuts from the Federal Reserve (Fed) within the close to future. Daan famous:

Many of the liquidity under was taken on the decrease time frames. There’s a number of untapped liquidity sitting greater in spite of everything these decrease highs the previous couple of weeks. If BTC can flip this native downtrend round, these may act as gasoline for the transfer greater.

The investor additionally warned that if BTC slides under $90,000, it may enter a “hazard zone.” This stage has served as a key help space, with Bitcoin rebounding from it a number of instances. A decisive break under it may enhance the chance of a bigger sell-off.

Associated Studying

Regardless of the latest bearish developments, Bitcoin has held agency within the mid-$90,000 vary. Nonetheless, some market individuals stay cautious about the opportunity of a drop to $80,000 if promoting strain intensifies. At press time, BTC trades at $95,324, down 1% up to now 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com