- BTC’s value tumbled over 5%, pushed by regulatory uncertainty, institutional repositioning, and safety issues within the crypto area.

- Accumulation patterns confirmed that traders have been nonetheless partaking, with new demand zones forming between $84K–and $92K.

Bitcoin [BTC], the world’s largest cryptocurrency by market worth, has skilled a major decline, falling over 5% to a three-and-a-half-month low.

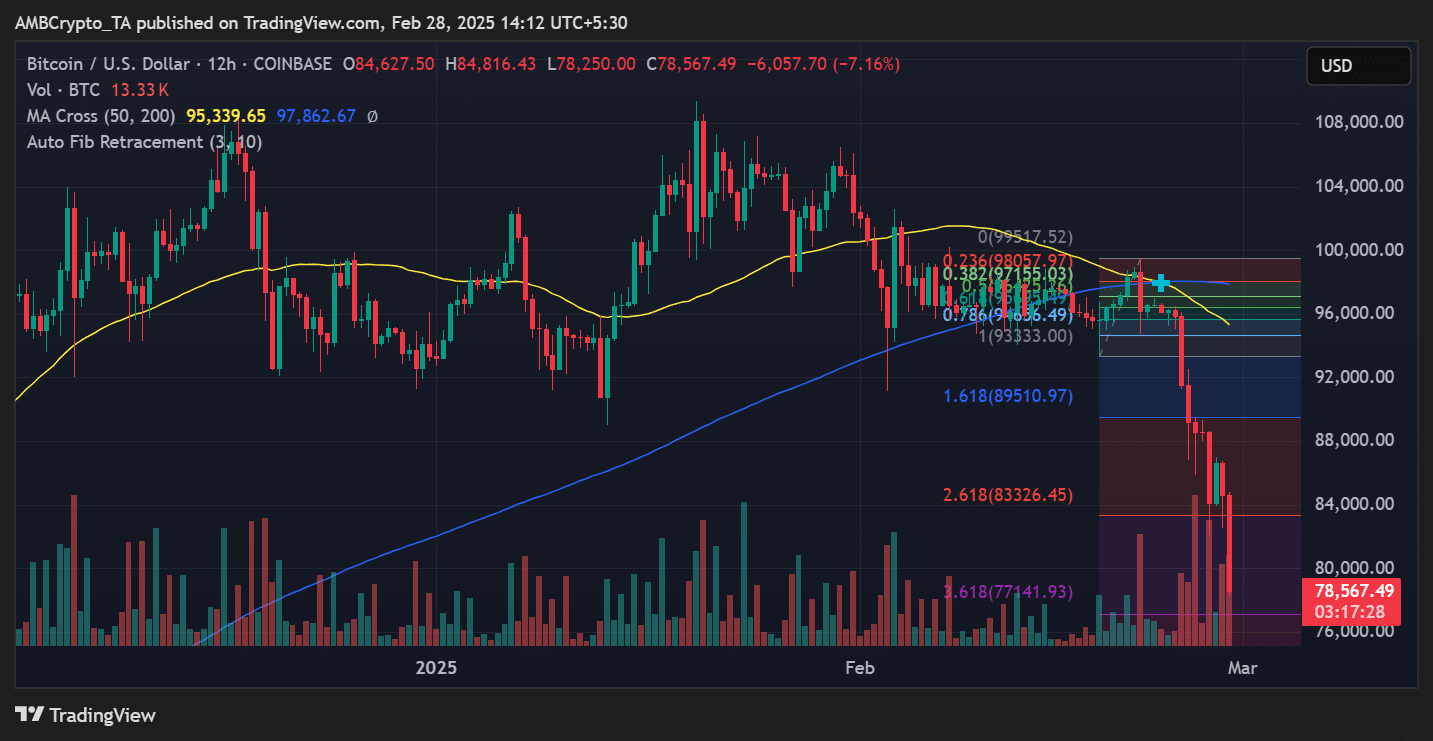

As of the twenty eighth of February, Bitcoin was buying and selling under $80,000 for the primary time for the reason that eleventh of November 2024.

This downturn is influenced by uncertainties surrounding U.S. President Donald Trump’s impending tariffs and crypto insurance policies. This was accompanied by diminished investor confidence following a considerable $1.5 billion hack involving Ethereum [ETH].

Components contributing to the Bitcoin slide

A number of key components have contributed to Bitcoin’s latest slide:

Coverage Uncertainty: President Trump’s announcement of a 25% tariff on imports from Canada and Mexico, set to start on the 4th of March, has launched important uncertainty into world markets.

This coverage transfer has raised issues about potential inflation and its impression on financial progress. It has led traders to reassess their positions in risk-sensitive property, together with cryptocurrencies like Bitcoin.

Safety Breaches: The cryptocurrency market’s confidence was additional shaken by a large safety breach, the place hackers stole roughly $1.5 billion value of ETH from the Bybit exchange.

This incident, described as the most important crypto heist up to now, has heightened apprehensions relating to the safety of digital property and the platforms that help them.

Investor Sentiment: The preliminary optimism following President Trump’s election, fueled by expectations of a crypto-friendly regulatory setting, has waned.

The absence of concrete coverage developments, such because the anticipated institution of a strategic Bitcoin reserve, has led to a cooling of the market euphoria that beforehand drove costs upward.

