On-chain information reveals the exchanges have witnessed web Bitcoin outflows via the newest volatility, an indication that could possibly be optimistic for BTC’s value.

Bitcoin Trade Netflow Has Been Detrimental Lately

In accordance with information from the market intelligence platform IntoTheBlock, Bitcoin has been leaving exchanges just lately. The on-chain metric of relevance right here is the “Exchange Netflow,” which measures the online quantity of BTC getting into into or exiting out of the wallets related to all centralized exchanges.

When the worth of the indicator is optimistic, it means the traders are making web deposits of the cryptocurrency into these platforms. As one of many primary the explanation why holders switch their tokens to exchanges is for selling-related functions, this sort of pattern can have a bearish impression on the BTC value.

Then again, the metric being beneath the zero mark suggests the outflows are overwhelming the inflows. Usually, traders take their cash off into self-custody after they plan to carry into the long run, so such a pattern can show to be bullish for the asset.

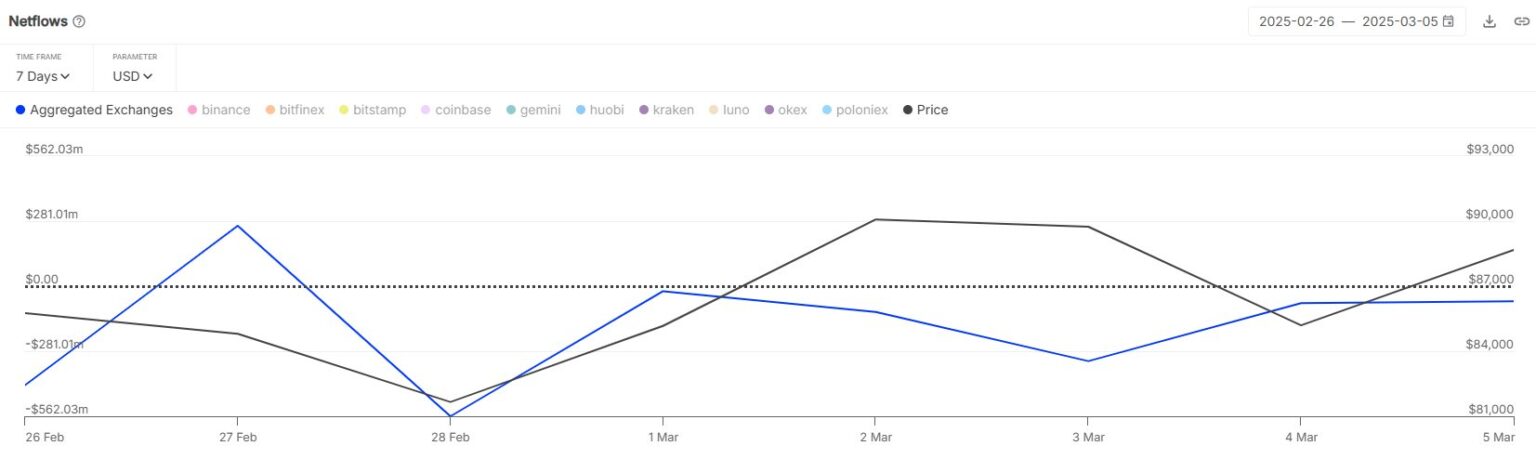

Now, here’s a chart that reveals the pattern within the Bitcoin Trade Netflow over the previous week or so:

As is seen within the above graph, the Bitcoin Trade Netflow noticed a spike into the optimistic area on the twenty seventh of final month, however the metric has since remained within the adverse area.

This pattern has maintained even supposing the asset has been observing volatility in each instructions just lately. Thus, it might seem that the traders are nonetheless bullish on the cryptocurrency.

“Regardless of the current market concern, merchants have proven conviction in BTC, withdrawing practically $900 million price of Bitcoin from exchanges up to now 7 days,” notes the analytics agency.

Whereas alternate inflows could be bearish with regards to unstable property like BTC, the identical doesn’t maintain true within the case of stablecoins, digital property which have their worth tied to fiat.

Often, traders who maintain these cash finally plan to take a position into the unstable facet of the market. As soon as they really feel the time has come, they deposit into the exchanges to swap to the tokens of their selection, thus offering a shopping for stress to their costs.

As such, a rise in stablecoin inflows generally is a optimistic signal for Bitcoin and different cryptocurrencies. This pattern has just lately been growing within the sector, as an analyst has identified in a CryptoQuant Quicktake post.

As displayed within the above chart, the Binance Stablecoin Exchange Reserve, a metric that retains observe of the whole quantity of those fiat-tied tokens sitting within the wallets of the Binance platform, has jumped to a brand new all-time excessive (ATH) just lately.

BTC Value

Bitcoin has been unable to maintain restoration as its value has as soon as once more dipped to $88,600.