- Bitcoin wants to show the $85,000 resistance right into a assist zone for a bullish breakout.

- Monitoring ETF circulate tendencies alongside key technical ranges will probably be important in assessing BTC’s near-term trajectory.

Bitcoin [BTC] has been range-bound between $81,000 and $85,000, since its decline to $78k every week in the past. Turning the $85k resistance right into a strong demand zone is now key for a rally.

Technical analysis means that if BTC fails to carry the $81,000 assist degree, it may check decrease assist zones round $78,446. Conversely, reclaiming and consolidating above the $85,000 resistance may pave the way in which for greater targets.

Indicators of a possible Bitcoin backside

On the seventeenth and 18th of March Bitcoin noticed a half-billion-dollar inflow into BTC ETFs. This marked the primary consecutive institutional inflow this month.

In the meantime, the worry index, shifting from “excessive worry” to worry, has traditionally signaled a possible backside, providing an opportunity to purchase BTC at a reduction for outsized returns.

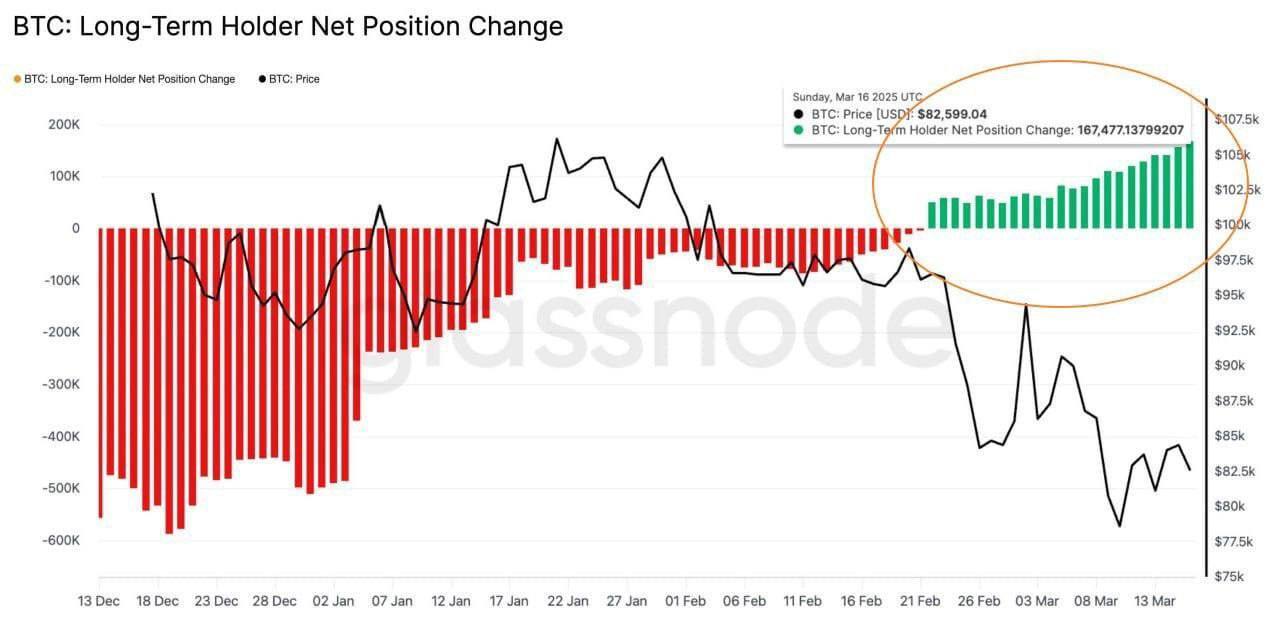

Lengthy-term holders (LTHs) appear to agree. On the sixteenth of March, they snapped up 167k BTC at $82k.

But, regardless of sturdy inflows and accumulation, Bitcoin nonetheless struggled to interrupt $85k. Heavy leverage at assist retains it above $80k, however fuels liquidations when profit-taking kicks in at $85k.

In different phrases, every BTC dip sees a spike in leverage and a $2B leap in Open Curiosity (OI). However as BTC reclaims $85k, liquidations hit, OI unwinds, and the worth drops again to $80k.

