- Bitcoin whales cashed out $800 million, signaling a possible shift in market sentiment.

- Key help ranges and declining indicators level to doable Bitcoin value correction.

Bitcoin whales have just lately cashed out practically $800 million in income, marking a considerable shift in market exercise.

At press time, Bitcoin [BTC] was buying and selling at $96,153.51, reflecting a 2.07% lower within the final 24 hours.

This vital revenue realization coincides with a noticeable value enhance, prompting hypothesis about market sentiment.

The surge in profit-taking by long-term holders raises essential questions on the opportunity of a value pullback or the start of a brand new market part.

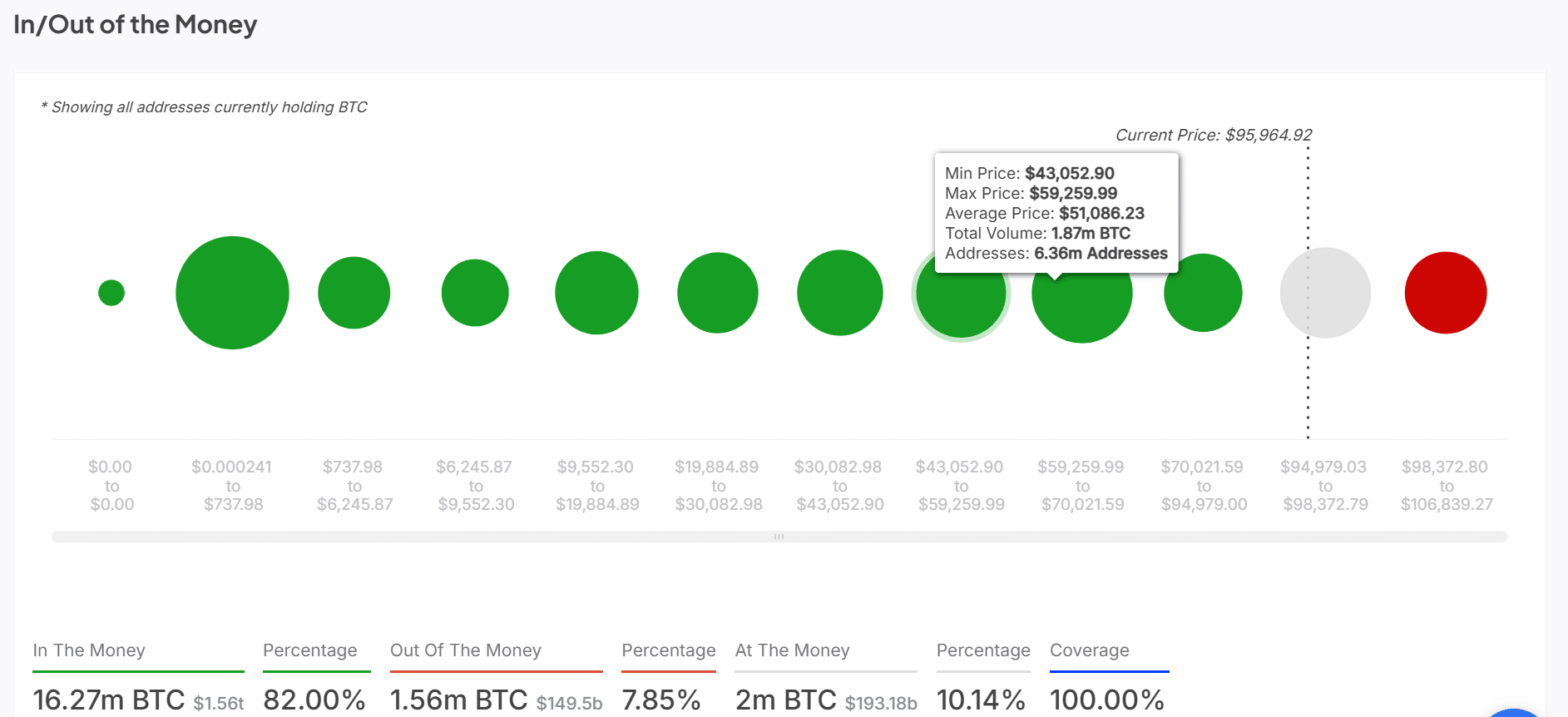

BTC in/out of the cash: Are most holders in revenue?

Bitcoin’s in/out of the cash evaluation exhibits that 82% of Bitcoin addresses are at the moment in revenue, with the typical value for these holders at $51,086.23. This massive share of worthwhile holders signifies widespread optimism amongst Bitcoin traders.

Nonetheless, there are nonetheless 7.85% of addresses out of the cash, which means a portion of holders might expertise losses if the value continues to drop.

As extra addresses turn out to be worthwhile, the probability of elevated promoting strain grows, presumably influencing the general value development.

