Bitcoin has seen a crash to the $87,000 degree up to now day, but when on-chain knowledge is to go by, the plunge might get a lot deeper.

Bitcoin Has Misplaced An Vital Help Degree With The Crash

In a brand new post on X, the on-chain analytics agency Glassnode has mentioned about how some Bitcoin indicators have modified following the plunge within the cryptocurrency’s value.

Associated Studying

The primary metric that the analytics agency has shared is the Realized Value of the short-term holders. The “Realized Price” retains monitor of the fee foundation of the typical investor or deal with on the BTC community.

When the spot value of the asset is buying and selling above this indicator, it means the buyers as an entire may be thought of in a state of revenue. However, it being underneath the metric implies the dominance of loss available in the market.

Within the context of the present matter, the Realized Value of solely a phase of the userbase is of curiosity: the short-term holders (STHs), who discuss with the buyers who bought their cash throughout the previous 155 days.

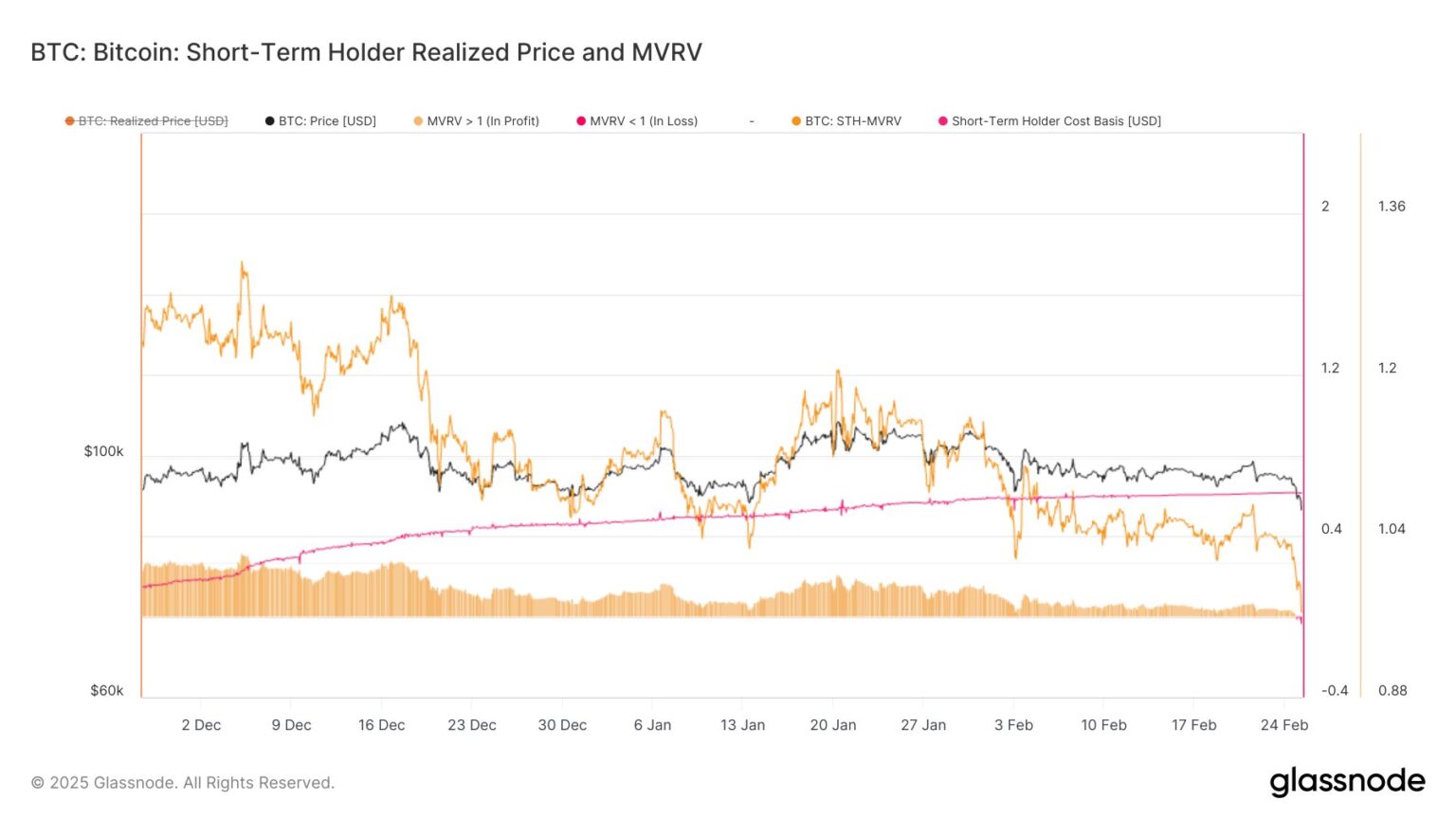

Now, here’s a chart that exhibits the pattern within the Bitcoin STH Realized Value over the previous couple of months:

