Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

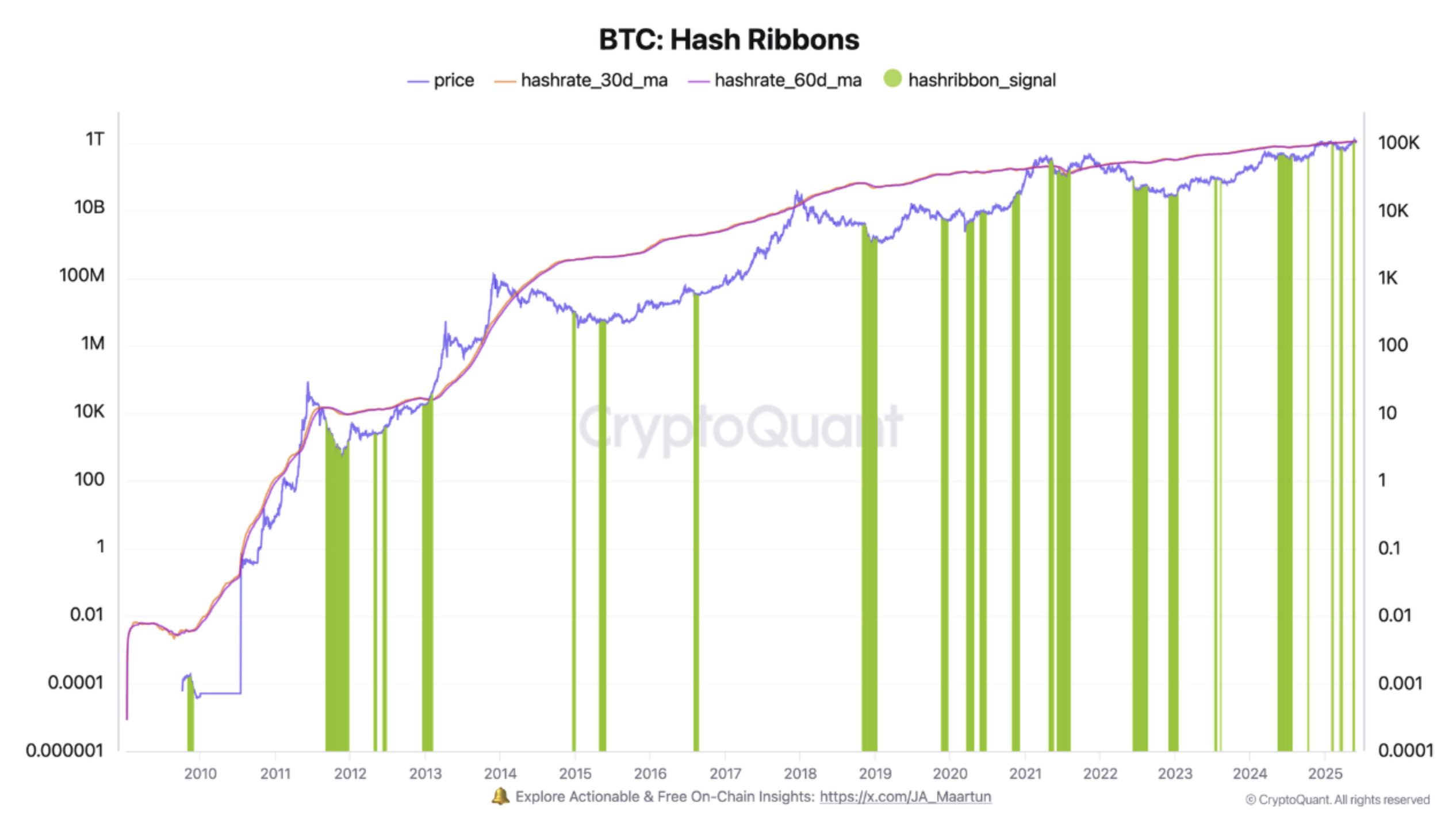

Bitcoin (BTC) stays range-bound within the mid-$100,000s, displaying no clear directional bias. Nonetheless, the Hash Ribbons indicator is now flashing a recent purchase sign, suggesting that the highest cryptocurrency could also be gearing up for its subsequent upward transfer.

Bitcoin Hash Ribbons Flash Purchase Sign

In accordance with a current CryptoQuant Quicktake put up by contributor Darkfost, Bitcoin’s Hash Ribbons are signalling a possible prime shopping for alternative for the main digital asset. This sign coincides with Bitcoin’s hashrate reaching new all-time highs (ATH).

Associated Studying

For the uninitiated, Bitcoin Hash Ribbons is an on-chain indicator that analyzes miner stress by evaluating the 30-day and 60-day shifting averages of Bitcoin’s hashrate. When the short-term common crosses above the long-term common after a interval of decline, it indicators that miner capitulation is ending – typically marking a powerful long-term shopping for alternative.

Such indicators can emerge when mining turns into unprofitable for sure miners, forcing them to promote their BTC holdings to remain afloat. These sell-offs might briefly stress the value, however traditionally they’ve created enticing long-term shopping for alternatives.

Of their evaluation, Darkfost notes that whereas the present sign is bullish from a long-term perspective, it might result in a short-term pullback in BTC worth. Nonetheless, he emphasizes that any dip needs to be considered as an opportunity to build up.

Darkfost additionally identified that the Hash Ribbons indicator has traditionally been dependable, except 2021 throughout the China mining ban. They shared the next chart illustrating how the indicator is presently displaying a powerful purchase sign.

Is BTC Headed For A Crash?

Whereas the Hash Ribbons counsel a good long-term setup, some analysts warn that the short-term correction could possibly be deeper than anticipated. As an illustration, crypto analyst Xanrox used the Fibonacci ranges to forecast that BTC might tumble as little as $98,000.

Associated Studying

Equally, analyst Jelle noted that Bitcoin might face “one final velocity bump” earlier than launching a serious rally to $140,000. In the meantime, extra pessimistic voices proceed to warn of a dramatic crash, with some speculating that BTC might fall beneath $10,000 – a view seen as more and more unlikely by most market individuals.

Regardless of the various predictions, recent on-chain information factors to a wholesome BTC market within the close to to medium time period. As an illustration, CryptoQuant contributor Amr Taha lately highlighted that the derivatives market has undergone a reset, with funding charges stabilizing round impartial ranges.

Equally, Fundstrat’s Head of Analysis, Tom Lee foresees BTC surging to as excessive as $250,000 by the top of the 12 months. At press time, BTC trades at $105,367, up 0.5% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com