- Bitcoin bear market may start if BTC breaks under key help ranges.

- With BTC bouncing from $94K to $96,200, volatility is excessive.

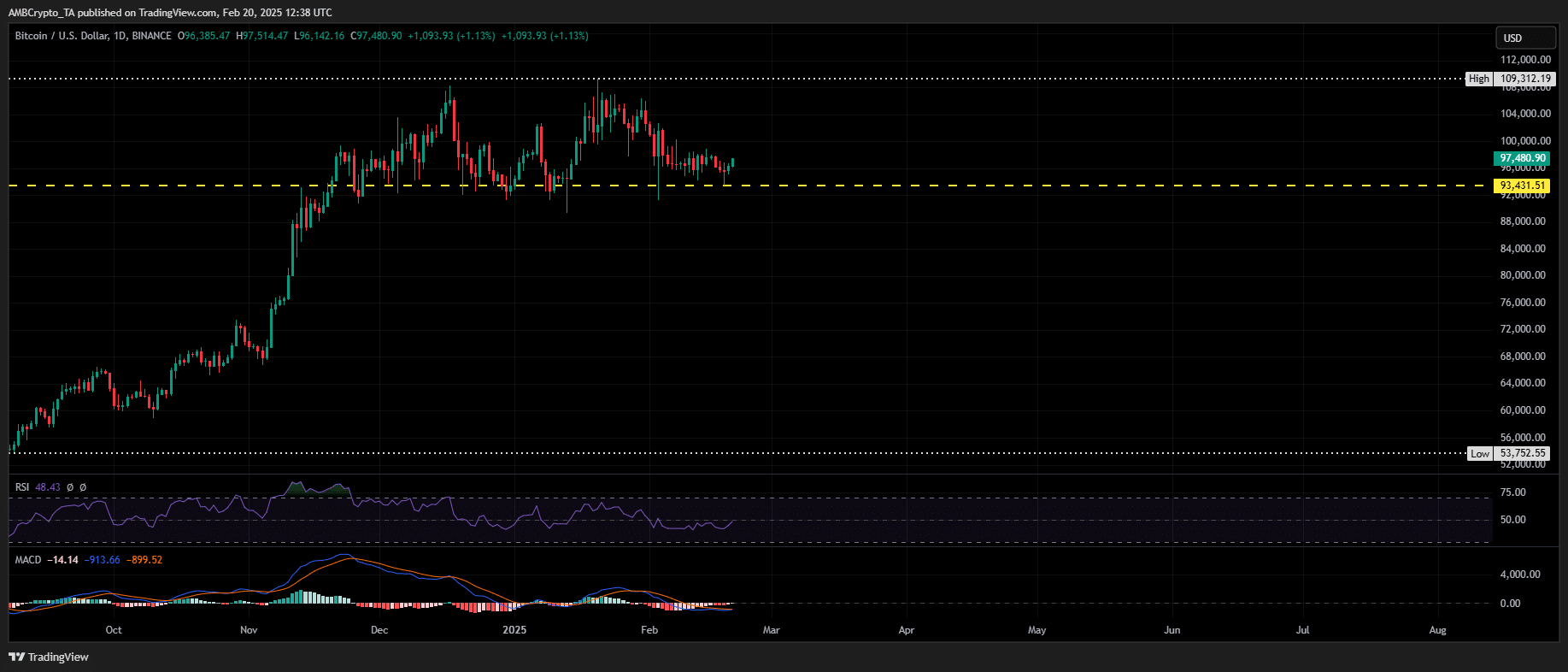

With Bitcoin [BTC] briefly dipping below $94K earlier than rebounding to $97,200, volatility stays excessive.

On this local weather, a possible Bitcoin bear market danger lingers if key investor teams, at present sitting on unrealized earnings, begin promoting.