As displayed within the above graph, Bitcoin was buying and selling above the STH Realized Value throughout the previous couple of months, that means the STHs have been having fun with income, however with the newest crash, the scenario has flipped.

The STH Realized Value is the same as $92,500, so on the present spot value, the members of this cohort can be carrying a median lack of greater than 6%. “A failure to reclaim STH price foundation might imply continued promote strain from current patrons,” notes Glassnode.

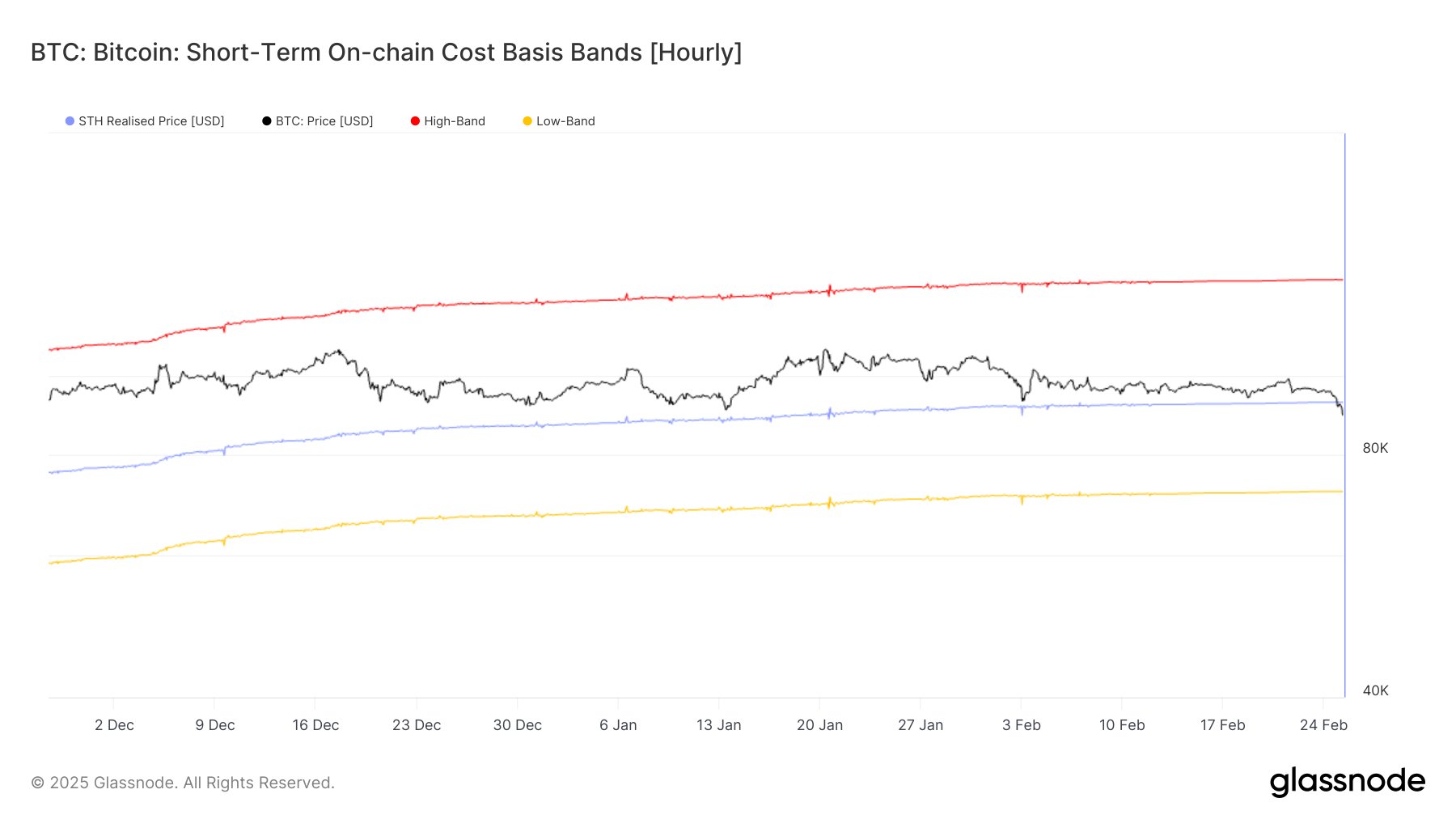

As for a way far BTC might fall from right here, maybe historic sample might maintain a touch. In accordance with the analytics agency, the post-ATH corrections of Could 2021, November 2021, and April 2024 all noticed BTC fall one normal deviation beneath the STH Realized Value.

