Bitcoin has been consolidating above a vital assist area, signaling robust purchaser curiosity and a possible bullish breakout.

If BTC reclaims the $108K resistance, it may set off a brief liquidation cascade, propelling the value towards $115K.

Technical Evaluation

By Shayan

The Each day Chart

Bitcoin’s value motion stays on a bullish trajectory, with the ascending channel’s center trendline appearing as a robust assist zone in latest months. This dynamic assist has repeatedly held value declines, reflecting purchaser confidence and a resurgence in demand.

Following this assist take a look at, Bitcoin surged towards its all-time excessive of $108K, a key resistance area with concentrated provide and promoting stress. The asset is now consolidating inside a decent vary, certain by the channel’s center trendline and the static $108K resistance.

Provided that liquidity grabs have already occurred above $108K and beneath $90K, a breakout seems imminent. If bullish momentum strengthens, reclaiming $108K may gasoline a pointy rally pushed by brief liquidations and elevated shopping for stress towards $115K.

The 4-Hour Chart

Within the decrease timeframe, BTC’s consumers stepped in on the $90K assist, stopping additional declines. Following a liquidity sweep beneath $90K, Bitcoin surged towards the $108K resistance zone, the place the ascending channel’s center boundary aligns with its ATH, reinforcing this degree as a serious inflection level.

The continued consolidation at $108K displays a battle between consumers and sellers, making this area a pivotal value degree. A breakout and consolidation above $108K may sign a sustained rally towards new ATHs. Nevertheless, a rejection from this degree may set off a retracement towards the channel’s decrease boundary at $98K.

Sentiment Evaluation

By Shayan

Bitcoin’s latest uptrend has merchants intently watching whether or not it could actually break above its all-time excessive of $108K. The important thing issue on this potential breakout is whether or not the market can generate sufficient momentum to surpass this vital resistance degree.

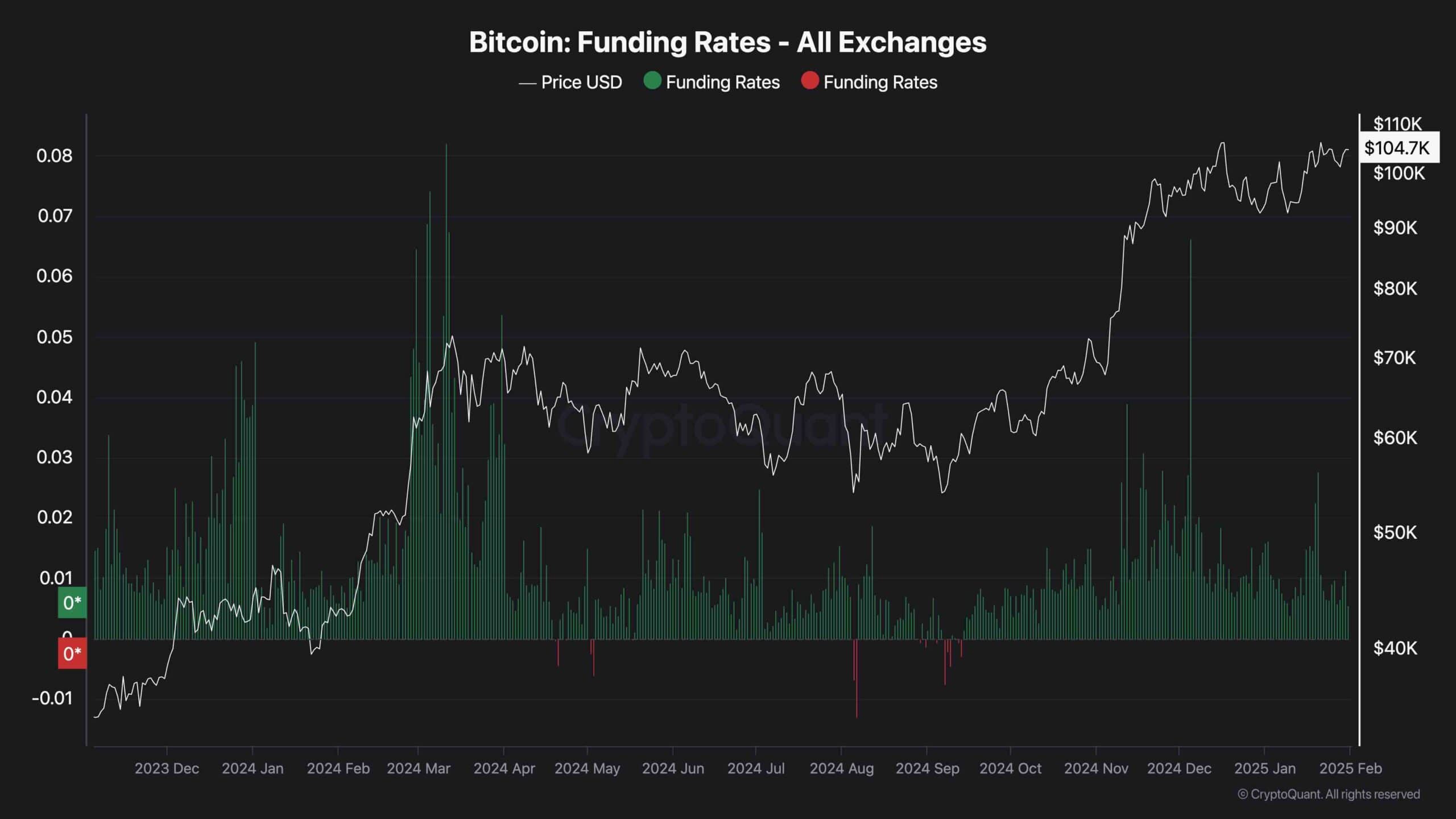

An important on-chain indicator, the funding charges metric, has proven a bearish divergence. Whereas Bitcoin’s value has surged towards ATH, funding charges have declined, suggesting weak demand in perpetual markets. This divergence signifies that bullish momentum might not be robust sufficient to assist a breakout.

For Bitcoin to decisively breach $108K, the funding charges should rise additional, signaling a rise in optimism and a larger inflow of lengthy positions. With out this market-wide enthusiasm, the resistance at $108K may maintain, resulting in potential consolidation or a short lived rejection.

The publish Bitcoin Price Analysis: This Is BTC’s Road to $115K appeared first on CryptoPotato.