Key ranges to observe

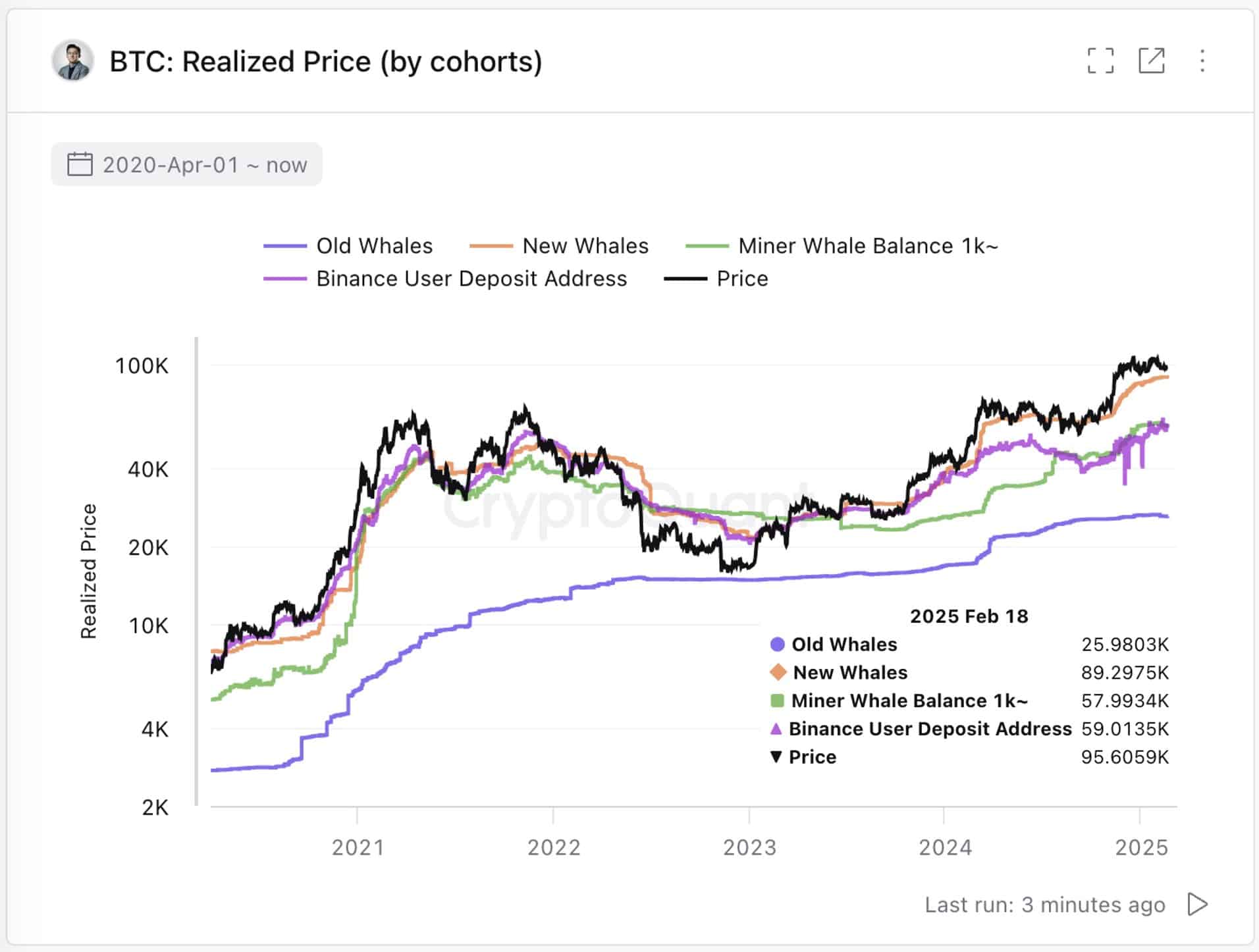

If BTC loses momentum, a drop under $89,300 may set off profit-taking amongst short-term holders (1,000+ BTC, held

Nevertheless, the important thing stage to observe stays $58,000 – the realized value of miner whales (wallets of mining corporations that maintain over 1,000 BTC).

Traditionally, breaking under this mark has confirmed Bitcoin bear market cycles, making it a crucial long-term help.

Whereas BTC holds a protected margin for now, sustained volatility may check these ranges. Holding above them is essential to sustaining bullish market construction.

Will bulls forestall a Bitcoin bear market?

Regardless of a hawkish macro backdrop within the U.S., bulls have prevented a Bitcoin bear market by defending the $90K stage for over a month, signaling sturdy demand.

Nevertheless, extended consolidation close to resistance suggests a possible liquidity lure.

If BTC breaches $99K without strong spot demand, leveraged lengthy positions may shut down, triggering liquidation cascades.

A drop again to $90K would then be a key check. Shedding this stage may push BTC towards $89,300, the place STH whales could start offloading, growing draw back strain.

Whereas a Bitcoin bear market isn’t confirmed, weak ETF inflows, fading FOMO, and declining network activity may set off a pointy reversal, wiping out billions in leverage.