On-chain knowledge reveals the demand for utilizing Bitcoin is now impartial from retail buyers and may very well be heading towards a reversal to the upside.

Bitcoin Retail Quantity No Longer Plummeting

As defined by an analyst in a CryptoQuant Quicktake post, the demand among the many retail buyers could also be near rising once more. The on-chain indicator of relevance right here is the “Retail Investor Demand,” which measures, as its title suggests, the demand for the Bitcoin community that’s current among the many smallest of entities.

Since these buyers have such small wallets, their transactions are usually of a small dimension as effectively. Thus, the Retail Investor Demand makes use of the collective transaction volume of the small transfers (lower than $10,000 in worth) to trace the exercise of this cohort.

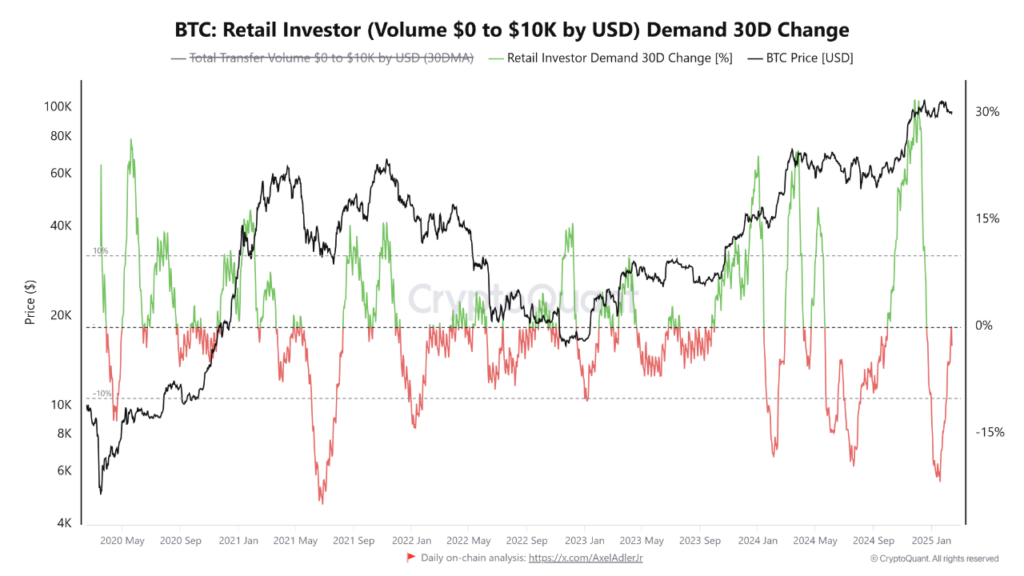

Now, right here is the chart shared by the quant that reveals the pattern within the 30-day share change of the Bitocin Retail Investor Demand over the previous couple of years:

As displayed within the above graph, the 30-day change within the Bitcoin Retail Investor Demand plunged to a major unfavorable stage earlier within the 12 months, which means the quantity associated to small buyers was down a big share over a 30-day interval.

Since this low, although, the metric has been climbing again up and its worth is at the moment at virtually the 0% mark, implying its drawdown has nearly completed. If the identical trajectory continues, it’s doable that the indicator ought to break into the constructive territory, which might suggest development in curiosity from the retail buyers.

From the chart, it’s seen that the final time the Retail Investor Demand noticed a break into the inexperienced zone was simply earlier than final 12 months’s rally past $100,000. Again then, the quantity from these buyers had stored rising till hitting a peak of about +30%, which had apparently practically coincided with final 12 months’s worth prime.

It could be no shock that the asset’s consolidation adopted when development within the quantity associated to this group disappeared and a decline in exercise took over.

Again throughout the 2021 bull run, the Retail Investor Demand noticed a plummet into the unfavorable territory just like the one witnessed earlier on this 12 months. The indicator then reversed its worth in spectacular trend because it broke previous the 0% mark with a pointy surge and stored rising till a notable inexperienced stage. This turnaround in retail investor coincided with the beginning of the second half of the 2021 rally.

It now stays to be seen whether or not retail quantity will make the same comeback this time as effectively, doubtlessly implying a reignition of bullish momentum for Bitcoin, or if it could take some time extra to recuperate.

BTC Value

Bitcoin has continued its current pattern of consolidation throughout the previous day as its worth remains to be buying and selling across the $96,300 stage.