- Bitcoin miners confronted squeezed earnings as transaction charges hit historic lows.

- Community issue and rising prices are difficult smaller miners’ survival.

Bitcoin [BTC] miners are going through a difficult panorama in 2025 as key factors squeeze profitability. Transaction charges have hit their lowest ranges since 2012, whereas community issue continues to climb.

The 2024 halving has elevated competitors, and income per unit of computational energy is quickly declining.

As well as, USD-denominated mining income stays risky, creating uncertainty even for main gamers.

As revenue margins tighten, miners are being compelled to optimize operations, shut down out of date tools, or contemplate mergers.

With smaller gamers vulnerable to exiting, trade consolidation appears imminent, leaving solely probably the most environment friendly and well-capitalized operations to outlive.

Bitcoin mining faces profitability pressure

The Bitcoin mining ecosystem is going through vital challenges, as a number of key metrics level towards declining profitability.

The Bitcoin mempool, which tracks unconfirmed transactions, has fallen to its lowest degree in years, signaling decreased community demand.

This drop straight impacts miners’ income from transaction charges, that are very important alongside block rewards.

Traditionally, related declines in transaction exercise have been adopted by bear markets, and this downturn – regardless of Bitcoin’s excessive worth — could point out a structural shift within the community.

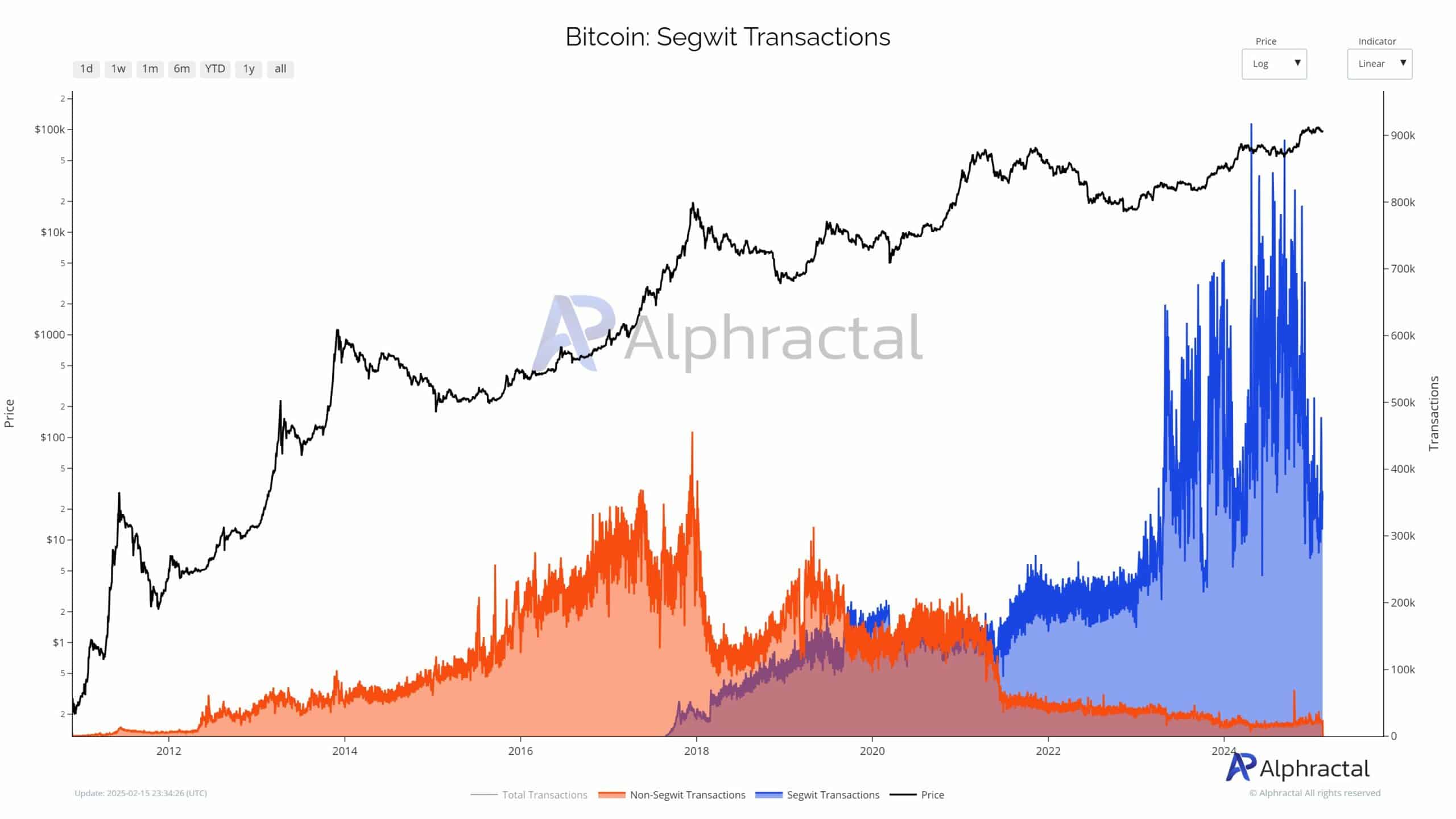

Furthermore, SegWit transactions, which had been as soon as the dominant and environment friendly transaction sort, at the moment are in decline.

This reduces general community effectivity, rising the demand for block area, and placing additional strain on miners’ earnings.