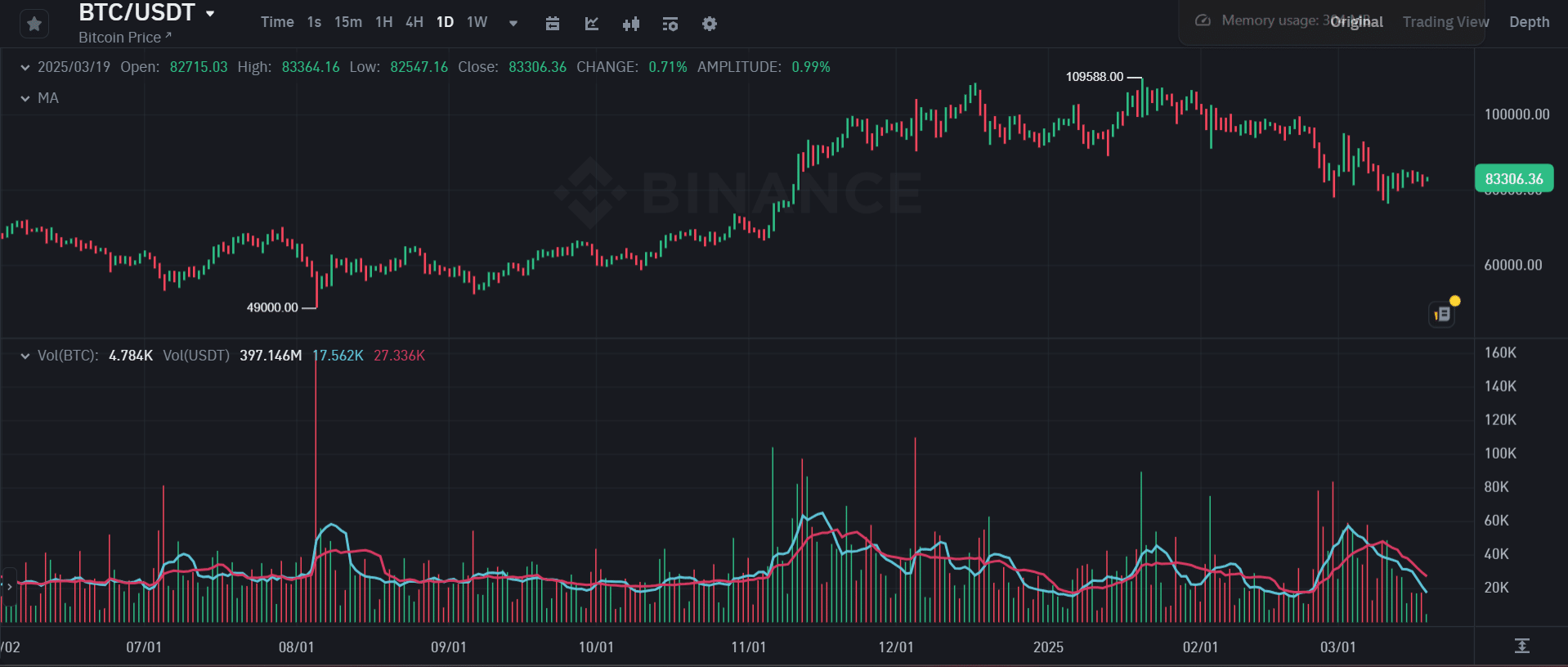

This sample leaves Bitcoin weak, with a possible pullback amid ongoing macroeconomic dangers. Moreover, Binance information reveals low buying and selling quantity, with spot markets missing vital purchase orders.

Clearly, indicators of $85K flipping into assist are rising – but it surely’s not there but.

With weak spot demand, one other long-squeeze threat stays

This chart reveals {that a} retest of $84,772 may set off one other flush-out, placing 772.4K Bitcoin liable to sell-offs.