At current, this value band is located between $71,000 and $72,000. If the previous sample is to go by, it’s attainable that this correction can also lead Bitcoin to close this band.

Associated Studying

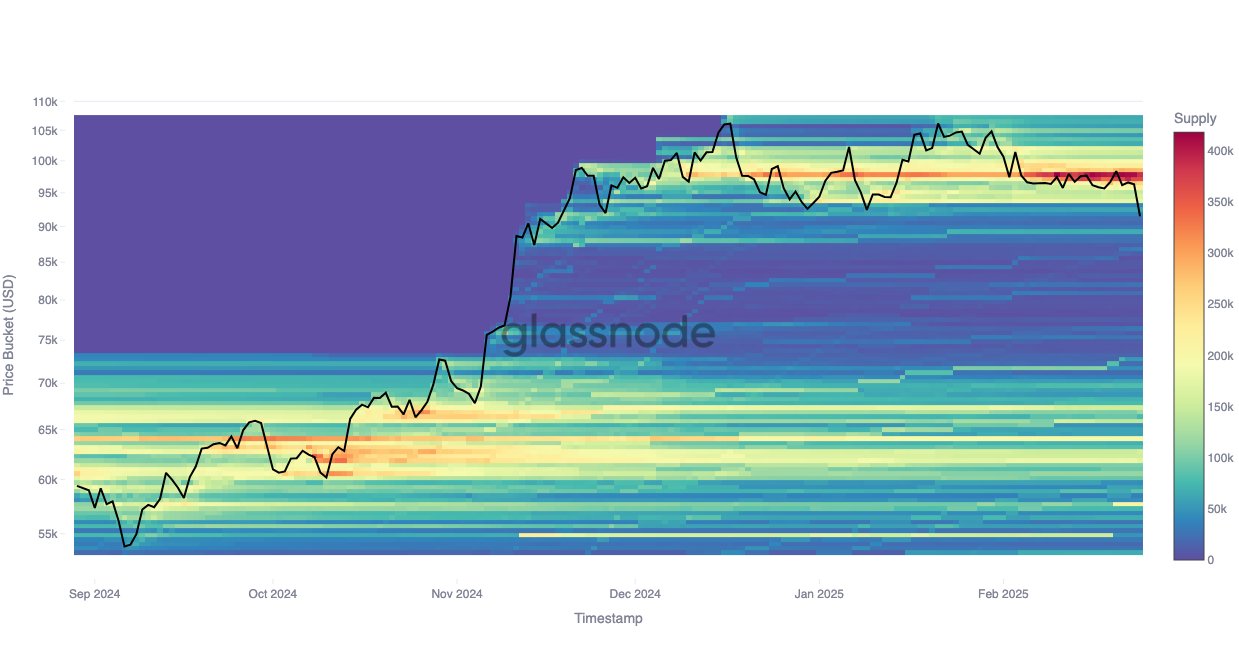

The Cost Basis Distribution, one other metric associated to investor price foundation, additionally highlights this identical degree as being essential for the cryptocurrency.

From the chart, it’s obvious {that a} substantial quantity of buyers have their price foundation at numerous zones above $87,000. Underneath this mark, nonetheless, only a few addresses purchased their cash, till the identical $71,000 to $72,000 band. “This might imply weaker assist on this vary, giving bears extra management,” explains the analytics agency.

BTC Value

On the time of writing, Bitcoin is floating round $87,200, down greater than 7% over the past week.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com