- Bitcoin’s worth motion and market construction align with earlier bull cycles.

- Whereas historic traits help a bullish outlook, buyers ought to stay cautious of exterior dangers.

Bitcoin’s [BTC] present worth motion mirrors its March 2017 cycle, the place BTC was nonetheless 9 months away from its peak.

If historical past repeats, BTC may enter its subsequent “excessive greed” section by This fall 2025, signaling the ultimate leg of its bull run.

In that case, what’s BTC’s long-term worth goal if this cycle follows previous patterns?

Bitcoin’s RSI indicators a repeat of 2017 cycle

A current X (previously Twitter) post highlighted that Bitcoin has returned to critically low RSI Bollinger Band % ranges.

When BTC’s RSI Bollinger Band % reaches critically low ranges, it suggests the asset is deeply oversold inside its volatility vary, typically signaling a possible rebound.

This sample is much like what occurred in 2013, 2016, and 2020, simply earlier than Bitcoin reached new all-time highs.

Notably, RSI Bollinger Bands now mirror 2017, when Bitcoin bottomed beneath $1,000 earlier than surging 1,500% to $19,086 by This fall.

Nonetheless, at $83,078, BTC’s worth motion stays unsure.

Analysts warn {that a} native backside hasn’t fashioned but, with institutional outflows accelerating and long-term holder supply dropping to pre-election lows – indicators of short-term weak spot.

Regardless of this volatility, Bitcoin’s historic cycle patterns stay intact. If historical past repeats, may HODLing nonetheless show to be the most effective long-term technique?

Figuring out the subsequent market high

Whereas a definitive backside hasn’t fashioned, there aren’t any robust indicators of a market high both.

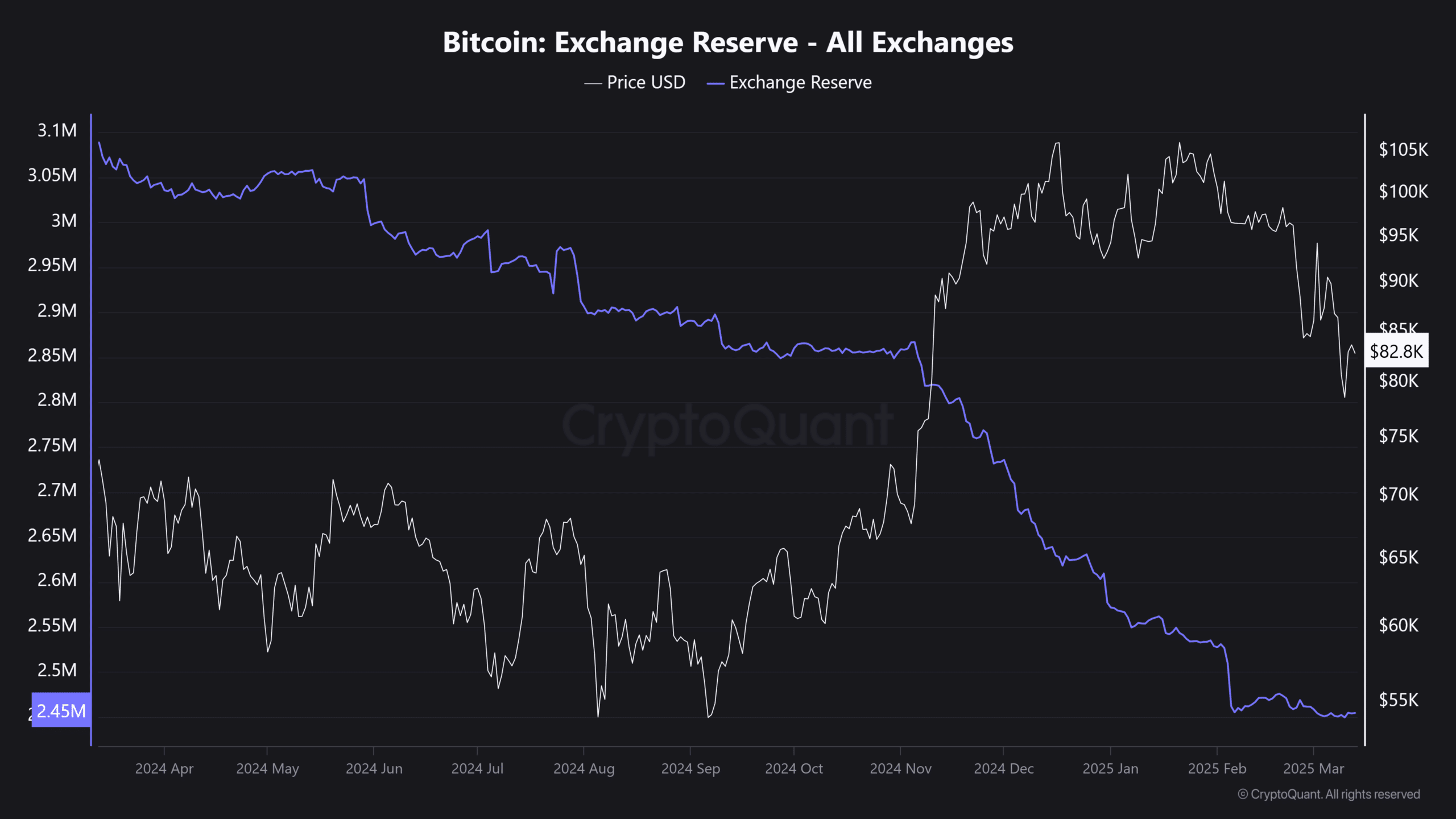

FOMO is steadily rising, with change reserves plunging to a one-year low, reflecting persistent long-term accumulation fairly than profit-taking.

The truth is, regardless of Bitcoin’s 22% pullback from its $109K peak, BTC provide on exchanges continues to shrink – an indication that buyers are holding, not promoting.

For Bitcoin to duplicate its 2017 bull cycle, this accumulation pattern should persist. If sustained, historic information suggests the market’s true cycle high may nonetheless be 9 months away.

Even amid macro uncertainty and inventory market liquidations, BTC has maintained its $77K–$80K vary, reflecting unwavering investor confidence.

Within the close to time period, breaking previous $90K stays the important thing problem. However in the long term, sustained accumulation and rising confidence may push Bitcoin into six-digit territory.