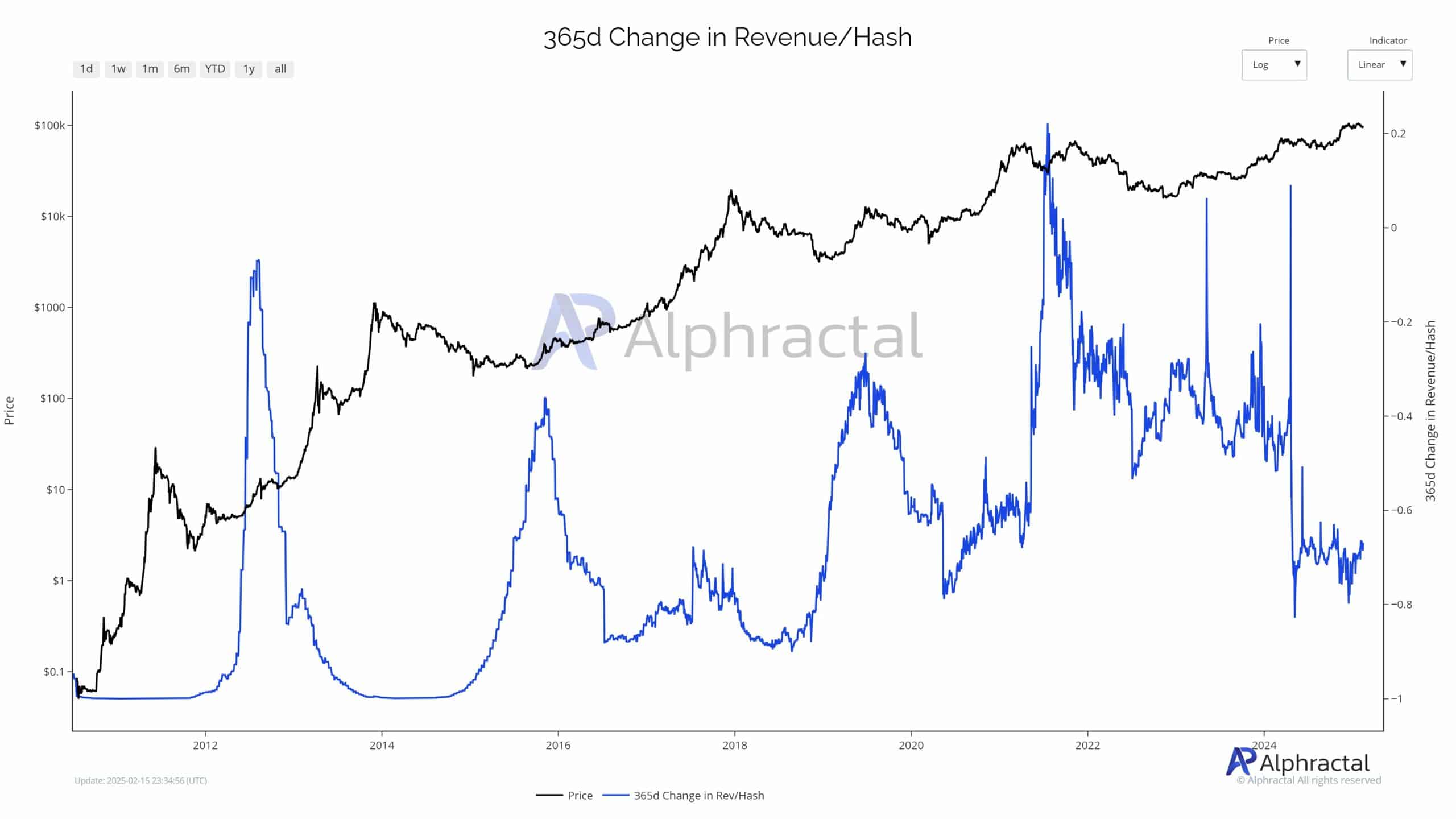

The Income/Hash ratio, a key metric for miners, is at historic lows. Regardless of Bitcoin’s rising worth, diminishing returns point out that rising community issue and competitors are eroding profitability.

With the halving approaching, lowering block rewards, smaller operations could battle to stay worthwhile.

This dynamic may result in elevated centralization, the place solely massive, technologically superior miners will thrive, doubtlessly forcing smaller gamers out of the market.

Rising issue and rising prices

Bitcoin miners are going through an rising squeeze on profitability as community issue reaches document highs.

The declining income per hash is making it tougher for smaller operators with outdated tools to compete, particularly as power and {hardware} prices proceed to rise.

To outlive, many miners are migrating to areas with cheaper, extra sustainable power sources, corresponding to hydro or geothermal energy.

Some are additionally diversifying income streams by branching into computing companies, whereas others are looking for mergers and acquisitions.

These efforts could result in additional centralization within the trade, with solely probably the most capitalized and environment friendly mining companies surviving.

This might have broader implications for Bitcoin’s decentralization, notably concerning the geographic distribution of mining energy.

A reshaping of Bitcoin’s safety mannequin could comply with, elevating issues concerning the long-term well being of its decentralized nature.

Market rebalancing

As operational prices surge and profitability declines, Bitcoin’s hashrate might even see a pure downturn, with inefficient miners shutting down.

This rebalancing will seemingly go away solely probably the most capitalized and technologically superior gamers standing, reinforcing mining as a high-barrier trade.

Nevertheless, this shift raises issues over centralization. With a shrinking pool of dominant miners, Bitcoin’s decentralized ethos may very well be in danger, doubtlessly concentrating community safety in fewer arms.

Whereas bigger entities could guarantee stability, this consolidation may result in questions on censorship resistance and belief within the community’s long-term integrity.

The 2024 halving has already examined the resilience of the Bitcoin mining ecosystem.

The aftermath of this occasion is a vital interval in figuring out whether or not Bitcoin mining stays an open, aggressive discipline, or whether or not the sector continues to consolidate into the arms of some dominant gamers.