- BlackRock and NYSE Arca push for ETH ETF staking, aiming to spice up returns and appeal to institutional traders.

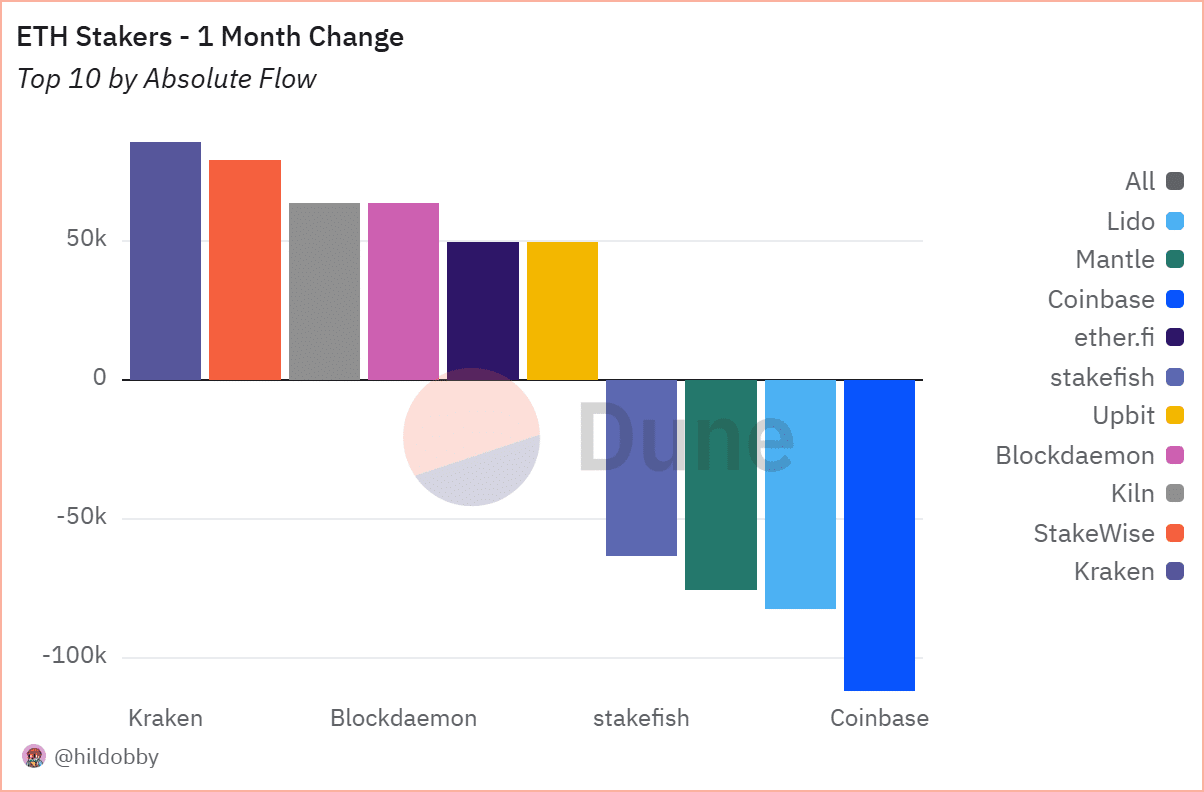

- Current staking knowledge exhibits elevated participation, with Kraken and Blockdaemon main deposit development whereas Coinbase sees outflows.

The demand for Ethereum[ETH] staking is rising, fueled by rising institutional curiosity and regulatory developments. BlackRock has voiced its help for staked ETH ETFs, emphasizing their potential to reinforce returns for traders.

Concurrently, NYSE Arca has submitted a proposal to the U.S. Securities and Trade Fee (SEC) to permit staking for Bitwise’s Ethereum ETF.

With Ethereum staking developments shifting, the panorama of ETH funding merchandise is evolving quickly.

BlackRock’s tackle staked ETH ETFs

BlackRock’s Digital Belongings Head, Robbie Mitchnick, recently stated that whereas the agency’s ETH ETF is successful, it stays “much less good” with out staking capabilities.

He highlighted that staking supplies extra yield and aligns with Ethereum’s proof-of-stake mannequin. Mitchnick believes that unlocking staking in ETFs could possibly be a game-changer, attracting a broader investor base.

Nevertheless, he additionally acknowledged the challenges of implementing staking throughout the ETF construction on account of regulatory constraints and operational complexities.

NYSE Arca’s proposal for staking in Bitwise’s Ethereum ETF

NYSE Arca has taken a step ahead by submitting a request with the SEC to include staking into the Bitwise Ethereum ETF.

If authorised, this may considerably shift how ETH ETFs perform, permitting them to generate staking rewards and doubtlessly improve investor returns. The SEC’s choice will likely be intently watched, because it may affect how different crypto-based ETFs are structured sooner or later.

