In a post on X printed yesterday, Jeff Park, Head of Alpha Methods at Bitwise, acknowledged that Bitcoin (BTC) at present presents a “generational alternative” amid intensifying international macroeconomic turmoil.

Park pointed to components comparable to US President Donald Trump’s proposed commerce tariffs, issues over the US debt ceiling, and the rising sentiment of deglobalization as key contributors to the present financial uncertainty.

Bitcoin Reigns Supreme Amid International Political And Financial Turmoil

The yr 2025 has began on an unstable footing, marked by rising international financial and political instability attributable to commerce tariffs, US debt ceiling points, and the broader push towards deglobalization. These components may considerably influence monetary markets and geopolitical stability.

Associated Studying

Including to the uncertainty is the upcoming expiration of the US Tax Cuts and Jobs Act (TCJA) later this yr, which may result in unprecedented tax coverage shifts and heightened financial unpredictability.

Park additionally underscored the “gold run tail threat,” referencing gold’s excessive value volatility during times of economic misery. On the time of writing, gold is trading at $2,900 per ounce, up considerably from round $2,585 in December 2024.

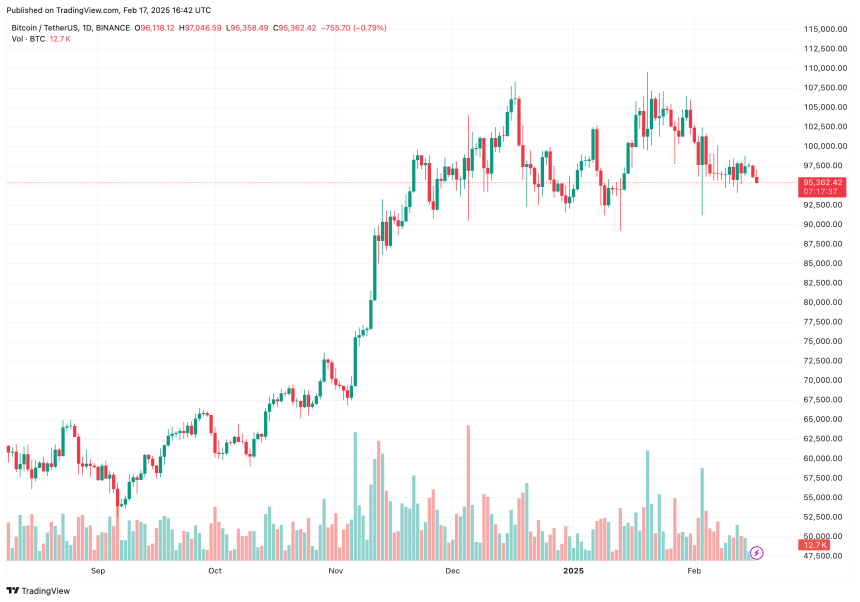

Regardless of these mounting dangers, Bitcoin has remained resilient, sustaining a value vary between $90,000 and $100,000. Park highlighted BTC’s implied volatility (IV) percentile – a measure that displays how its present volatility compares to historic ranges.

He famous that BTC’s IV percentile is at its lowest degree of the yr, reinforcing his view that Bitcoin presents a “generational alternative.” Echoing this sentiment, Bitwise CEO Hunter Horsley remarked that many are underestimating “the large leaps Bitcoin goes to take into the mainstream this yr.”

Certainly, Bitcoin continues to achieve mainstream traction and display resilience amid rising international financial uncertainty. For instance, BTC remained largely unaffected by the tech market sell-off triggered by the discharge of the Chinese language AI mannequin DeepSeek.

No Altseason Anytime Quickly?

As Bitcoin strengthens its dominance, the altcoin market has struggled, weighed down by skinny liquidity and waning retail curiosity. One key indicator supporting this development is Bitcoin dominance (BTC.D), which measures BTC’s market cap relative to the entire cryptocurrency market.

Associated Studying

The weekly BTC.D chart exhibits a powerful rebound from round 54% in December 2024. On the time of writing, BTC.D stands at 60.65%, a degree not seen since March 2021.

That stated, some analysts stay optimistic a few potential Ethereum-led (ETH) altseason later in 2025. Current evaluation by Titan of Crypto means that Ethereum is poised for a significant upward transfer this yr.

The analyst additionally identified similarities between ETH’s present value motion and BTC’s conduct throughout its third market cycle, implying that Ethereum might quickly enter what he calls its “most hated rally.” At press time, BTC trades at $95,362, down 0.4% previously 24 hours.

Featured picture from Unsplash, Charts from X.com and Tradingview.com