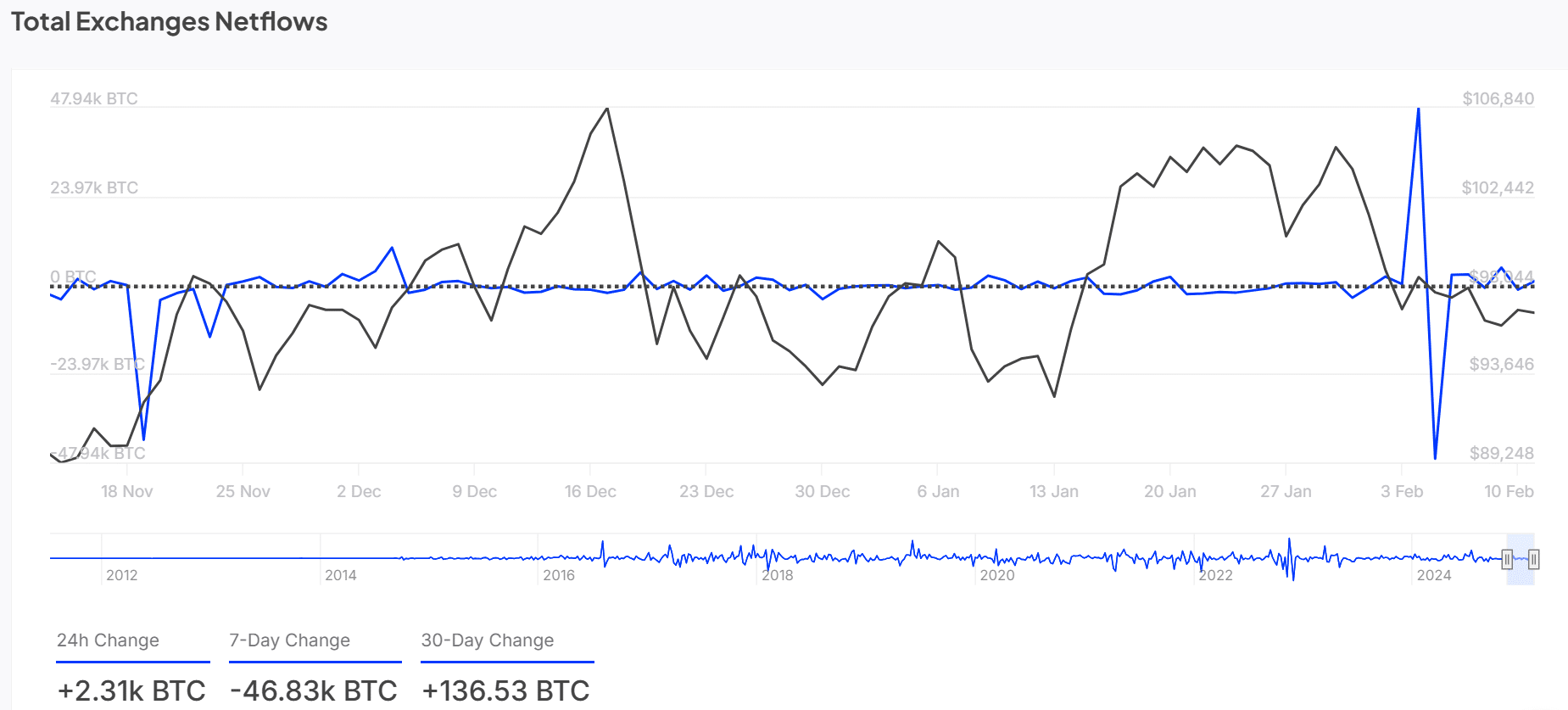

Whole trade netflows: Are merchants getting ready for extra volatility?

Bitcoin has skilled a 24-hour netflow enhance of +2.31k BTC, indicating extra Bitcoin coming into exchanges, presumably in anticipation of promoting exercise.

Over the past thirty days, netflows have surged by +136.53k BTC, signaling substantial liquidity available in the market. This influx might counsel merchants are getting ready for potential volatility.

Nonetheless, it may additionally point out a bullish outlook if costs break by key resistance ranges.

Testing key help and resistance ranges

The Bitcoin chart reveals that BTC is consolidating inside a key value vary. Assist is discovered at $92,450.82, whereas resistance ranges are seen at $101,441.81 and $109,260.07. These value zones are important for figuring out Bitcoin’s subsequent transfer.

If Bitcoin can break by these resistance ranges, it could proceed its bullish momentum.

Nonetheless, any failure to surpass these key ranges may result in a consolidation part or a possible value correction.

Inventory-to-Stream ratio and NVT golden cross: Bearish indicators?

Bitcoin’s Inventory-to-Stream Ratio stood at 1.2686M, reflecting a 20% lower over the previous 24 hours, based on CryptoQuant. This decline suggests a discount in BTC’s shortage, which can influence its long-term worth.

Equally, the NVT Golden Cross has decreased by 29.22% over the previous 24 hours, doubtlessly signaling a market prime or an impending correction.

These components point out that Bitcoin might face strain within the quick time period, because the diminishing shortage and declining transaction quantity counsel a slowdown in demand.

Conclusion: What’s subsequent for BTC?

Bitcoin’s market exercise exhibits combined alerts, with whales cashing out. In/out of the cash figures point out potential promoting strain. Key technical indicators level to each bullish and bearish potentialities.

The evaluation means that Bitcoin might face challenges in breaking by resistance ranges, whereas diminished shortage and declining NVT figures elevate issues about value sustainability.

Due to this fact, a pullback in Bitcoin’s value appears possible quickly as market dynamics shift.