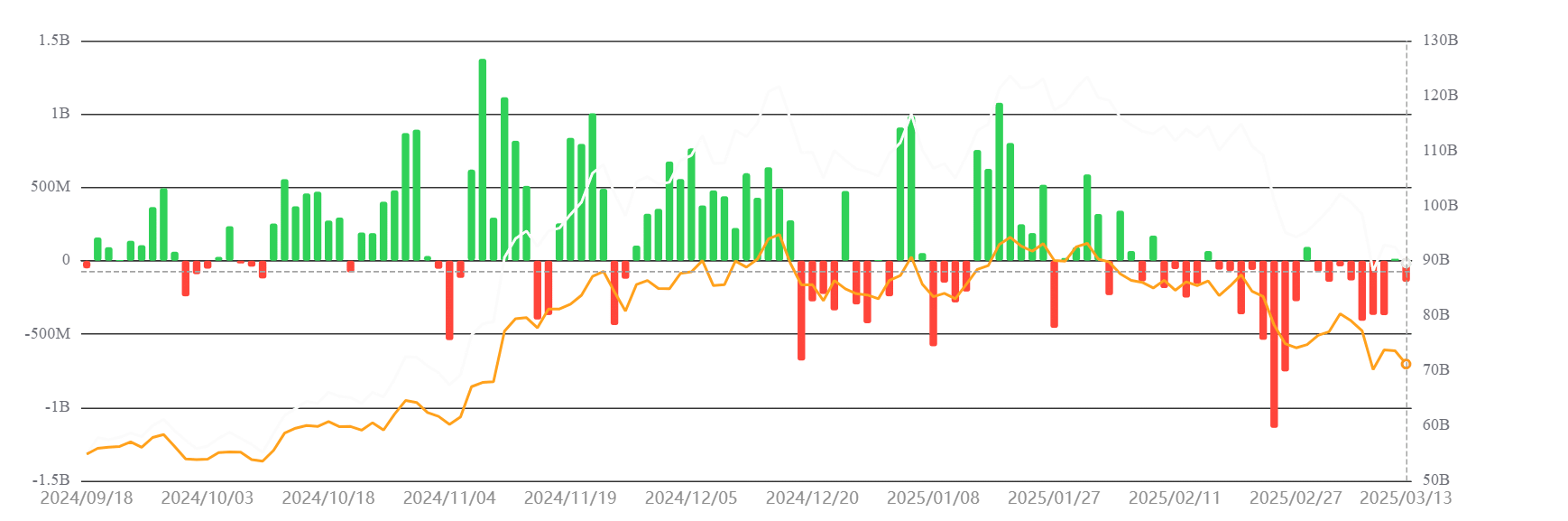

- Bitcoin Spot ETFs witnessed $900M in outflows, with a complete of $5.4B leaving since February.

- BTC’s worth declined practically 12%, hovering round $77,000, reflecting rising uncertainty in institutional sentiment.

Bitcoin [BTC] Spot ETFs have been experiencing a notable decline in inflows, with over $900 million in outflows recorded within the final 5 weeks. This sharp drop has fueled hypothesis about whether or not investor confidence in Bitcoin is starting to wane.

As institutional buyers regulate their portfolios amid financial and regulatory uncertainty, Bitcoin’s worth has additionally been affected, dipping practically 12% up to now month.

With market sentiment shifting, a better evaluation of Bitcoin Spot ETF flows, and worth developments is essential to understanding the place the market is headed.

BTC Spot ETF outflows: A five-week decline

Based on latest information from Sosovalue, BTC Spot ETFs have seen sustained outflows, with the most recent weekly figures displaying a internet outflow of $921.4 million.

This marks the fifth consecutive week of declining capital inside these funds, bringing the overall outflow to roughly $5.4 billion since mid-February.

Whereas BTC Spot ETFs initially noticed vital inflows after their approval, latest redemptions counsel a shift in investor sentiment.

The timing of those outflows has coincided with Bitcoin’s worth decline, which has dropped from $84,000 to roughly $77,000.

Whereas broader market components contribute to Bitcoin’s volatility, the persistent ETF outflows point out that institutional buyers could be extra cautious towards Bitcoin allocations of their portfolios.

The position of institutional buyers in BTC Spot ETFs

One of many key benefits of BTC Spot ETFs is their means to draw institutional buyers into the cryptocurrency market.

Outstanding asset administration companies like BlackRock and Constancy launched Bitcoin ETFs, providing a regulated funding choice that offered Bitcoin publicity with out requiring direct possession. This led to an preliminary surge in inflows and contributed to Bitcoin reaching an all-time worth excessive.

Nevertheless, institutional buyers usually make the most of strategic, short-term capital allocation strategies. During times of market uncertainty, they have a tendency to regulate positions swiftly, doubtlessly explaining the present outflows.

Analysts counsel that institutional buyers could possibly be redirecting funds to conventional property or higher-yield alternatives as international monetary markets react to inflation issues and regulatory modifications.

Elements influencing the outflows

There are a number of contributing components to the latest BTC Spot ETF redemptions. Probably the most vital issues is macroeconomic circumstances.

Rising rates of interest and inflation fears have led buyers to reevaluate their portfolios, usually prioritizing lower-risk property over unstable markets like cryptocurrencies. With conventional markets providing extra enticing risk-adjusted returns, Bitcoin Spot ETFs might face elevated competitors from conventional funding autos.

Moreover, Bitcoin’s worth volatility performs a task. Traditionally, giant worth corrections have triggered sell-offs, and the present worth dip might have led some buyers to liquidate their BTC holdings to safe income or reduce losses.

What’s subsequent for BTC Spot ETFs?

Regardless of the latest outflows, the long-term outlook for BTC Spot ETFs stays optimistic. The introduction of those funds has already had a optimistic impact on the cryptocurrency market, and there are indications that institutional adoption will proceed to develop.

Nevertheless, within the brief time period, buyers will intently monitor macroeconomic developments, regulatory developments, and Bitcoin’s means to reclaim key worth ranges.

If Bitcoin can stabilize above $80,000, it could regain investor confidence, resulting in renewed inflows into BTC Spot ETFs. However, if outflows persist and Bitcoin struggles to search out assist, a chronic interval of market uncertainty may observe.