Latest constructive worth motion has propelled Bitcoin (BTC) above the short-term holders’ realized price of $91,000. This growth has prompted some crypto analysts to query whether or not BTC’s newfound power is sustainable – or merely a bull lure forward of a significant pullback.

Is Bitcoin About To Rally Or Will It Double Prime?

US President Donald Trump’s latest statement that tariffs on China might be “considerably” decrease than the proposed 145% supplied a lift to risk-on belongings. Each fairness and crypto markets responded positively, with BTC up 5.6% over the previous 24 hours.

Bitcoin is at present buying and selling within the low $90,000s for the primary time since March, renewing hopes for an extended rally that would push it previous the $100,000 mark. Nevertheless, CryptoQuant contributor Avocado_onchain urges warning.

In a latest CryptoQuant Quicktake put up, the on-chain analyst supplied insights into the conduct of the 1–3 month holder cohort. This group usually enters the market throughout bullish phases and tends to carry their BTC by worth corrections.

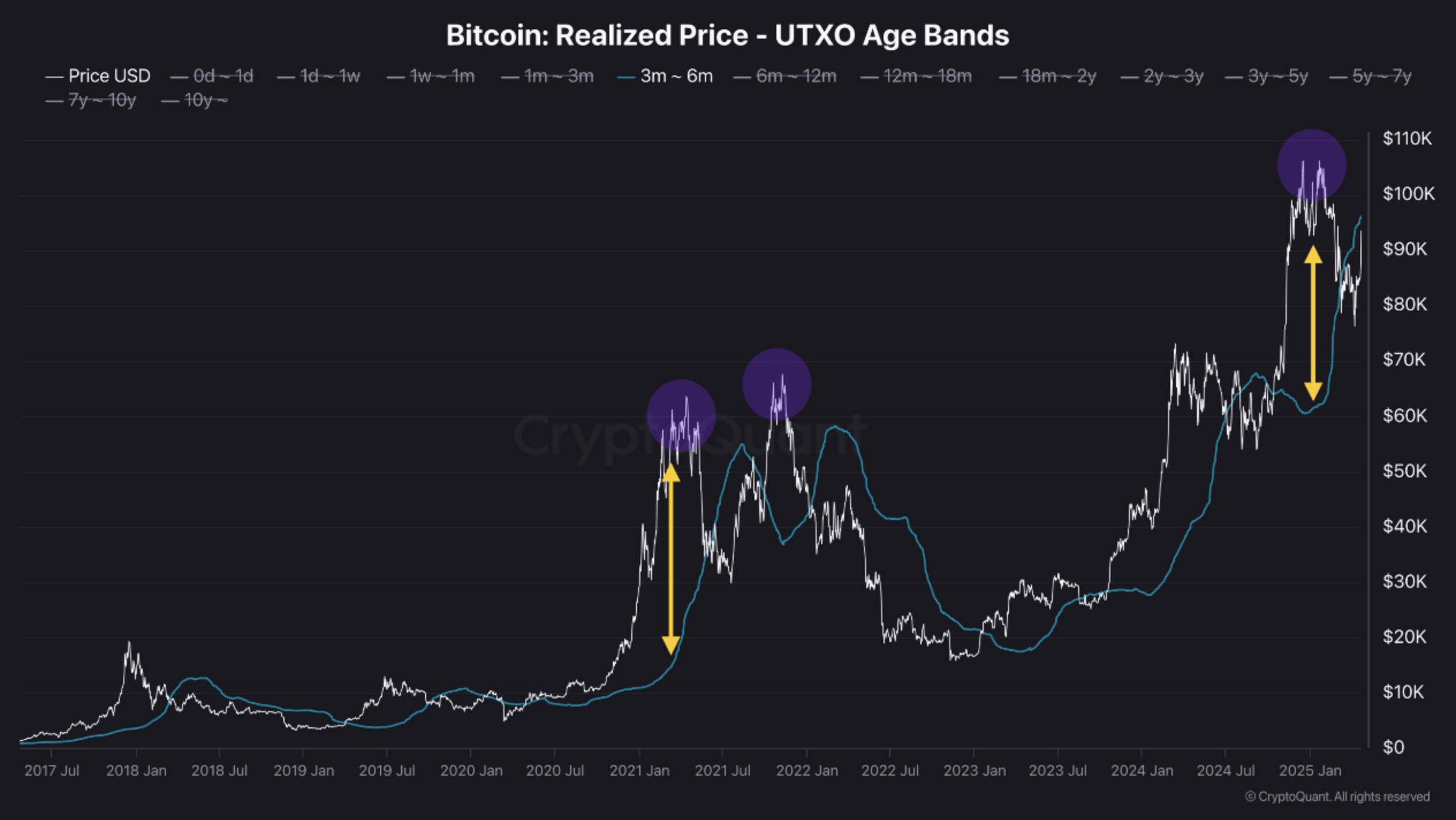

The analyst shared the next chart, illustrating how these short-term members usually transition into the three–6 month holding class – highlighted with a yellow arrow – throughout prolonged drawdowns. Conversely, throughout sturdy rallies – highlighted with a inexperienced arrow – this group tends to take earnings by promoting to new market entrants.

Because the market nears the ultimate levels of a rally – highlighted with a purple circle – this cohort normally grows considerably in measurement. When a drawdown begins, these short-term holders usually exit the market as costs method their realized value foundation.

Avocado_onchain additionally shared one other chart displaying how the peaks of earlier BTC halving cycles have persistently surpassed the typical realized worth of 1–3 month holders.

Additional, the analyst warned that the present market cycle could mirror the double prime formation witnessed in 2021. They added:

When Bitcoin hit its all-time excessive of $109,000 in January 2025, it considerably exceeded this realized worth degree, suggesting which will have been the primary prime of a possible double prime formation. Therefore, moderately than chasing the rally, it might be wiser for present holders to undertake a extra cautious method.

Macro Headwinds Might Derail BTC Momentum

The analyst additional cautioned that restricted market liquidity and macroeconomic components – comparable to US-China tariff tensions – might weigh closely on risk-on belongings like BTC. That stated, market sentiment can shift quickly, and the entry of fresh liquidity might reignite a full-scale bull market.

In the meantime, crypto analyst Xanrox just lately warned that BTC’s breakout from a falling wedge sample could also be a whale-driven lure designed to lure retail traders earlier than one other leg down. At press time, Bitcoin is buying and selling at $93,754, up 5.6% prior to now 24 hours.