Ethereum staking developments: Analyzing the info

Current knowledge highlights vital shifts in ETH staking dynamics.

In accordance with knowledge from Dune Analytics, Kraken and Blockdaemon have led the expansion in staking deposits over the previous month, whereas Coinbase has skilled essentially the most substantial outflows.

This divergence displays shifting preferences amongst institutional and retail traders relating to custodial staking options. In the meantime, platforms like Lido, stakefish, and Upbit have maintained regular inflows, reinforcing their dominance within the staking ecosystem.

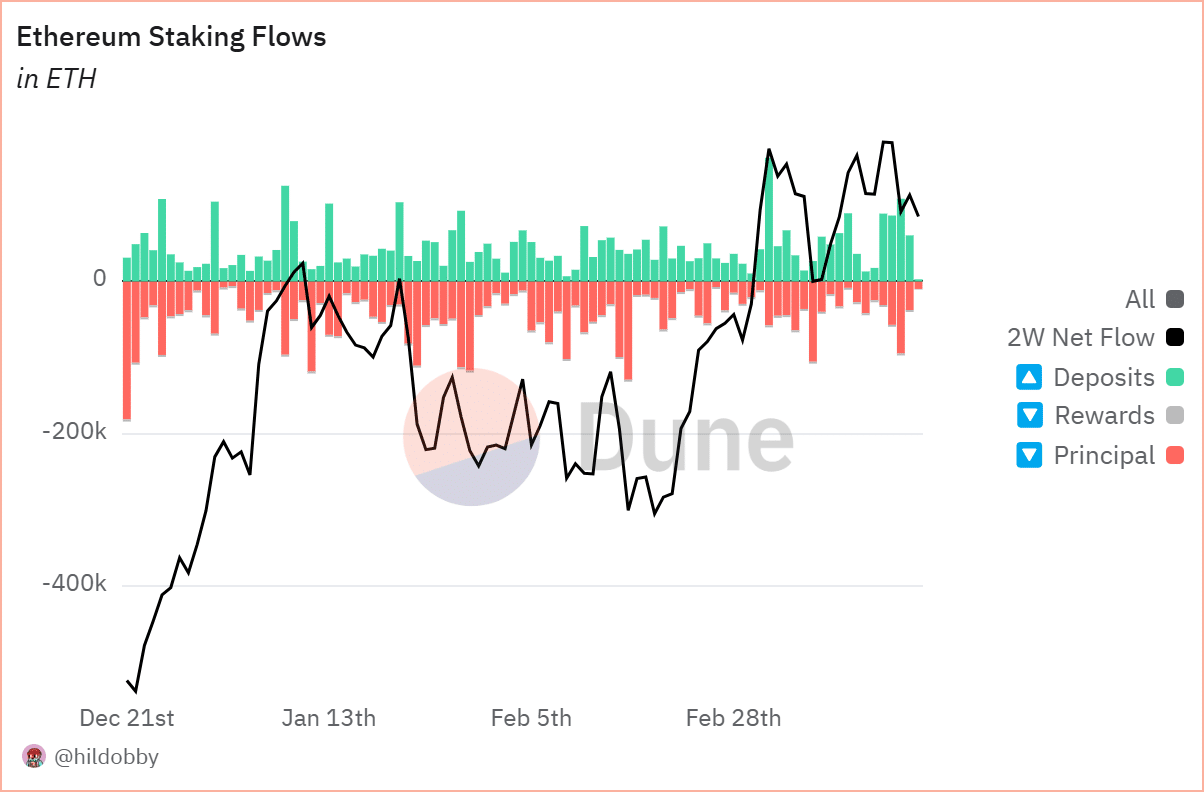

The second chart supplies deeper insights into Ethereum staking flows. Over the previous few months, staking deposits have outpaced withdrawals, resulting in a web optimistic circulate.

The black line representing the two-week web circulate showcases an upward development, indicating rising confidence in Ethereum’s staking ecosystem.

Notably, principal withdrawals (proven in purple) have decreased, suggesting that fewer traders are opting to unstake their ETH regardless of market fluctuations.

This development alerts that long-term holders and establishments are embracing Ethereum staking as a sustainable funding technique.

Implications for ETH ETFs and traders

The rising emphasis on staking carries vital implications for ETH ETFs and their traders. If authorised, staking inside ETFs may introduce an extra income stream by staking rewards, making ETH ETFs extra interesting than conventional spot ETFs.

Institutional traders could favor staked ETH ETFs, as they supply each value publicity and passive earnings by staking yields.

Nevertheless, regulatory uncertainty stays a significant impediment, with the SEC traditionally cautious about crypto-related merchandise, notably these involving staking.

A good choice on NYSE Arca’s proposal may set a precedent, paving the best way for extra superior Ethereum-based funding merchandise.