Insights into investor habits

Regardless of the latest slides, on-chain data revealed notable accumulation tendencies amongst Bitcoin traders:

September to October 2024: Throughout this era, important accumulation occurred throughout the $60,000 to $67,000 value vary.

Addresses with price bases on this bracket have maintained their holdings, indicating a powerful perception in Bitcoin’s long-term worth.

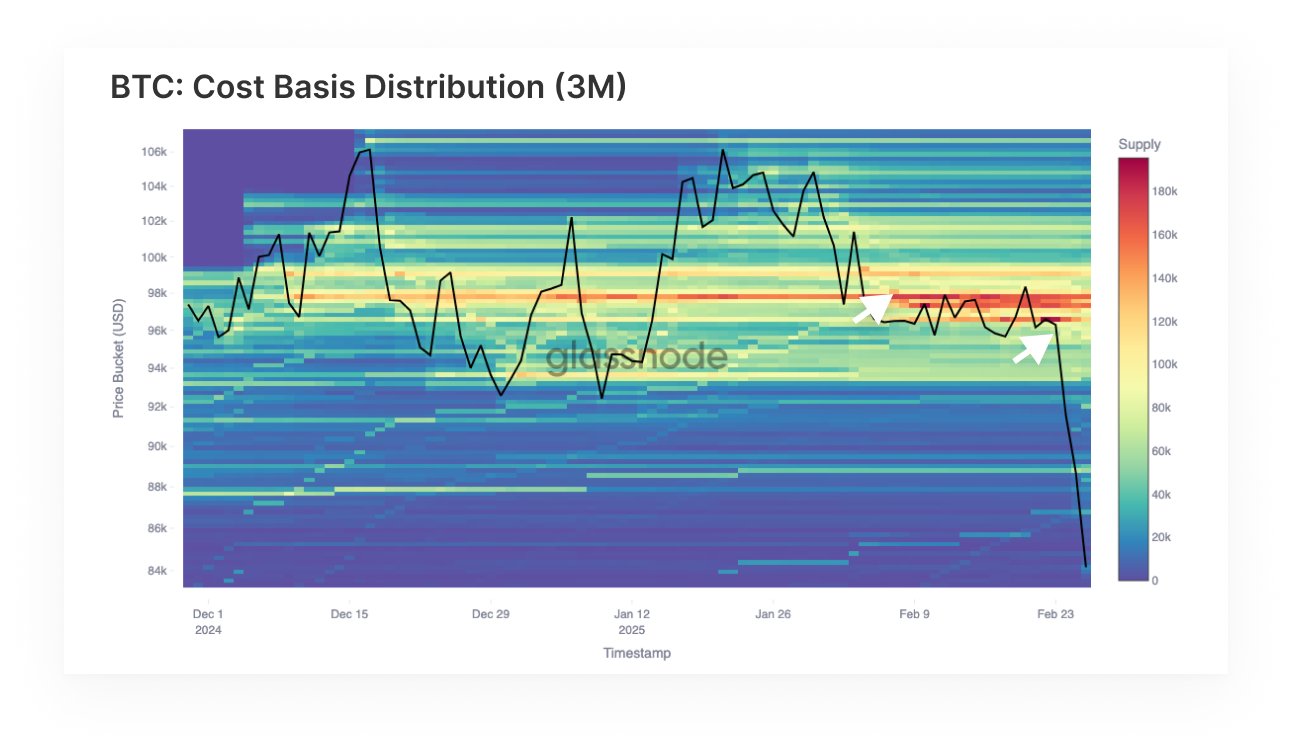

December 2024 to February 2025: A brand new accumulation zone emerged between $96,000 and $98,000.

Whereas some traders on this vary have begun redistributing their holdings, the density of this provide cluster suggests it might act as a formidable resistance degree if costs revisit this territory.

Quick-term analyses additionally spotlight rising demand clusters between $84,000 and $92,000. The essential query stays whether or not this new demand is enough to counterbalance the prevailing sell-side stress.

Analyzing the institutional involvement

Institutional participation within the Bitcoin market has been a major driver of its value dynamics:

Technique’s Aggressive Acquisition: Previously generally known as MicroStrategy, the corporate has expanded its Bitcoin holdings by practically $2 billion, bringing its complete reserves to roughly 499,096 bitcoins.

This aggressive accumulation technique underscores a powerful institutional perception in Bitcoin’s future appreciation.

Market Volatility Issues: Regardless of such endorsements, the broader institutional sentiment stays cautious. Components resembling coverage uncertainties, safety points, and market volatility contribute to a hesitant strategy amongst potential institutional traders.

Bitcoin’s future outlook

The cryptocurrency market stands at a crossroads, influenced by completely different coverage selections, safety issues, and investor sentiment:

Regulatory Developments: The market is carefully monitoring the Trump administration’s forthcoming insurance policies on digital property. Clear and supportive laws might rejuvenate investor confidence and probably reverse the present downward development.

Market Sentiment: Whereas short-term volatility presents challenges, the underlying accumulation patterns recommend a section of traders stays optimistic about Bitcoin’s long-term prospects.

The interaction between rising demand zones and present resistance ranges can be pivotal in figuring out Bitcoin’s value trajectory within the coming months.

In conclusion, Bitcoin’s latest slide under the $80,000 threshold displays a posh interaction of policy-induced uncertainties, safety issues, and shifting investor sentiments.

Because the market navigates these challenges, the actions of each institutional and particular person traders will play an important function in shaping the longer term panorama of the cryptocurrency sector.