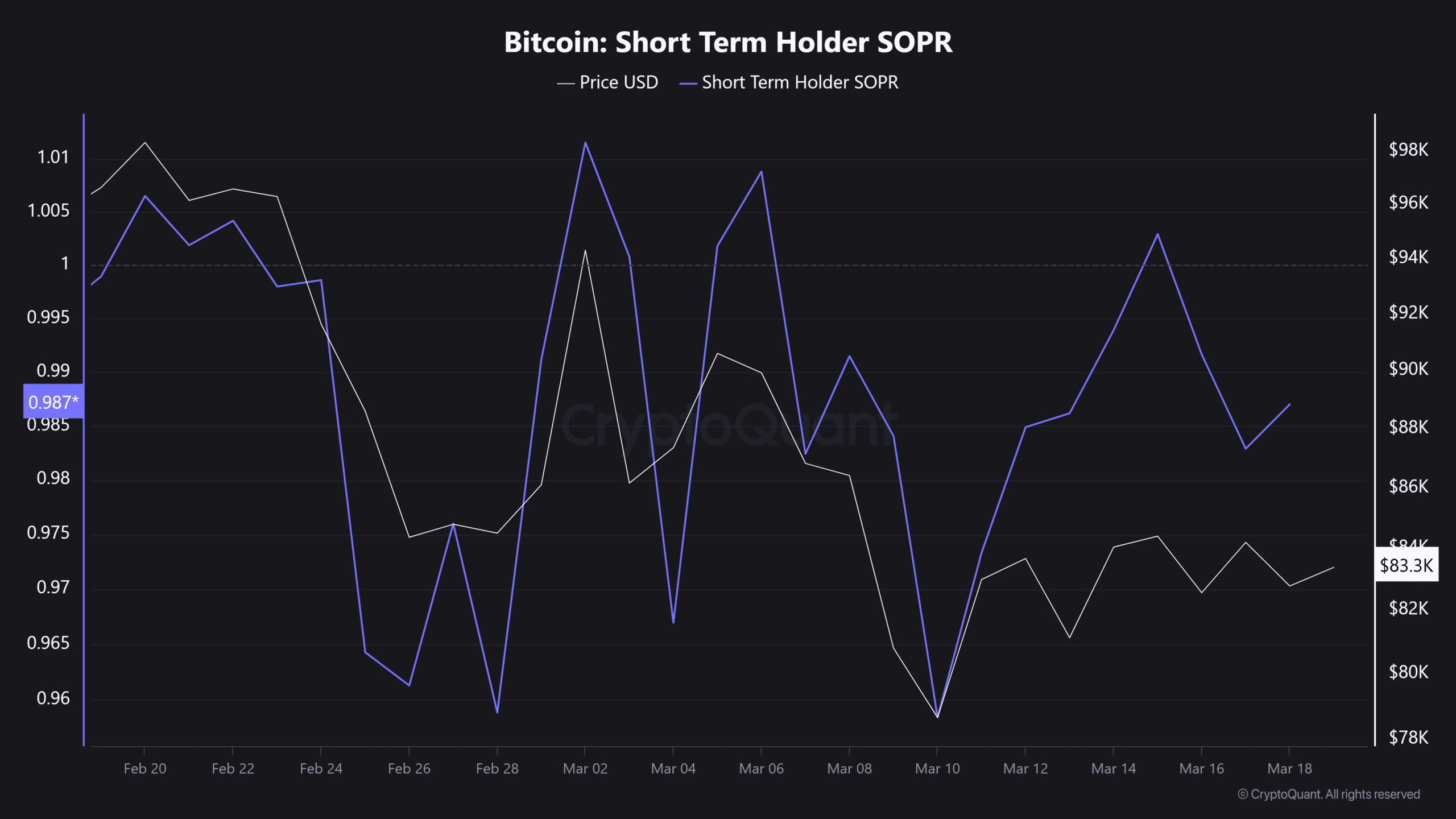

Quick-term holders (STHs) stay cautious as volatility persists, with HODLing not the popular technique.

The STH Spend Output Revenue Ratio (SOPR) has turned detrimental, indicating that STHs (holding

Leverage buying and selling continues to rise, with OI up 0.64% to $48.80 billion. Nonetheless, weak spot demand will increase the likelihood of an extended squeeze as soon as Bitcoin crosses this degree.

With out sturdy institutional accumulation, sell-side liquidity may rise, resulting in mass liquidations of lengthy positions and a possible retrace to the $80k demand zone.

To invalidate this setup and set off a bear entice, Bitcoin should generate sturdy shopping for momentum at $85k to interrupt resistance.